Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help?? Q4 Roller Limited started trading seven years ago and has gone from strength to strength. Dividends are currently 2p per ordinary share, having

please help??

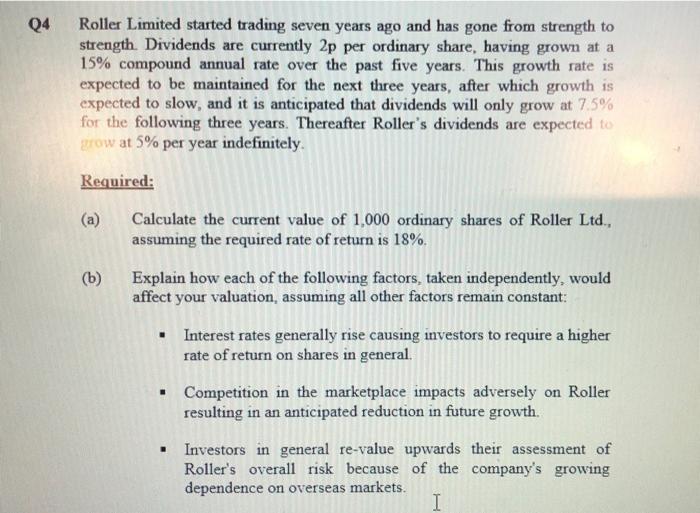

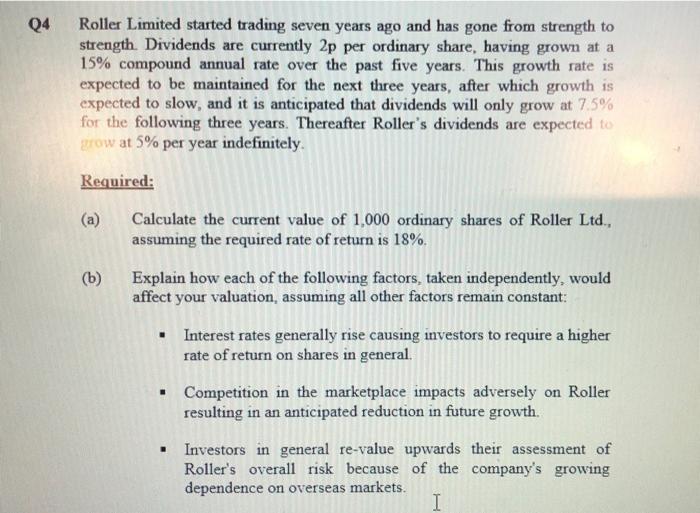

Q4 Roller Limited started trading seven years ago and has gone from strength to strength. Dividends are currently 2p per ordinary share, having grown at a 15% compound annual rate over the past five years. This growth rate is expected to be maintained for the next three years, after which growth is expected to slow, and it is anticipated that dividends will only grow at 7.5% for the following three years. Thereafter Roller's dividends are expected to grow at 5% per year indefinitely Required: Calculate the current value of 1,000 ordinary shares of Roller Ltd., assuming the required rate of return is 18%. (b) Explain how each of the following factors, taken independently, would affect your valuation, assuming all other factors remain constant: . Interest rates generally rise causing investors to require a higher rate of return on shares in general. Competition in the marketplace impacts adversely on Roller resulting in an anticipated reduction in future growth. . Investors in general re-value upwards their assessment of Roller's overall risk because of the company's growing dependence on overseas markets

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started