Please help on problem #3. It appears to me that we take the risk free rate from problem #2 and the market risk premium from problem #2 and input these into the CAPM formula. The beta should be the unique beta for each project, correct?

The required returns for each project that I am coming up with are not correct (I don't think), because later when I compute NPV, IRR and PI, these are not following each other. For example I get a positive NPV, too low IRR and too low PI for one of the projects. I must be using an incorrect required rate of return, which would come from the CAPM.

For example, for project A, I am getting this:

R= rf + (MRP x B)

1.43 + (8.6 x 1.7)

1.43 + 14.62 = 16.05%

However, I don't think this is correct. I posted this question earlier and the answer I received was using 1.15 as the beta in the formula, but I am confused because we are given the beta for each project, so why would I need to use 1.15?

Here are my returns for each project as I have calculated them so far (which I believe to be incorrect):

Project A: 16.05%, Project B: 10.89%, Project C: 11.75%, Project D: 14.33%

Below are the screenshots from the questions that are relevant. (my answers thus far are typed in the color blue)

Again, please help me get the correct returns for each project (problem #3), so that my additional calculations that come later are using the correct return for each project. Thank you

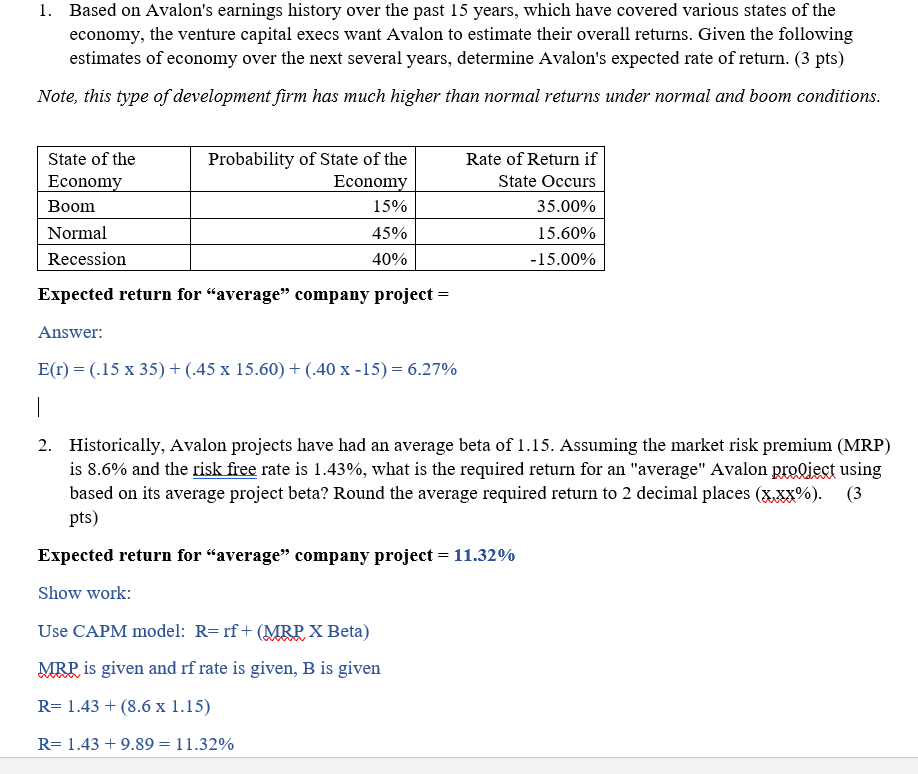

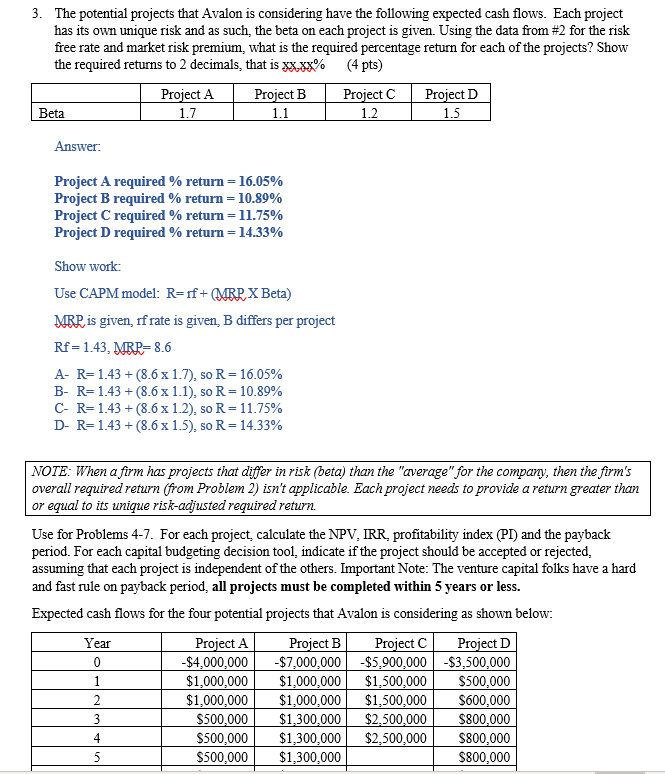

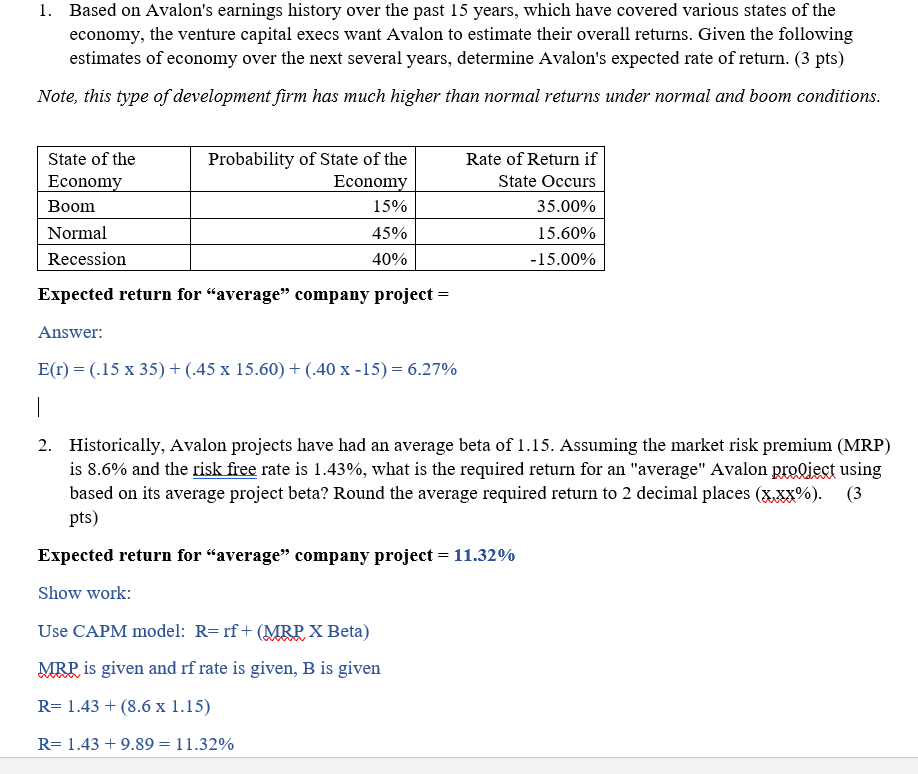

