Answered step by step

Verified Expert Solution

Question

1 Approved Answer

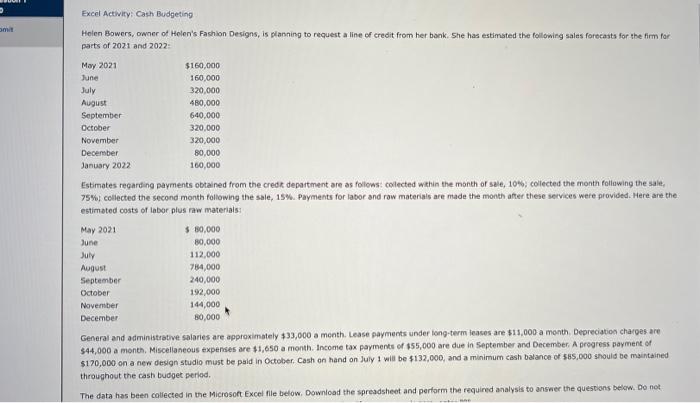

Please Help on Incorrect/Blank Problems. I will up vote your response. ma Excel Activity: Cash Budgeting Helen Bowers, owner of Helen's Fashion Designs, is planning

Please Help on Incorrect/Blank Problems. I will up vote your response.

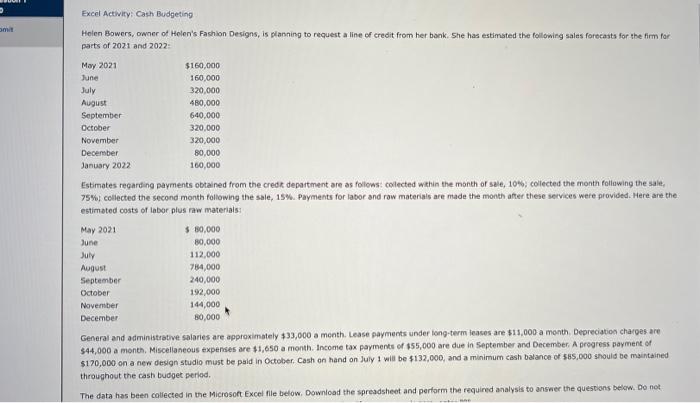

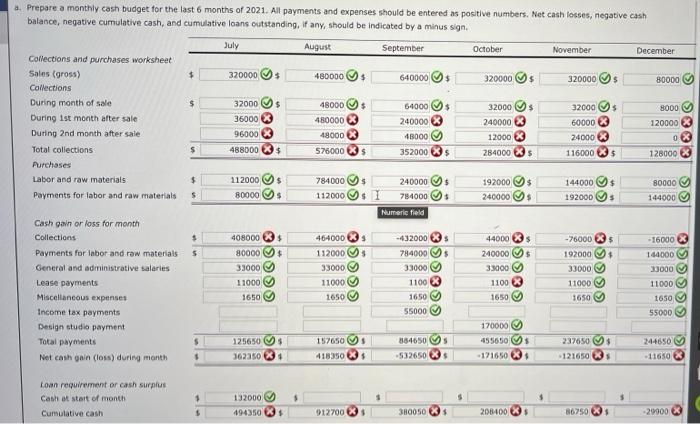

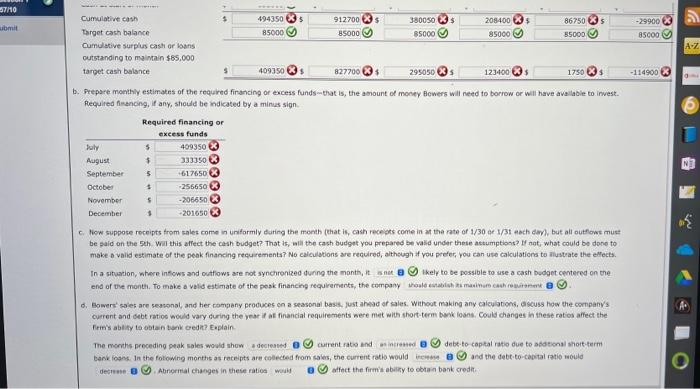

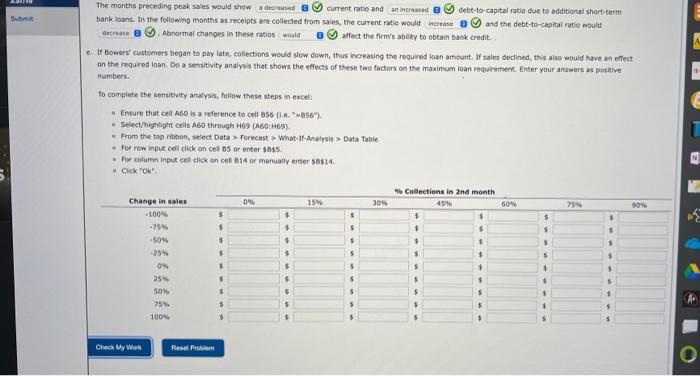

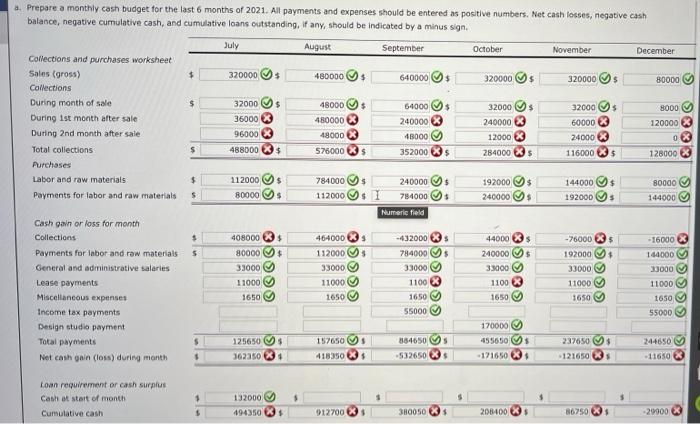

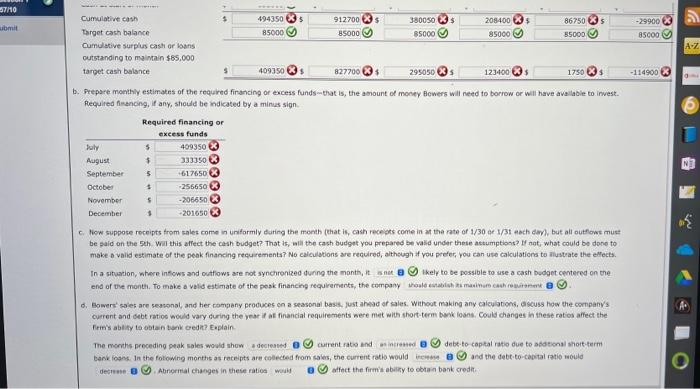

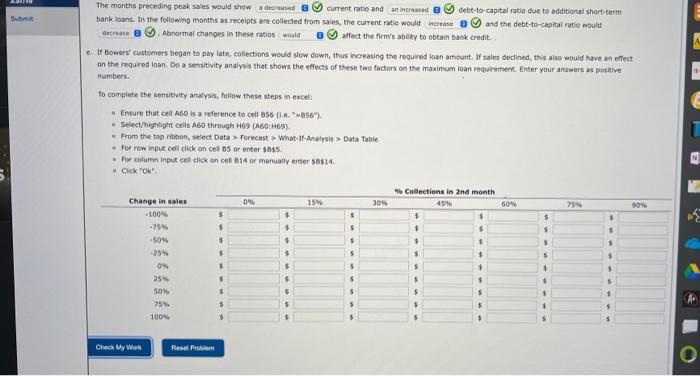

ma Excel Activity: Cash Budgeting Helen Bowers, owner of Helen's Fashion Designs, is planning to request a line of credit from her bank. She has estimated the following sales forecasts for the firm for parts of 2021 and 2022 May 2021 $160,000 June 160,000 July 320,000 August 480,000 September 640,000 October 320,000 November 320,000 December 80,000 January 2022 160,000 Estimates regarding payments obtained from the credit department are as follows: collected within the month of sale, 10%, collected the month following the sale, 75%) collected the second month following the sale, 15%. Payments for labor and raw materials are made the month after these services were provided. Here are the estimated costs of labor plus raw materials: May 2021 $ 80.000 June 80,000 July 112,000 August 784,000 September 240,000 October 192,000 November 144,000 December 80,000 General and administrative salaries are approximately $33,000 a month. Lease payments under long-term leases are $11,000 a month Depreciation charges are $44,000 a month. Miscellaneous expenses are $1,650 a month. Income tax payments of $55,000 are due in September and December. A progress payment of $170,000 on a new design studio must be paid in October Cash on hand on July 1 will be $132,000, and a minimum cash balance of $85.000 should be maintained throughout the cash budget period. The data has been collected in the Microsoft Excel file below. Download the spreadsheet and perform the required analysis to answer the questions below. Do not a. Prepare a monthly cash budget for the last 6 months of 2021. All payments and expenses should be entered as positive numbers. Net cash losses, negative cash balance, negative cumulative cash, and cumulative