Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help needed asap! Flounder Business Consulting provides management consulting evaluations for clients at a price of $14000 upon completion. Flounder has variable costs of

please help needed asap!

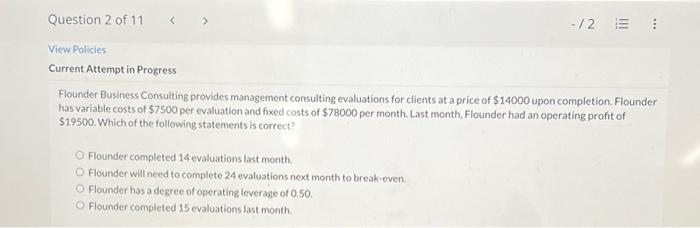

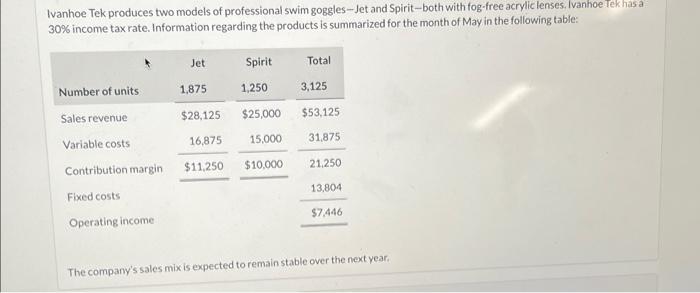

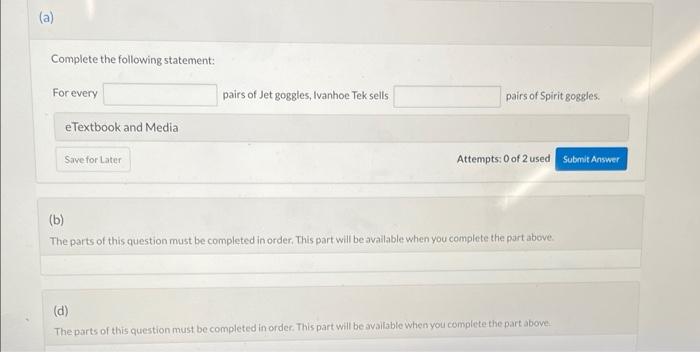

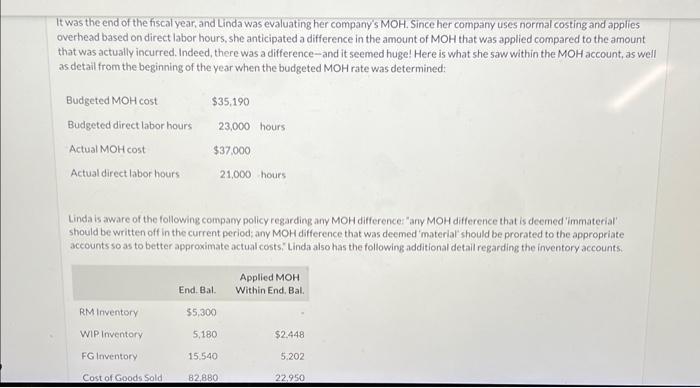

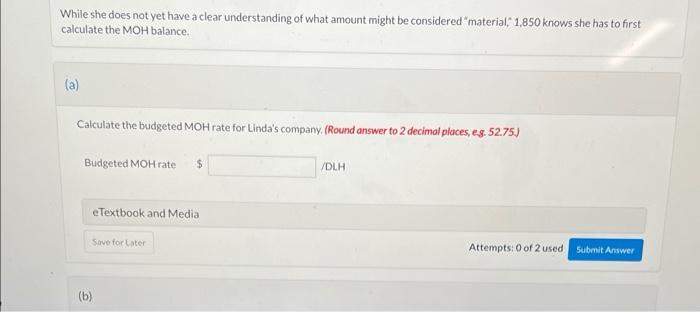

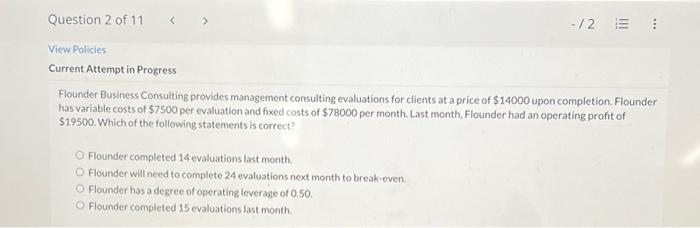

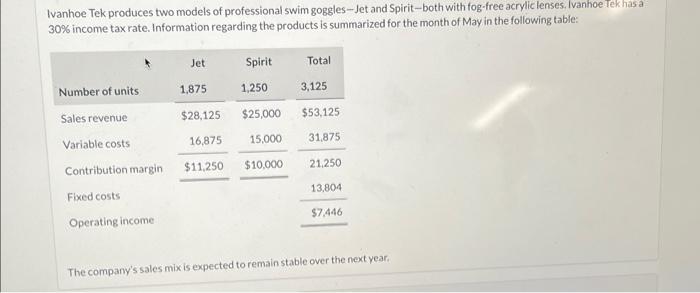

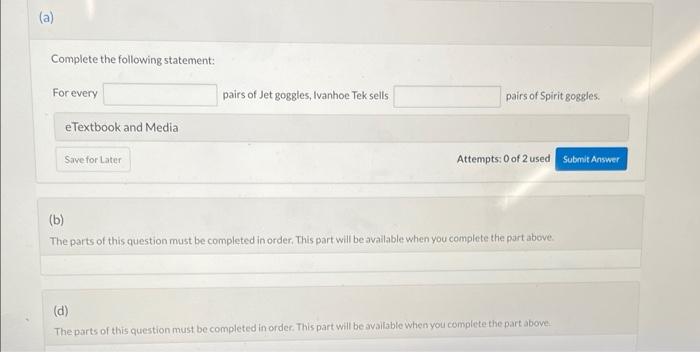

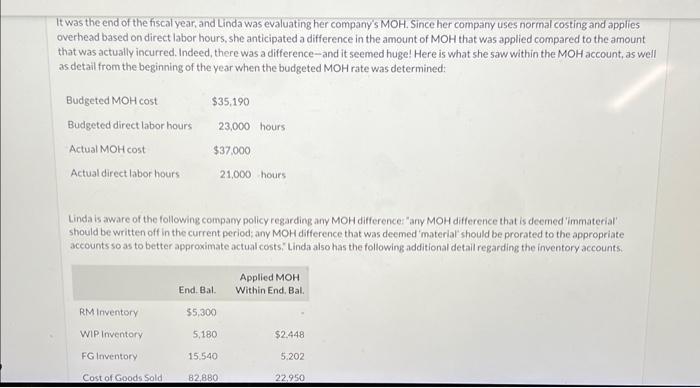

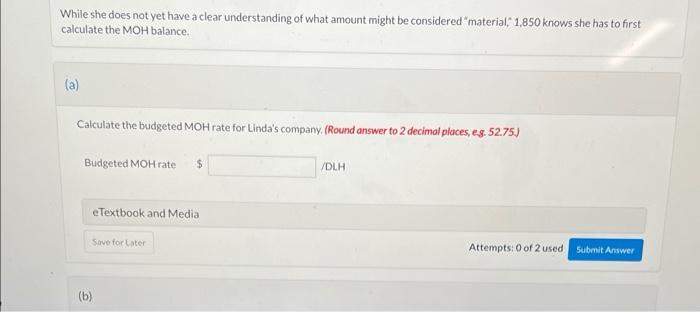

Flounder Business Consulting provides management consulting evaluations for clients at a price of $14000 upon completion. Flounder has variable costs of $7500 per evaluation and fixed costs of $78000 per month. Last month, Flounder had an operating profit of \$19500. Which of the following statements is correct? Flounder completed 14 evaluations last month. Flounder will need to complete 24 evaluations next month to break-even. Flounder has a degree of operating leverage of 0.50. Flounder completed 15 evaluations last month. Ivanhoe Tek produces two models of professional swim goggles - Jet and Spirit-both with fog-free acrylic lenses. Ivanhoe Tekhas a 30% income tax rate. Information regarding the products is summarized for the month of May in the following table: The company's sales mix is expected to remain stable over the next year. Complete the following statement: For every pairs of Jet goggles, Ivanhoe Tek sells pairs of Spirit goggles. eTextbook and Media Attempts: 0 of 2 used (b) The parts of this question must be completed in order. This part will be available when you complete the part above. (d) The parts of this question must be completed in order. This part will be available when you complete the part above. It was the end of the fiscal year, and Linda was evaluating her company's MOH. Since her company uses normal costing and applies overhead based on direct labor hours, she anticipated a difference in the amount of MOH that was applied compared to the amount that was actually incurred, Indeed, there was a difference-and it seemed huge! Here is what she saw within the MOH account, as well as detail from the beginning of the year when the budgeted MOH rate was determined: Linda is aware of the following company policy regarding any MOH difference: "any MOH difference that is deemed 'immaterial' should be written off in the current period; any MOH difference that was deemed 'material should be prorated to the appropriate accounts so as to better approximate actual costs; Linda also has the following additional detail regarding the inventory accounts. While she does not yet have a clear understanding of what amount might be considered "material," 1,850 knows she has to first calculate the MOH balance. (a) Calculate the budgeted MOH rate for Linda's company. (Round answer to 2 decimal places, eg. 52.75.) Budgeted MOH rate $ DLH eTextbook and Media Attempts: 0 of 2 used

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started