Answered step by step

Verified Expert Solution

Question

1 Approved Answer

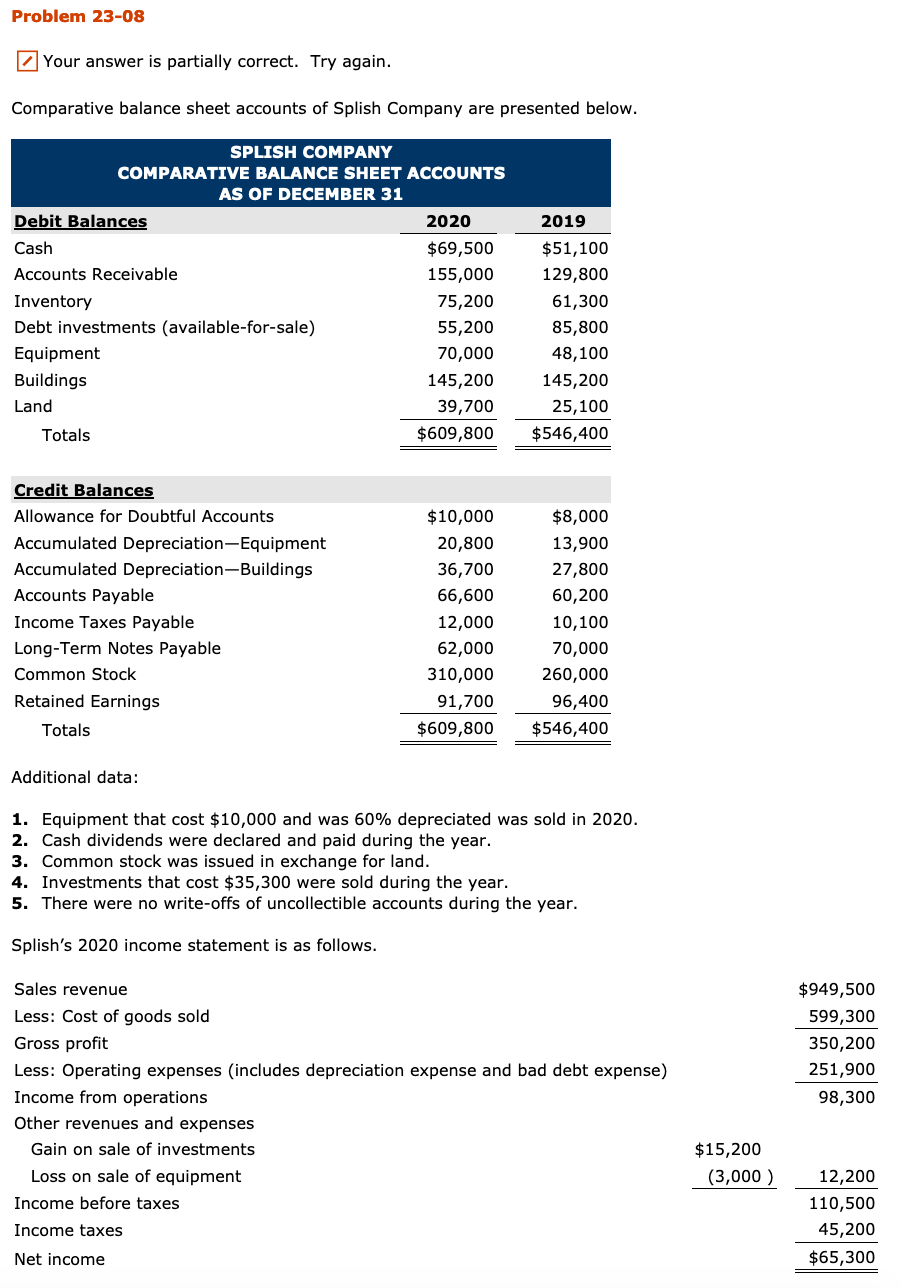

please help Problem 23-08 Your answer is partially correct. Try again. Comparative balance sheet accounts of Splish Company are presented below. SPLISH COMPANY COMPARATIVE BALANCE

