Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help!! Problem 1. Asset pricing models and Momentum (70 points: 10 per each question) Download 10 Portfolios Formed on MOMENTUM from Kenneth French website

Please help!!

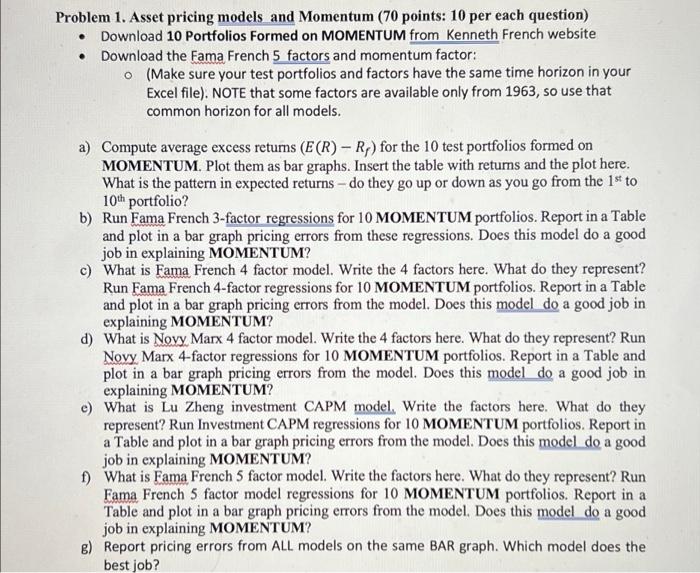

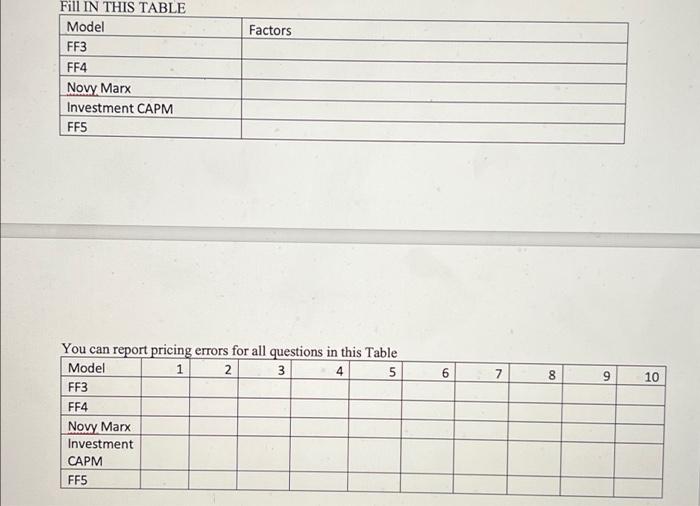

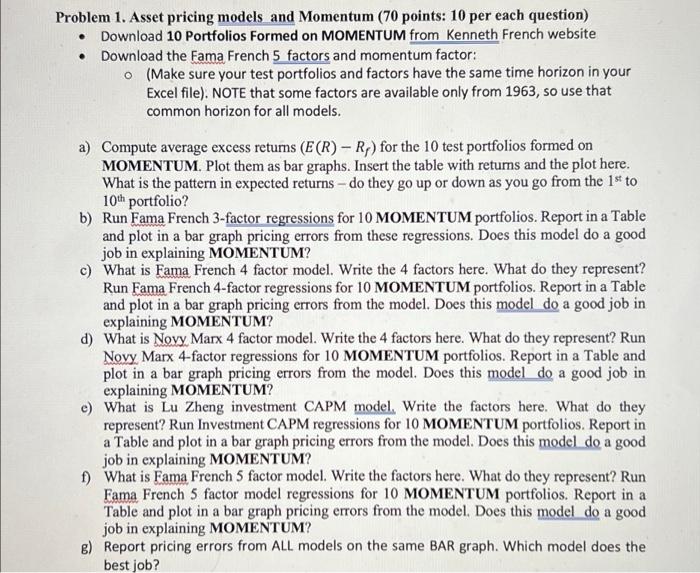

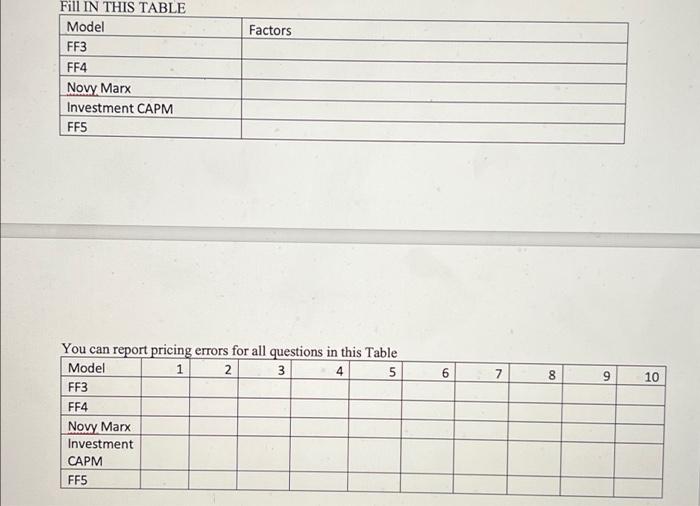

Problem 1. Asset pricing models and Momentum (70 points: 10 per each question) Download 10 Portfolios Formed on MOMENTUM from Kenneth French website Download the Fama French 5 factors and momentum factor: o (Make sure your test portfolios and factors have the same time horizon in your Excel file). NOTE that some factors are available only from 1963, so use that common horizon for all models. a) Compute average excess returns (E(R) - Rp) for the 10 test portfolios formed on MOMENTUM. Plot them as bar graphs. Insert the table with returns and the plot here. What is the pattern in expected returns - do they go up or down as you go from the 1st to 10th portfolio? b) Run Fama French 3-factor regressions for 10 MOMENTUM portfolios. Report in a Table and plot in a bar graph pricing errors from these regressions. Does this model do a good job in explaining MOMENTUM? c) What is Fama French 4 factor model. Write the 4 factors here. What do they represent? Run Fama French 4-factor regressions for 10 MOMENTUM portfolios. Report in a Table and plot in a bar graph pricing errors from the model. Does this model do a good job in explaining MOMENTUM? d) What is Novy Marx 4 factor model. Write the 4 factors here. What do they represent? Run Novy Marx 4-factor regressions for 10 MOMENTUM portfolios. Report in a Table and plot in a bar graph pricing errors from the model. Does this model do a good job in explaining MOMENTUM? e) What is Lu Zheng investment CAPM model. Write the factors here. What do they represent? Run Investment CAPM regressions for 10 MOMENTUM portfolios. Report in a Table and plot in a bar graph pricing errors from the model. Does this model do a good job in explaining MOMENTUM? 1) What is Fama French 5 factor model. Write the factors here. What do they represent? Run Fama French 5 factor model regressions for 10 MOMENTUM portfolios. Report in a Table and plot in a bar graph pricing errors from the model. Does this model do a good job in explaining MOMENTUM? c) Report pricing errors from ALL models on the same BAR graph. Which model does the best job? Factors Fill IN THIS TABLE Model