Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help! pracrice exam but doesnt have answers to check CHAPTER 3 TRUE/FALSE QUESTIONS: 1. The major difference between a cash basis accounting system and

please help! pracrice exam but doesnt have answers to check

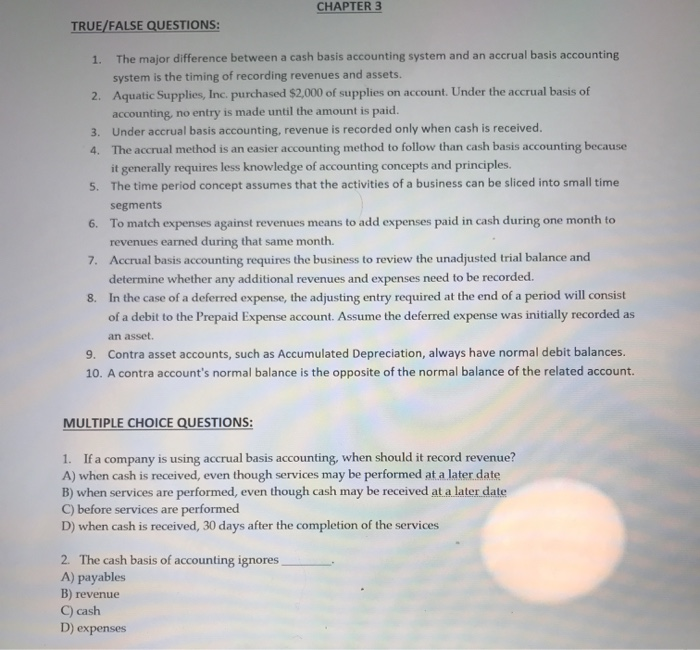

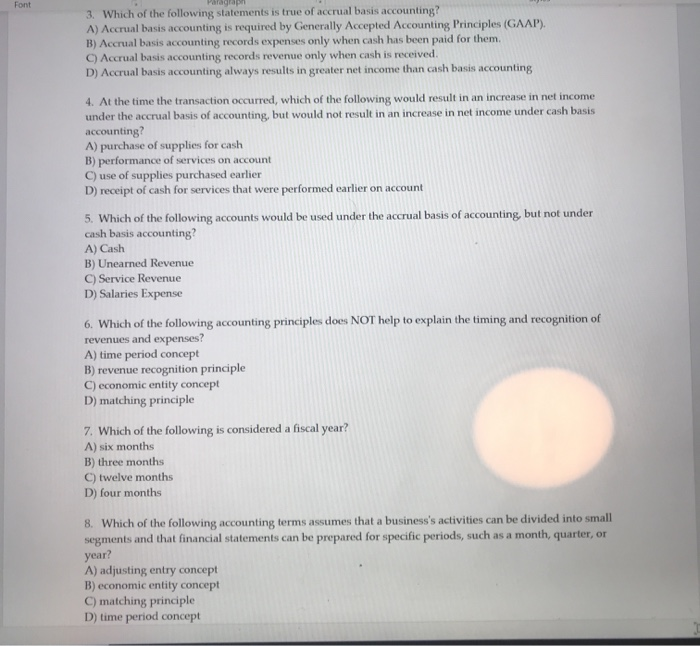

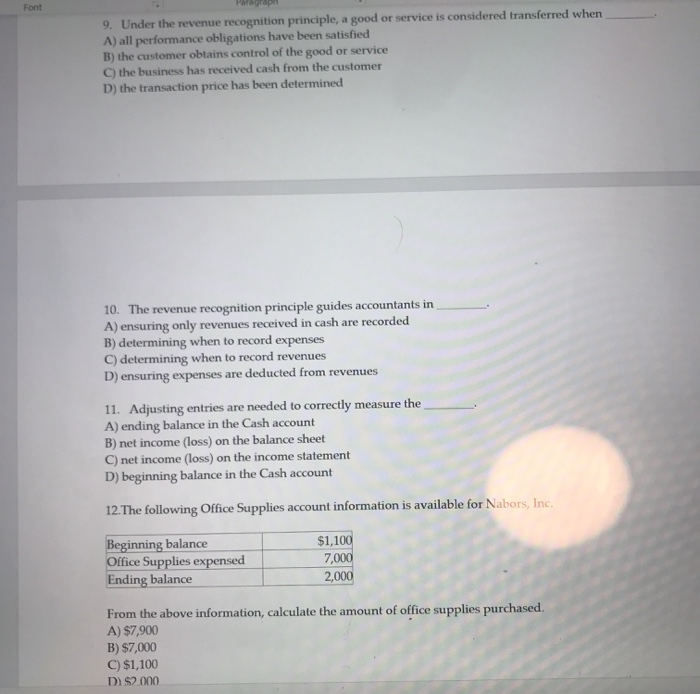

CHAPTER 3 TRUE/FALSE QUESTIONS: 1. The major difference between a cash basis accounting system and an accrual basis accounting system is the timing of recording revenues and assets. 2. Aquatic Supplies, Inc. purchased $2,000 of supplies on account. Under the accrual basis of accounting, no entry is made until the amount is paid. 3. Under accrual basis accounting, revenue is recorded only when cash is received. 4. The accrual method is an easier accounting method to follow than cash basis accounting because it generally requires less knowledge of accounting concepts and principles. 5. The time period concept assumes that the activities of a business can be sliced into small time segments 6. To match expenses against revenues means to add expenses paid in cash during one month to revenues earned during that same month. 7. Accrual basis accounting requires the business to review the unadjusted trial balance and determine whether any additional revenues and expenses need to be recorded. 8. In the case of a deferred expense, the adjusting entry required at the end of a period will consist of a debit to the Prepaid Expense account. Assume the deferred expense was initially recorded as an asset 9. Contra asset accounts, such as Accumulated Depreciation, always have normal debit balances. 10. A contra account's normal balance is the opposite of the normal balance of the related account. MULTIPLE CHOICE QUESTIONS: 1. If a company is using accrual basis accounting, when should it record revenue? A) when cash is received, even though services may be performed at a later date B) when services are performed, even though cash may be received at a later date C) before services are performed D) when cash is received, 30 days after the completion of the services 2. The cash basis of accounting ignores A) payables B) revenue C) cash D) expenses 3. Which of the following statements is true of accrual basis accounting? A) Accrual basis accounting is required by Generally Accepted Accounting Principles (GAAP). B) Accrual basis accounting records expenses only when cash has been paid for them. C) Accrual basis