Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help Note: All sources, net income, and depreciation should be treated as positive values. All uses, net loss, and dividend paid should be treated

please help

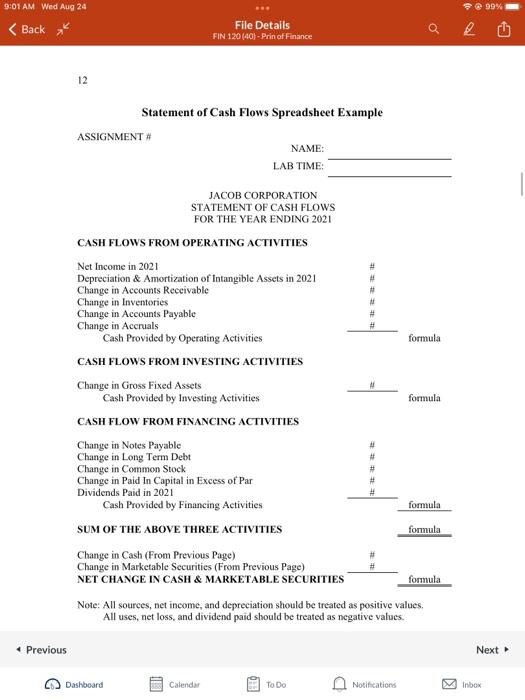

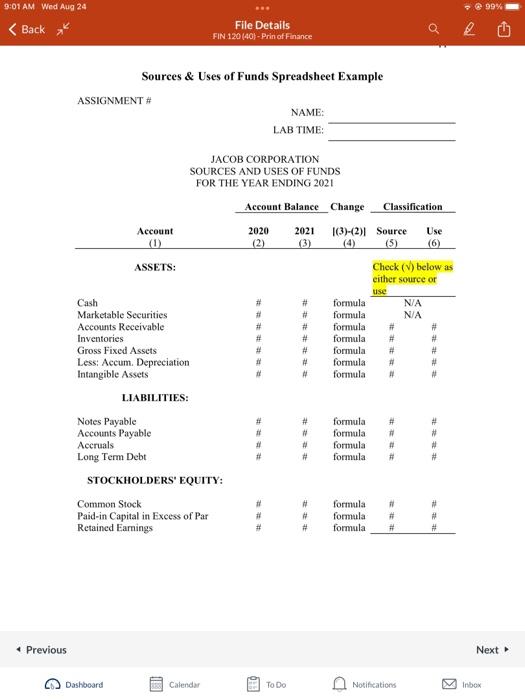

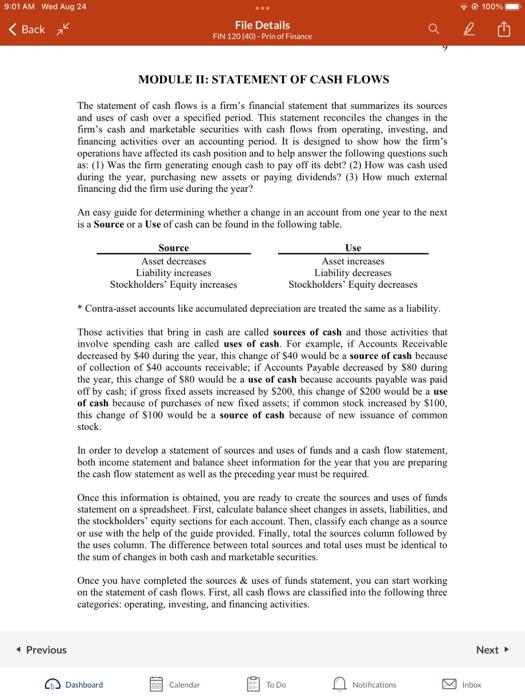

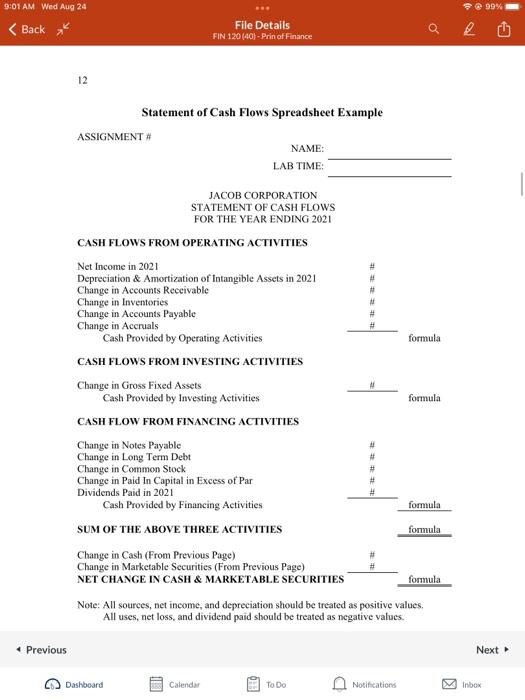

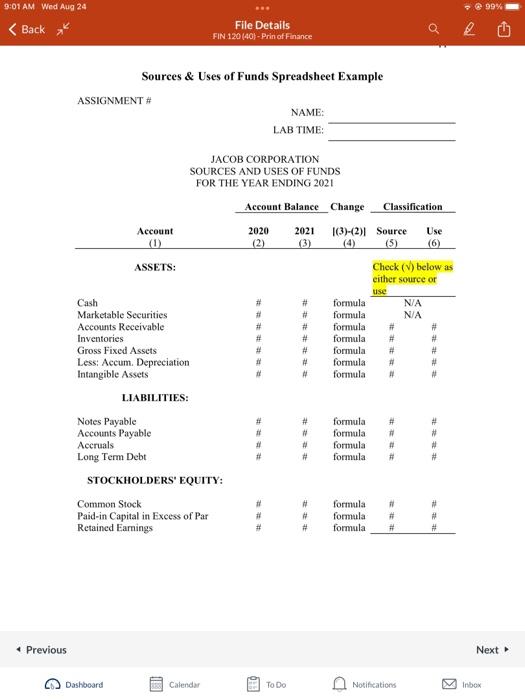

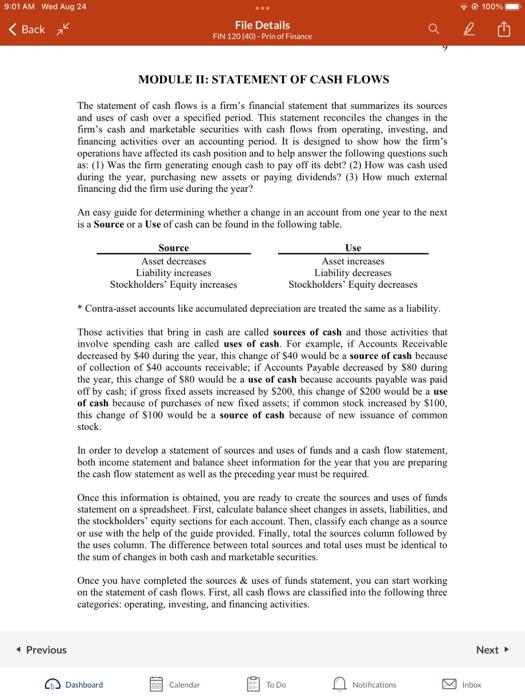

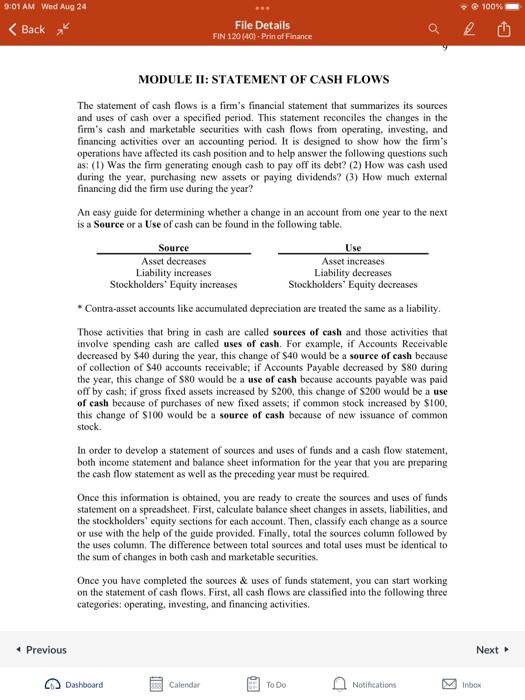

Note: All sources, net income, and depreciation should be treated as positive values. All uses, net loss, and dividend paid should be treated as negative values. JACOB CORPORATION SOURCES AND USES OF FUNDS FOR THE YEAR ENDING 2021 MODULE II: STATEMENT OF CASH FLOWS The statement of cash flows is a firm's financial statement that summarizes its sources and uses of cash over a specified period. This statement reconciles the changes in the firm's cash and marketable securities with cash flows from operating, investing, and financing activities over an accounting period. It is designed to show how the firm's operations have affected its cash position and to help answer the following questions such as: (1) Was the firm generating enough cash to pay off its debt? (2) How was cash used during the year, purchasing new assets or paying dividends? (3) How much external financing did the firm use during the year? An easy guide for determining whether a change in an account from one year to the next is a Source or a Use of cash can be found in the following table. " Contra-asset accounts like accumulated depreciation are treated the same as a liability. Those activities that bring in cash are called sourees of cash and those activities that involve spending cash are called uses of cash. For example, if Accounts Receivable decreased by $40 during the year, this change of $40 would be a source of cash because of collection of $40 accounts receivable; if Accounts Payable decreased by $80 during the year, this change of $80 would be a use of cash because accounts payable was paid off by cash; if gross fixed assets increased by $200, this change of $200 would be a use of eash because of purchases of new fixed assets; if common stock increased by $100. this change of $100 would be a source of cash because of new issuance of common stock. In order to develop a statement of sources and uses of funds and a cash flow statement, both income statement and balance sheet information for the year that you are preparing the cash flow statement as well as the preceding year must be required. Once this information is obtained, you are ready to create the sources and uses of funds statement on a spreadsheet. First, calculate balance sheet changes in assets, liabilities, and the stockholders' equity sections for each account. Then, classify each change as a source