loans outstanding, if any, should be indicated by a minus sign July August September October November December $ 320000 $ 480000 $ 640000 320000 $ 320000 $ 80000 $ 32000 $ 32000 $ 8000 Collections and purchases worksheet Sales (gross) Collections During month of sale During ist month after sale During 2nd month after sale Total collections Purchases Labor and raw materials Payments for labor and raw materials 36000 96000 488000 120000 48000 $ 480000 48000 x 57600035 64000 $ 240000 48000 352000 $ 32000 $ 60000 X 24000 3 240000 12000 284000 0 $ $ 5 116000 $ 128000 @S $ $ $ $ $ $ 112000 80000 784000 112000 240000 $ 784000 $ Numeric field 192000 240000 144000 192000 80000 144000 $ 5 5 $ $ - 16000 5 100000 408000 80000 $ 33000 11000 1650 Cash pain or loss for month Collections Payments for labor and raw materials General and administrative salaries Lease payments Miscellaneous expenses Income tax payments Design studio payment Total payments Net cash gain (loss) during month 464000 112000 33000 11000 1650 -432000 $ 784000 $ 33000 11003 1650 55000 44000 $ 240000 $ 33000 M 11003 1650 33000 eges - 76000 192000 33000 11000 1650 OOO 11000 1650 55000 GGGGG 170000 M 237650 125650 3623503 157650 S 418350 $ 354650 532650 4556505 171650 244650 -11650 $ -121650 Loan requirement or cash surplus Cash at start of month Cumulative cash 5 132000 194350 $ 912700 380050 $ 208400 $ 86750 29900 3710 $ $ 86750 5 -29900 submit 494350 85000 912700 85000 380050 85000 208400 85000 55000 85000 Cumulative cash Target cash balance Cumulative surplus cash or loans outstanding to maintain $65.000 target cash balance A-Z $ 409350 is 827700 295050 s 123400 1750 X -114900 b. Prepare monthly estimates of the required financing or excess funds--that is, the amount of money Bowers will need to borrow or will have available to invest. Required financing, if any, should be indicated by a minus sign Required financing or excess funds July 5 409350 August $ 3333503 September 5 -617650 x October $ 256650 X November 5 -206650 December $ -201650 c. Now suppote receipts from sales come in uniformly during the month (that is, cash receots come in at the rate of 1/30 o 1/31aach day), but all outflow must be said on the 5th Will this affect the cash budget? That is, will the cash budget you prepared be valid under these astumptions? not, what could be done to make a valid estimate