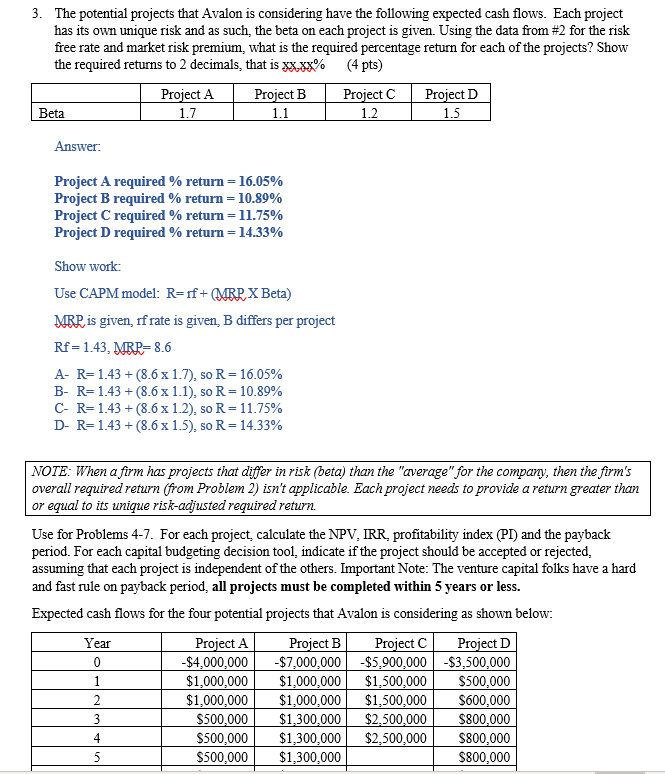

1. Based on Avalon's earnings history over the past 15 years, which have covered various states of the economy, the venture capital execs want Avalon to estimate their overall returns. Given the following estimates of economy over the next several years, determine Avalon's expected rate of return. (3 pts) Note, this type of development firm has much higher than normal returns under normal and boom conditions. State of the Economy Boom Normal Recession Probability of State of the Economy 15% 45% 40% Rate of Return if State Occurs 35.00% 15.60% -15.00% Expected return for "average" company project = Answer: E(r) =(.15 x 35) + (.45 x 15.60) + (.40 x-15) = 6.27% 2. Historically, Avalon projects have had an average beta of 1.15. Assuming the market risk premium (MRP) is 8.6% and the risk free rate is 1.43%, what is the required return for an "average" Avalon prolject using based on its average project beta? Round the average required return to 2 decimal places (x.xx%). (3 pts) Expected return for "average" company project = 11.32% Show work: Use CAPM model: R=rf+ (MRR X Beta) MRP is given and rf rate is given, B is given R= 1.43+ (8.6 x 1.15) R= 1.43 +9.89 = 11.32% 3. The potential projects that Avalon is considering have the following expected cash flows. Each project has its own unique risk and as such, the beta on each project is given. Using the data from #2 for the risk free rate and market risk premium, what is the required percentage return for each of the projects? Show the required returns to 2 decimals, that