Answered step by step

Verified Expert Solution

Question

1 Approved Answer

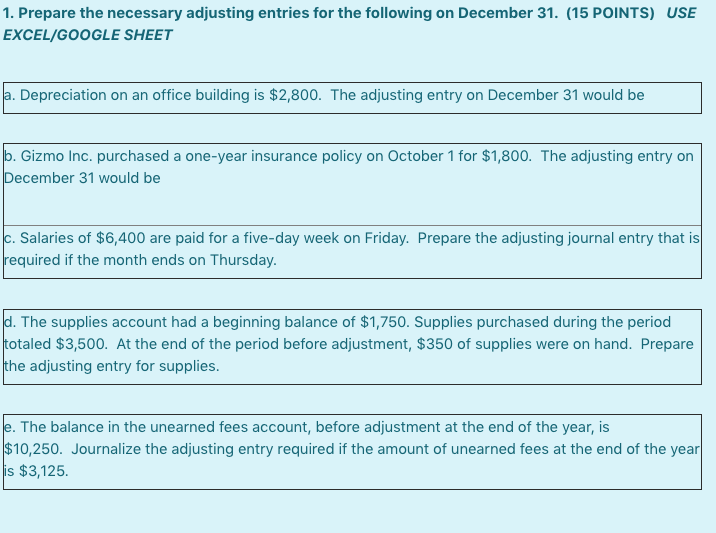

PLEASE HELP! ONLY NEED HELP WITH NUMBER 2 1. Prepare the necessary adjusting entries for the following on December 31. (15 POINTS) USE EXCEL/GOOGLE SHEET

PLEASE HELP! ONLY NEED HELP WITH NUMBER 2

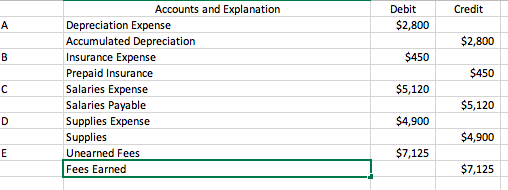

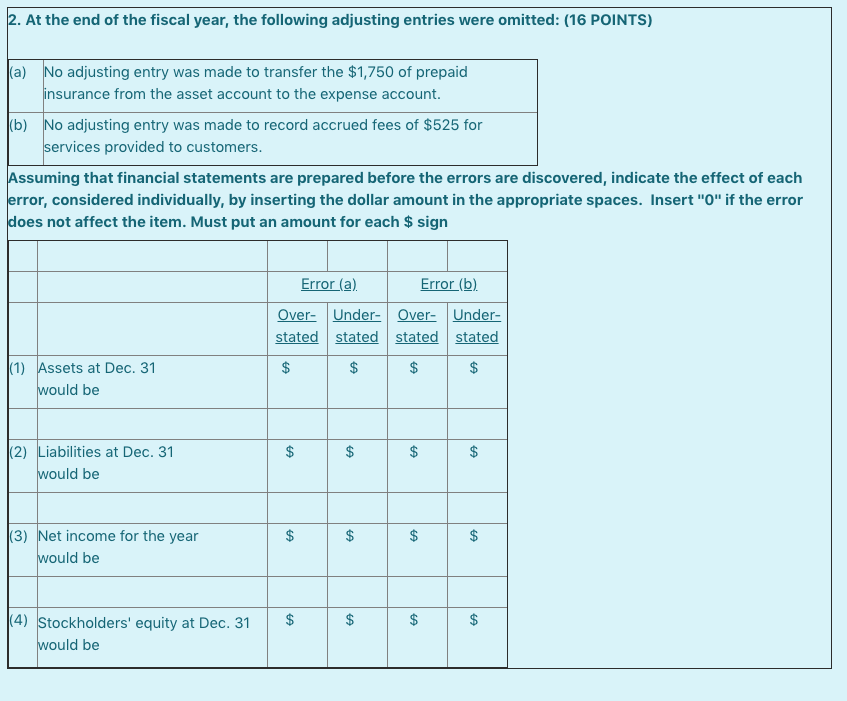

1. Prepare the necessary adjusting entries for the following on December 31. (15 POINTS) USE EXCEL/GOOGLE SHEET a. Depreciation on an office building is $2,800. The adjusting entry on December 31 would be b. Gizmo Inc. purchased a one-year insurance policy on October 1 for $1,800. The adjusting entry on December 31 would be c. Salaries of $6,400 are paid for a five-day week on Friday. Prepare the adjusting journal entry that is required if the month ends on Thursday. d. The supplies account had a beginning balance of $1,750. Supplies purchased during the period totaled $3,500. At the end of the period before adjustment, $350 of supplies were on hand. Prepare the adjusting entry for supplies. e. The balance in the unearned fees account, before adjustment at the end of the year, is $10,250. Journalize the adjusting entry required if the amount of unearned fees at the end of the year is $3,125. Credit Debit $2,800 $2,800 $450 $450 Accounts and Explanation Depreciation Expense Accumulated Depreciation Insurance Expense Prepaid Insurance Salaries Expense Salaries Payable Supplies Expense Supplies Unearned Fees Fees Earned $5,120 $5,120 $4,900 $4,900 $7,125 $7,125 2. At the end of the fiscal year, the following adjusting entries were omitted: (16 POINTS) (a) No adjusting entry was made to transfer the $1,750 of prepaid insurance from the asset account to the expense account. (b) No adjusting entry was made to record accrued fees of $525 for services provided to customers. Assuming that financial statements are prepared before the errors are discovered, indicate the effect of each error, considered individually, by inserting the dollar amount in the appropriate spaces. Insert "O" if the error does not affect the item. Must put an amount for each $ sign Error (a). Error (b) Over- Under- Over- Under- stated stated stated stated (1) Assets at Dec. 31 would be (2) Liabilities at Dec. 31 would be (3) Net income for the year would be $ $ 14) Stockholders' equity at Dec. 31 would beStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started