Please Help!

Question 1

Question 2

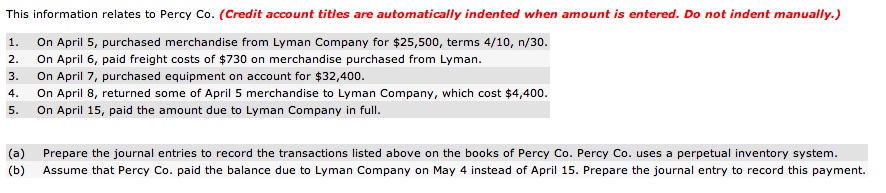

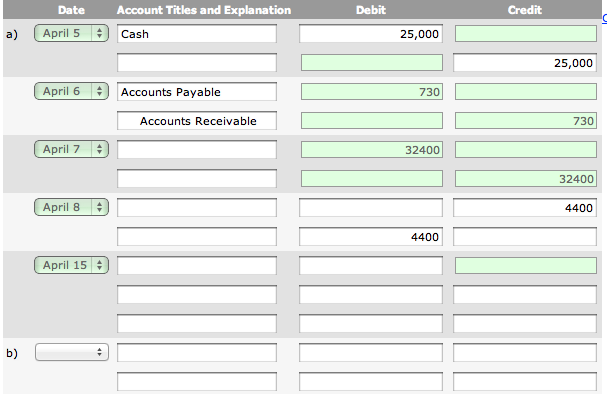

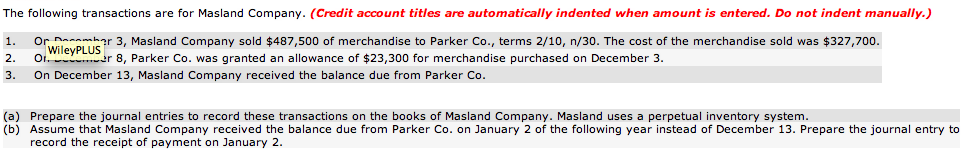

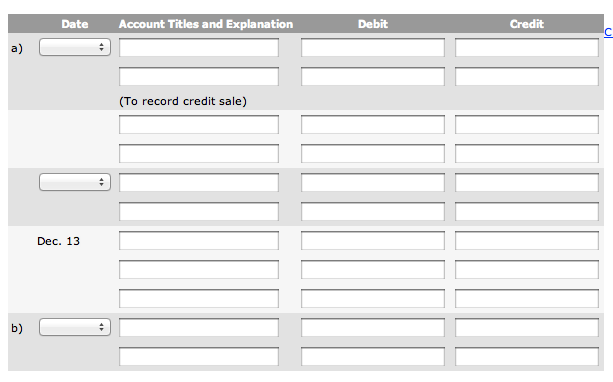

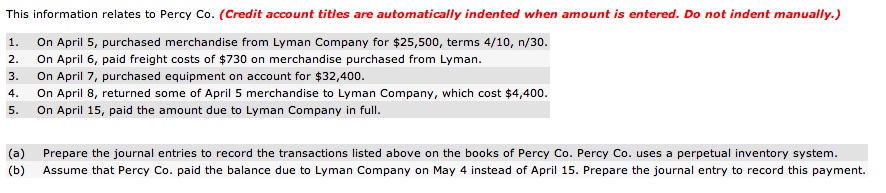

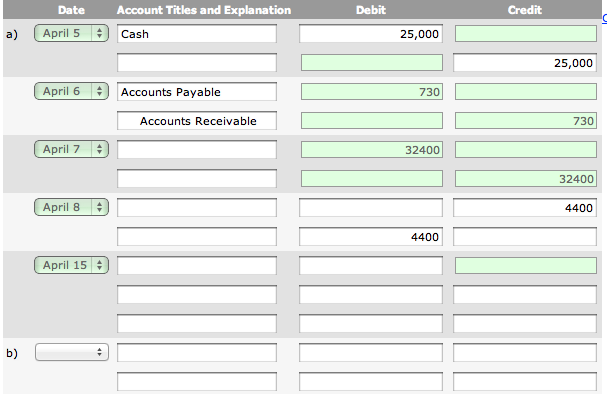

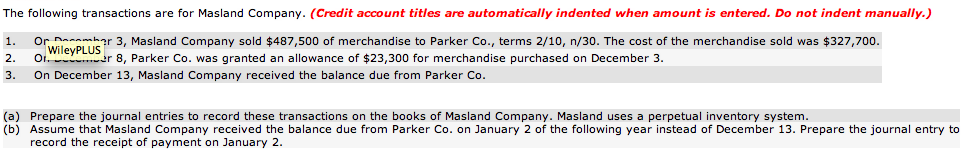

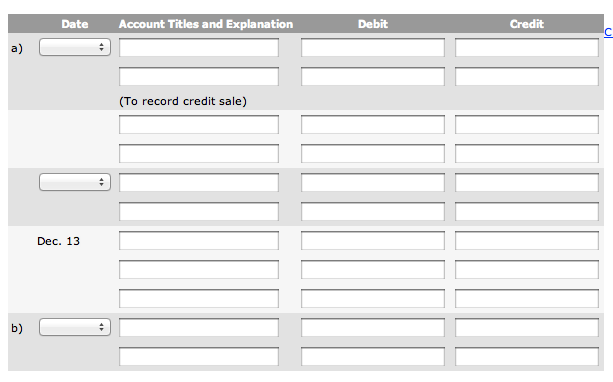

This information relates to Percy Co. (credit account titles are automatically indented when amount is entered. Do not indent manually.) On April 5, purchased merchandise from Lyman Company for $25,500, terms 4/10, n/30. On April 6, paid freight costs of $730 on merchandise purchased from Lyman. On April 7, purchased equipment on account for $32,400. On April 8, returned some of April 5 merchandise to Lyman Company, which cost $4,400. On April 15, paid the amount due to Lyman Company in full. Prepare the journal entries to record the transactions listed above on the books of Percy Co. Percy Co. uses a perpetual inventory system. Assume that Percy Co. paid the balance due to Lyman Company on May 4 instead of April 15. Prepare the journal entry to record this payment. The following transactions are for Masland Company. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) 3, Masland Company sold $487,500 of merchandise to Parker Co., terms 2/10, n/30. The cost of the merchandise sold was $327,700. 8, Parker Co. was granted an allowance of $23,300 for merchandise purchased on December 3. On December 13, Masland Company received the balance due from Parker Co. Prepare the journal entries to record these transactions on the books of Masland Company. Masland uses a perpetual inventory system. Assume that