Answered step by step

Verified Expert Solution

Question

1 Approved Answer

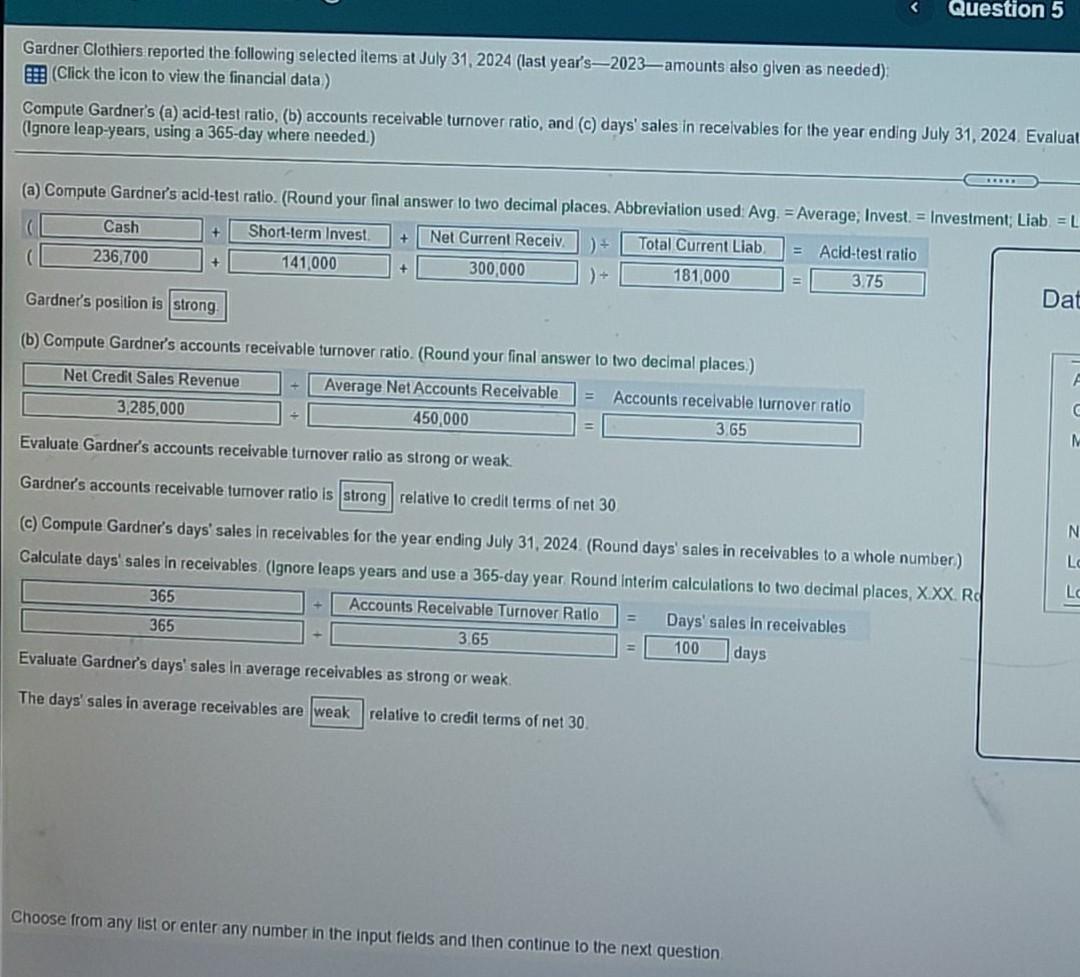

please help Question 5 Gardner Clothiers reported the following selected items at July 31, 2024 (last year's2023amounts also given as needed) : (Click the icon

please help

Question 5 Gardner Clothiers reported the following selected items at July 31, 2024 (last year's2023amounts also given as needed) : (Click the icon to view the financial data) Compute Gardner's (@) acld-test ratio, (b) accounts recevable turnover ratio, and (c) days' sales in recelvables for the year ending July 31, 2024 Evaluat (Ignore leap-years, using a 365-day where needed.) (@) Compute Gardner's acld-test ratio. (Round your final answer to two decimal places. Abbreviation used. Avg. = Average, Invest. = Investment; Liab=L Cash + Short-term Invest 141000 Net Current Receiv, 300,000 Total Current Liab, 236,700 = Acid-test ratio ) ) + 181,000 3.75 Gardner's position is strong Dat (b) Compute Gardner's accounts receivable turnover ratio. (Round your final answer to two decimal places) Net Credit Sales Revenue 3,285,000 Average Net Accounts Receivable Accounts receivable turnover ratio 450,000 3.65 Evaluate Gardner's accounts receivable turnover ratio as strong or weak. M Gardner's accounts receivable tumover ratio is strong relative to credit terms of net 30 N LO Compute Gardner's days' sales in receivables for the year ending July 31, 2024 (Round days sales in receivables to a whole number) Calculate days sales in receivables (Ignore leaps years and use a 365-day year Round Interim calculations to two decimal places, X.XX.RO 365 Accounts Receivable Turnover Ratlo Days' sales in receivables 365 3.65 100 Lo days Evaluate Gardner's days' sales in average receivables as strong or weak The days' sales in average receivables are weak relative to credit terms of net 30 Choose from any list or enter any number in the input fields and then continue to the next question Question 5 Gardner Clothiers reported the following selected items at July 31, 2024 (last year's2023amounts also given as needed) : (Click the icon to view the financial data) Compute Gardner's (@) acld-test ratio, (b) accounts recevable turnover ratio, and (c) days' sales in recelvables for the year ending July 31, 2024 Evaluat (Ignore leap-years, using a 365-day where needed.) (@) Compute Gardner's acld-test ratio. (Round your final answer to two decimal places. Abbreviation used. Avg. = Average, Invest. = Investment; Liab=L Cash + Short-term Invest 141000 Net Current Receiv, 300,000 Total Current Liab, 236,700 = Acid-test ratio ) ) + 181,000 3.75 Gardner's position is strong Dat (b) Compute Gardner's accounts receivable turnover ratio. (Round your final answer to two decimal places) Net Credit Sales Revenue 3,285,000 Average Net Accounts Receivable Accounts receivable turnover ratio 450,000 3.65 Evaluate Gardner's accounts receivable turnover ratio as strong or weak. M Gardner's accounts receivable tumover ratio is strong relative to credit terms of net 30 N LO Compute Gardner's days' sales in receivables for the year ending July 31, 2024 (Round days sales in receivables to a whole number) Calculate days sales in receivables (Ignore leaps years and use a 365-day year Round Interim calculations to two decimal places, X.XX.RO 365 Accounts Receivable Turnover Ratlo Days' sales in receivables 365 3.65 100 Lo days Evaluate Gardner's days' sales in average receivables as strong or weak The days' sales in average receivables are weak relative to credit terms of net 30 Choose from any list or enter any number in the input fields and then continue to the nextStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started