Answered step by step

Verified Expert Solution

Question

1 Approved Answer

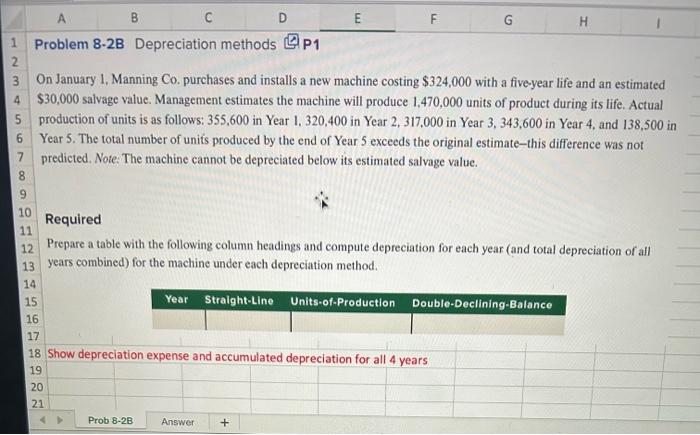

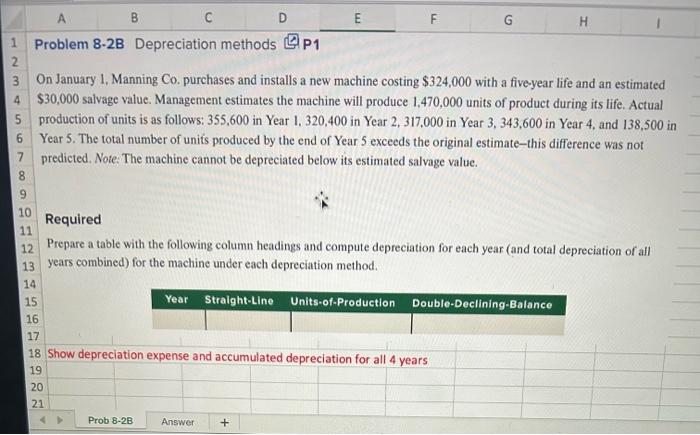

please help out!! On January 1, Manning Co. purchases and installs a new machine costing $324,000 with a five-year life and an estimated $30,000 salvage

please help out!!

