Answered step by step

Verified Expert Solution

Question

1 Approved Answer

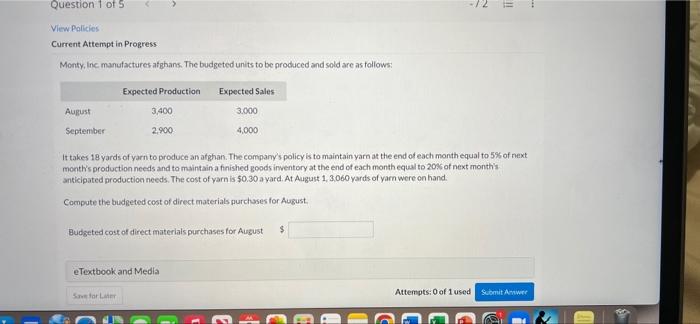

please help only have 20 minutes Question 1 of 5 View Policies Current Attempt in Progress Monty, Inc. manufactures afghans. The budgeted units to be

please help only have 20 minutes

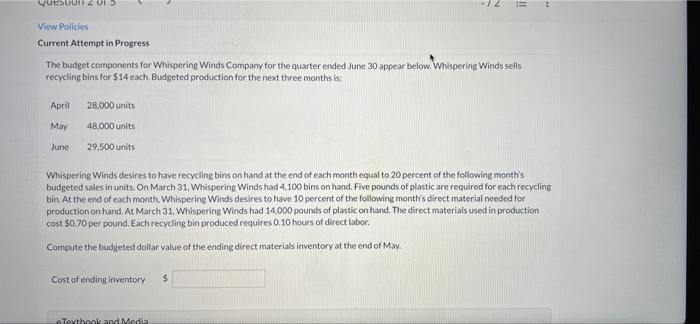

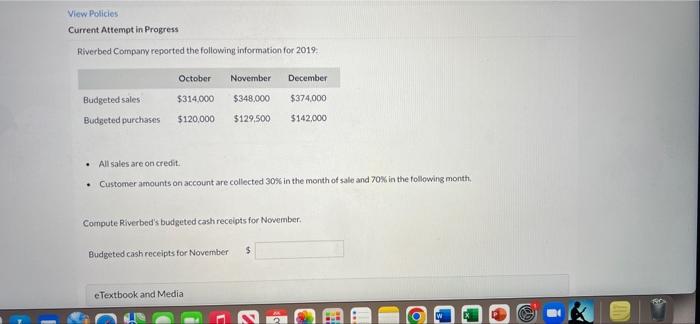

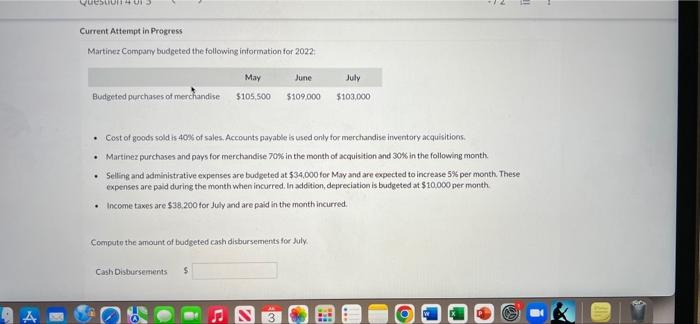

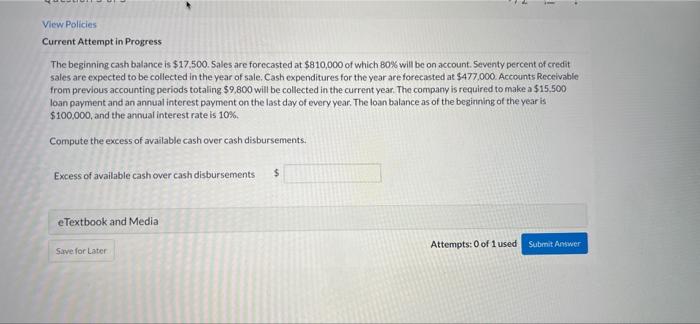

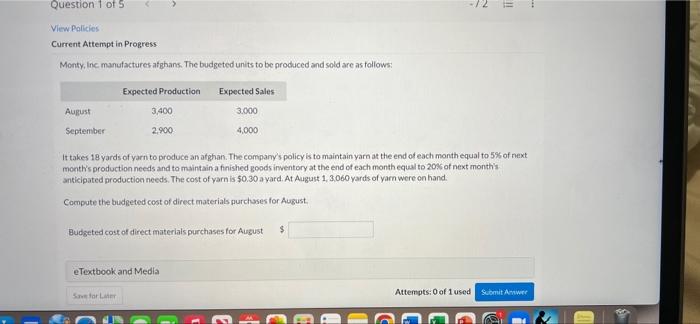

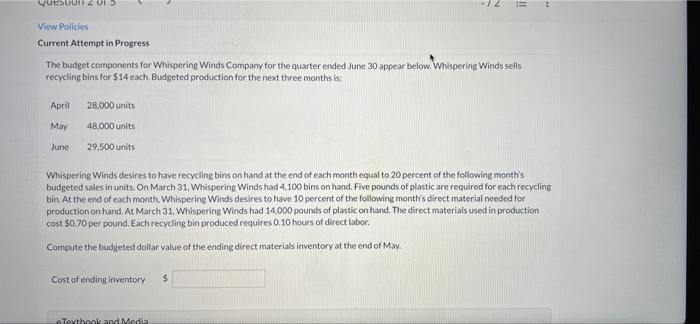

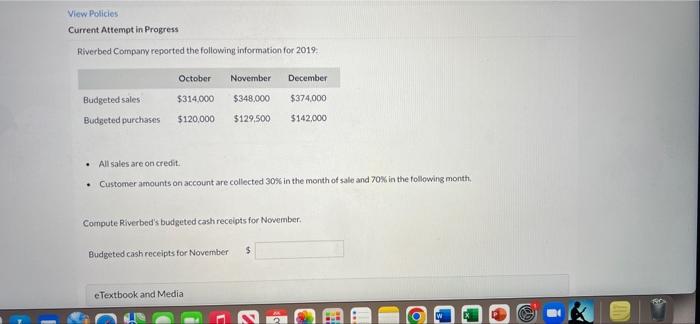

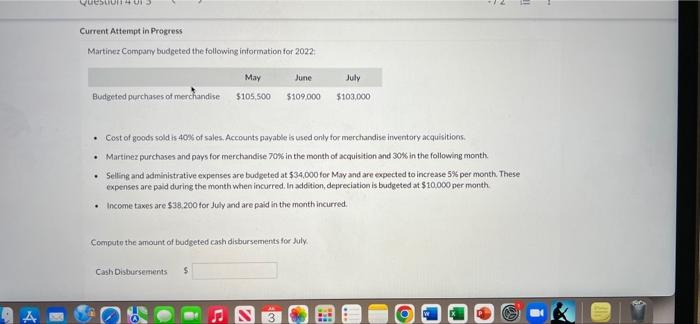

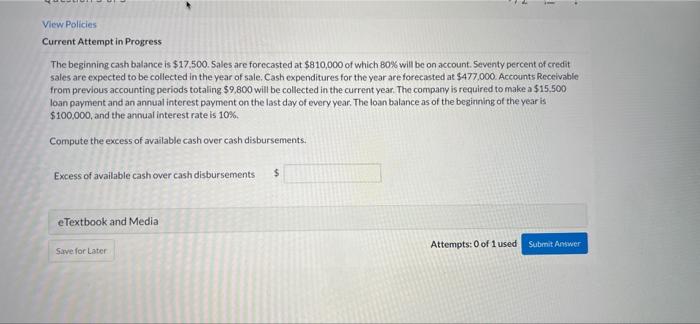

Question 1 of 5 View Policies Current Attempt in Progress Monty, Inc. manufactures afghans. The budgeted units to be produced and sold are as follows: August September Expected Production 3,400 2,900 Save for Later eTextbook and Medial Expected Sales 3.000 4,000 E It takes 18 yards of yarn to produce an afghan. The company's policy is to maintain yarn at the end of each month equal to 5% of next month's production needs and to maintain a finished goods inventory at the end of each month equal to 20% of next month's anticipated production needs. The cost of yarn is $0.30 a yard. At August 1, 3,060 yards of yarn were on hand. Compute the budgeted cost of direct materials purchases for August. Budgeted cost of direct materials purchases for August $ II Attempts: 0 of 1 used Submit Answer View Policies Current Attempt in Progress April 28,000 units May 48,000 units June 29,500 units The budget components for Whispering Winds Company for the quarter ended June 30 appear below. Whispering Winds sells recycling bins for $14 each. Budgeted production for the next three months is: V Cost of ending inventory !! Whispering Winds desires to have recycling bins on hand at the end of each month equal to 20 percent of the following month's budgeted sales in units. On March 31, Whispering Winds had 4,100 bins on hand. Five pounds of plastic are required for each recycling bin. At the end of each month, Whispering Winds desires to have 10 percent of the following month's direct material needed for production on hand. At March 31, Whispering Winds had 14,000 pounds of plastic on hand. The direct