please help

please help

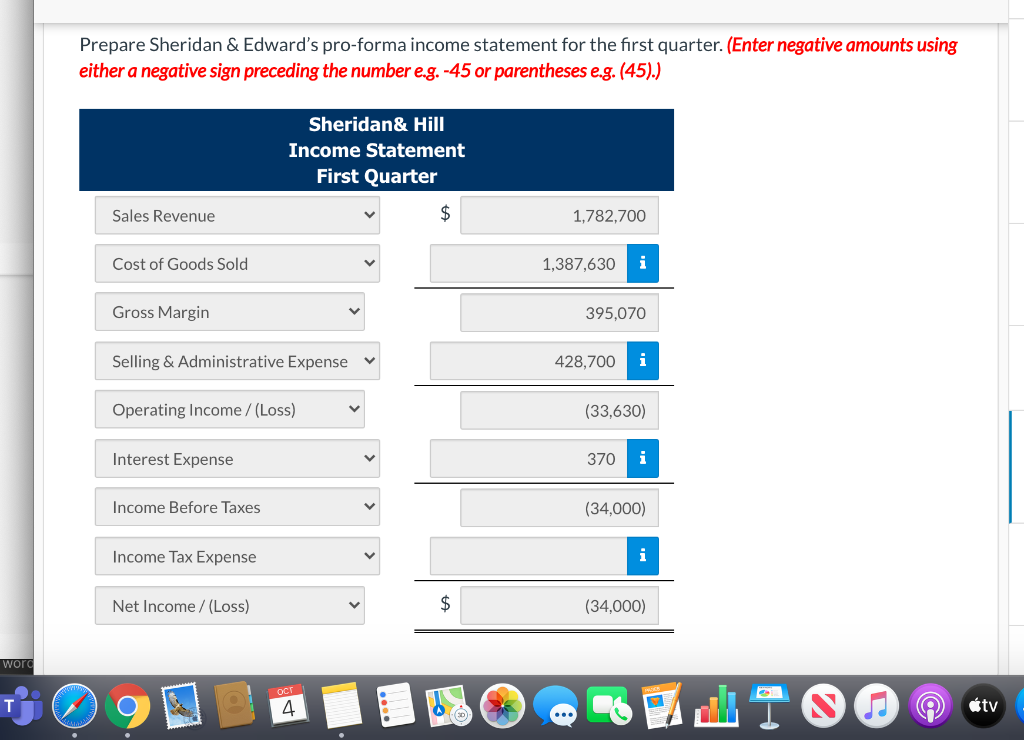

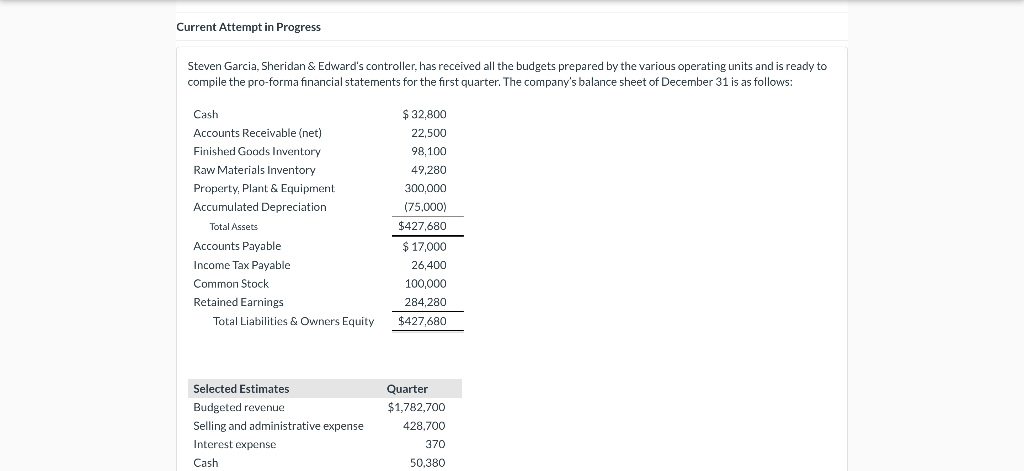

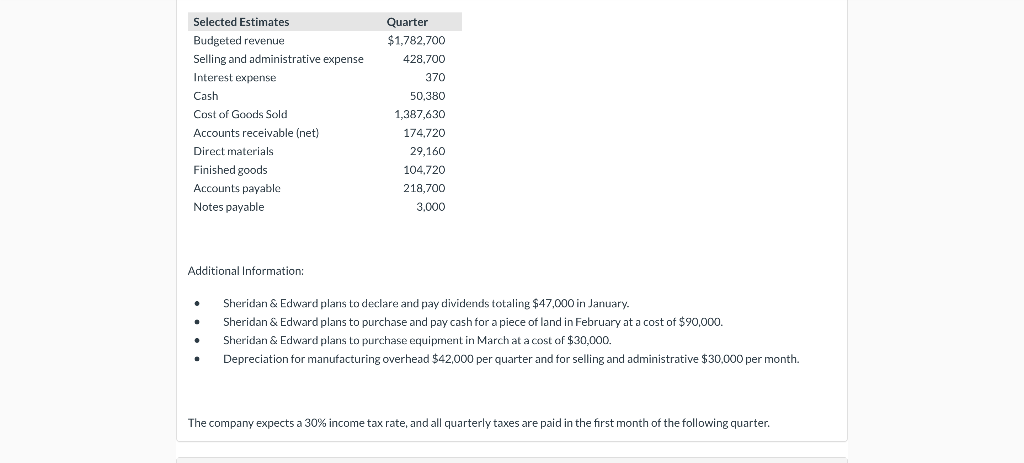

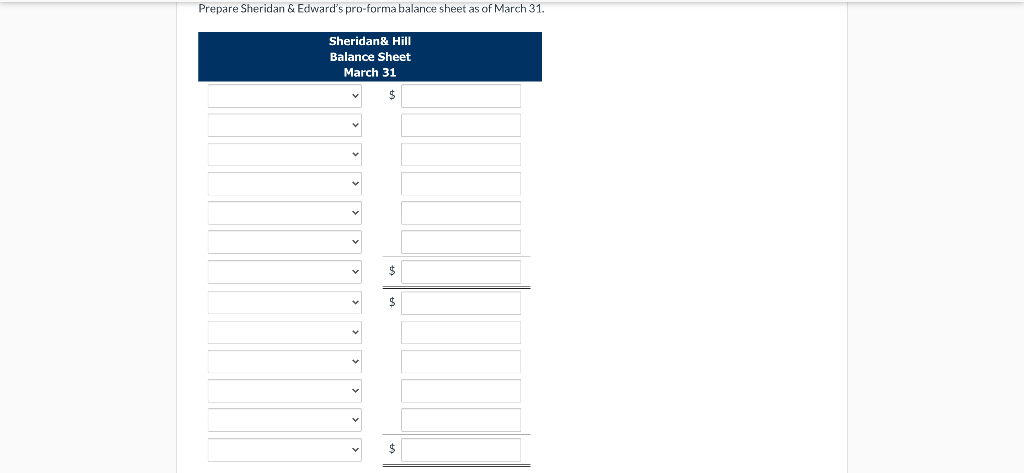

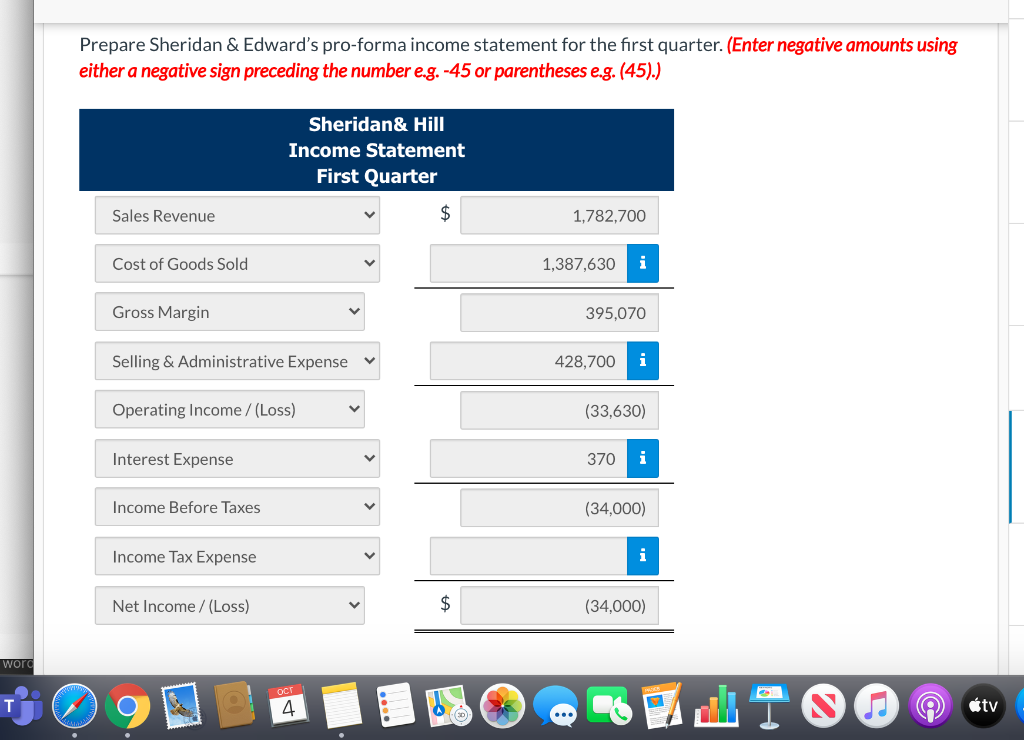

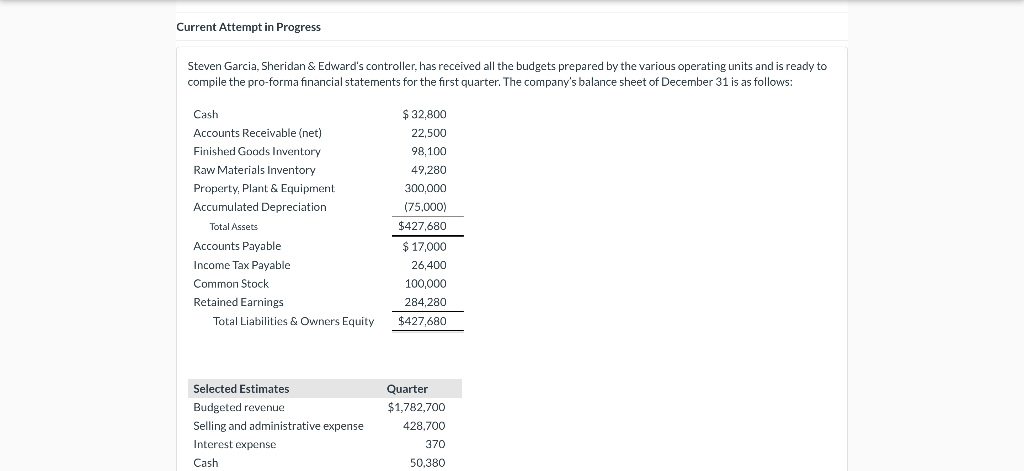

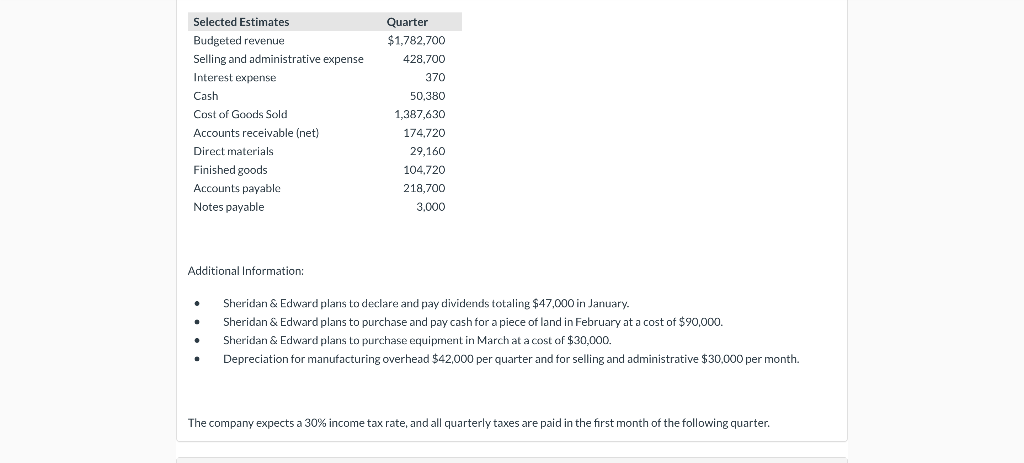

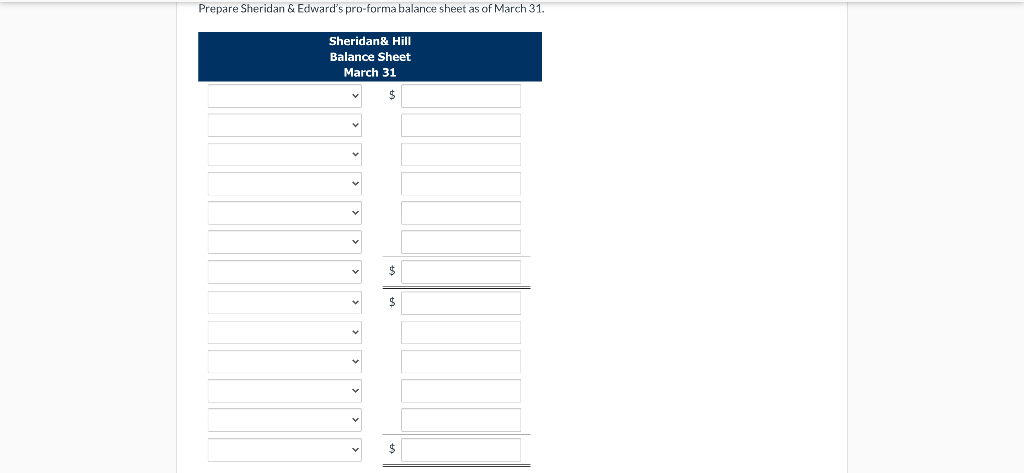

Prepare Sheridan & Edward's pro-forma income statement for the first quarter. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Sheridan & Hill Income Statement First Quarter Sales Revenue $ 1,782,700 Cost of Goods Sold 1,387,630 i Gross Margin 395,070 Selling & Administrative Expense 428,700 i Operating Income /(Loss) (33,630) Interest Expense 370 i Income Before Taxes (34,000) Income Tax Expense i Net Income /(Loss) $ (34,000) word OCT 4 tv Current Attempt in Progress Steven Garcia, Sheridan & Edward's controller, has received all the budgets prepared by the various operating units and is ready to compile the pro-forma financial statements for the first quarter. The company's balance sheet of December 31 is as follows: $32,800 22,500 98,100 49,280 300,000 (75,000) Cash Accounts