Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE HELP!! Required information [The following information applies to the questions displayed below.] Peng Company is considering an investment expected to generate an average net

PLEASE HELP!!

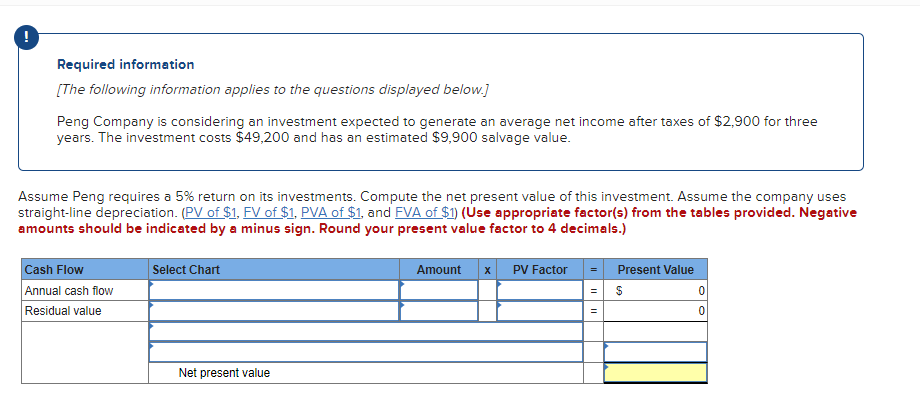

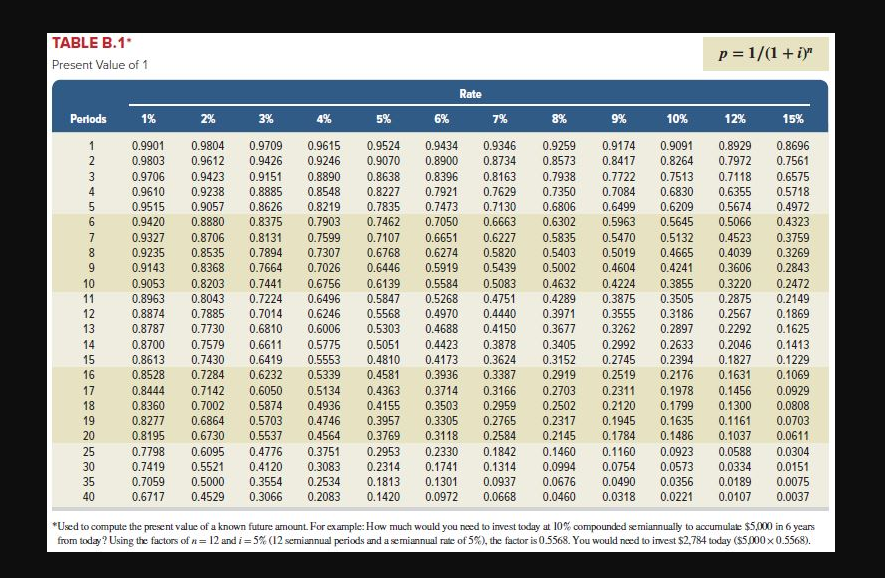

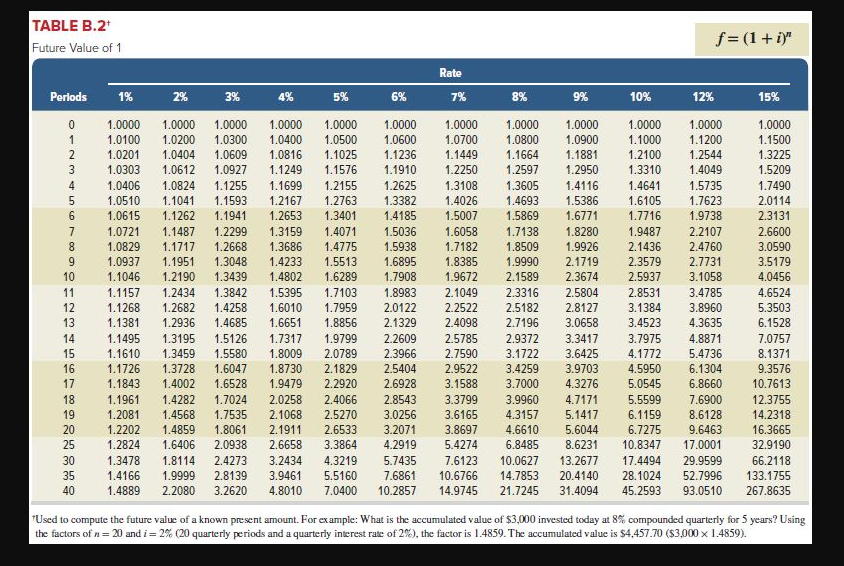

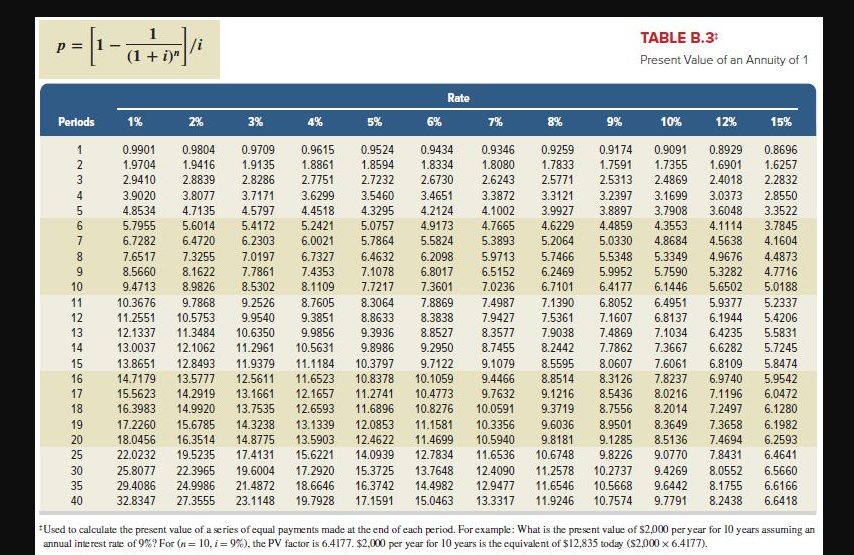

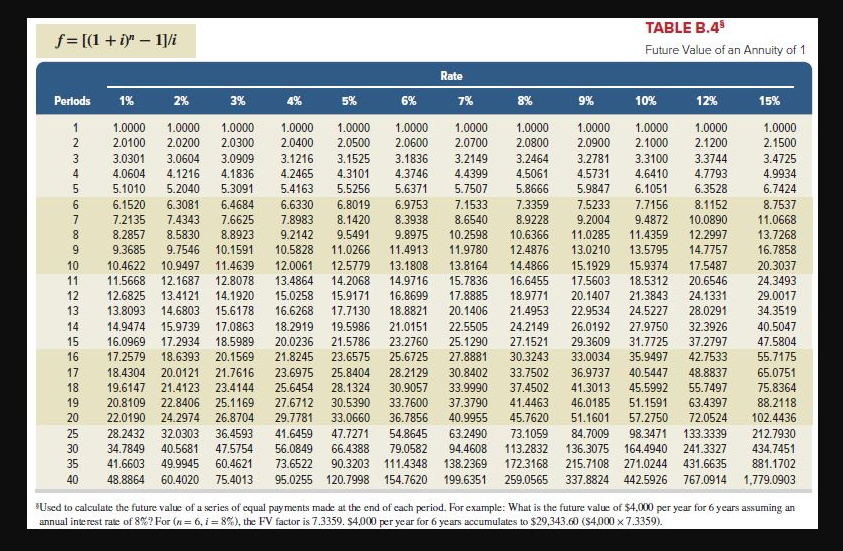

Required information [The following information applies to the questions displayed below.] Peng Company is considering an investment expected to generate an average net income after taxes of $2,900 for three years. The investment costs $49,200 and has an estimated $9,900 salvage value. Assume Peng requires a 5% return on its investments. Compute the net present value of this investment. Assume the company uses straight-line depreciation. (PV of $1, FV of $1, PVA of $1, and FVA of $1 ) (Use appropriate factor(s) from the tables provided. Negative amounts should be indicated by a minus sign. Round your present value factor to 4 decimals.) TABLE B.1* Present Value of 1 p=1/(1+i)n *Used to compute the present value of a known future amount. For example: How much would you noed to invest today at 10% compounded semiannually to accumulate $5,000 in 6 years from today? Using the factors of n=12 and i=5% ( 12 semiannual periods and a semiannual rate of 5% ), the factor is 0.5568 . You would need to irvest $2,784 today ( $5,0000.5568 ). TABLE B. 2+ Firture Value of 1 f=(1+i)n usea to compute the ruture value or a known present amount. ror