is xx.xx% (4 pts) Project A | Project B Project C Project D Beta 1.7 I 1.1 | 12 | 1.5 Answer: Project A required % return = 16.05% Project B required % return = 10.89% Project C required % return= 11.75% Project D required % return=14.33% Show work: Use CAPM model: R=rf+ MRR X Beta) MRR is given, rf rate is given B differs per project Rf=1.43, MRR= 8.6 A- R=1.43 +(8.6 x 1.7), so R=16.05% B- R=1.43 +(8.6 x 1.1), so R = 10.89% C- R=1.43 +(8.6 x 1.2), so R=11.75% D- R=1.43 +(8.6 x 1.5), so R = 14.33% NOTE: When a firm has projects that differ in risk (beta) than the "average" for the company, then the firm's overall required return (from Problem 2) isn't applicable. Each project needs to provide a return greater than or equal to its unique risk-adjusted required return. Use for Problems 4-7. For each project, calculate the NPV, IRR profitability index (PI) and the payback period. For each capital budgeting decision tool, indicate if the project should be accepted or rejected, assuming that each project is independent of the others. Important Note: The venture capital folks have a hard and fast rule on payback period, all projects must be completed within 5 years or less. Expected cash flows for the four potential projects that Avalon is considering as shown below: Year Project A Project B Project C Project D $4,000,000 $7,000,000 $5,900,000 $3,500,000 $1,000,000 $1,000,000 $1,500,000 $500,000 $1,000,000 $1,000,000 $1,500,000 $600,000 $500,000 $1,300,000 $2.500.000 $800,000 $500,000 $1,300,000 $2,500,000 $800,000 $500,000 $1,300,000 $800,000