or use with the help of the guide provided. Finally, total the sourees column followed by the uses column. The difference between total sources and total uses must be identical to the sum of changes in both cash and marketable securities. Once you have completed the sources \& uses of funds statement, you can start working on the statement of cash flows. First, all cash flows are classified into the following three categories: operating, investing, and financing activities. MODULE II: STATEMENT OF CASH FLOWS The statement of cash flows is a firm's financial statement that summarizes its sources and uses of cash over a specified period. This statement reconciles the changes in the firm's cash and marketable securities with cash flows from operating, investing, and financing activities over an accounting period. It is designed to show how the firm's operations have affected its cash position and to help answer the following questions such as: (1) Was the firm generating enough cash to pay off its debt? (2) How was cash used during the year, purchasing new assets or paying dividends? (3) How much external financing did the firm use during the year? An easy guide for determining whether a change in an account from one year to the next is a Source or a Use of cash can be found in the following table. " Contra-asset accounts like accumulated depreciation are treated the same as a liability. Those activities that bring in cash are called sourees of cash and those activities that involve spending cash are called uses of cash. For example, if Accounts Receivable decreased by $40 during the year, this change of $40 would be a source of cash because of collection of $40 accounts receivable; if Accounts Payable decreased by $80 during the year, this change of $80 would be a use of cash because accounts payable was paid off by cash; if gross fixed assets increased by $200, this change of $200 would be a use of eash because of purchases of new fixed assets; if common stock increased by $100. this change of $100 would be a source of cash because of new issuance of common stock. In order to develop a statement of sources and uses of funds and a cash flow statement, both income statement and balance sheet information for the year that you are preparing the cash flow statement as well as the preceding year must be required. Once this information is obtained, you are ready to create the sources and uses of funds statement on a spreadsheet. First, calculate balance sheet changes in assets, liabilities, and the stockholders' equity sections for each account. Then, classify each change as a source or use with the help of the guide provided. Finally, total the sourees column followed by the uses column. The difference between total sources and total uses must be identical to the sum of changes in both cash and marketable securities. Once you have