Answered step by step

Verified Expert Solution

Question

1 Approved Answer

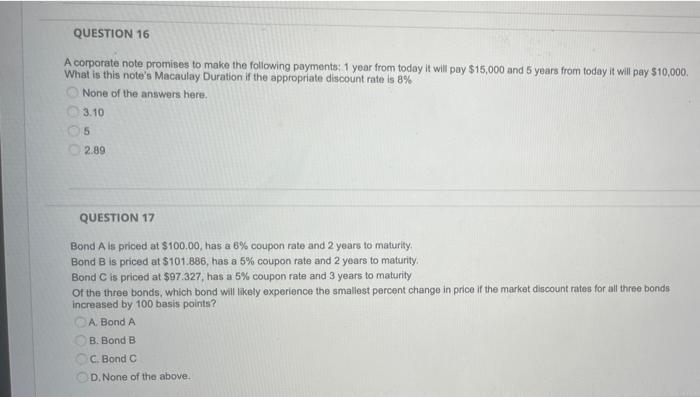

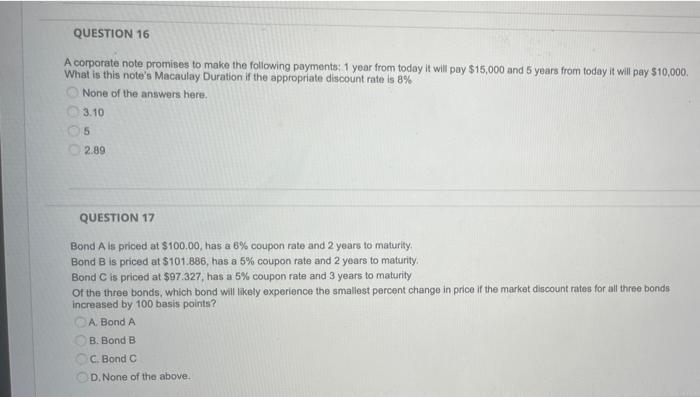

please help QUESTION 16 A corporate note promises to make the following payments: 1 year from today it will pay $15,000 and 5 years from

please help

QUESTION 16 A corporate note promises to make the following payments: 1 year from today it will pay $15,000 and 5 years from today it will pay $10,000 What is this note's Macaulay Duration if the appropriate discount rate is 8% None of the answers here. 3.10 5 2.89 QUESTION 17 Bond A is priced at $100.00, has a 8% coupon rate and 2 years to maturity, Bond B is priced at $101.886, has a 5% coupon rate and 2 years to maturity Bond C is priced at $97.327, has a 5% coupon rate and 3 years to maturity of the three bonds, which bond will likely experience the smallest percent change in price if the market discount rates for all three bonds increased by 100 basis points? A Bond A B. Bond B C. Bond C D. None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started