Answered step by step

Verified Expert Solution

Question

1 Approved Answer

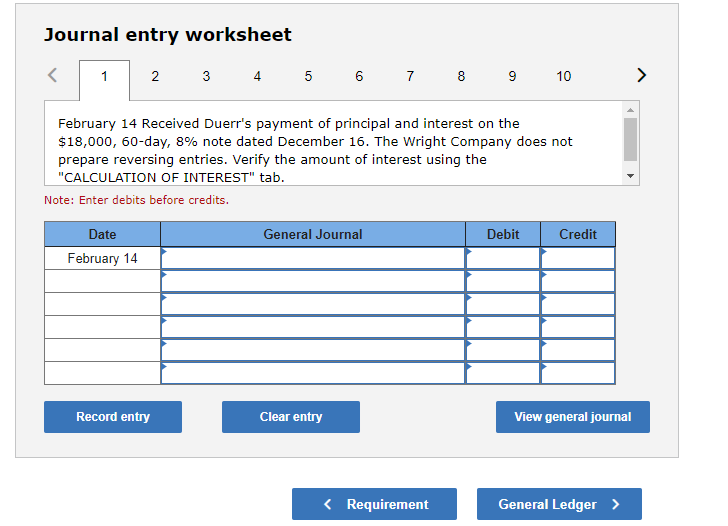

Please Help!! P7-5a Journal entry worksheet 8 February 14 Received Duerr's payment of principal and interest on the $18,000,60-day, 8% note dated December 16 .

Please Help!!

