Answered step by step

Verified Expert Solution

Question

1 Approved Answer

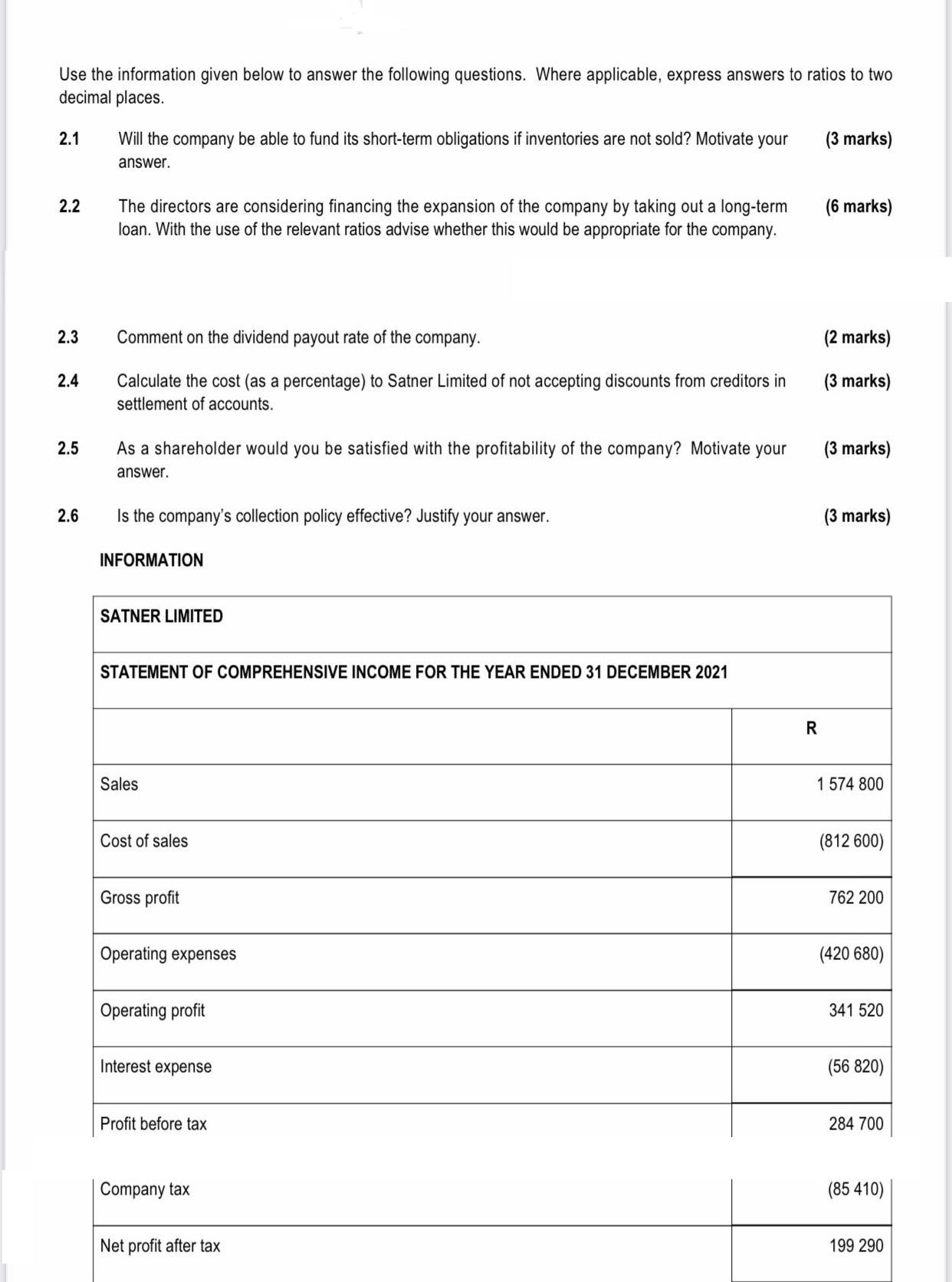

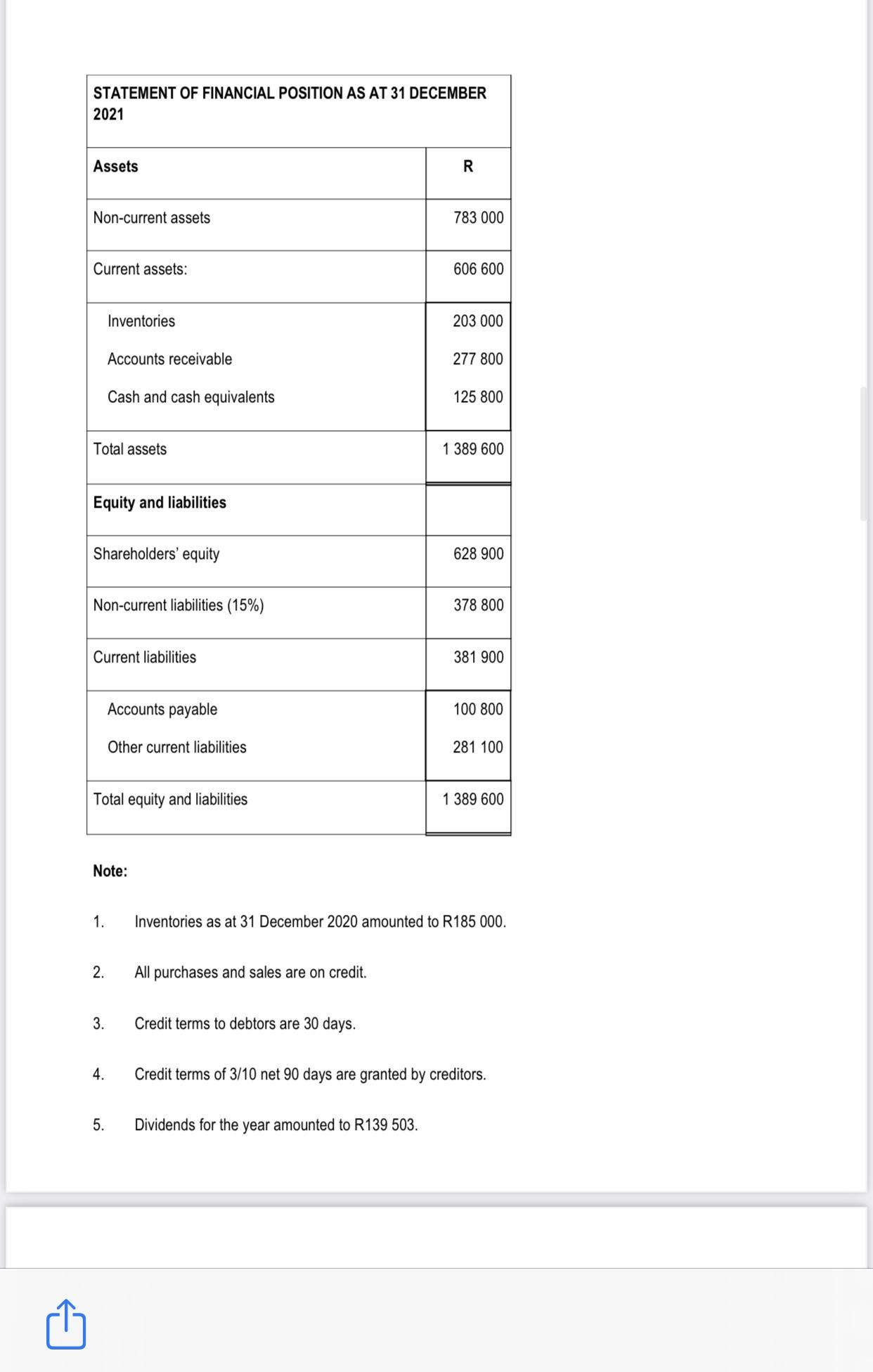

Use the information given below to answer the following questions. Where applicable, express answers to ratios to two decimal places. 2.1 Will the company

Use the information given below to answer the following questions. Where applicable, express answers to ratios to two decimal places. 2.1 Will the company be able to fund its short-term obligations if inventories are not sold? Motivate your (3 marks) answer. (6 marks) The directors are considering financing the expansion of the company by taking out a long-term loan. With the use of the relevant ratios advise whether this would be appropriate for the company. 2.2 2.3 Comment on the dividend payout rate of the company. (2 marks) 2.4 Calculate the cost (as a percentage) to Satner Limited of not accepting discounts from creditors in settlement of accounts. (3 marks) 2.5 As a shareholder would you be satisfied with the profitability of the company? Motivate your (3 marks) answer. 2.6 Is the company's collection policy effective? Justify your answer. (3 marks) INFORMATION SATNER LIMITED STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER 2021 R Sales 1 574 800 Cost of sales (812 600) Gross profit 762 200 Operating expenses (420 680) Operating profit 341 520 Interest expense (56 820) Profit before tax 284 700 Company tax (85 410) Net profit after tax 199 290 STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER 2021 Assets R Non-current assets 783 000 Current assets: 606 600 Inventories 203 000 Accounts receivable 277 800 Cash and cash equivalents 125 800 Total assets 1 389 600 Equity and liabilities Shareholders' equity 628 900 Non-current liabilities (15%) 378 800 Current liabilities 381 900 Accounts payable 100 800 Other current liabilities 281 100 Total equity and liabilities 1 389 600 Note: 1. Inventories as at 31 December 2020 amounted to R185 000. 2. All purchases and sales are on credit. 3. Credit terms to debtors are 30 days. 4. Credit terms of 3/10 net 90 days are granted by creditors. 5. Dividends for the year amounted to R139 503.

Step by Step Solution

★★★★★

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

2 Abilily to fnd shart lm obligalim nudged igudily ntiCuent rato ond quink natn li...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started