accounting records revenue only when cash is received. D) Accrual basis accounting always results in greater net income than cash basis accounting 4. At the time the transaction occurred, which of the following would result in an increase in net income under the accrual basis of accounting, but would not result in an increase in net income under cash basis accounting? A) purchase of supplies for cash B) performance of services on account C) use of supplies purchased earlier D) receipt of cash for services that were performed earlier on account 5. Which of the following accounts would be used under the accrual basis of accounting, but not under cash basis accounting? A) Cash B) Unearned Revenue C) Service Revenue D) Salaries Expense 6. Which of the following accounting principles does NOT help to explain the timing and recognition of revenues and expenses? A) time period concept B) revenue recognition principle C) economic entity concept D) matching principle 7. Which of the following is considered a fiscal year? A) six months B) three months C) twelve months D) four months 8. Which of the following accounting terms assumes that a business's activities can be divided into small segments and that financial statements can be prepared for specific periods, such as a month, quarter, or year? A) adjusting entry concept B) economic entity concept C) matching principle D) time period concept Paragraph Font 9. Under the revenue recognition principle, a good or service is considered transferred when A) all performance obligations have been satisfied B) the customer obtains control of the good or service C) the business has received cash from the customer D) the transaction price has been determined 10. The revenue recognition principle guides accountants in A) ensuring only revenues received in cash are recorded B) determining when to record expenses C) determining when to record revenues D) ensuring expenses are deducted from revenues 11. Adjusting entries are needed to correctly measure the A) ending balance in the Cash account B) net income (loss) on the balance sheet C) net income (loss) on the income statement D) beginning balance in the Cash account 12. The following Office Supplies account information is available for Nabors, Inc. Beginning balance Office Supplies expensed Ending balance $1,100 7,000 2,000 From the above information, calculate the amount of office supplies purchased A) $7,900 B) $7,000 C) $1,100 D) $2.000 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started