Answered step by step

Verified Expert Solution

Question

1 Approved Answer

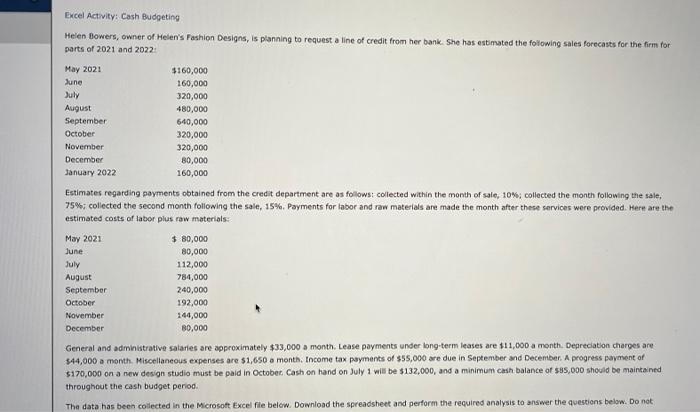

Please help on the few incorrect answers (mostly part b). I will upvote the response. Thank you in advance! Excel Activity: Cash Budgeting Helen Bowers,

Please help on the few incorrect answers (mostly part b). I will upvote the response. Thank you in advance!

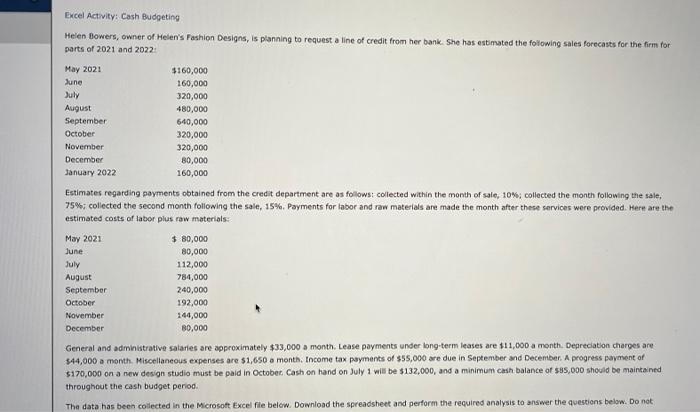

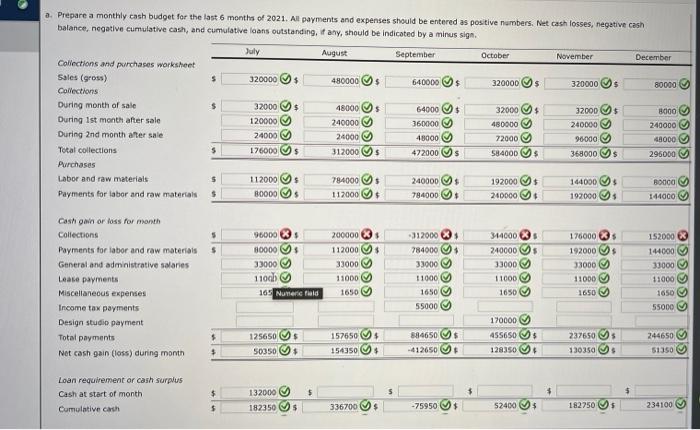

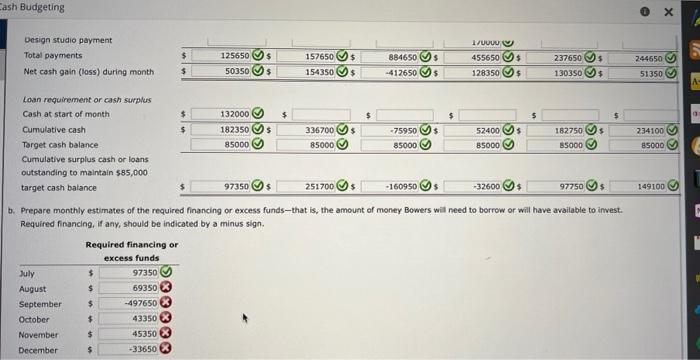

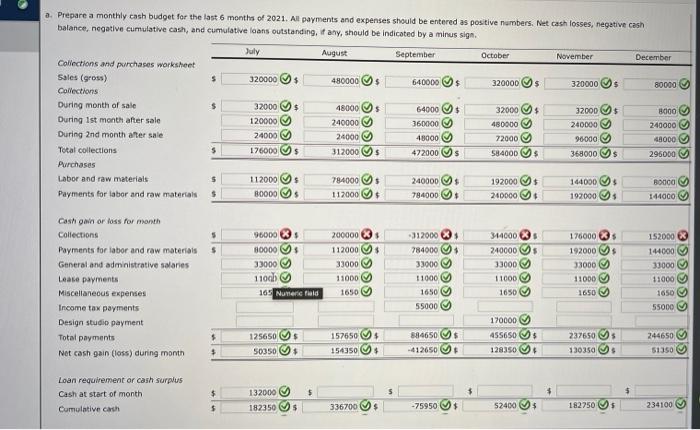

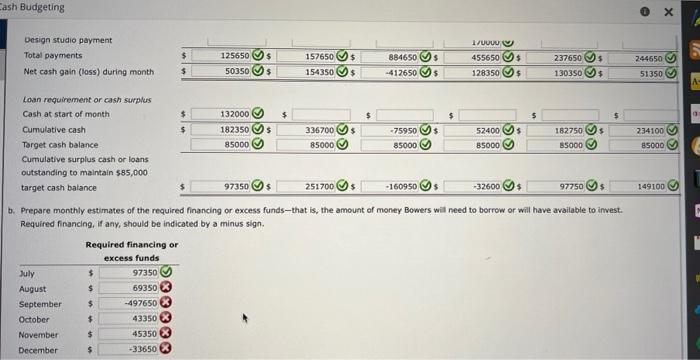

Excel Activity: Cash Budgeting Helen Bowers, owner of Helen's Fashion Designs, is planning to request a line of credit from her bank. She has estimated the following sales forecasts for the firm for parts of 2021 and 2022 May 2021 $160,000 June 160,000 July 320,000 August 480,000 September 640,000 October 320,000 November 320,000 December 80,000 January 2022 160,000 Estimates regarding payments obtained from the credit department are as follows: collected within the month of sale, 10%, collected the month following the sale, 75% collected the second month following the sale, 15%. Payments for labor and raw materials are made the month after these services were provided. Here are the estimated costs of labor plus raw materials May 2021 $ 80,000 June 80,000 July 112,000 August 784,000 September 240,000 October 192,000 November 144,000 December 80,000 General and administrative salaries are approximately $33,000 a month. Lease payments under long-term leases are $11,000 a month. Depreciation charges are $44,000 a month Miscellaneous expenses are $1,650 a month. Income tax payments of $55,000 are due in September and December. A progress payment of $170,000 on a new design studio must be paid in October Cash on hand on July 1 will be $132,000, and a minimum cash balance of $35,000 should be maintained throughout the cash budget period The data has been collected in the Microsoft Excel file below. Download the spreadsheet and perform the required analysis to answer the questions below. Do not 9 a. Prepare a monthly cash budget for the last 6 months of 2021. All payments and expenses should be entered as positive numbers. Net cash losses, negative cash balance, negative cumulative cash, and cumulative loans outstanding, fany, should