Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help Q1 Q2 Q3 During 2021, a company sells 280 units of inventory for $92 each. The company has the following inventory purchase transactions

please help

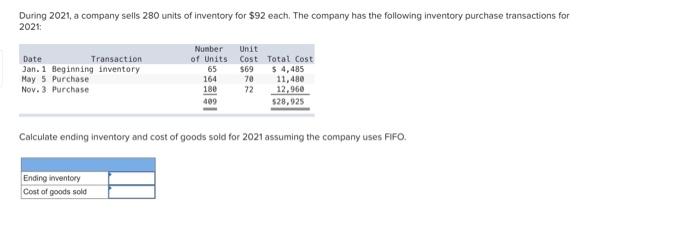

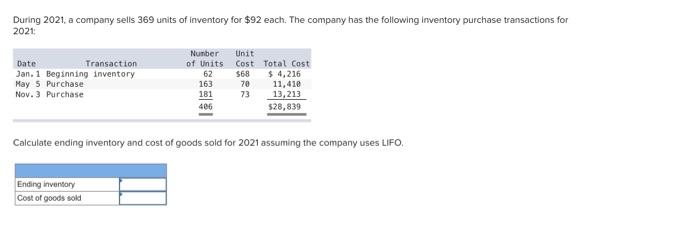

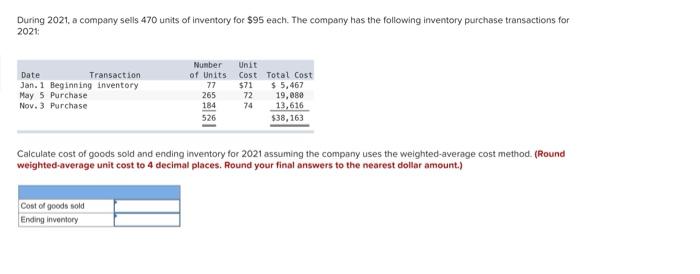

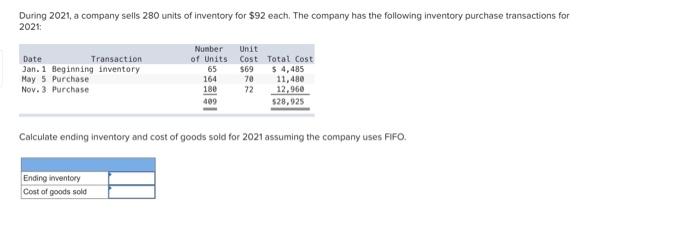

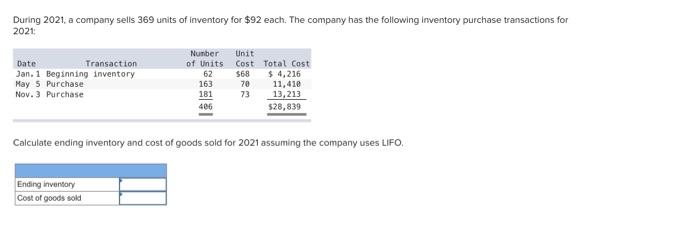

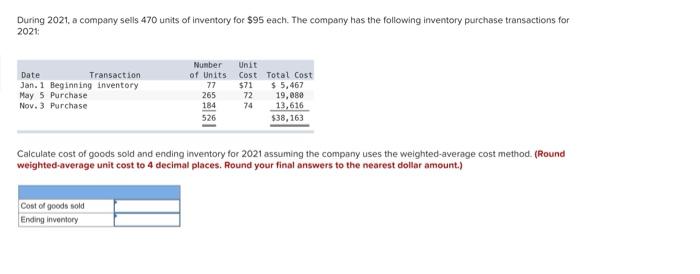

During 2021, a company sells 280 units of inventory for $92 each. The company has the following inventory purchase transactions for 2021: Date Transaction Jan. 1 Beginning inventory May 5 Purchase Nov. 3. Purchase Number Unit of Units Cost Total Cost 65 $69 $ 4,485 164 70 11,480 180 72 12,960 409 $28,025 Calculate ending inventory and cost of goods sold for 2021 assuming the company uses FIFO. Ending inventory Cost of goods sold During 2021, a company sells 369 units of Inventory for $92 each. The company has the following Inventory purchase transactions for 2021 Date Transaction Jan. 1 Beginning inventory May 5 Purchase Nov. 3 Purchase Number Unit of Units Cost Total Cost 62 $68 $ 4,216 70 11,410 181 73 13,213 528,839 163 Calculate ending inventory and cost of goods sold for 2021 assuming the company uses LIFO. Ending inventory Cost of goods sold During 2021. a company sells 470 units of inventory for $95 each. The company has the following inventory purchase transactions for 2021 Date Transaction Jan. 1 Beginning inventory May 5 Purchase Nov. 3 Purchase Number Unit of Units Cost Total Cost 77 $71 $ 5,467 265 72 19,080 184 74 13,616 526 $38,163 Calculate cost of goods sold and ending inventory for 2021 assuming the company uses the weighted average cost method. (Round weighted-average unit cost to 4 decimal places. Round your final answers to the nearest dollar amount.) Cost of goods sold Ending inventory Q1

Q2

Q3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started