Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help! Please provide me with your advice and recommendations respecting tax planning opportunities and consequences for these two options. Dear Red: The Fictious Cattle

Please help!

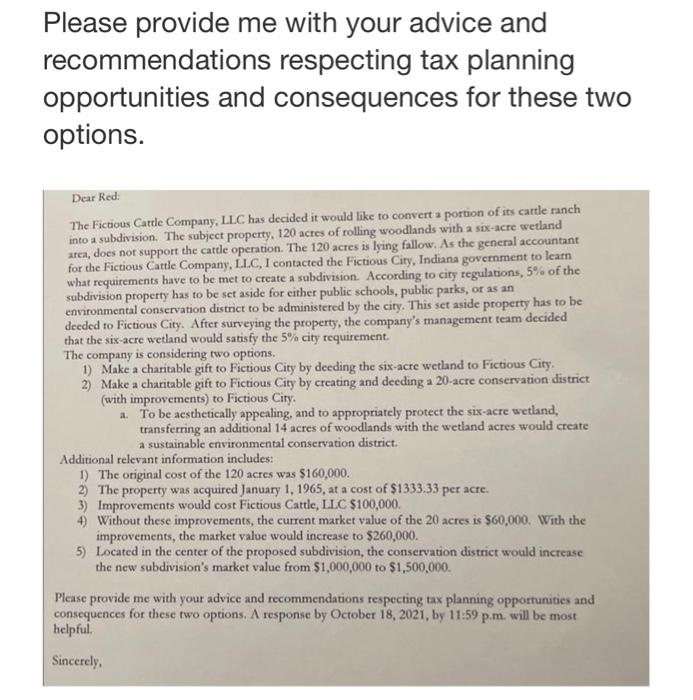

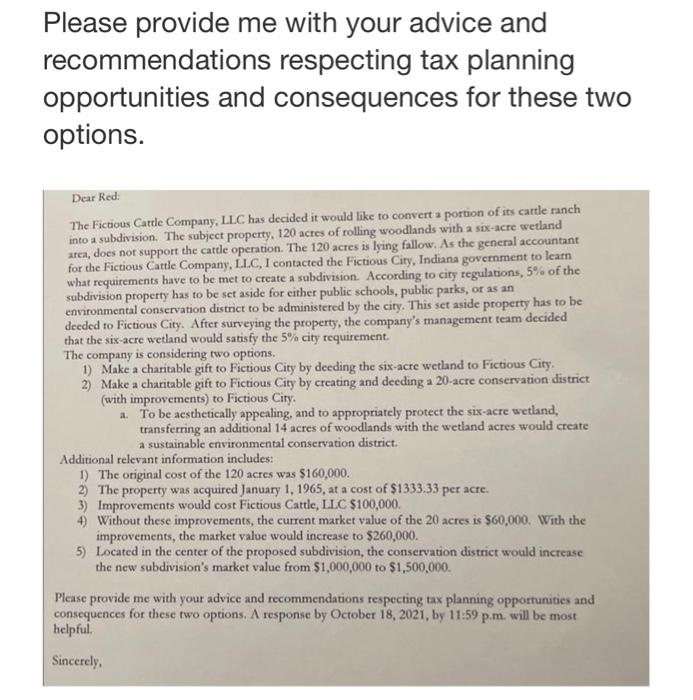

Please provide me with your advice and recommendations respecting tax planning opportunities and consequences for these two options. Dear Red: The Fictious Cattle Company, LLC has decided it would like to convert a portion of its cartle ranch into a subdivision. The subject property, 120 acres of rolling woodlands with a six-acre wetland area, does not support the cattle operation. The 120 actes is lying fallow. As the general accountant for the Fictious Cattle Company, I.L.C, I contacted the Fictious City, Indiana government to learn what requirements have to be met to create a subdivision. According to ciry regulations, 5% of the sabdrvision property has to be set aside for either public schools, public parks, or as an environmental conservation district to be administered by the city. This set aside property has to be decded to Fictious City. After surveying the property, the company's management team decided that the six-acre wetland would satisfy the 5% city requirement. The company is considering two options. 1) Make a charitable gift to Fictious City by deeding the six-acre wetland to Fictious City. 2) Make a charitable gift to Fictious City by creating and deeding a 20 -acre conservation district (with improvements) to Fictious City. a. To be aesthetically appealing, and to appropriately protect the six-acre wetland, transferring an additional 14 acres of woodlands with the wetland acres would create a sustainable environmental conservation district. Additional relevant information includes: 1) The original cost of the 120 acres was $160,000. 2) The property was acquired January 1, 1965, at a cost of $1333.33 per acte. 3) Improvements would cost Fictious Cattle, LLC $100,000. 4) Without these improvements, the current market value of the 20 acres is $60,000. With the improvements, the market value would increase to $260,000. 5) Located in the center of the proposed subdivision, the conservation district would increase the new subdivision's market value from $1,000,000 to $1,500,000. Please provide me with your advice and recommendations respecting tax planning opportunities and consequences for these two options, A response by October 18, 2021, by 11:59 p.m. will be most helpful

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started