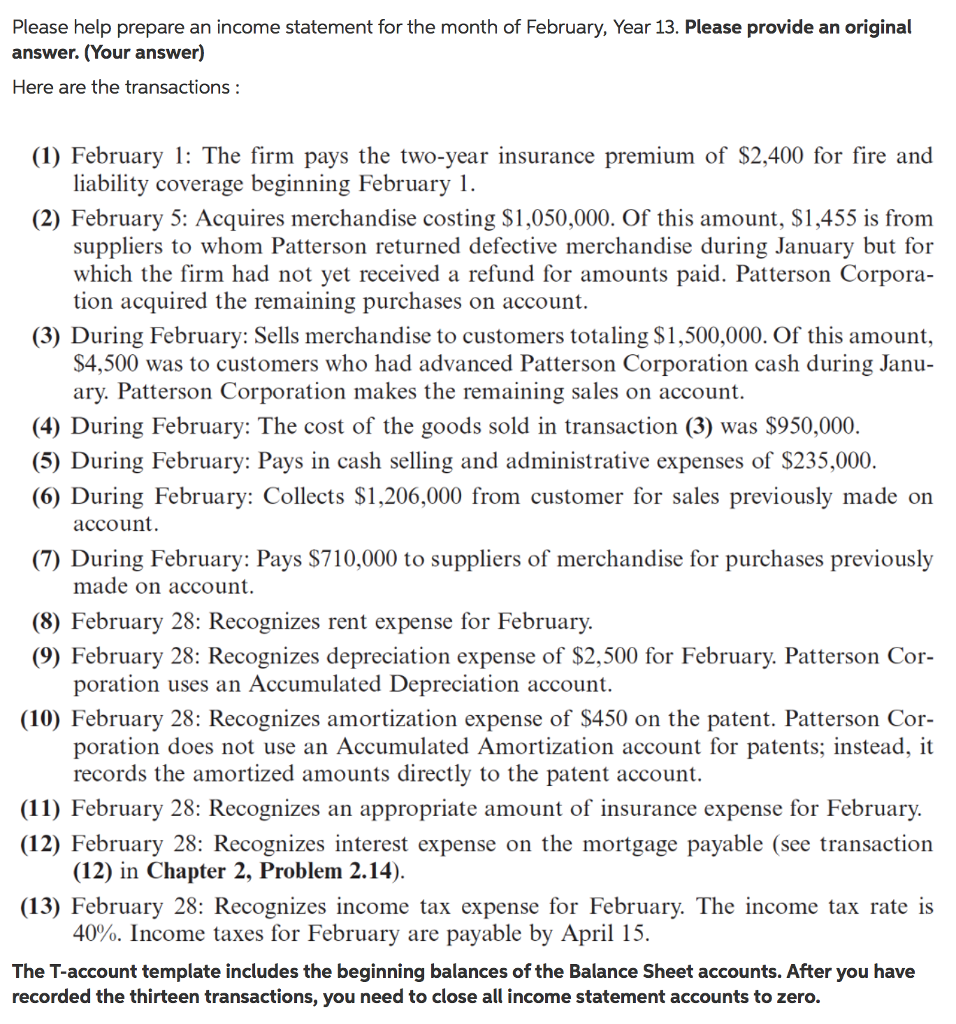

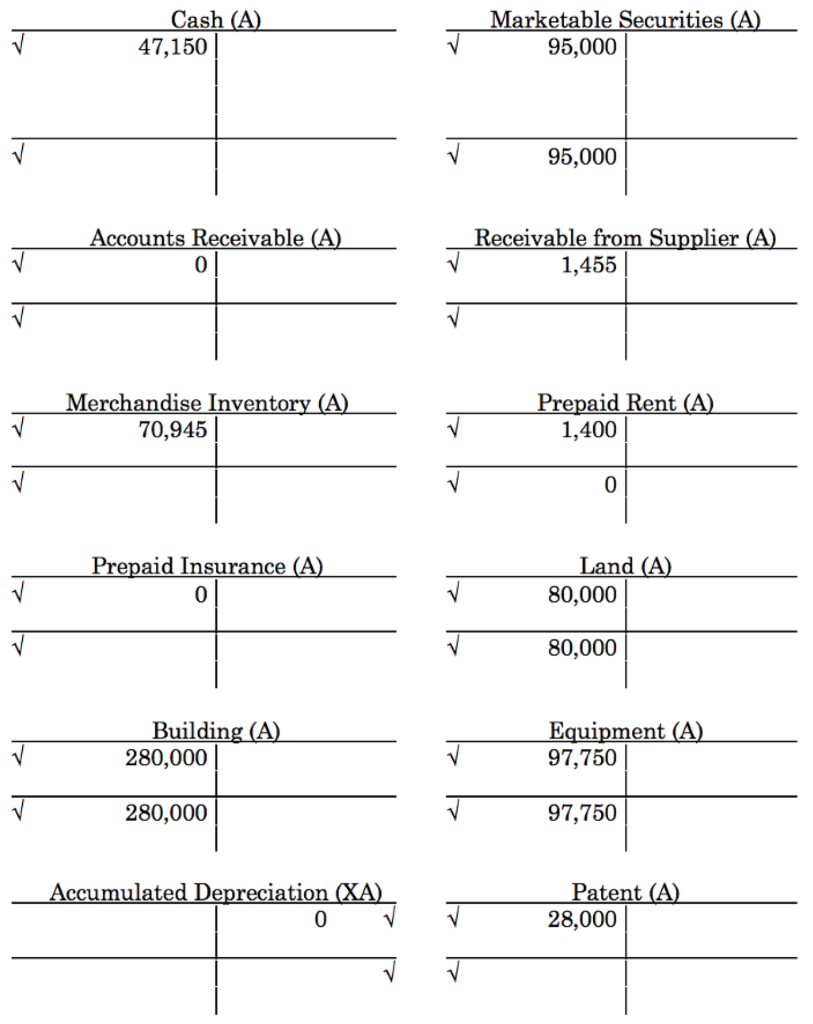

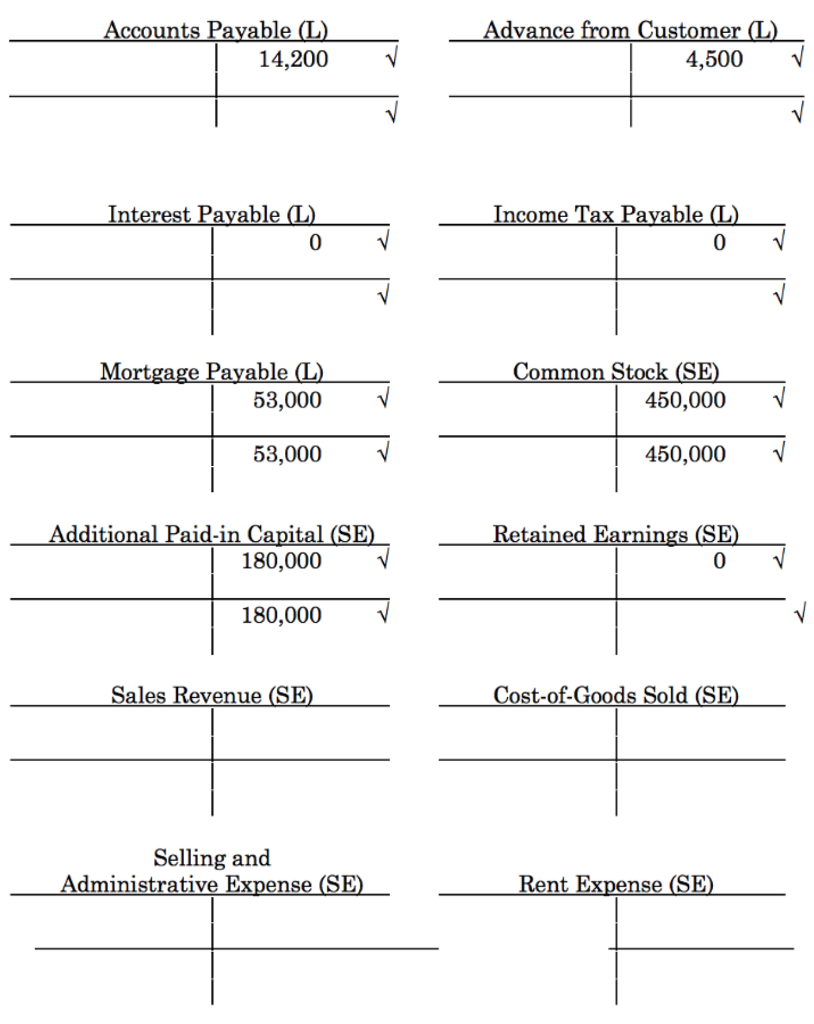

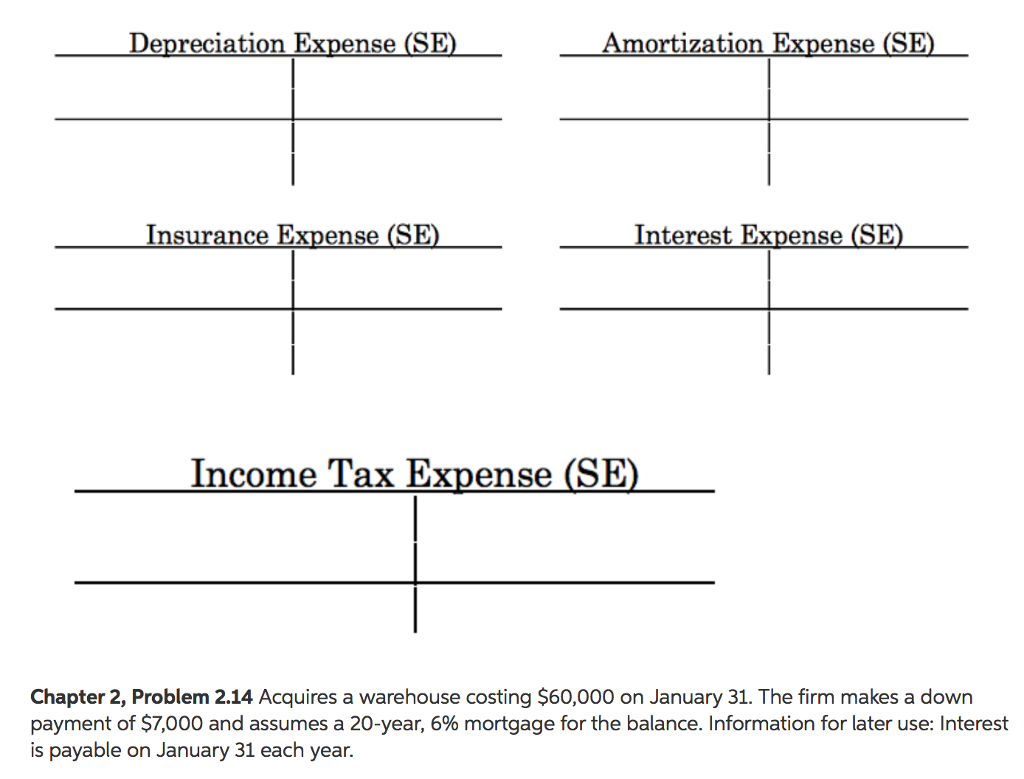

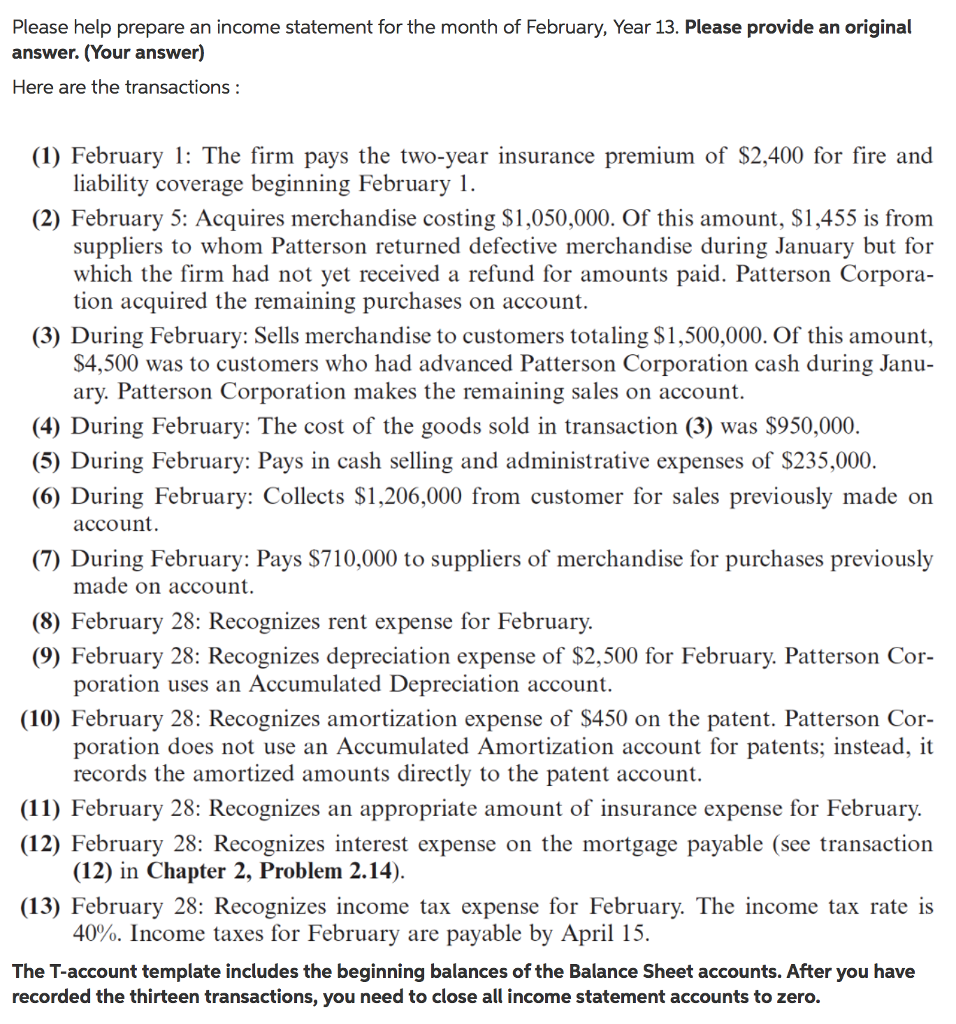

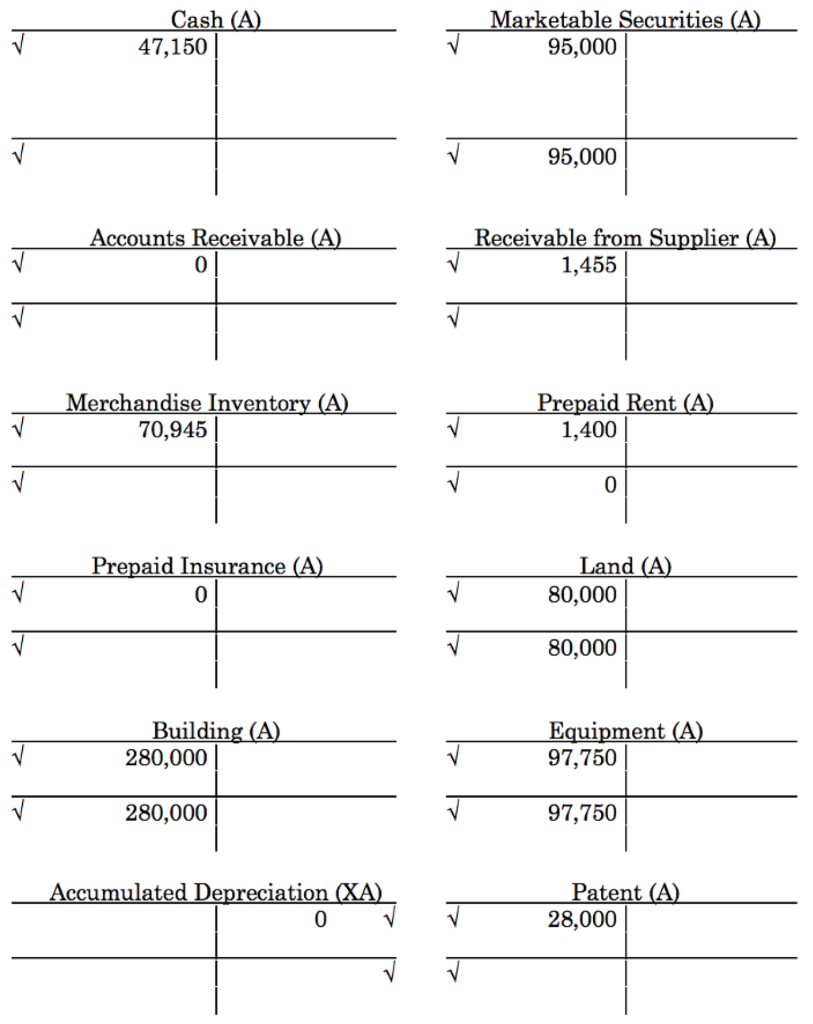

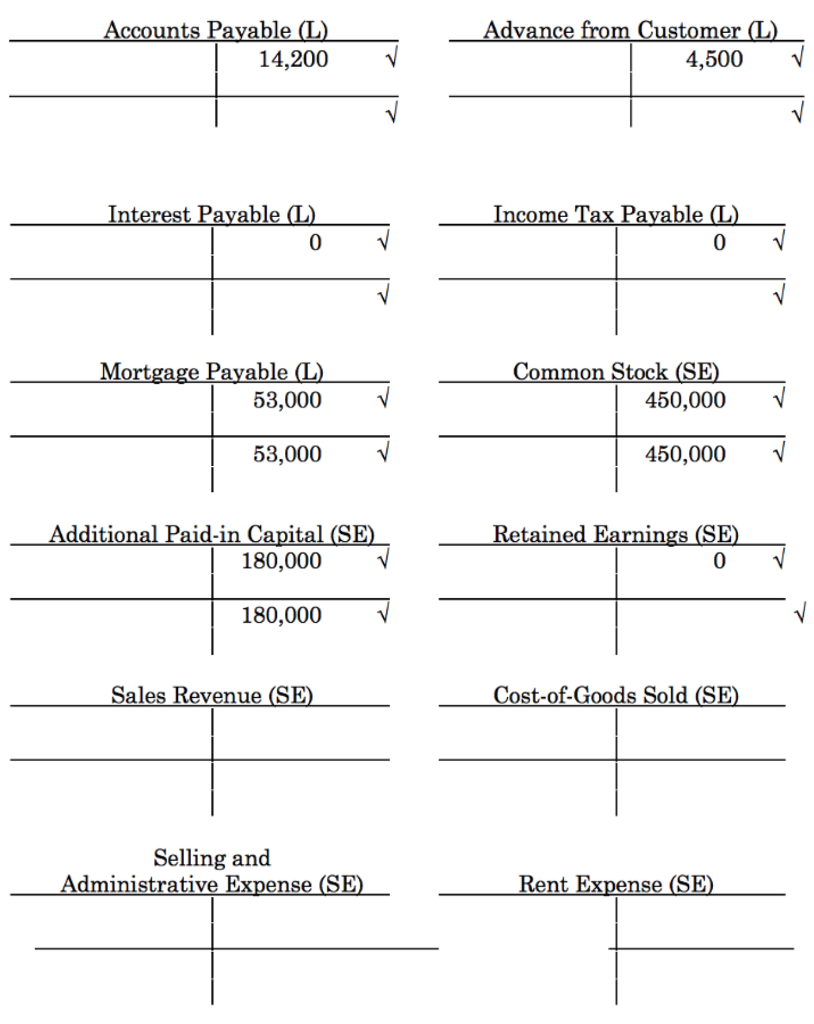

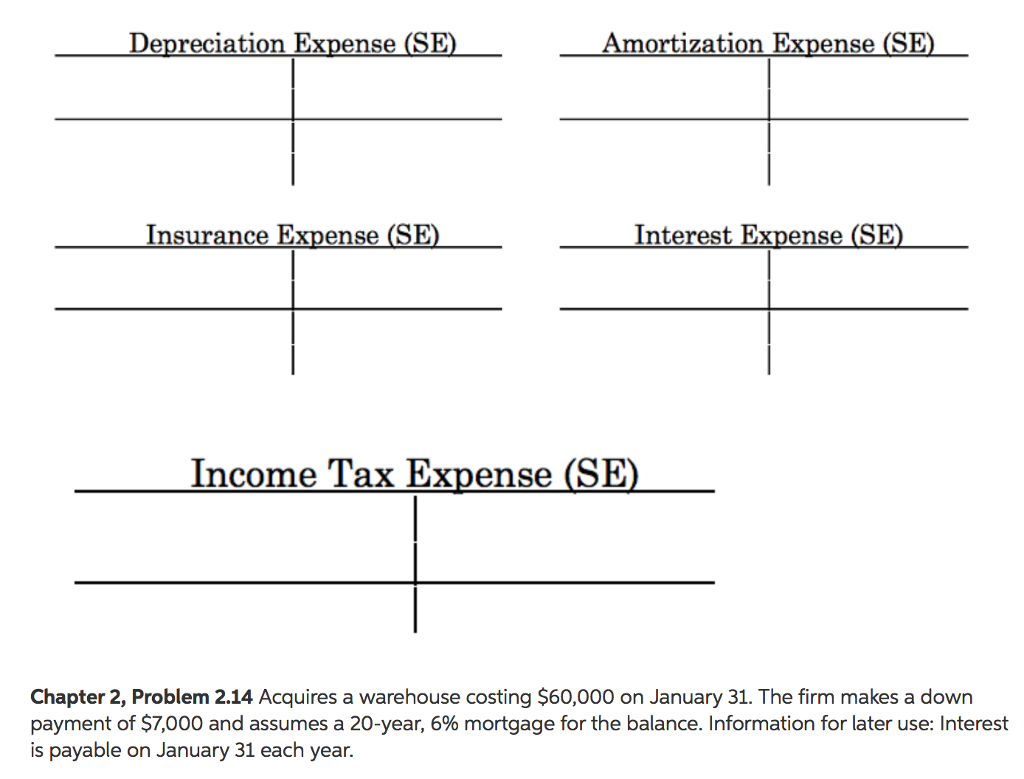

Please help prepare an income statement for the month of February, Year 13. Please provide an original answer. (Your answer) Here are the transactions (1) February 1: The firm pays the two-year insurance premium of $2,400 for fire and liability coverage beginning February 1. (2) February 5: Acquires merchandise costing $1,050,000. Of this amount, S1,455 is fronm suppliers to whom Patterson returned defective merchandise during