Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help!! Question 1 4 pts Costs that differ between alternatives are: O relevant to the decision not relevant to the decision sunk costs o

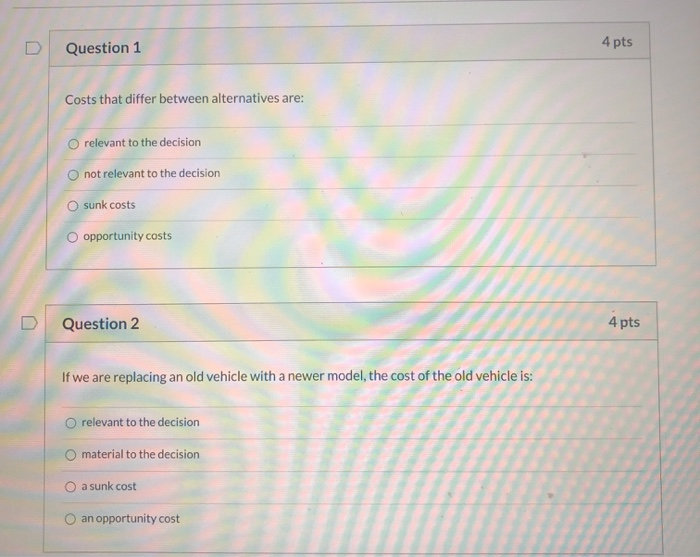

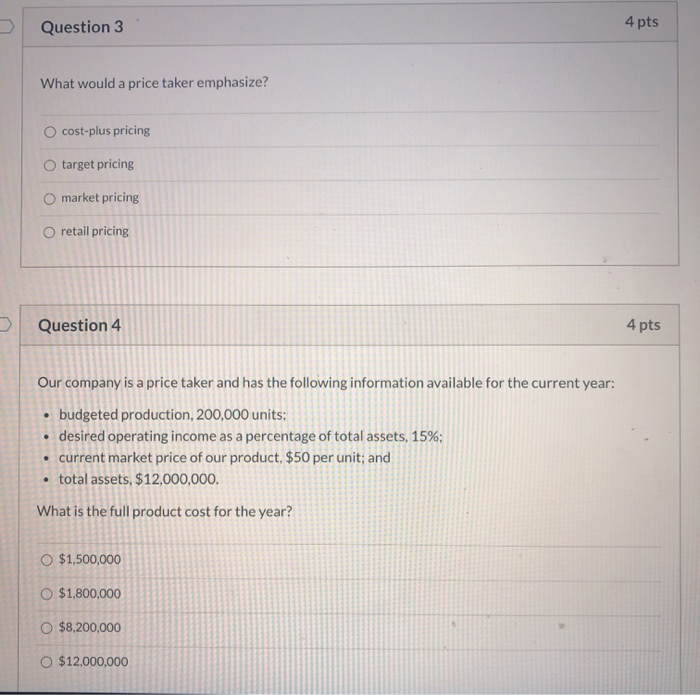

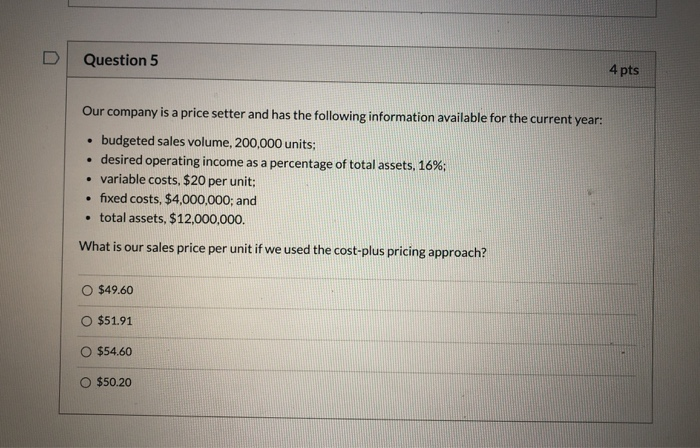

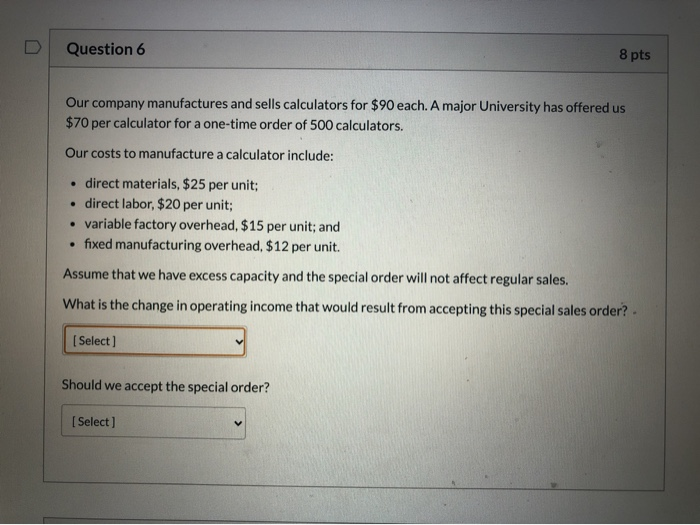

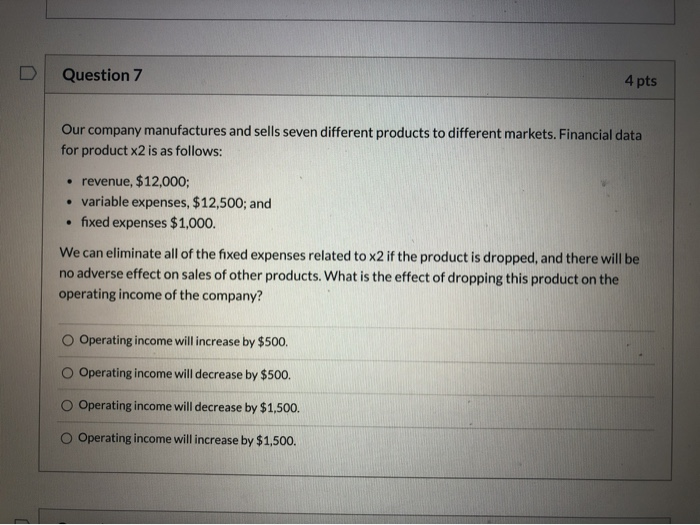

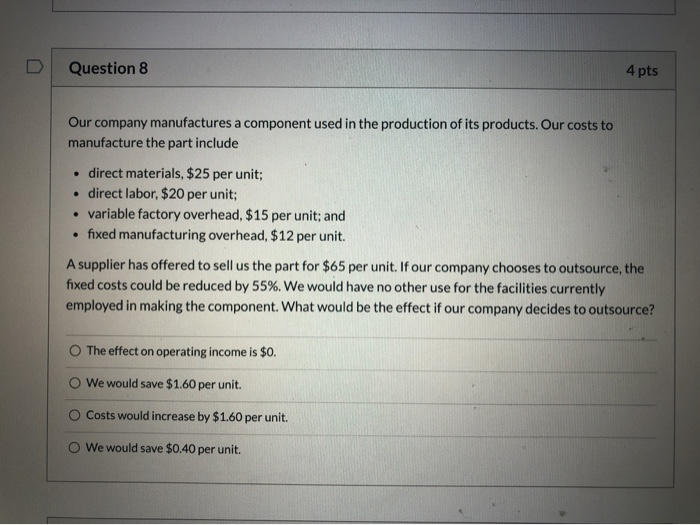

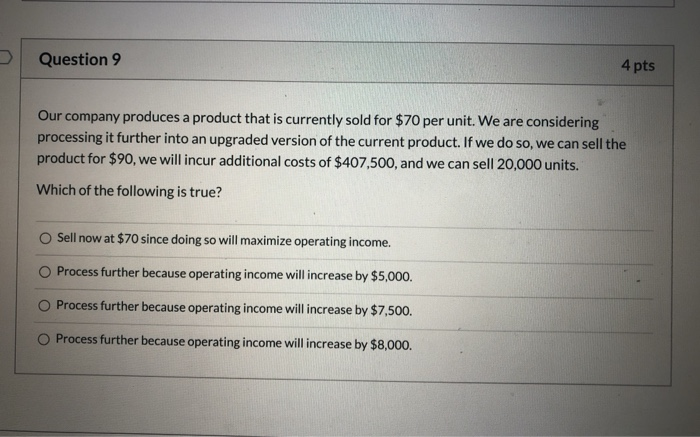

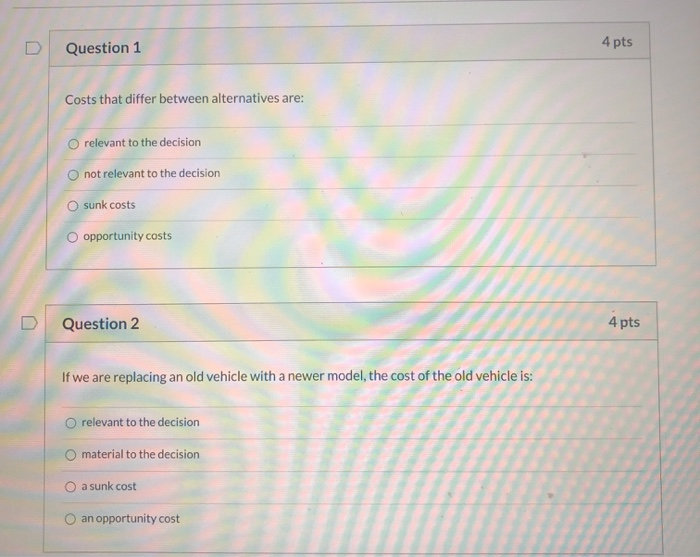

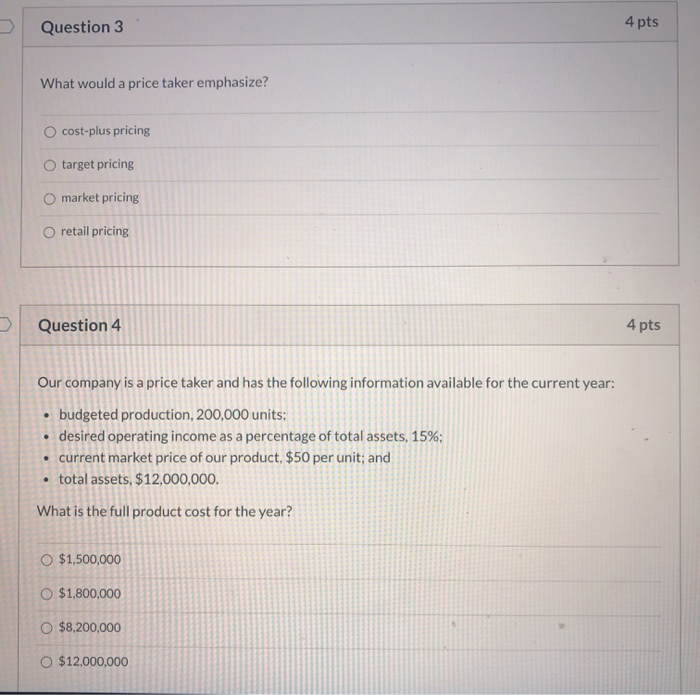

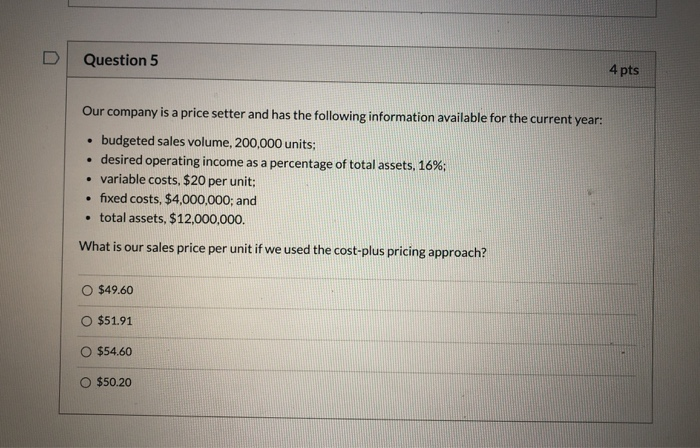

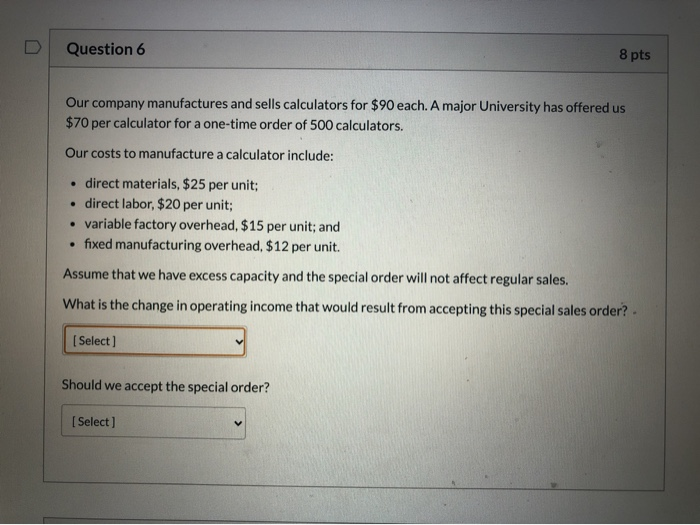

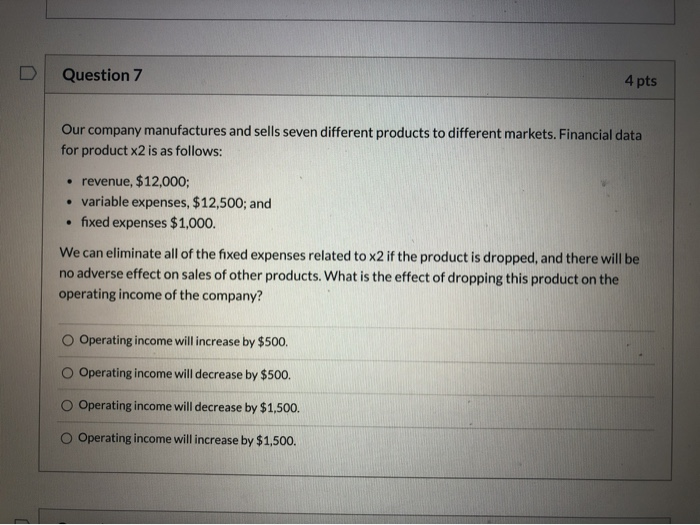

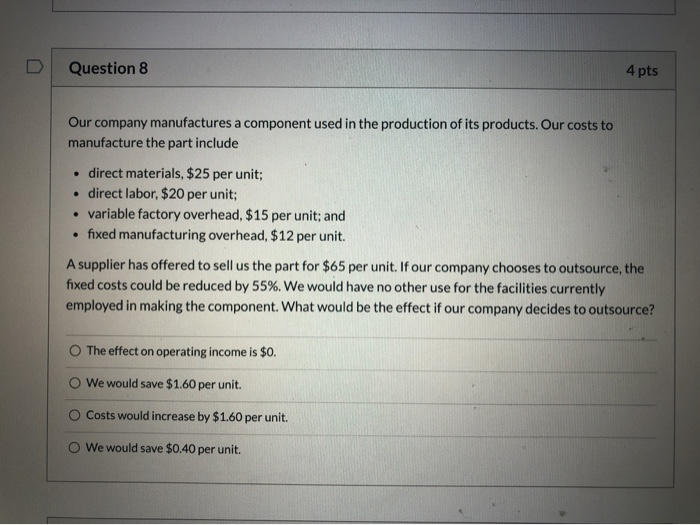

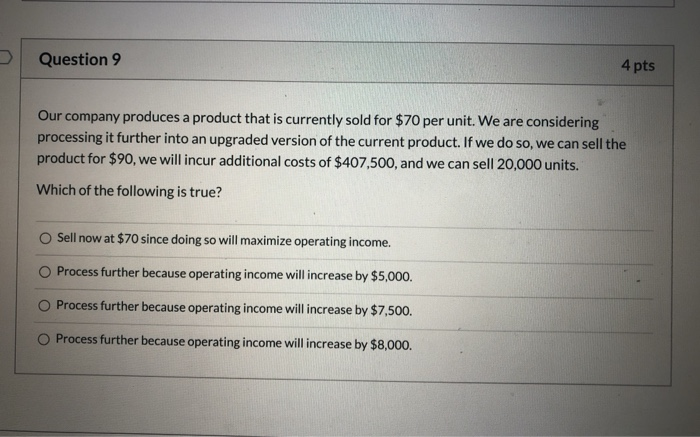

please help!! Question 1 4 pts Costs that differ between alternatives are: O relevant to the decision not relevant to the decision sunk