P7-5a

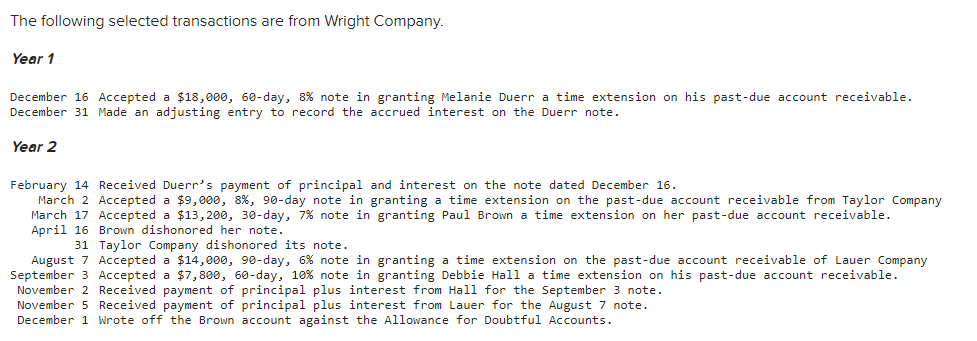

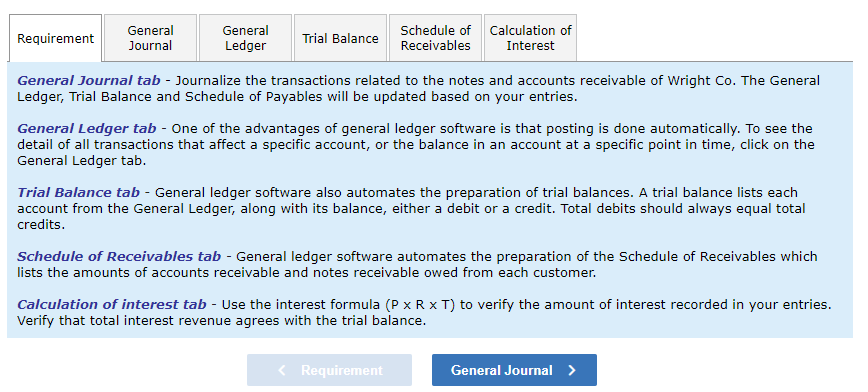

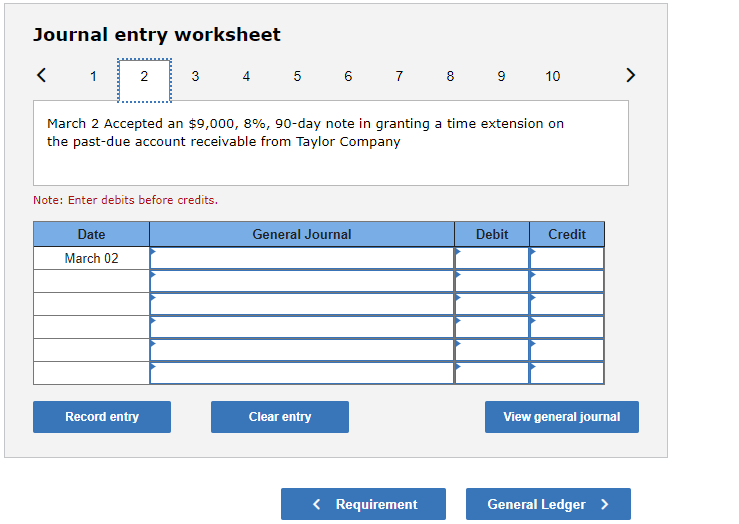

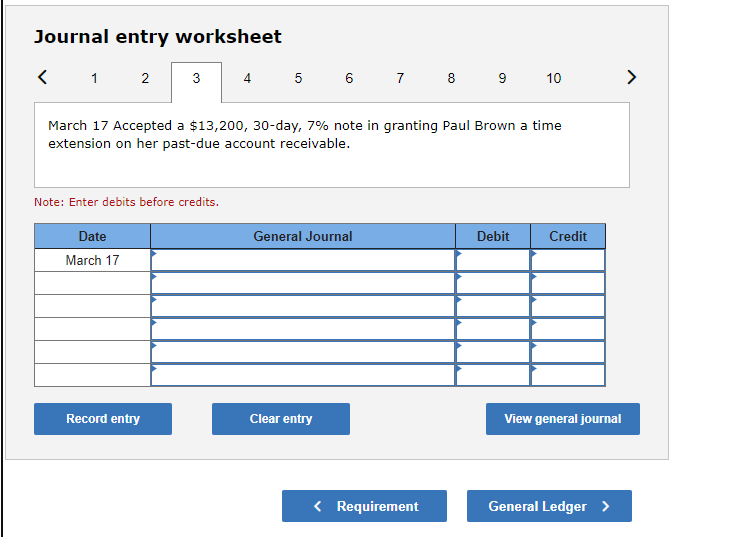

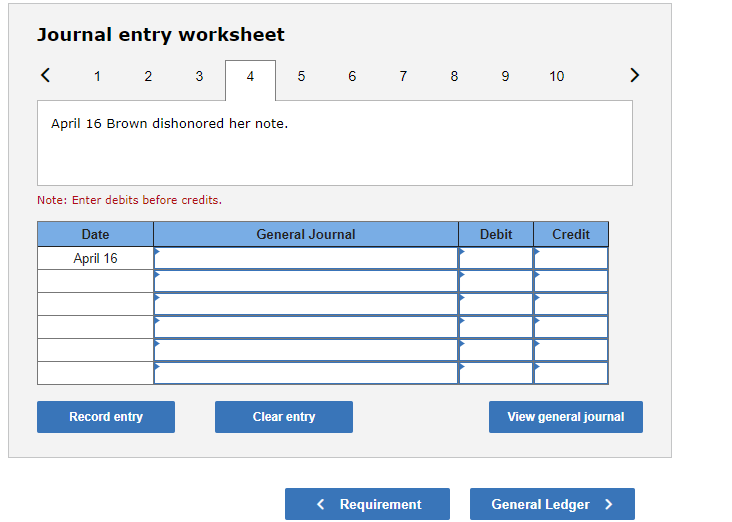

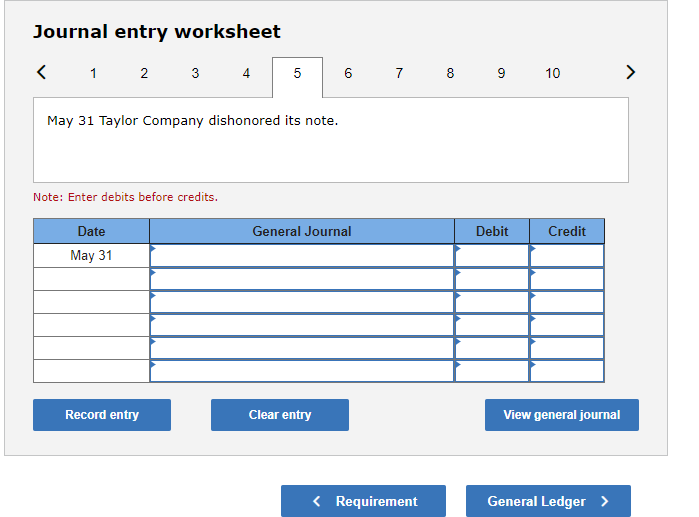

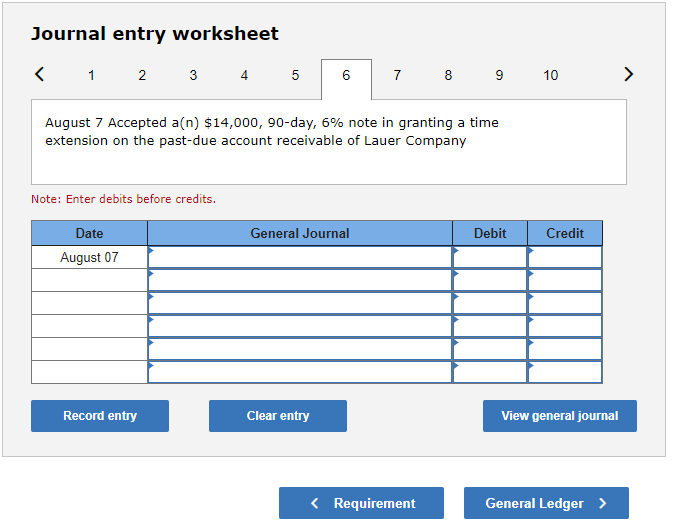

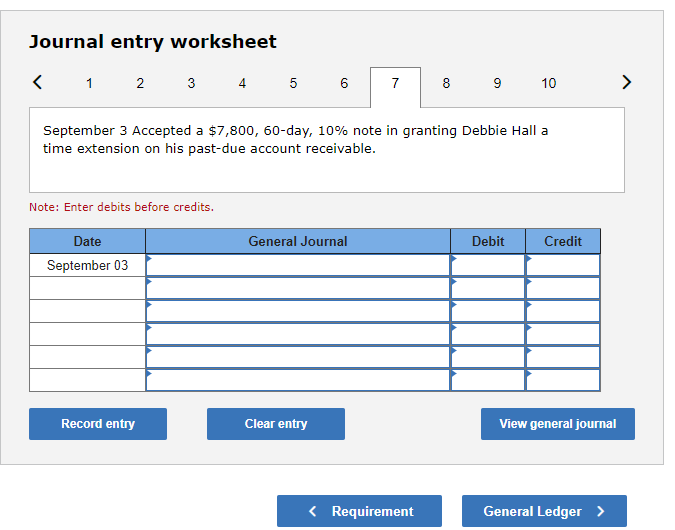

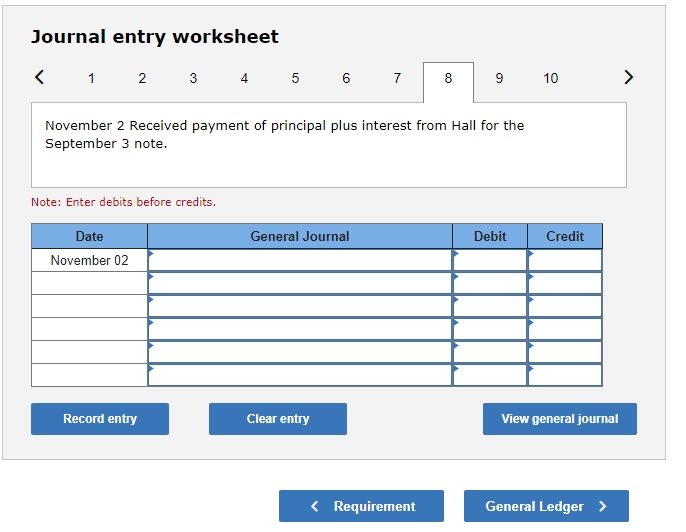

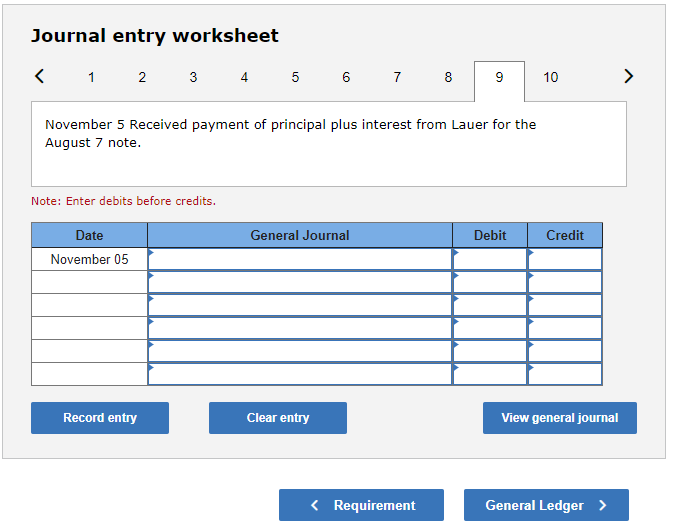

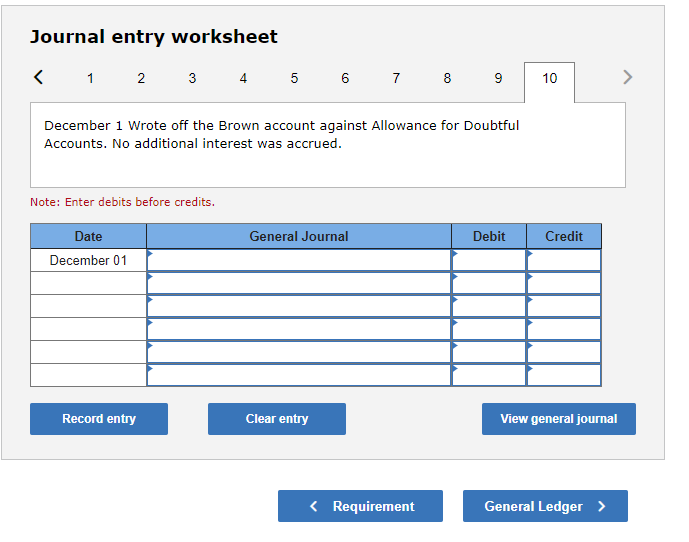

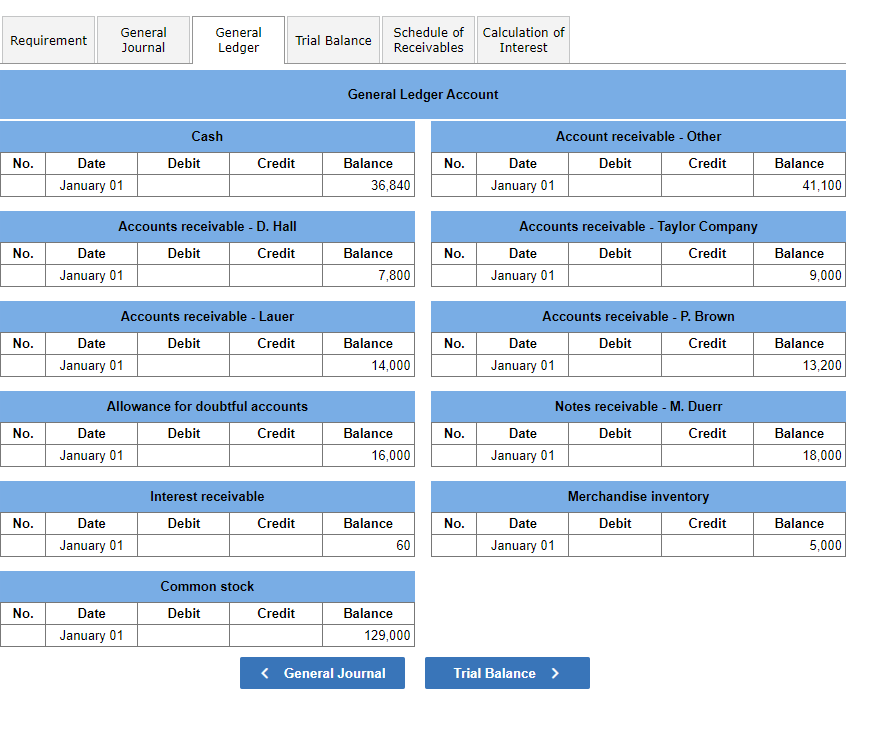

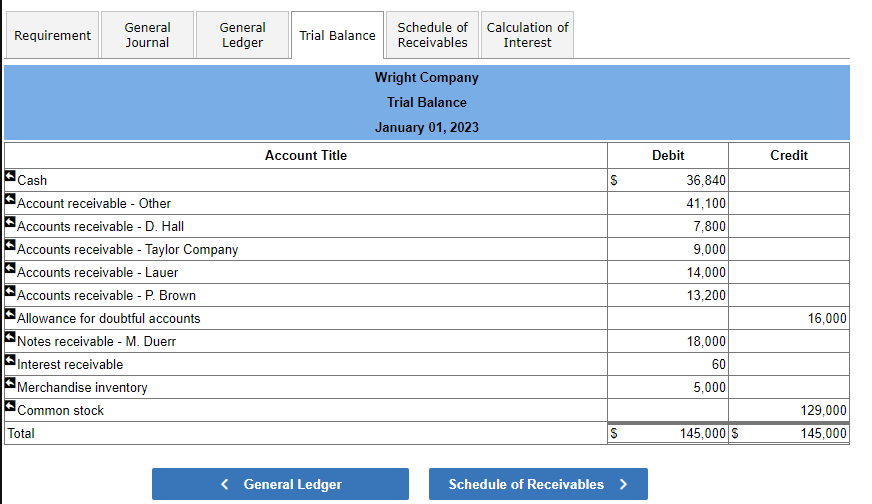

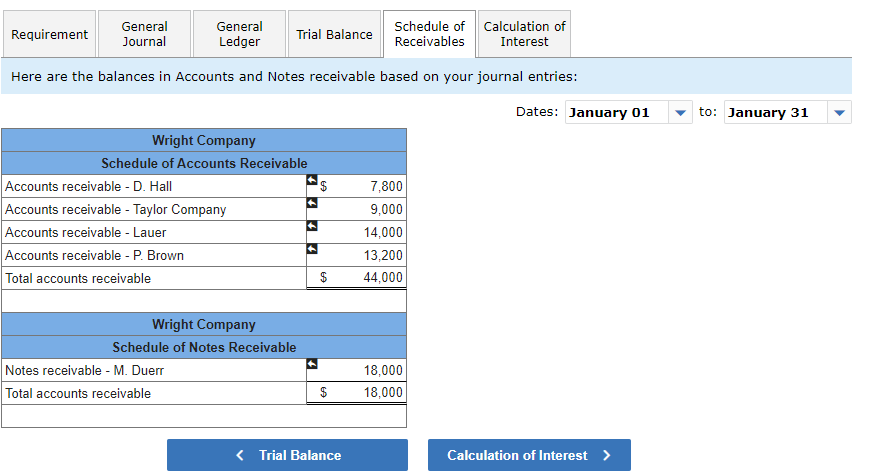

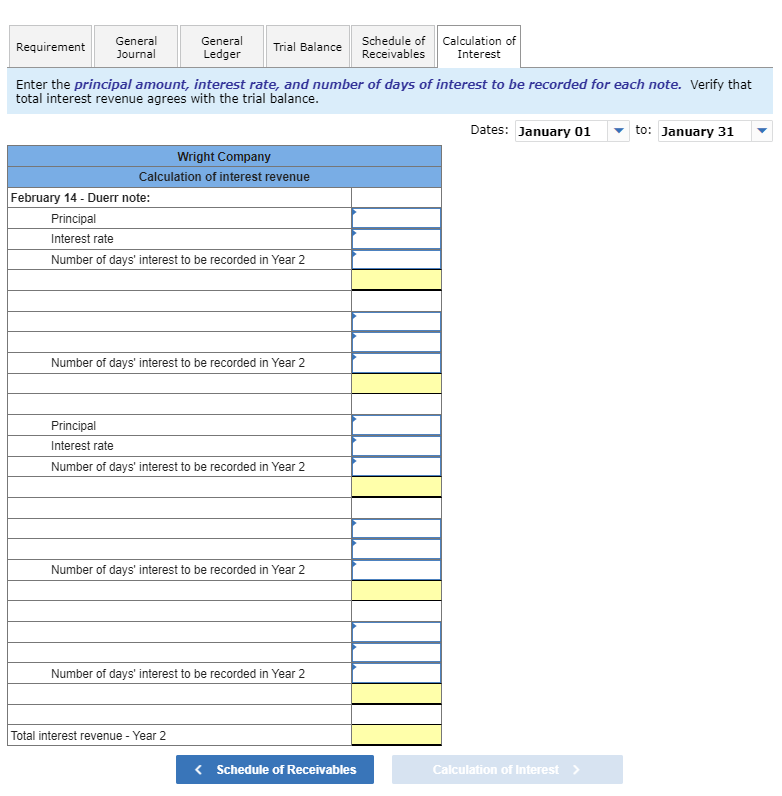

Journal entry worksheet 8 February 14 Received Duerr's payment of principal and interest on the $18,000,60-day, 8% note dated December 16 . The Wright Company does not prepare reversing entries. Verify the amount of interest