Answered step by step

Verified Expert Solution

Question

1 Approved Answer

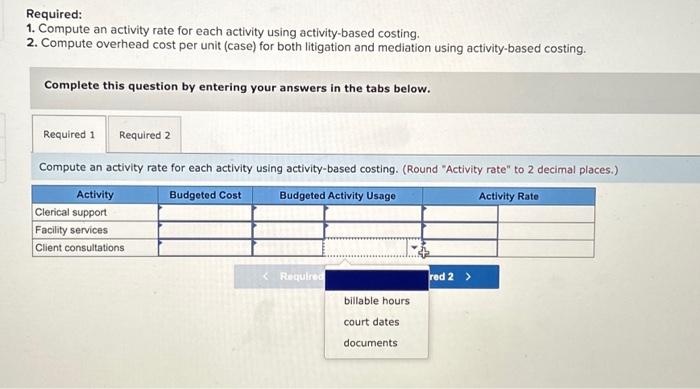

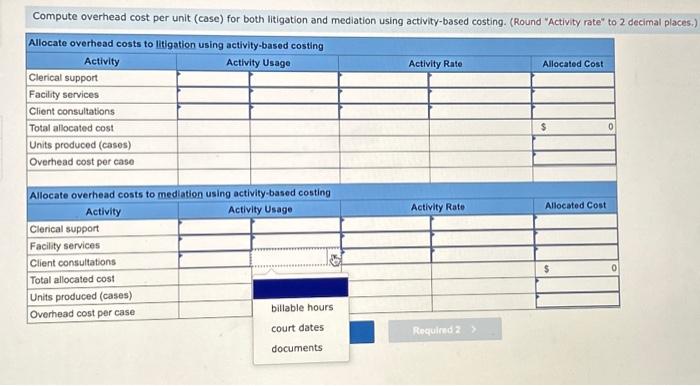

please help Required: 1. Compute an activity rate for each activity using activity-based costing. 2. Compute overhead cost per unit (case) for both litigation and

please help

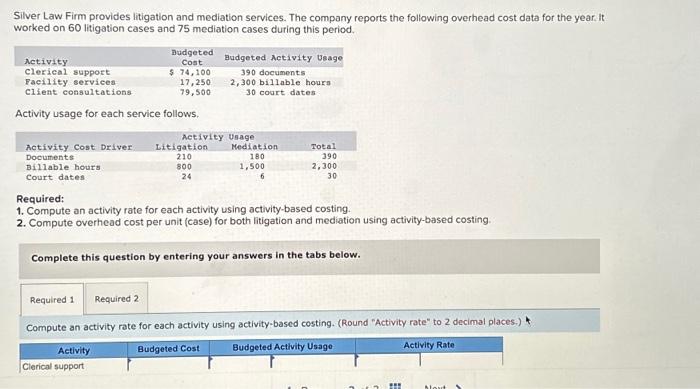

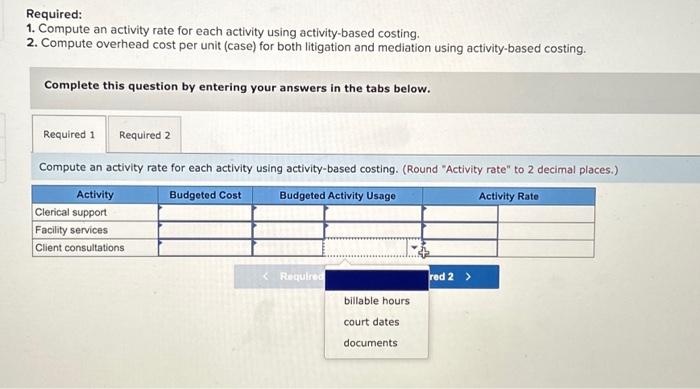

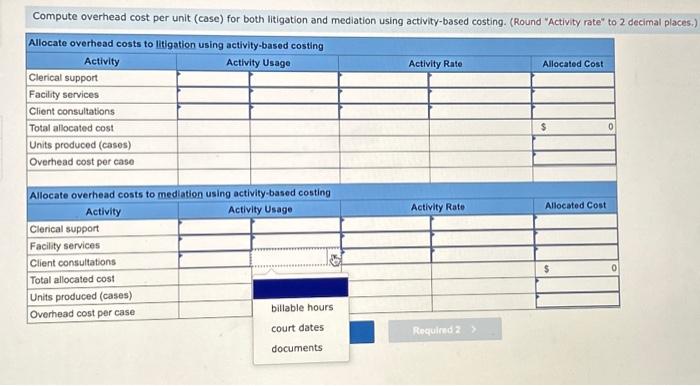

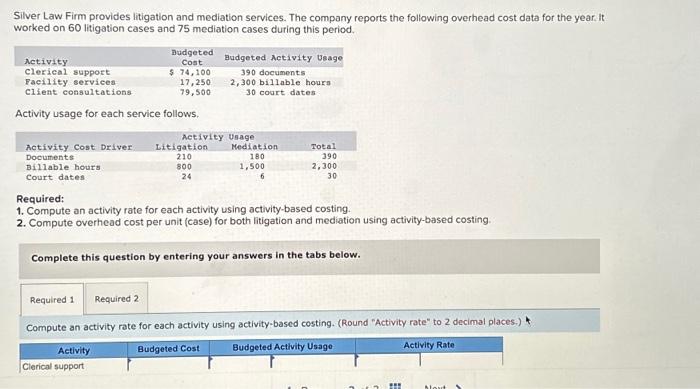

Required: 1. Compute an activity rate for each activity using activity-based costing. 2. Compute overhead cost per unit (case) for both litigation and mediation using activity-based costing. Complete this question by entering your answers in the tabs below. Compute an activity rate for each activity using activity-based costing. (Round "Activity rate" to 2 decimal places. Compute overhead cost per unit (case) for both litigation and mediation using activity-based costing. (Round "Activity rate" to 2 decimal places.) Allocate overhead costs to mediation using activity-based costing Silver Law Firm provides litigation and mediation services. The company reports the following overhead cost data for the year. it worked on 60 litigation cases and 75 mediation cases during this period. Activity usage for each service follows. Required: 1. Compute an activity rate for each activity using activity-based costing. 2. Compute overhead cost per unit (case) for both litigation and mediation using activity-based costing. Complete this question by entering your answers in the tabs below. Compute an activity rate for each activity using activity-based costing. (Round "Activity rate" to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started