costs o opportunity costs D Question 2 4 pts If we are replacing an old vehicle with a newer model, the cost of the old vehicle is: O relevant to the decision material to the decision a sunk cost O an opportunity cost Question 3 4 pts What would a price taker emphasize? O cost-plus pricing O target pricing O market pricing O retail pricing > Question 4 4 pts Our company is a price taker and has the following information available for the current year: budgeted production, 200,000 units; desired operating income as a percentage of total assets, 15%; current market price of our product, $50 per unit; and total assets, $12,000,000. What is the full product cost for the year? $1,500,000 O $1,800,000 O $8,200,000 O $12,000,000 Question 5 4 pts Our company is a price setter and has the following information available for the current year: budgeted sales volume, 200,000 units: desired operating income as a percentage of total assets, 16%; variable costs, $20 per unit: fixed costs, $4,000,000; and total assets, $12,000,000. What is our sales price per unit if we used the cost-plus pricing approach? $49.60 O $51.91 0 $54.60 $50.20 Question 6 8 pts Our company manufactures and sells calculators for $90 each. A major University has offered us $70 per calculator for a one-time order of 500 calculators. Our costs to manufacture a calculator include: direct materials, $25 per unit: direct labor, $20 per unit; variable factory overhead, $15 per unit; and fixed manufacturing overhead, $12 per unit. Assume that we have excess capacity and the special order will not affect regular sales. What is the change in operating income that would result from accepting this special sales order?. [Select) Should we accept the special order? [Select) Question 7 4 pts Our company manufactures and sells seven different products to different