Masland Company received the balance due from Parker Co. on January 2 of the following year instead of December 13. Prepare the journal entry to record the receipt of payment on January 2. This information relates to Percy Co. (credit account titles are automatically indented when amount is entered. Do not indent manually.) On April 5, purchased merchandise from Lyman Company for $25,500, terms 4/10, n/30. On April 6, paid freight costs of $730 on merchandise purchased from Lyman. On April 7, purchased equipment on account for $32,400. On April 8, returned some of April 5 merchandise to Lyman Company, which cost $4,400. On April 15, paid the amount due to Lyman Company in full. Prepare the journal entries to record the transactions listed above on the books of Percy Co. Percy Co. uses a perpetual inventory system. Assume that Percy Co. paid the balance due to Lyman Company on May 4 instead of April 15. Prepare the journal entry to record this payment. The following transactions are for Masland Company. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) 3, Masland Company sold $487,500 of merchandise to Parker Co., terms 2/10, n/30. The cost of the merchandise sold was $327,700. 8, Parker Co. was granted an allowance of $23,300 for merchandise purchased on December 3. On December 13, Masland Company received the balance due from Parker Co. Prepare the journal entries to record these transactions on the books of Masland Company. Masland uses a perpetual inventory system. Assume that Masland Company received the balance due from Parker Co. on January 2 of the following year instead of December 13. Prepare the journal entry to record the receipt of payment on January 2