please help

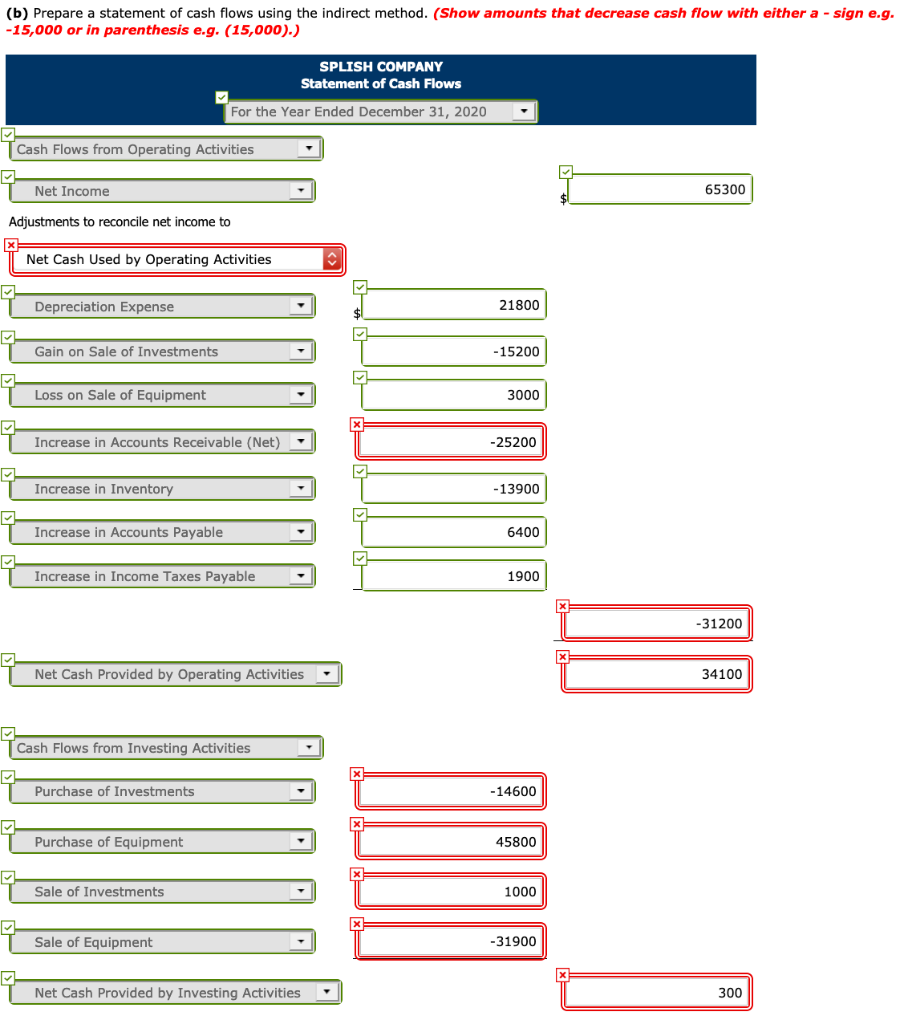

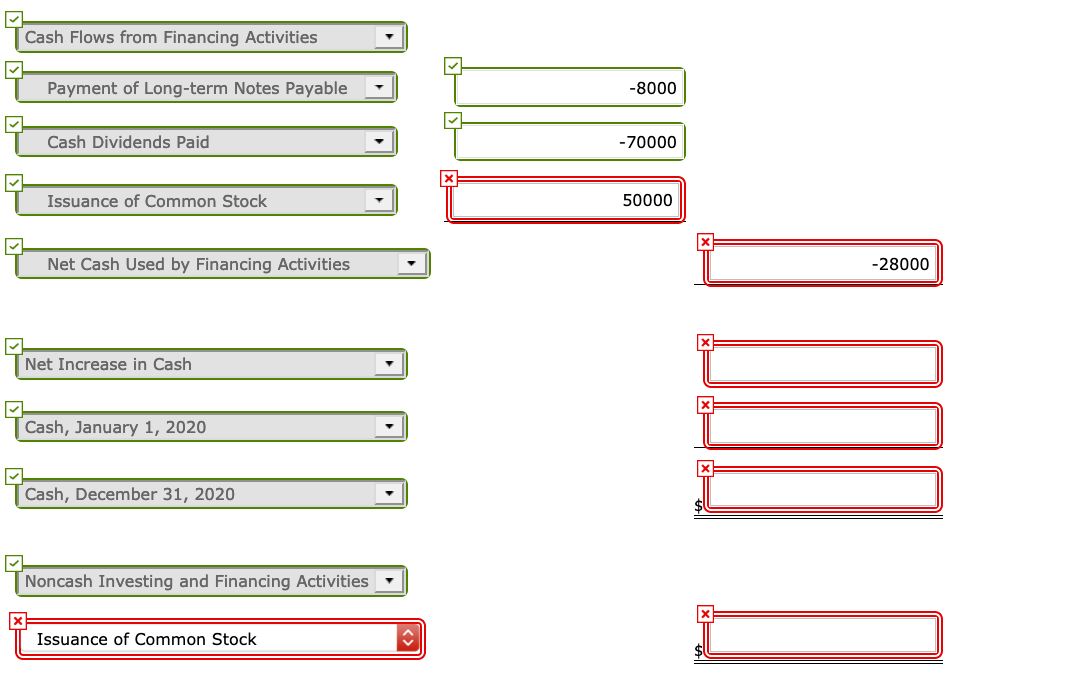

Problem 23-08 Your answer is partially correct. Try again. Comparative balance sheet accounts of Splish Company are presented below. SPLISH COMPANY COMPARATIVE BALANCE SHEET ACCOUNTS AS OF DECEMBER 31 Debit Balances 2020 Cash $69,500 Accounts Receivable 155,000 Inventory 75,200 Debt investments (available-for-sale) 55,200 Equipment 70,000 Buildings 145,200 Land 39,700 Totals $609,800 2019 $51,100 129,800 61,300 85,800 48,100 145,200 25,100 $546,400 Credit Balances Allowance for Doubtful Accounts Accumulated Depreciation-Equipment Accumulated Depreciation-Buildings Accounts Payable Income Taxes Payable Long-Term Notes Payable Common Stock Retained Earnings Totals $10,000 20,800 36,700 66,600 12,000 62,000 310,000 91,700 $609,800 $8,000 13,900 27,800 60,200 10,100 70,000 260,000 96,400 $546,400 Additional data: 1. Equipment that cost $10,000 and was 60% depreciated was sold in 2020. 2. Cash dividends were declared and paid during the year. 3. Common stock was issued in exchange for land. 4. Investments that cost $35,300 were sold during the year. 5. There were no write-offs of uncollectible accounts during the year. Splish's 2020 income statement is as follows. $949,500 599,300 350,200 251,900 98,300 Sales revenue Less: Cost of goods sold Gross profit Less: Operating expenses (includes depreciation expense and bad debt expense) Income