Answered step by step

Verified Expert Solution

Question

1 Approved Answer

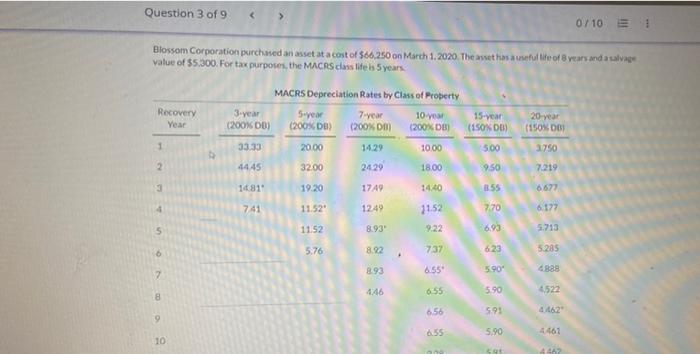

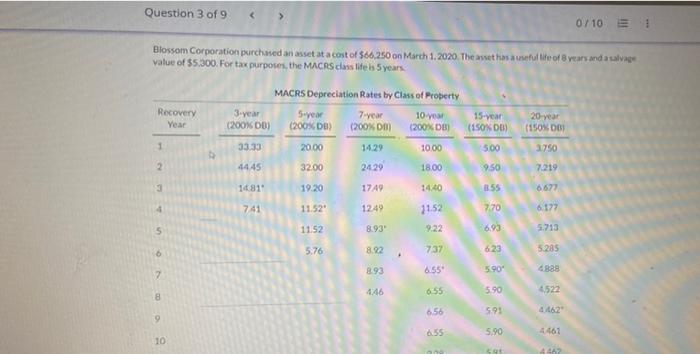

please help Question 3 of 9 0/10 E 1 Blossom Corporation purchased an asset at a cost of $66.250 on March 1.2020. The awet assetule