January but for which the firm had not yet received a refund for amounts paid. Patterson Corpora- tion acquired the remaining purchases on account. (3) During February: Sells merchandise to customers totaling $1,500,000. Of this amount, S4,500 was to customers who had advanced Patterson Corporation cash during Janu- ary. Patterson Corporation makes the remaining sales on account. (4) During February: The cost of the goods sold in transaction (3) was $950,000. (5) During February: Pays in cash selling and administrative expenses of $235,000. (6) During February: Collects $1,206,000 from customer for sales previously made on account. (7) During February: Pays $710,000 to suppliers of merchandise for purchases previously made on account. (8) February 28: Recognizes rent expense for February. (9) February 28: Recognizes depreciation expense of $2,500 for February. Patterson Con- poration uses an Accumulated Depreciation account. (10) February 28: Recognizes amortization expense of $450 on the patent. Patterson Cor- poration does not use an Accumulated Amortization account for patents; instead, it records the amortized amounts directly to the patent account. (11) February 28: Recognizes an appropriate amount of insurance expense for February (12) February 28: Recognizes interest expense on the mortgage payable (see transaction (13) February 28: Recognizes income tax expense for February. The income tax rate is The T-account template includes the beginning balances of the Balance Sheet accounts. After you have (12) in Chapter 2, Problem 2.14) 40%. Income taxes for February are payable by April 15 recorded the thirteen transactions, you need to close all income statement accounts to zero. Please help prepare an income statement for the month of February, Year 13. Please provide an original answer. (Your answer) Here are the transactions (1) February 1: The firm pays the two-year insurance premium of $2,400 for fire and liability coverage beginning February 1. (2) February 5: Acquires merchandise costing $1,050,000. Of this amount, S1,455 is fronm suppliers to whom Patterson returned defective merchandise during January but for which the firm had not yet received a refund for amounts paid. Patterson Corpora- tion acquired the remaining purchases on account. (3) During February: Sells merchandise to customers totaling $1,500,000. Of this amount, S4,500 was to customers who had advanced Patterson Corporation cash during Janu- ary. Patterson Corporation makes the remaining sales on account. (4) During February: The cost of the goods sold in transaction (3) was $950,000. (5) During February: Pays in cash selling and administrative expenses of $235,000. (6) During February: Collects $1,206,000 from customer for sales previously made on account. (7) During February: Pays $710,000 to suppliers of merchandise for purchases previously made on account. (8) February 28: Recognizes rent expense for February. (9) February 28: Recognizes depreciation expense of $2,500 for February. Patterson Con- poration uses an Accumulated Depreciation account. (10) February 28: Recognizes amortization expense of $450 on the patent. Patterson Cor- poration does not use an Accumulated Amortization account for patents; instead, it records the amortized amounts directly to the patent account. (11) February 28: Recognizes an appropriate amount of insurance expense for February (12) February 28: Recognizes interest expense on the mortgage payable (see transaction (13) February 28: Recognizes income tax expense for February. The income tax rate is The T-account template includes the beginning balances of the Balance Sheet accounts. After you have (12) in Chapter 2, Problem 2.14) 40%. Income taxes for February are payable by April 15 recorded the thirteen transactions, you need to close all income statement accounts to zero