Receivable (net) Finished Goods Inventory Raw Materials Inventory Property, Plant & Equipment Accumulated Depreciation Total Assets Accounts Payable Income Tax Payable Common Stock Retained Earnings Total Liabilities & Owners Equity $427,680 $ 17,000 26,400 100,000 284,280 $427,680 Selected Estimates Budgeted revenue Selling and administrative expense Interest expense Cash Quarter $1,782,700 428.700 370 50.380 Selected Estimates Budgeted revenue Selling and administrative expense Interest expense Cash Cost of Goods Sold Accounts receivable (net) Direct materials Finished goods Accounts payable Notes payable Quarter $1,782,700 428,700 370 50,380 1,387,630 174,720 29,160 104.720 218,700 3,000 Additional Information: Sheridan & Edward plans to declare and pay dividends totaling $47,000 in January. Sheridan & Edward plans to purchase and pay cash for a piece of land in February at a cost of $90,000. Sheridan & Edward plans to purchase equipment in March at a cost of $30,000. Depreciation for manufacturing overhead $42,000 per quarter and for selling and administrative $30,000 per month. The company expects a 30% income tax rate, and all quarterly taxes are paid in the first month of the following quarter. Prepare Sheridan & Edward's pro-forma balance sheet as of March 31. Sheridan Hill Balance Sheet March 31 $ Prepare Sheridan & Edward's pro-forma income statement for the first quarter. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Sheridan & Hill Income Statement First Quarter Sales Revenue $ 1,782,700 Cost of Goods Sold 1,387,630 i Gross Margin 395,070 Selling & Administrative Expense 428,700 i Operating Income /(Loss) (33,630) Interest Expense 370 i Income Before Taxes (34,000) Income Tax Expense i Net Income /(Loss) $ (34,000) word OCT 4 tv Current Attempt in Progress Steven Garcia, Sheridan & Edward's controller, has received all the budgets prepared by the various operating units and is ready to compile the pro-forma financial statements for the first quarter. The company's balance sheet of December 31 is as follows: $32,800 22,500 98,100 49,280 300,000 (75,000) Cash Accounts Receivable (net) Finished Goods Inventory Raw Materials Inventory Property, Plant & Equipment Accumulated Depreciation Total Assets Accounts Payable Income Tax Payable Common Stock Retained Earnings Total Liabilities & Owners Equity $427,680 $ 17,000 26,400 100,000 284,280 $427,680 Selected Estimates Budgeted revenue Selling and administrative expense Interest expense Cash Quarter $1,782,700 428.700 370 50.380 Selected Estimates Budgeted revenue Selling and administrative expense Interest expense Cash Cost of Goods Sold Accounts receivable (net) Direct materials Finished goods Accounts payable Notes payable Quarter $1,782,700 428,700 370 50,380 1,387,630 174,720 29,160 104.720 218,700 3,000 Additional Information: Sheridan & Edward plans to declare and pay dividends totaling $47,000 in January. Sheridan & Edward plans to purchase and pay cash for a piece of land in February at a cost of $90,000. Sheridan & Edward plans to purchase equipment in March at a cost of $30,000. Depreciation for manufacturing overhead $42,000 per quarter and for selling and administrative $30,000 per month. The company expects a 30% income tax rate, and all quarterly taxes are paid in the first month of the following quarter. Prepare Sheridan & Edward's pro-forma balance sheet as of March 31. Sheridan Hill Balance Sheet March 31 $

please help

please help