FF3 FF4 Novy Marx Investment CAPM FFS 4 5 6 7 8 9 10 You can report pricing errors for all questions in this Table Model 1 2 3 5 FF3 FF4 Novy Marx Investment CAPM FF5 Problem 1. Asset pricing models and Momentum (70 points: 10 per each question) Download 10 Portfolios Formed on MOMENTUM from Kenneth French website Download the Fama French 5 factors and momentum factor: o (Make sure your test portfolios and factors have the same time horizon in your Excel file). NOTE that some factors are available only from 1963, so use that common horizon for all models. a) Compute average excess returns (E(R) - Rp) for the 10 test portfolios formed on MOMENTUM. Plot them as bar graphs. Insert the table with returns and the plot here. What is the pattern in expected returns - do they go up or down as you go from the 1st to 10th portfolio? b) Run Fama French 3-factor regressions for 10 MOMENTUM portfolios. Report in a Table and plot in a bar graph pricing errors from these regressions. Does this model do a good job in explaining MOMENTUM? c) What is Fama French 4 factor model. Write the 4 factors here. What do they represent? Run Fama French 4-factor regressions for 10 MOMENTUM portfolios. Report in a Table and plot in a bar graph pricing errors from the model. Does this model do a good job in explaining MOMENTUM? d) What is Novy Marx 4 factor model. Write the 4 factors here. What do they represent? Run Novy Marx 4-factor regressions for 10 MOMENTUM portfolios. Report in a Table and plot in a bar graph pricing errors from the model. Does this model do a good job in explaining MOMENTUM? e) What is Lu Zheng investment CAPM model. Write the factors here. What do they represent? Run Investment CAPM regressions for 10 MOMENTUM portfolios. Report in a Table and plot in a bar graph pricing errors from the model. Does this model do a good job in explaining MOMENTUM? 1) What is Fama French 5 factor model. Write the factors here. What do they represent? Run Fama French 5 factor model regressions for 10 MOMENTUM portfolios. Report in a Table and plot in a bar graph pricing errors from the model. Does this model do a good job in explaining MOMENTUM? c) Report pricing errors from ALL models on the same BAR graph. Which model does the best job? Factors Fill IN THIS TABLE Model FF3 FF4 Novy Marx Investment CAPM FFS 4 5 6 7 8 9 10 You can report pricing errors for all questions in this Table Model 1 2 3 5 FF3 FF4 Novy Marx Investment CAPM FF5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started