using the "CALCULATION OF INTEREST" tab. Note: Enter debits before credits. dger Account Journal entry worksheet \begin{tabular}{lllll} 5 & 6 & 8 & 9 & 10 \end{tabular} March 17 Accepted a $13,200,30-day, 7% note in granting Paul Brown a time extension on her past-due account receivable. Note: Enter debits before credits. The following selected transactions are from Wright Company. Year 1 December 16 Accepted a $18,000,60-day, 8% note in granting Melanie Duerr a time extension on his past-due account receivable. December 31 Made an adjusting entry to record the accrued interest on the Duerr note. Year 2 February 14 Received Duerr's payment of principal and interest on the note dated December 16. March 2 Accepted a $9,000, 8\%, 90-day note in granting a time extension on the past-due account receivable from Taylor Company March 17 Accepted a $13,200, 30-day, 7% note in granting Paul Brown a time extension on her past-due account receivable. April 16 Brown dishonored her note. 31 Taylor Company dishonored its note. August 7 Accepted a $14,000, 90-day, 6% note in granting a time extension on the past-due account receivable of Lauer Company September 3 Accepted a $7,800, 60-day, 10% note in granting Debbie Hall a time extension on his past-due account receivable. November 2 Received payment of principal plus interest from Hall for the September 3 note. November 5 Received payment of principal plus interest from Lauer for the August 7 note. December 1 Wrote off the Brown account against the Allowance for Doubtful Accounts. Journal entry worksheet 123 April 16 Brown dishonored her note. Note: Enter debits before credits. General Journal tab - Journalize the transactions related to the notes