materials used in production cost 50.70 per pound. Each recycling bin produced requires 0.10 hours of direct labor. Compute the budgeted dollar value of the ending direct materials inventory at the end of May. Textbook and Media View Policies Current Attempt in Progress Riverbed Company reported the following information for 2019 Budgeted sales Budgeted purchases October November $314,000 $348,000 $120,000 December $374,000 $129,500 $142,000 . All sales are on credit. Customer amounts on account are collected 30% in the month of sale and 70% in the following month. Compute Riverbed's budgeted cash receipts for November. Budgeted cash receipts for November eTextbook and Media $ S Current Attempt in Progress Martinez Company budgeted the following information for 2022: May Budgeted purchases of merchandise $105,500 June $109,000 Compute the amount of budgeted cash disbursements for July Cash Disbursements Cost of goods sold is 40% of sales. Accounts payable is used only for merchandise inventory acquisitions. Martinez purchases and pays for merchandise 70% in the month of acquisition and 30% in the following month Selling and administrative expenses are budgeted at $34,000 for May and are expected to increase 5% per month. These expenses are paid during the month when incurred. In addition, depreciation is budgeted at $10,000 per month Income taxes are $38.200 for July and are paid in the month incurred. $ July $103,000 E 11 View Policies Current Attempt in Progress The beginning cash balance is $17.500. Sales are forecasted at $810,000 of which 80% will be on account. Seventy percent of credit sales are expected to be collected in the year of sale. Cash expenditures for the year are forecasted at $477,000. Accounts Receivable from previous accounting periods totaling $9,800 will be collected in the current year. The company is required to make a $15.500 loan payment and an annual interest payment on the last day of every year. The loan balance as of the beginning of the year is $100,000, and the annual interest rate is 10%. Compute the excess of available cash over cash disbursements. Excess of available cash over cash disbursements eTextbook and Media Save for Later $ Attempts: 0 of 1 used Submit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started