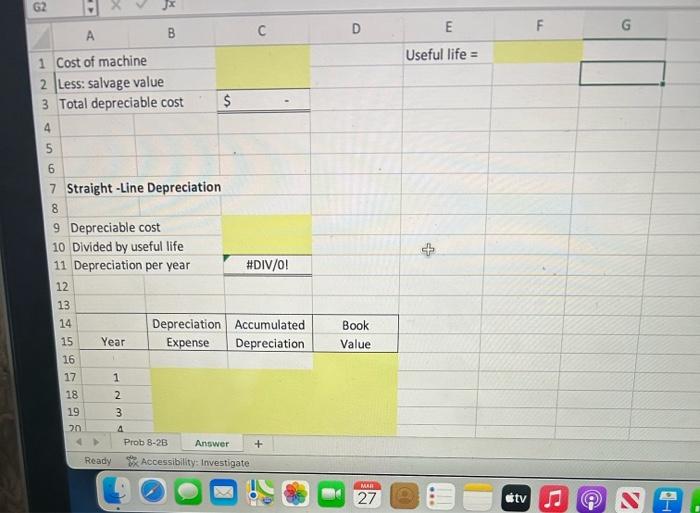

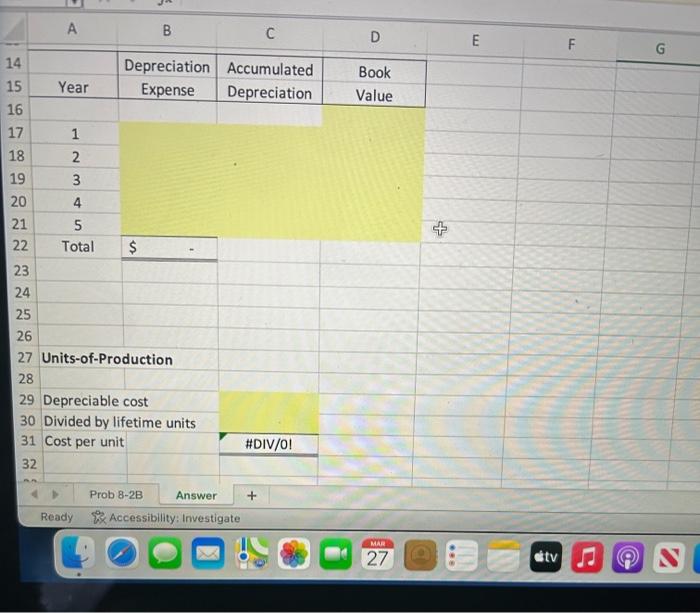

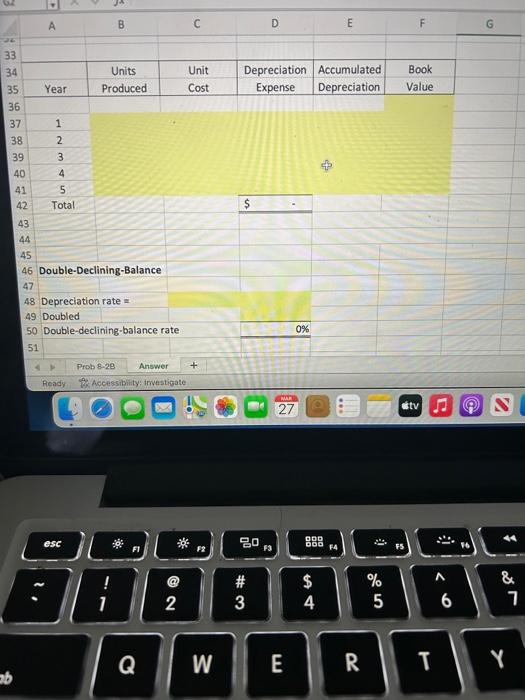

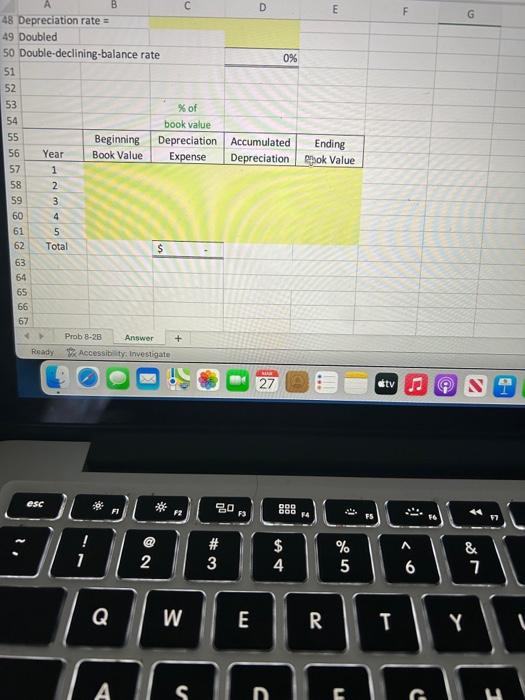

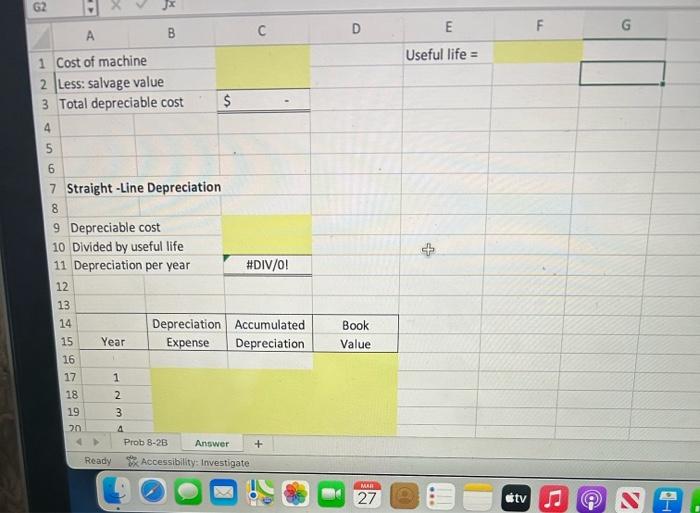

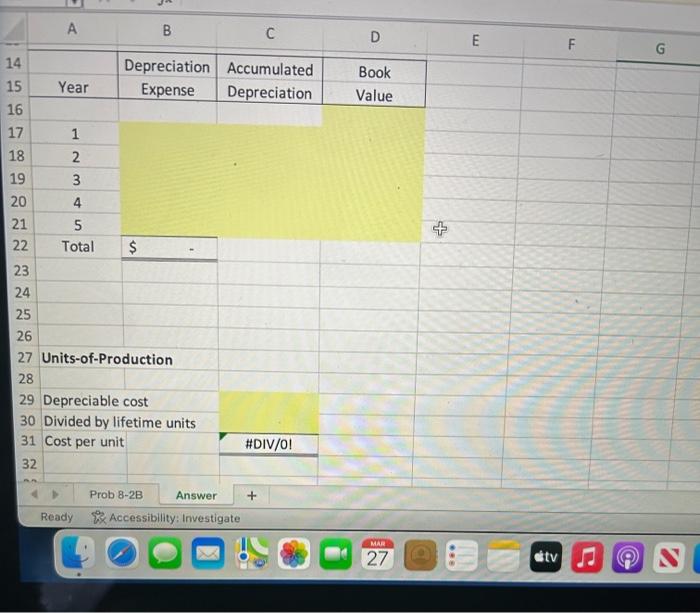

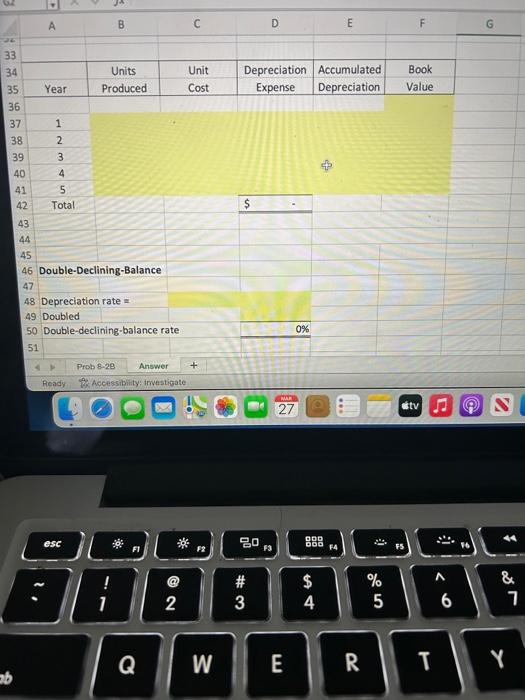

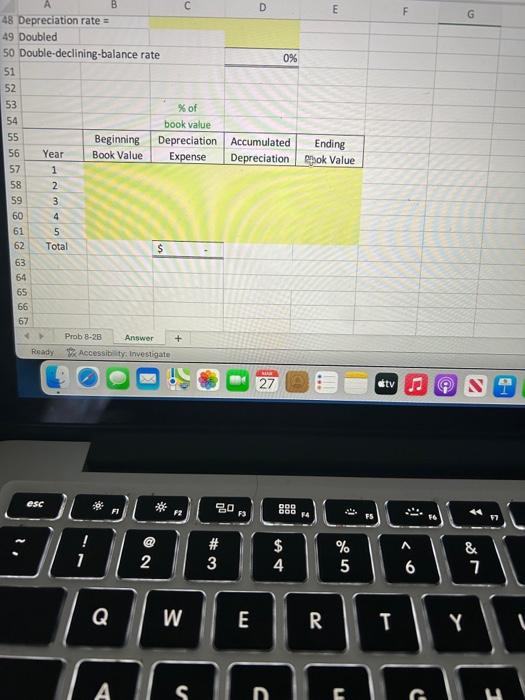

On January 1, Manning Co. purchases and installs a new machine costing $324,000 with a five-year life and an estimated $30,000 salvage value. Management estimates the machine will produce 1,470,000 units of product during its life. Actual production of units is as follows: 355,600 in Year 1,320,400 in Year 2,317,000 in Year 3,343,600 in Year 4, and 138,500 in Year 5. The total number of units produced by the end of Year 5 exceeds the original estimate-this difference was not predicted. Note: The machine cannot be depreciated below its estimated salvage value. Required Prepare a table with the following column headings and compute depreciation for each year (and total depreciation of all years combined) for the machine under each depreciation method. 8 Show depreciation expense and accumulated depreciation for all 4 years B C D E F G Useful life = 2 Less: salvage value 3 Total depreciable cost $ 54 Straight -Line Depreciation 8 9 Depreciable cost 10 Divided by useful life 11 Depreciation per year \#DIV/0! 12 13 \begin{tabular}{|c|c|c|c|c|} \hline 14 & & Depreciation & Accumulated & Book \\ \hline 15 & Year & Expense & Depreciation & Value \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline 17 & 1 \\ \hline 18 & 2 \\ \hline 19 & 3 \\ \hline 20 & 4 \\ \hline 21 & 5 \\ \hline 22 & Total \\ \hline \end{tabular} $ Units-of-Production Ready ix Accessibility: Investigate \begin{tabular}{|l|l|} \hline 37 & 1 \\ \hline 38 & 2 \\ \hline 39 & 3 \\ \hline 40 & 4 \\ \hline 41 & 5 \\ \hline \end{tabular} 42 Total $ 43 Double-Declining-Balance Depreciation rate = 49 Doubled 50 Double-declining-balance rate 51 54 65 67

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started