and accounts receivable of Wright Co. The General Ledger, Trial Balance and Schedule of Payables will be updated based on your entries. General Ledger tab - One of the advantages of general ledger software is that posting is done automatically. To see the detail of all transactions that affect a specific account, or the balance in an account at a specific point in time, click on the General Ledger tab. Trial Balance tab - General ledger software also automates the preparation of trial balances. A trial balance lists each account from the General Ledger, along with its balance, either a debit or a credit. Total debits should always equal total credits. Schedule of Receivables tab - General ledger software automates the preparation of the Schedule of Receivables which lists the amounts of accounts receivable and notes receivable owed from each customer. Calculation of interest tab - Use the interest formula (PRT) to verify the amount of interest recorded in your entries. Verify that total interest revenue agrees with the trial balance. Journal entry worksheet \begin{tabular}{|lllll} 5 & 7 & 8 & 9 & 10 \\ \hline \end{tabular} March 2 Accepted an $9,000,8%,90-day note in granting a time extension on the past-due account receivable from Taylor Company Note: Enter debits before credits. Journal entry worksheet 89 August 7 Accepted a(n) $14,000,90-day, 6% note in granting a time extension on the past-due account receivable of Lauer Company Note: Enter debits before credits. Journal entry worksheet 1 6 8 December 1 Wrote off the Brown account against Allowance for Doubtful Accounts. No additional interest was accrued. Note: Enter debits before credits. Journal entry worksheet \begin{tabular}{llll}

