please help

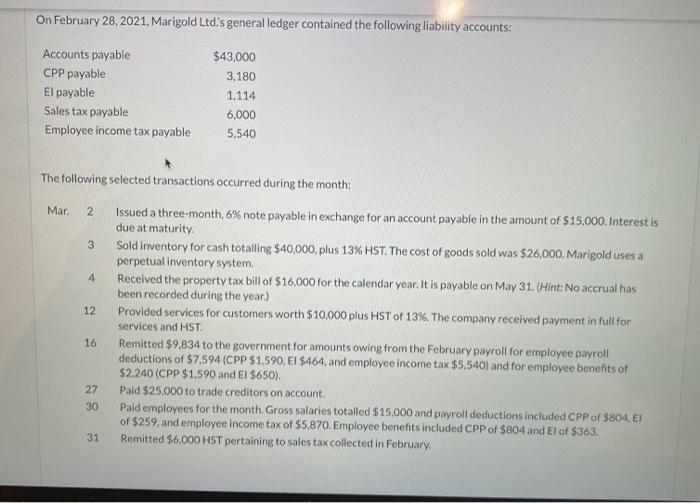

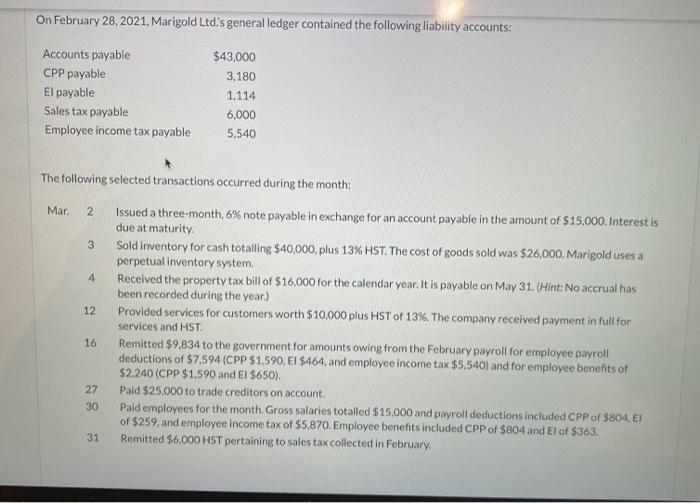

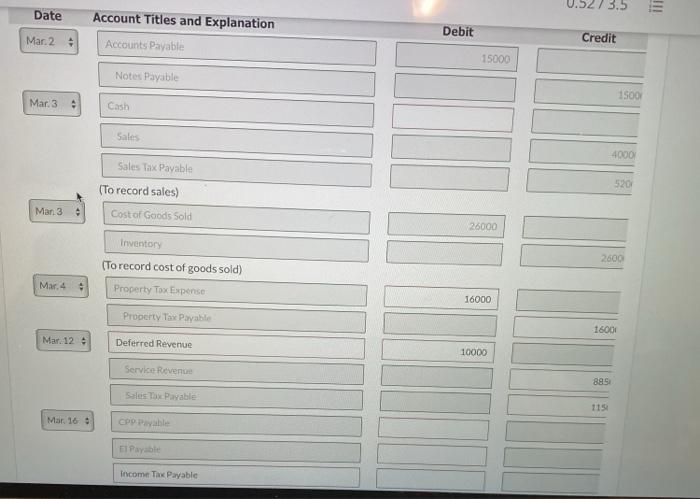

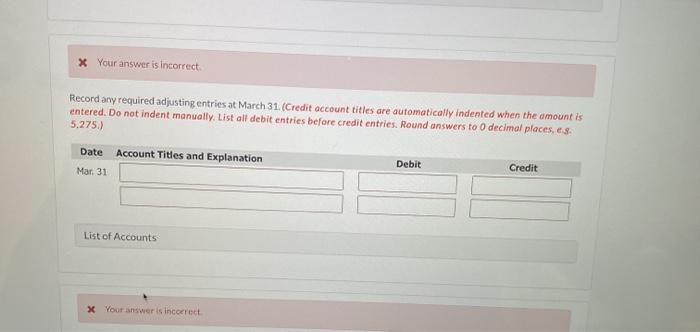

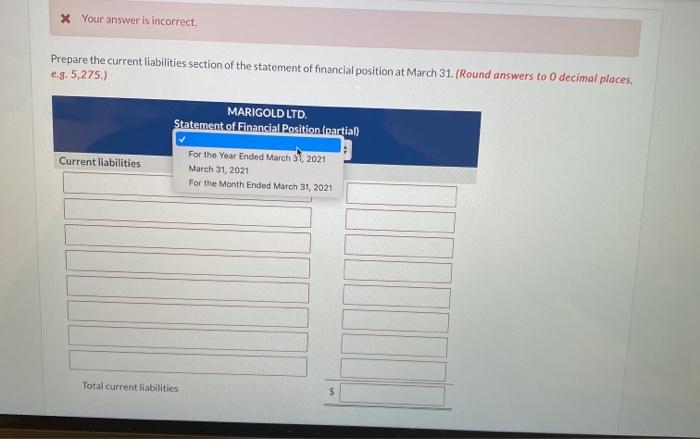

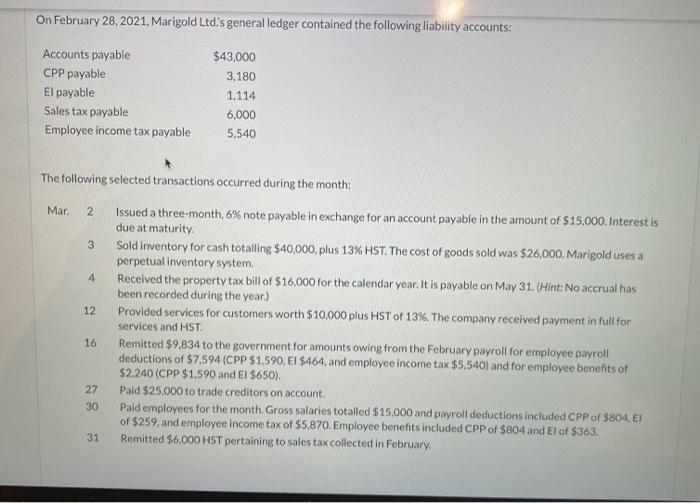

On February 28, 2021, Marigold Ltd's general ledger contained the following liability accounts: Accounts payable CPP payable El payable Sales tax payable Employee income tax payable $43,000 3,180 1,114 6,000 5,540 The following selected transactions occurred during the month: Mar. 2 3 4 12 Issued a three-month, 6% note payable in exchange for an account payable in the amount of $15,000. Interestis due at maturity Sold inventory for cash totalling $40,000, plus 13% HST. The cost of goods sold was $26,000. Marigold uses a perpetual inventory system Received the property tax bill of $16,000 for the calendar year. It is payable on May 31. (Hint: No accrual has been recorded during the year.) Provided services for customers worth $10,000 plus HST of 13%. The company received payment in full for services and HST Remitted $9,834 to the government for amounts owing trom the February payroll for employee payroll deductions of $7,594 (CPP $1,590, EI $464, and employee income tax $5,540) and for employee benefits of $2,240 (CPP $1,590 and El $650). Paid $25.000 to trade creditors on account Pald employees for the month. Gross salaries