please help

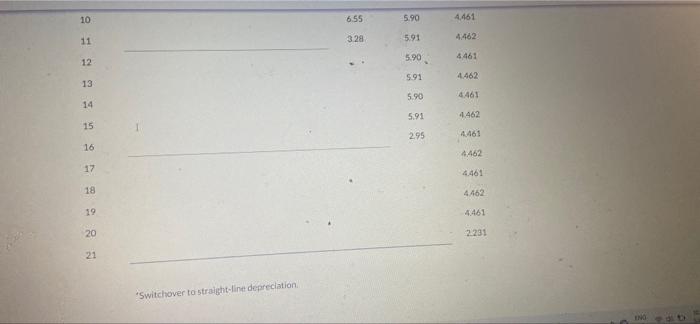

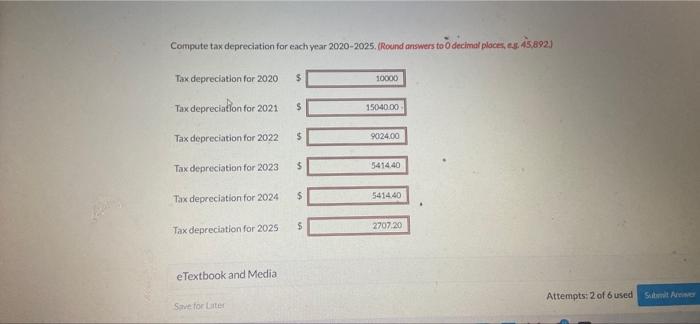

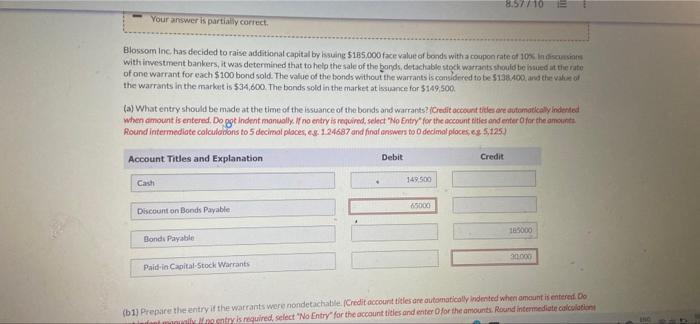

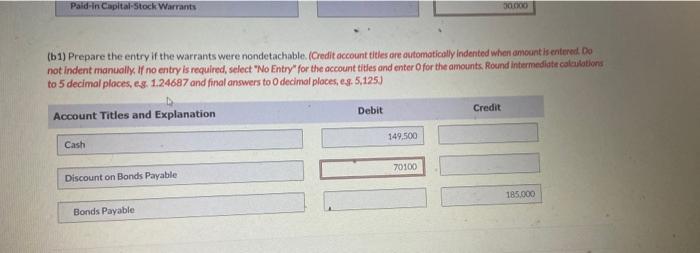

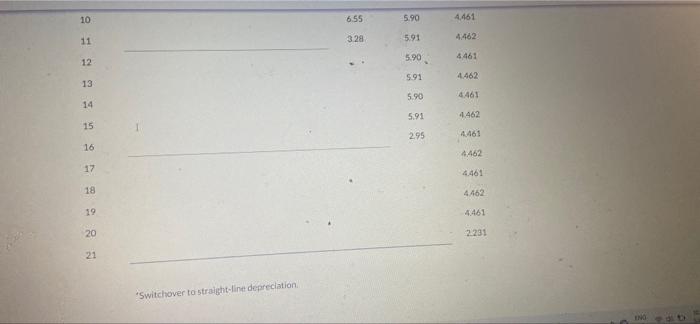

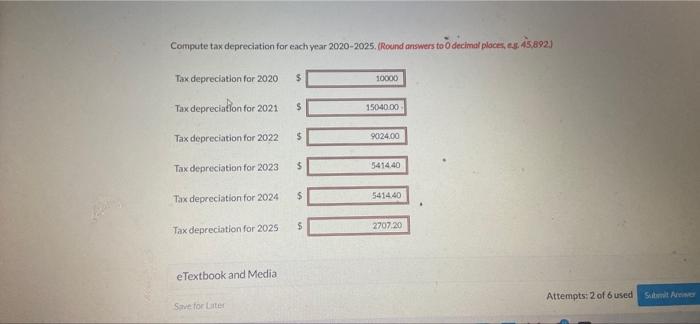

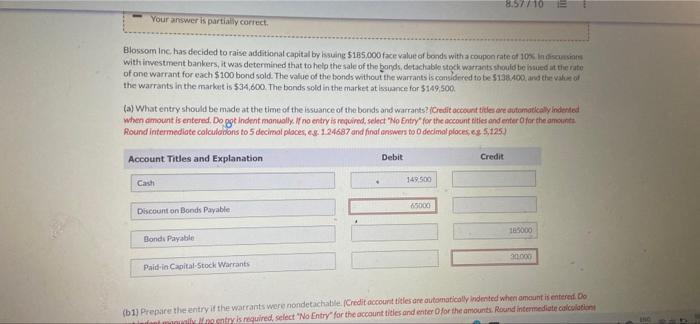

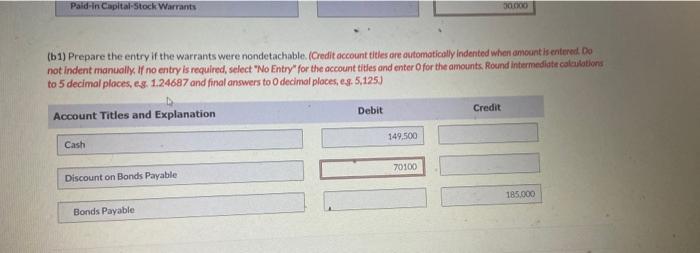

Question 3 of 9 0/10 E 1 Blossom Corporation purchased an asset at a cost of $66.250 on March 1.2020. The awet assetule of years and a salvage value of $5,300. For tax purposes, the MACRS ces liels 5 years MACRS Depreciation Rates by Class of Property Recovery 3-year 5 year 7-year 10 year 15-year 20 year Year (200% DB) (2003) (200% DM (200XD) (150X DE) (150W DB) 1 33.33 20.00 14.29 10.00 500 3750 2 4445 3200 2429 18.00 9.50 7.219 3 1681 19.20 1749 14:40 355 6677 4 741 11.52 1249 7.70 6.177 11.52 9.22 5 1152 8.93 6,93 5.713 5.76 8.92 737 6 623 5.285 + 8.93 7 6.55 590 4888 446 5.90 8 6:55 4522 656 591 4462 9 6.35 5.90 1461 10 59 142 10 6.55 5.90 4.461 11 3.28 5.91 4482 5.90 4.461 12 5.91 4.462 13 5.90 4.461 14 5.91 4.462 15 1 2.95 4.461 16 4462 17 4.461 18 4462 19 4.461 20 2.231 21 Switchever to straight-line depreciation Compute tax depreciation for each year 2020-2025. Round answers to decimal places, s. 45.892) $ 10000 Tax depreciation for 2020 Tax depreciation for 2021 $ 15040.00 Tax depreciation for 2022 $ 9024.00 Tax depreciation for 2023 $ 5414.40 $ 5414.40 Tax depreciation for 2024 $ 2707.20 Tax depreciation for 2025 e Textbook and Media Attempts: 2 of 6 used States Save for Liter 8.5710 Your answer is partially correct Blossom Inc. has decided to raise additional capital by sing $185.000 face value of bonds with a coupon rate of 10% Indicions with investment bankers, it was determined that to help the sale of the bonds, detachable stock warrants should be heat the rate of one warrant for each $100 bond sold. The value of the bonds without the warrants is considered to be 5138400, and the stof the warrants in the market is $34,600. The bonds sold in the market at lance for 5149.500 (a) Whatentry should be made at the time of the issuance of the bonds and warrants? (Credit account title ore automatically indented when amount is entered. Do gotIndent manually. If no entry is required, select "No Entry for the account titles and enter for the amount Round intermediate calculations to 5 decimal places, eg. 124687 and final answers to decimal places, es 5,1253 Account Titles and Explanation Debit Credit Cash 149.500 65000 Discount on Bonds Payable 185000 Bondi Payable 30.000 Paid-in Capital Stock Warrants (b1) Prepare the entry if the warrants were nondetachable Credit account titles are automatically indested when amount is entered. Do entry is required, select "No Entry for the accounttities and enter for the amounts. Round intermediate clotion Paid in Capital Stock Warrants 30000 (61) Prepare the entry if the warrants were nondetachable. (Credit account titles are automatically Indented when amount is entered Do not indent manually. If no entry is required, select "No Entry for the account titles and enter Ofor the amounts. Round intermediate calculations to 5 decimal places, eg. 1.24687 and final answers to decimal places, os. 5,125) Debit Credit Account Titles and Explanation 149,500 Cashi 70100 Discount on Bonds Payable 185.000 Bonds Payable

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started