exampie: w nat is the accumuarea varue or $3,wu investea toaly at or compounoea quarteny ror 2 years : usang the factors of n=20 and i=2% ( 20 quarterly periods and a quarterly interest rase of 2%, the factor is 1.4859 . The accumulated value is $4,457.70 ( $3,0001.4859). p=[1(1+i)n1]/i TABLE B. 3t Present Value of an Annuity of 1 tUsed to calculate the present value of a series of equal payments made at the end of each period. For example: What is the present value of $2,000 per year for 10 years assuming an annual interest rate of 9% For (n=10,i=9%), the PV factor is 6.4177.$2,000 per year for 10 years is the equivalent of $12,835 today ( $2,0006.4177) f=[(1+i)n1]/i TABLE B.4 SUsed to calculate the future value of a series of equal payments made at the end of each period. For example: What is the future value of $4,000 per yeur for 6 years assuming an annual interest rate of 8%? For (n=6,i=8% ), the FV factor is 7.3359 . $4,000 per year for 6 years accumulates to $29,343.60($4,0007.3359)

Required information [The following information applies to the questions displayed below.] Peng Company is considering an investment expected to generate an average net income after taxes of $2,900 for three years. The investment costs $49,200 and has an estimated $9,900 salvage value. Assume Peng requires a 5% return on its investments. Compute the net present value of this investment. Assume the company uses straight-line depreciation. (PV of $1, FV of $1, PVA of $1, and FVA of $1 ) (Use appropriate factor(s) from the tables provided. Negative amounts should be indicated by a minus sign. Round