Question: Please help on how to solve this Finance problem. If you could show how you did it please. Thank you for your time. 1 Example

Please help on how to solve this Finance problem. If you could show how you did it please. Thank you for your time.

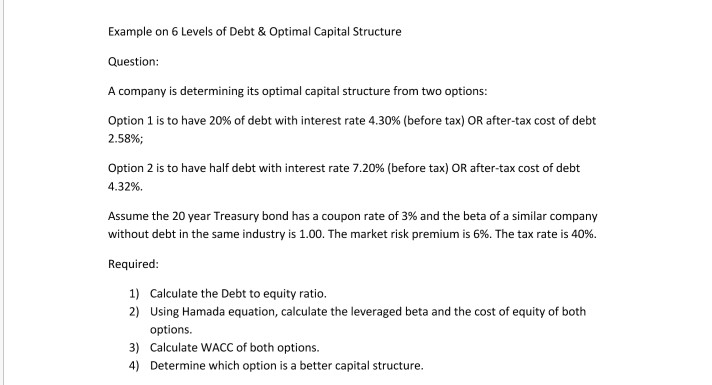

1 Example on 6 Levels of Debt & Optimal Capital Structure Question: A company is determining its optimal capital structure from two options: Option 1 is to have 20% of debt with interest rate 4.30% (before tax) OR after-tax cost of debt 2.58%; Option 2 is to have half debt with interest rate 7.20% (before tax) OR after-tax cost of debt 4.32%. Assume the 20 year Treasury bond has a coupon rate of 3% and the beta of a similar company without debt in the same industry is 1.00. The market risk premium is 6%. The tax rate is 40%. Required: Calculae the Debt to equity ratio. Using Hamada equation, calculate the leveraged beta and the cost of equity of both options Calculate WACC of both options. Determine which option is a better capital structure. 2) 3) 4)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts