Answered step by step

Verified Expert Solution

Question

1 Approved Answer

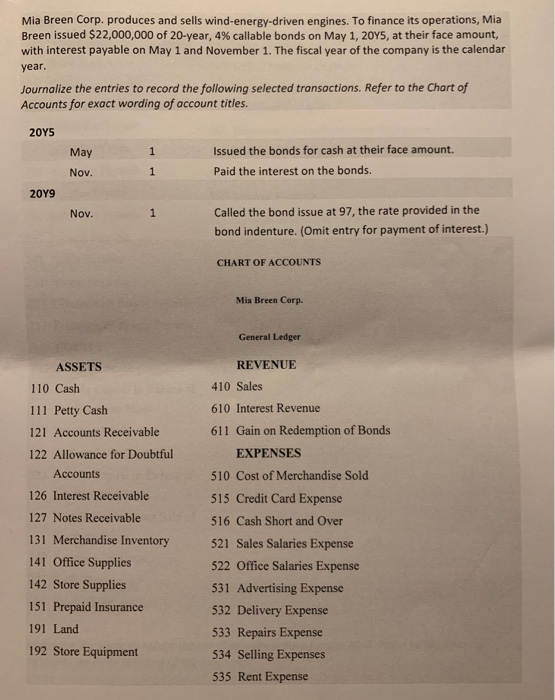

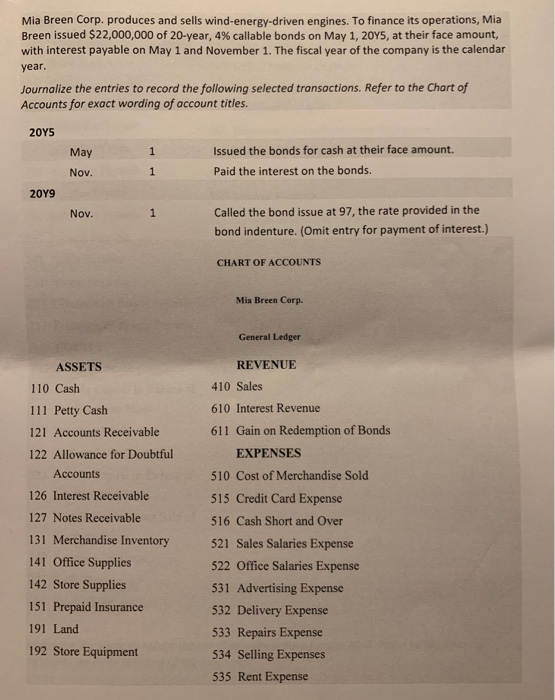

PLEASE HELP! Read the question very carefully. Mia Breen Corp. produces and sells wind-energy-driven engines. To finance its operations, Mia 000 of 20-year, 4% callable

PLEASE HELP! Read the question very carefully.

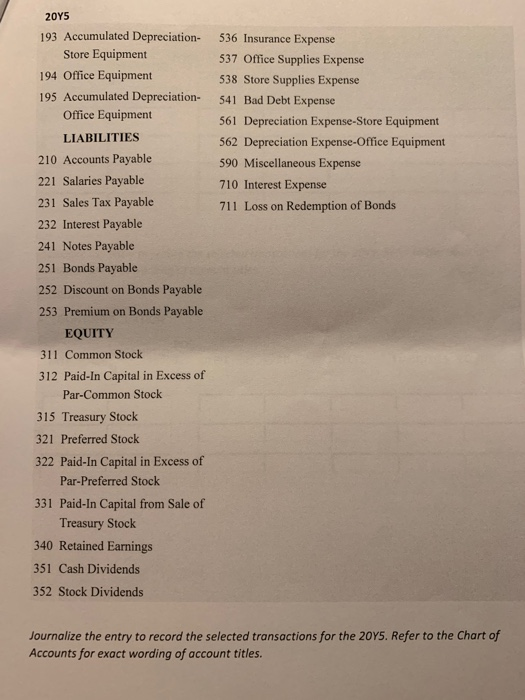

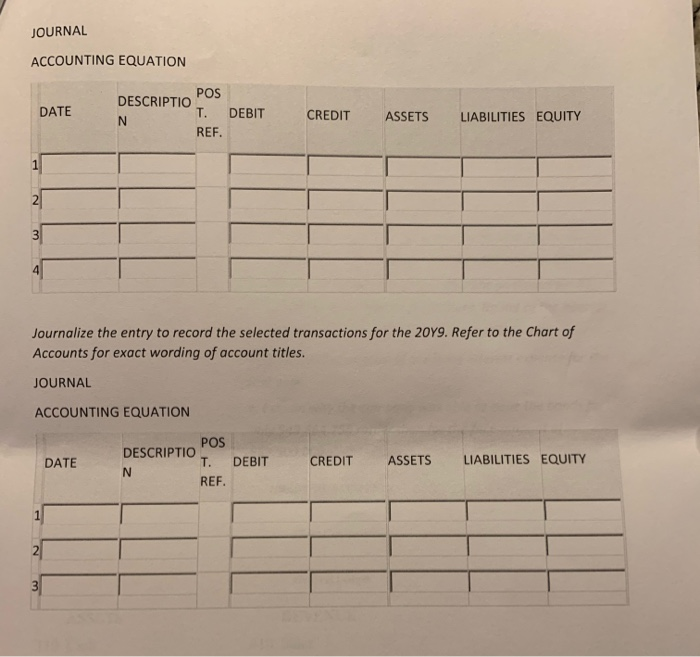

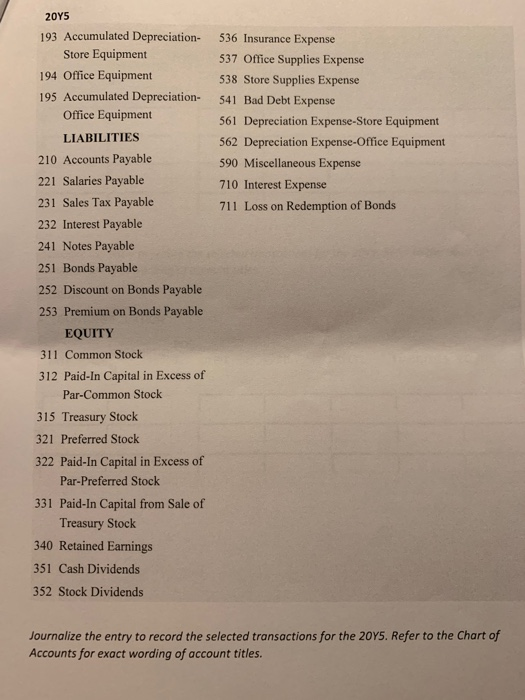

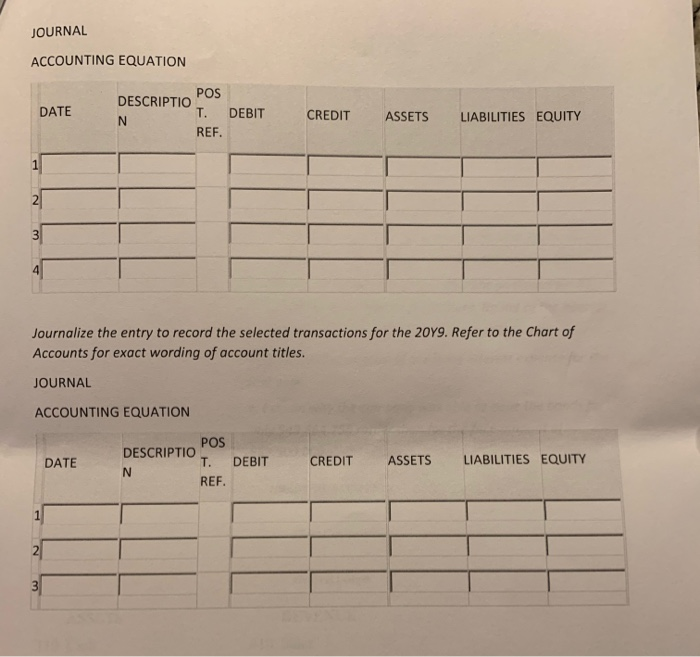

Mia Breen Corp. produces and sells wind-energy-driven engines. To finance its operations, Mia 000 of 20-year, 4% callable bonds on May 1, 2045, at their face amount, with interest payable on May 1 and November 1. The fiscal year of the company is the calendar year. Journalize the entries to record the following selected transactions. Refer to the Chart of Accounts for exact wording of account titles. 2045 1 May Nov. Issued the bonds for cash at their face amount. Paid the interest on the bonds. 1 2049 Nov. 1 Called the bond issue at 97, the rate provided in the bond indenture. (Omit entry for payment of interest.) CHART OF ACCOUNTS Mia Breen Corp. General Ledger ASSETS 110 Cash 111 Petty Cash 121 Accounts Receivable 122 Allowance for Doubtful Accounts 126 Interest Receivable 127 Notes Receivable 131 Merchandise Inventory 141 Office Supplies 142 Store Supplies 151 Prepaid Insurance 191 Land 192 Store Equipment REVENUE 410 Sales 610 Interest Revenue 611 Gain on Redemption of Bonds EXPENSES 510 Cost of Merchandise Sold 515 Credit Card Expense 516 Cash Short and Over 521 Sales Salaries Expense 522 Office Salaries Expense 531 Advertising Expense 532 Delivery Expense 533 Repairs Expense 534 Selling Expenses 535 Rent Expense 536 Insurance Expense 537 Office Supplies Expense 538 Store Supplies Expense 541 Bad Debt Expense 561 Depreciation Expense-Store Equipment 562 Depreciation Expense-Office Equipment 590 Miscellaneous Expense 710 Interest Expense 711 Loss on Redemption of Bonds 2045 193 Accumulated Depreciation- Store Equipment 194 Office Equipment 195 Accumulated Depreciation- Office Equipment LIABILITIES 210 Accounts Payable 221 Salaries Payable 231 Sales Tax Payable 232 Interest Payable 241 Notes Payable 251 Bonds Payable 252 Discount on Bonds Payable 253 Premium on Bonds Payable EQUITY 311 Common Stock 312 Paid-In Capital in Excess of Par-Common Stock 315 Treasury Stock 321 Preferred Stock 322 Paid-In Capital in Excess of Par-Preferred Stock 331 Paid-In Capital from Sale of Treasury Stock 340 Retained Earnings 351 Cash Dividends 352 Stock Dividends Journalize the entry to record the selected transactions for the 20Y5. Refer to the Chart of Accounts for exact wording of account titles. JOURNAL ACCOUNTING EQUATION DESCRIPTIO POS DATE T. DEBIT N CREDIT ASSETS LIABILITIES EQUITY REF. Journalize the entry to record the selected transactions for the 2019. Refer to the Chart of Accounts for exact wording of account titles. JOURNAL ACCOUNTING EQUATION DATE DATE DESCRIPTIO POS DESCRIPTIOT DEBIT CREDIT ASSETS LIABILITIES EQUITY N REF

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started