totalled $15,000 and payroll deductions included CPP of $804, E1 of $259, and employee income tax of $5,870. Employee benefits included CPP of $804 and El of $363. Remitted $6,000 HST pertaining to sales tax collected in February 16 27 30 31 .527 3.5 Date Account Titles and Explanation Debit Mar. 2 Credit Accounts Payable 15000 Notes Payable 1500 Mar. 3 Cash Sales 4000 Sales Tax Payable (To record sales) 520 Mar3 Cost of Goods Sold 26000 Inventory 2600 (To record cost of goods sold) Property Tax Expense Mar. 4 . 16000 Property Tax Payable 16000 Mar 12 Deferred Revenue 10000 Service Revenue 89S Sales Payable Mar. 160 El Payable Income Tax Payable Income Tax Payable Gith (To record payroll and employee deductions) To record employee benents) List of Accounts X Your answer is incorrect Record any required adjusting entries at March 31. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. Round answers to 0 decimal places, es. 5.275.) Account Titles and Explanation Mar. 31 Date Debit Credit List of Accounts x Your answer is incorrect X Your answer is incorrect. Prepare the current liabilities section of the statement of financial position at March 31. (Round answers to 0 decimal places, e.g. 5,275.) MARIGOLD LTD. Statement of Financial Position (partial) Current liabilities For the Year Ended March 37 2021 March 31, 2021 For the Month Ended March 31, 2021 Total current liabilities $