of the peak financing requirements? No calculations are required, although if you prefer, you can use cakulations to mustrate the effects. In a situation, where inflows and outflows are not synchronized during the month, it tkely to be possible to use a cash dont centered on the end of the month. To make a valid estimate of the peak financing requirements, the company would the main che o Bowers' sales are seasonal, and her company produces on a seasonal basis just ahead of sales. Without making any calculations, Scuss how the company's current and debt ratios would vary during the year it financial requirements were met with short term bank loans. Could changes in these ratios affect the Firm's ability to obtain tanker? Explain The months preceding peak sales would show a decreased current rate and are debt to capital ratio due to sitional short-term bankfoons. In the following months as receipts are collected from sales, the current ratio would rem and the debt-to-capital ratio would decreme Abnormal changes in the ratio wit affect the firm's ability to obtain bank credit Suomi The months preceding peak sales would show a decreased B current ratio and an increased debt-to-capital ratio due to additional short-term bank loans. In the following months as receipts are collected from sales, the current ratio would create and the debt-to-capital ratio would decrease o . Abnormal changes in these ratios would e affect the firm's ability to obtain bank credit ef Bowers customers began to pay late, collections would slow down, thus ncrenting the required loan amount. If sales declined, this also would have an effect on the required toan. Do a sensitivity analysis that shows the effects of these two factors on the maximum loan requirement. Enter your answers positive numbers. To complete the sensitivity analysis, follow these steps in excel Ensure that cell AGO is a reference to cell 056 0556). Select/highlight cells Ago through H69 (AGO:H69) From the top ribbon, select Data > Forecast >> What-tf-Analysis > Data Table Forrow Input cell click on cell 5 or enter $8$5. For column input chill click on cel 14 or manually enter 58514 . Click "OK" Collections in and month Change in sales 0 15% 30 60% 754 90 -100% $ -75% -50 $ 0 25 $ so 75% $ 100% 5 $ $ $ $ $ S 1 $ 5 $ Check My Wor Raasi Pa

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started