Answered step by step

Verified Expert Solution

Question

1 Approved Answer

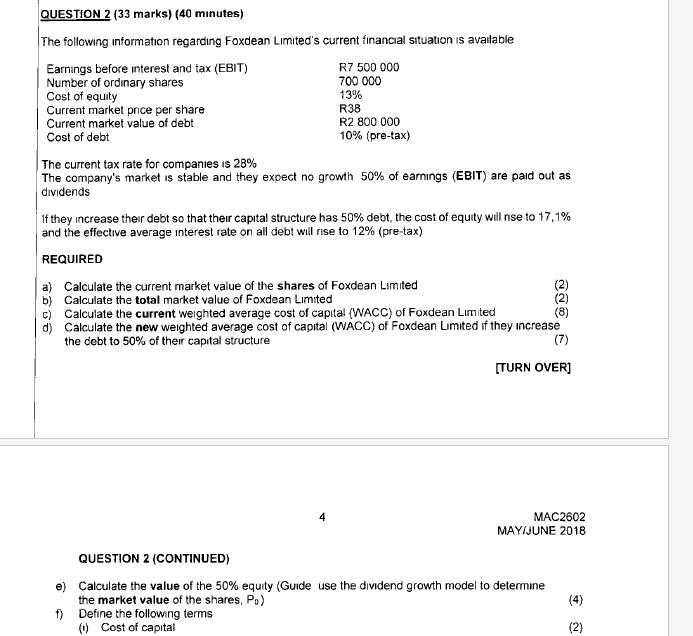

Please help QUESTION 2 ( 33 marks) ( 40 mnutes) The following information regarding Foxdean Limited's current financial situation is avalable The current tax rate

Please help

QUESTION 2 ( 33 marks) ( 40 mnutes) The following information regarding Foxdean Limited's current financial situation is avalable The current tax rate for companies is 28% The company's market is stable and they expect no growth 50% of earnings (EBIT) are paid out as dividends If they increase their debt so that their capital structure has 50% debt, the cost of equity will nse to 17,1\% and the effective average interest rate on all debt wil rise to 12% (pre-tax) REQUIRED a) Calculate the current market value of the shares of Foxdean Limited b) Calculate the total market value of Foxdean Limited (2) c) Calculate the current weighted average cost of capital (WACC) of Foxdean Limited (8) d) Calculate the new weighted average cost of capital (WACC) of Foxdean Limited if they increase the debt to 50% of their capital structure (7) [TURN OVER] 4 MAC2602 MAY/JUNE 2018 QUESTION 2 (CONTINUED) e) Calculate the value of the 50% equity (Guide use the dividend growth model to determine the market value of the shares, P0) (4) f) Define the followng terms (1) Cost of capital (2)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started