be indicated by a minus sign. July August September October November December Collections and purchases worksheet Sales (gross) $ 320000 480000 $ 640000 $ 320000 $ 320000 5 80000 Collections During month of sale $ 32000 $ 48000 $ 64000 $ 32000$ 32000 8000 During 1st month after sale 120000 240000 360000 480000 240000 240000 During and month after sale 24000 24000 48000 72000 96000 48000 Total collections $ 176000 $ 312000 472000 $ 584000 $ 368000 $ 295000 Purchases Labor and raw materials 5 112000 784000 $ 240000 $ 192000$ 144000 $ 80000 M Payments for labor and raw materials $ B0000 $ 112000 $ 784000 $ 240000 $ 192000 $ 144000 GOO COO 95000 S S $ $ CE $ 80000 33000 1100h 200000 112000$ 33000 11000 1650 Cash gain or loss for month Collections Payments for labor and raw materials General and administrative salaries Lease payments Miscellaneous expenses Income tax payments Design studio payment Total payments Net cash gain (loss) during month 152000 144000 33000 312000 784000 33000 11000 1650 55000 3414000 240000 33000 11000 1650 1760003 192000 $ 33000 11000 11000 1650 169 Numer fald 1650 55000 $ $ 125650 50350 $ 157650 $ 154350 $ 884650 -412650 170000 45S6SD $ 128350 $ 237650 M 130350 244650 51350 Loan requirement or cash surplus Cash at start of month Cumulative cash $ 132000 $ $ $ 182350 $ 336700 -75950 $ 52400 $ 182750 s 234100 Cash Budgeting x Design studio payment Total payments Net cash gain (loss) during month $ $ 125650 50350 237650 gs 157650 154350 1/UVU 455650 $ 128350 $ 884650 s -412650 $ $ 244650 51350 M $ $ 130350 $ A $ $ $ 5 $ 234100 85000 BS000 $ 149100 Loan requirement or cash surplus Cash at start of month $ 132000 Cumulative cash $ 182350 $ 336700 -75950 52400 182750 $ Target cash balance 85000 85000 85000 85000 Cumulative surplus cash or loans outstanding to maintain $85,000 target cash balance 97350 $ 251700 $ -160950 $ -32600 $ 97750 b. Prepare monthly estimates of the required financing or excess fundsthat is, the amount of money Bowers will need to borrow or will have available to invest. Required financing, if any, should be indicated by a minus sign. Required financing or excess funds July 97350 August 69350 September -497650 October $ 43350 X November $ 45350 December $ $ $ $ X X X X * * * * * -33650

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started