completed the sources \& uses of funds statement, you can start working on the statement of cash flows. First, all cash flows are classified into the following three categories: operating, investing, and financing activities. Note: All sources, net income, and depreciation should be treated as positive values. All uses, net loss, and dividend paid should be treated as negative values. JACOB CORPORATION SOURCES AND USES OF FUNDS FOR THE YEAR ENDING 2021 MODULE II: STATEMENT OF CASH FLOWS The statement of cash flows is a firm's financial statement that summarizes its sources and uses of cash over a specified period. This statement reconciles the changes in the firm's cash and marketable securities with cash flows from operating, investing, and financing activities over an accounting period. It is designed to show how the firm's operations have affected its cash position and to help answer the following questions such as: (1) Was the firm generating enough cash to pay off its debt? (2) How was cash used during the year, purchasing new assets or paying dividends? (3) How much external financing did the firm use during the year? An easy guide for determining whether a change in an account from one year to the next is a Source or a Use of cash can be found in the following table. " Contra-asset accounts like accumulated depreciation are treated the same as a liability. Those activities that bring in cash are called sourees of cash and those activities that involve spending cash are called uses of cash. For example, if Accounts Receivable decreased by $40 during the year, this change of $40 would be a source of cash because of collection of $40 accounts receivable; if Accounts Payable decreased by $80 during the year, this change of $80 would be a use of cash because accounts payable was paid off by cash; if gross fixed assets increased by $200, this change of $200 would be a use of eash because of purchases of new fixed assets; if common stock increased by $100. this change of $100 would be a source of cash because of new issuance of common stock. In order to develop a statement of sources and uses of funds and a cash flow statement, both income statement and balance sheet information for the year that you are preparing the cash flow statement as well as the preceding year must be required. Once this information is obtained, you are ready to create the sources and uses of funds statement on a spreadsheet. First, calculate balance sheet changes in assets, liabilities, and the stockholders' equity sections for each account. Then, classify each change as a source or use with the help of the guide provided. Finally, total the sourees column followed by the uses column. The difference between total sources and total uses must be identical to the sum of changes in both cash and marketable securities. Once you have completed the sources \& uses