your present value factor to 4 decimals.) TABLE B.1* Present Value of 1 p=1/(1+i)n *Used to compute the present value of a known future amount. For example: How much would you noed to invest today at 10% compounded semiannually to accumulate $5,000 in 6 years from today? Using the factors of n=12 and i=5% ( 12 semiannual periods and a semiannual rate of 5% ), the factor is 0.5568 . You would need to irvest $2,784 today ( $5,0000.5568 ). TABLE B. 2+ Firture Value of 1 f=(1+i)n usea to compute the ruture value or a known present amount. ror exampie: w nat is the accumuarea varue or $3,wu investea toaly at or compounoea quarteny ror 2 years : usang the factors of n=20 and i=2% ( 20 quarterly periods and a quarterly interest rase of 2%, the factor is 1.4859 . The accumulated value is $4,457.70 ( $3,0001.4859). p=[1(1+i)n1]/i TABLE B. 3t Present Value of an Annuity of 1 tUsed to calculate the present value of a series of equal payments made at the end of each period. For example: What is the present value of $2,000 per year for 10 years assuming an annual interest rate of 9% For (n=10,i=9%), the PV factor is 6.4177.$2,000 per year for 10 years is the equivalent of $12,835 today ( $2,0006.4177) f=[(1+i)n1]/i TABLE B.4 SUsed to calculate the future value of a series of equal payments made at the end of each period. For example: What is the future value of $4,000 per yeur for 6 years assuming an annual interest rate of 8%? For (n=6,i=8% ), the FV factor is 7.3359 . $4,000 per year for 6 years accumulates to $29,343.60($4,0007.3359) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started