markets. Financial data for product x2 is as follows: revenue, $12,000; variable expenses, $12,500; and fixed expenses $1,000. We can eliminate all of the fixed expenses related to x2 if the product is dropped, and there will be no adverse effect on sales of other products. What is the effect of dropping this product on the operating income of the company? Operating income will increase by $500 Operating income will decrease by $500. Operating income will decrease by $1,500. o Operating income will increase by $1,500. Question 8 4 pts Our company manufactures a component used in the production of its products. Our costs to manufacture the part include direct materials, $25 per unit; direct labor, $20 per unit; variable factory overhead, $15 per unit; and fixed manufacturing overhead, $12 per unit. A supplier has offered to sell us the part for $65 per unit. If our company chooses to outsource, the fixed costs could be reduced by 55%. We would have no other use for the facilities currently employed in making the component. What would be the effect if our company decides to outsource? The effect on operating income is $0. We would save $1.60 per unit. Costs would increase by $1.60 per unit. O We would save $0.40 per unit. Question 9 4 pts Our company produces a product that is currently sold for $70 per unit. We are considering processing it further into an upgraded version of the current product. If we do so, we can sell the product for $90, we will incur additional costs of $407,500, and we can sell 20,000 units. Which of the following is true? Sell now at $70 since doing so will maximize operating income. Process further because operating income will increase by $5,000. Process further because operating income will increase by $7,500. Process further because operating income will increase by $8,000

