Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help please urgent i will give good rating a. Capital structure refers to the financial structure of a firm. It is the mix of

Please help please urgent i will give good rating

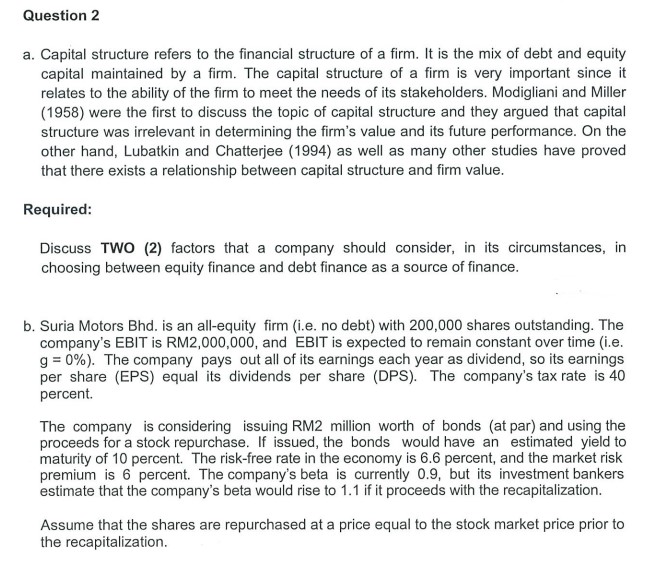

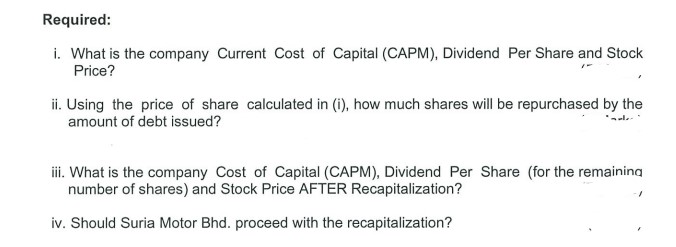

a. Capital structure refers to the financial structure of a firm. It is the mix of debt and equity capital maintained by a firm. The capital structure of a firm is very important since it relates to the ability of the firm to meet the needs of its stakeholders. Modigliani and Miller (1958) were the first to discuss the topic of capital structure and they argued that capital structure was irrelevant in determining the firm's value and its future performance. On the other hand, Lubatkin and Chatterjee (1994) as well as many other studies have proved that there exists a relationship between capital structure and firm value. Required: Discuss TWO (2) factors that a company should consider, in its circumstances, in choosing between equity finance and debt finance as a source of finance. b. Suria Motors Bhd. is an all-equity firm (i.e. no debt) with 200,000 shares outstanding. The company's EBIT is RM2,000,000, and EBIT is expected to remain constant over time (i.e. \mathrmg=0 ). The company pays out all of its earnings each year as dividend, so its earnings per share (EPS) equal its dividends per share (DPS). The company's tax rate is 40 percent. The company is considering issuing RM2 million worth of bonds (at par) and using the proceeds for a stock repurchase. If issued, the bonds would have an estimated yield to maturity of 10 percent. The risk-free rate in the economy is 6.6 percent, and the market risk premium is 6 percent. The company's beta is currently 0.9 , but its investment bankers estimate that the company's beta would rise to 1.1 if it proceeds with the recapitalization. Assume that the shares are repurchased at a price equal to the stock market price prior to the recapitalization. Required: i. What is the company Current Cost of Capital (CAPM), Dividend Per Share and Stock Price? ii. Using the price of share calculated in (i), how much shares will be repurchased by the amount of debt issued? iii. What is the company Cost of Capital (CAPM), Dividend Per Share (for the remainina number of shares) and Stock Price AFTER Recapitalization? iv. Should Suria Motor Bhd. proceed with the recapitalization

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started