Journal entry worksheet 8 February 14 Received Duerr's payment of principal and interest on the $18,000,60-day, 8% note dated December 16 . The Wright Company does not prepare reversing entries. Verify the amount of interest using the "CALCULATION OF INTEREST" tab. Note: Enter debits before credits. dger Account Journal entry worksheet \begin{tabular}{lllll} 5 & 6 & 8 & 9 & 10 \end{tabular} March 17 Accepted a $13,200,30-day, 7% note in granting Paul Brown a time extension on her past-due account receivable. Note: Enter debits before credits. The following selected transactions are from Wright Company. Year 1 December 16 Accepted a $18,000,60-day, 8% note in granting Melanie Duerr a time extension on his past-due account receivable. December 31 Made an adjusting entry to record the accrued interest on the Duerr note. Year 2 February 14 Received Duerr's payment of principal and interest on the note dated December 16. March 2 Accepted a $9,000, 8\%, 90-day note in granting a time extension on the past-due account receivable from Taylor Company March 17 Accepted a $13,200, 30-day, 7% note in granting Paul Brown a time extension on her past-due account receivable. April 16 Brown dishonored her note. 31 Taylor Company dishonored its note. August 7 Accepted a $14,000, 90-day, 6% note in granting a time extension on the past-due account receivable of Lauer Company September 3 Accepted a $7,800, 60-day, 10% note in granting Debbie Hall a time extension on his past-due account receivable. November 2 Received payment of principal plus interest from Hall for the September 3 note. November 5 Received payment of principal plus interest from Lauer for the August 7 note. December 1 Wrote off the Brown account against the Allowance for Doubtful Accounts. Journal entry worksheet 123 April 16 Brown dishonored her note. Note: Enter debits before credits. General Journal tab - Journalize the transactions related to the notes and accounts receivable of Wright Co. The General Ledger, Trial Balance and Schedule of Payables will be updated based on your entries. General Ledger tab - One of the advantages of general ledger software is that posting is done automatically. To see the detail of all transactions that affect a specific account, or the balance in an account at a specific point in time, click on the General Ledger tab. Trial Balance tab - General ledger software also automates the preparation of trial balances. A trial balance lists each account from the General Ledger, along with its balance, either a debit or a credit. Total debits should always equal total credits. Schedule of Receivables tab - General ledger software automates the preparation of the Schedule of Receivables which lists the amounts of accounts receivable and notes receivable owed from each customer. Calculation of interest tab - Use the interest formula (PRT) to verify the amount of interest recorded in your entries. Verify that total interest revenue agrees with the trial balance. Journal entry worksheet \begin{tabular}{|lllll} 5 & 7 & 8 & 9 & 10 \\ \hline \end{tabular} March 2 Accepted an $9,000,8%,90-day note in granting a time extension on the past-due account receivable from Taylor Company Note: Enter debits before credits. Journal entry worksheet 89 August 7 Accepted a(n) $14,000,90-day, 6% note in granting a time extension on the past-due account receivable of Lauer Company Note: Enter debits before credits. Journal entry worksheet 1 6 8 December 1 Wrote off the Brown account against Allowance for Doubtful Accounts. No additional interest was accrued. Note: Enter debits before credits. Journal entry worksheet \begin{tabular}{llll} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started