from operations Other revenues and expenses Gain on sale of investments Loss on sale of equipment Income before taxes Income taxes Net income $15,200 (3,000) 12,200 110,500 45,200 $65,300 (b) Prepare a statement of cash flows using the indirect method. (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).) SPLISH COMPANY Statement of Cash Flows For the Year Ended December 31, 2020 - TCash Flows from Operating Activities : Net Income 65300 65300 Adjustments to reconcile net income to I Net Cash Used by Operating Activities 21800 4 1 Depreciation Expense Gain on Sale of Investments -15200 T Loss on Sale of Equipment 3000 T Increase in Accounts Receivable (Net) - -25200 T Increase in Inventory - 13900 T Increase in Accounts Payable - 6400 T Increase in Income Taxes Payable - 1900 -31200 T Net Cash Provided by Operating Activities - 34100 Cash Flows from Investing Activities - 1 Purchase of Investments T -14600 1 Purchase of Equipment T 45800 1 Sale of Investments 1000 Sale of Equipment - T -31900 T Net Cash Provided by Investing Activities - 300 Cash Flows from Financing Activities T Payment of Long-term Notes Payable - -8000 * Cash Dividends Paid -70000 T Issuance of Common Stock - 50000 Net Cash Used by Financing Activities -28000 Net Increase in Cash TCash, January 1, 2020 - Cash, December 31, 2020 - Noncash Investing and Financing Activities Issuance of Common StockStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started