please help!! Question 1 4 pts Costs that differ between alternatives are: O relevant to the decision not relevant to the decision sunk costs o opportunity costs D Question 2 4 pts If we are replacing an old vehicle with a newer model, the cost of the old vehicle is: O relevant to the decision material to the decision a sunk cost O an opportunity cost Question 3 4 pts What would a price taker emphasize? O cost-plus pricing O target pricing O market pricing O retail pricing > Question 4 4 pts Our company is a price taker and has the following information available for the current year: budgeted production, 200,000 units; desired operating income as a percentage of total assets, 15%; current market price of our product, $50 per unit; and total assets, $12,000,000. What is the full product cost for the year? $1,500,000 O $1,800,000 O $8,200,000 O $12,000,000 Question 5 4 pts Our company is a price setter and has the following information available for the current year: budgeted sales volume, 200,000 units: desired operating income as a percentage of total assets, 16%; variable costs, $20 per unit: fixed costs, $4,000,000; and total assets, $12,000,000. What is our sales price per unit if we used the cost-plus pricing approach? $49.60 O $51.91 0 $54.60 $50.20 Question 6 8 pts Our company manufactures and sells calculators for $90 each. A major University has offered us $70 per calculator for a one-time order of 500 calculators. Our costs to manufacture a calculator include: direct materials, $25 per unit: direct labor, $20 per unit; variable factory overhead, $15 per unit; and fixed manufacturing overhead, $12 per unit. Assume that we have excess capacity and the special order will not affect regular sales. What is the change in operating income that would result from accepting this special sales order?. [Select) Should we accept the special order? [Select) Question 7 4 pts Our company manufactures and sells seven different products to different markets. Financial data for product x2 is as follows: revenue, $12,000; variable expenses, $12,500; and fixed expenses $1,000. We can eliminate all of the fixed expenses related to x2 if the product is dropped, and there will be no adverse effect on sales of other products. What is the effect of dropping this product on the operating income of the company? Operating income will increase by $500 Operating income will decrease by $500. Operating income will decrease by $1,500. o Operating income will increase by $1,500. Question 8 4 pts Our company manufactures a component used in the production of its products. Our costs to manufacture the part include direct materials, $25 per unit; direct labor, $20 per unit; variable factory overhead, $15 per unit; and fixed manufacturing overhead, $12 per unit. A supplier has offered to sell us the part for $65 per unit. If our company chooses to outsource, the fixed costs could be reduced by 55%. We would have no other use for the facilities currently employed in making the component. What would be the effect if our company decides to outsource? The effect on operating income is $0. We would save $1.60 per unit. Costs would increase by $1.60 per unit. O We would save $0.40 per unit. Question 9 4 pts Our company produces a product that is currently sold for $70 per unit. We are considering processing it further into an upgraded version of the current product. If we do so, we can sell the product for $90, we will incur additional costs of $407,500, and we can sell 20,000 units. Which of the following is true? Sell now at $70 since doing so will maximize operating income. Process further because operating income will increase by $5,000. Process further because operating income will increase by $7,500. Process further because operating income will increase by $8,000

please help!!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started