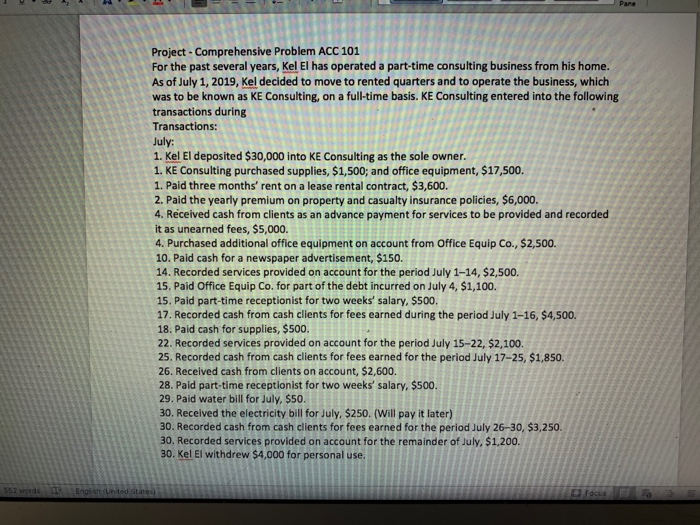

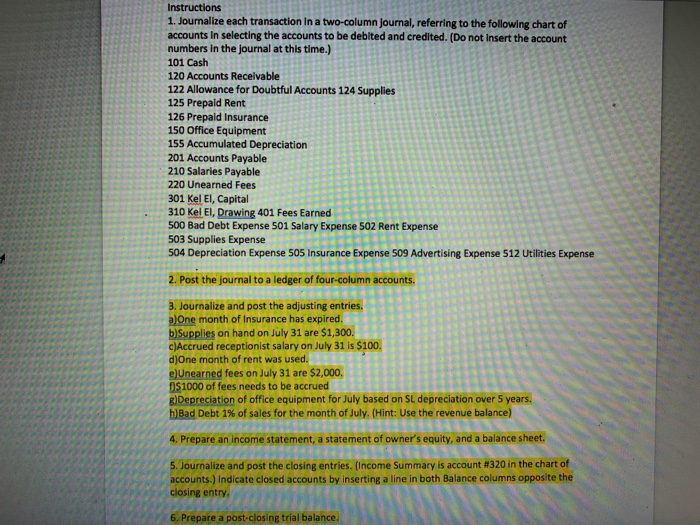

Para Project - Comprehensive Problem ACC 101 For the past several years, Kel El has operated a part-time consulting business from his home. As of July 1, 2019, Kel decided to move to rented quarters and to operate the business, which was to be known as KE Consulting, on a full-time basis. KE Consulting entered into the following transactions during Transactions: July: 1. Kel El deposited $30,000 into Ke Consulting as the sole owner. 1. KE Consulting purchased supplies, $1,500; and office equipment, $17,500. 1. Paid three months' rent on a lease rental contract, $3,600. 2. Paid the yearly premium on property and casualty insurance policies, $6,000. 4. Received cash from clients as an advance payment for services to be provided and recorded it as unearned fees, $5,000. 4. Purchased additional office equipment on account from Office Equip Co., $2,500. 10. Paid cash for a newspaper advertisement, $150. 14. Recorded services provided on account for the period July 114, $2,500. 15. Paid Office Equip Co. for part of the debt incurred on July 4, $1,100. 15. Paid part-time receptionist for two weeks' salary, $500. 17. Recorded cash from cash clients for fees earned during the period July 1-16, $4,500. 18. Paid cash for supplies, $500. 22. Recorded services provided on account for the period July 15-22, $2,100. 25. Recorded cash from cash clients for fees earned for the period July 17-25, $1,850. 26. Received cash from clients on account, $2,600. 28. Paid part-time receptionist for two weeks' salary, $500. 29. Paid water bill for July, $50. 30. Received the electricity bill for July, $250. (Will pay it later) 30. Recorded cash from cash clients for fees earned for the period July 26-30, $3,250. 30. Recorded services provided on account for the remainder of July, $1,200. 30. Kel El withdrew $4,000 for personal use. 552 words English (United States Instructions 1. Journalize each transaction in a two-column Journal, referring to the following chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.) 101 Cash 120 Accounts Receivable 122 Allowance for Doubtful Accounts 124 Supplies 125 Prepaid Rent 126 Prepaid Insurance 150 Office Equipment 155 Accumulated Depreciation 201 Accounts Payable 210 Salaries Payable 220 Unearned Fees 301 Kel El, Capital 310 Kel El, Drawing 401 Fees Earned 500 Bad Debt Expense 501 Salary Expense 502 Rent Expense 503 Supplies Expense 504 Depreciation Expense 505 Insurance Expense 509 Advertising Expense 512 Utilities Expense 2. Post the journal to a ledger of four-column accounts. 3. Journalize and post the adjusting entries. a)One month of Insurance has expired. b)Supplies on hand on July 31 are $1,300. c)Accrued receptionist salary on July 31 is $100. d)One month of rent was used. e) Unearned fees on July 31 are $2,000 0$1000 of fees needs to be accrued g)Depreciation of office equipment for July based on SL depreciation over 5 years. h Bad Debt 1% of sales for the month of July. (Hint: Use the revenue balance) 4. Prepare an income statement, a statement of owner's equity, and a balance sheet. 5. Journalize and post the closing entries. (Income Summary is account #320 in the chart of accounts.) indicate closed accounts by inserting a line in both Balance columns opposite the closing entry, 6. Prepare a post-closing trial balance