of funds statement, you can start working on the statement of cash flows. First, all cash flows are classified into the following three categories: operating, investing, and financing activities. MODULE II: STATEMENT OF CASH FLOWS The statement of cash flows is a firm's financial statement that summarizes its sources and uses of cash over a specified period. This statement reconciles the changes in the firm's cash and marketable securities with cash flows from operating, investing, and financing activities over an accounting period. It is designed to show how the firm's operations have affected its cash position and to help answer the following questions such as: (1) Was the firm generating enough cash to pay off its debt? (2) How was cash used during the year, purchasing new assets or paying dividends? (3) How much external financing did the firm use during the year? An easy guide for determining whether a change in an account from one year to the next is a Source or a Use of cash can be found in the following table. " Contra-asset accounts like accumulated depreciation are treated the same as a liability. Those activities that bring in cash are called sourees of cash and those activities that involve spending cash are called uses of cash. For example, if Accounts Receivable decreased by $40 during the year, this change of $40 would be a source of cash because of collection of $40 accounts receivable; if Accounts Payable decreased by $80 during the year, this change of $80 would be a use of cash because accounts payable was paid off by cash; if gross fixed assets increased by $200, this change of $200 would be a use of eash because of purchases of new fixed assets; if common stock increased by $100. this change of $100 would be a source of cash because of new issuance of common stock. In order to develop a statement of sources and uses of funds and a cash flow statement, both income statement and balance sheet information for the year that you are preparing the cash flow statement as well as the preceding year must be required. Once this information is obtained, you are ready to create the sources and uses of funds statement on a spreadsheet. First, calculate balance sheet changes in assets, liabilities, and the stockholders' equity sections for each account. Then, classify each change as a source or use with the help of the guide provided. Finally, total the sourees column followed by the uses column. The difference between total sources and total uses must be identical to the sum of changes in both cash and marketable securities. Once you have completed the sources \& uses of funds statement, you can start working on the statement of cash flows. First, all cash flows are classified into the following three categories: operating, investing, and financing activities

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started