Answered step by step

Verified Expert Solution

Question

1 Approved Answer

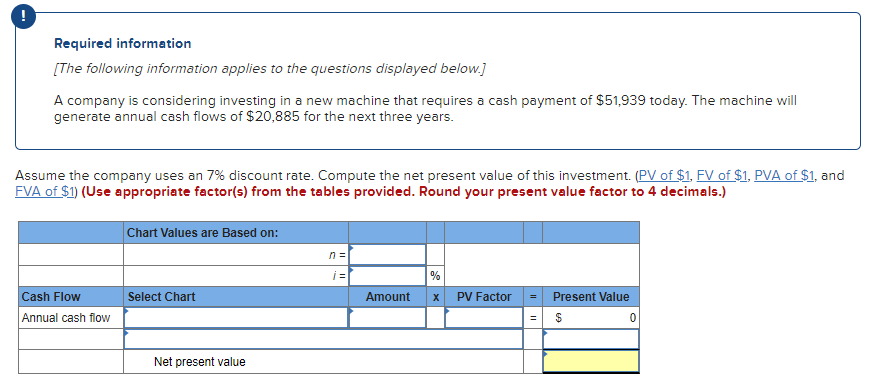

Please Help!!!! Required information [The following information applies to the questions displayed below.] A company is considering investing in a new machine that requires a

Please Help!!!!

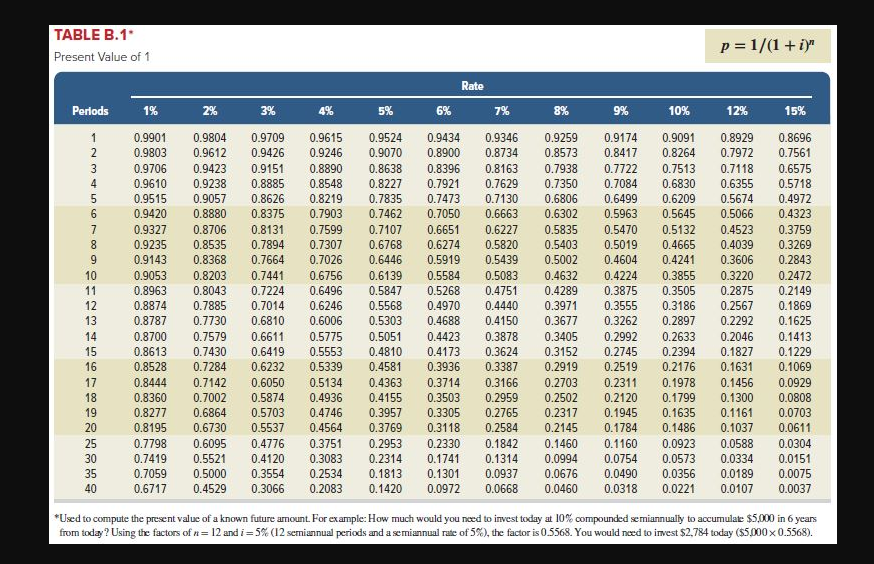

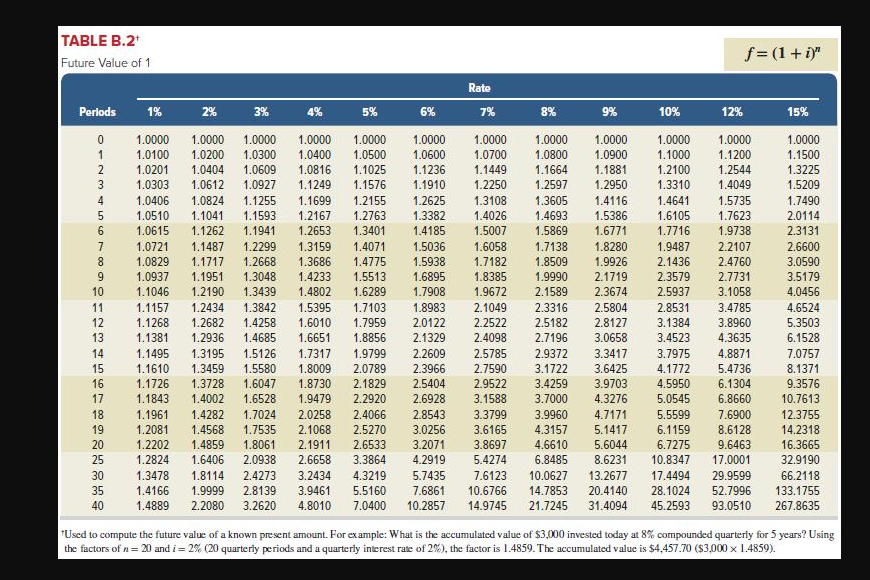

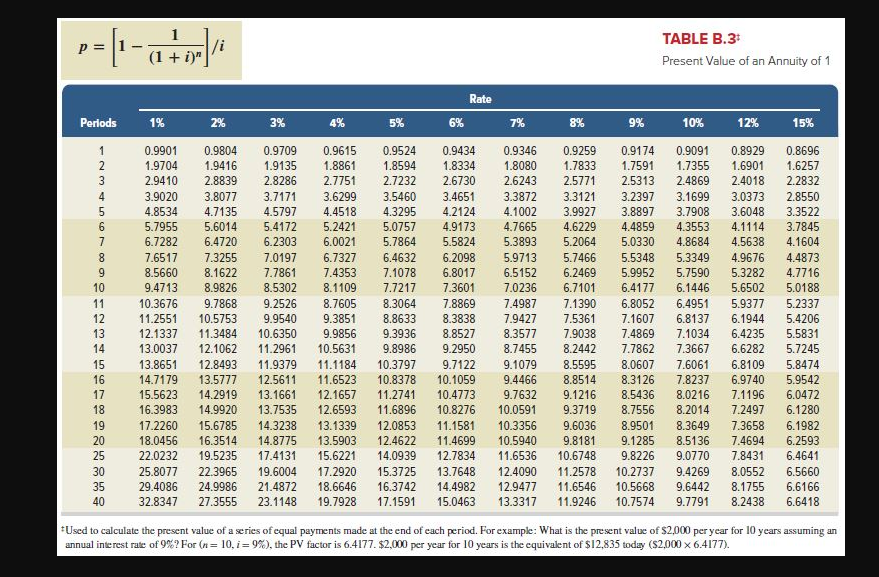

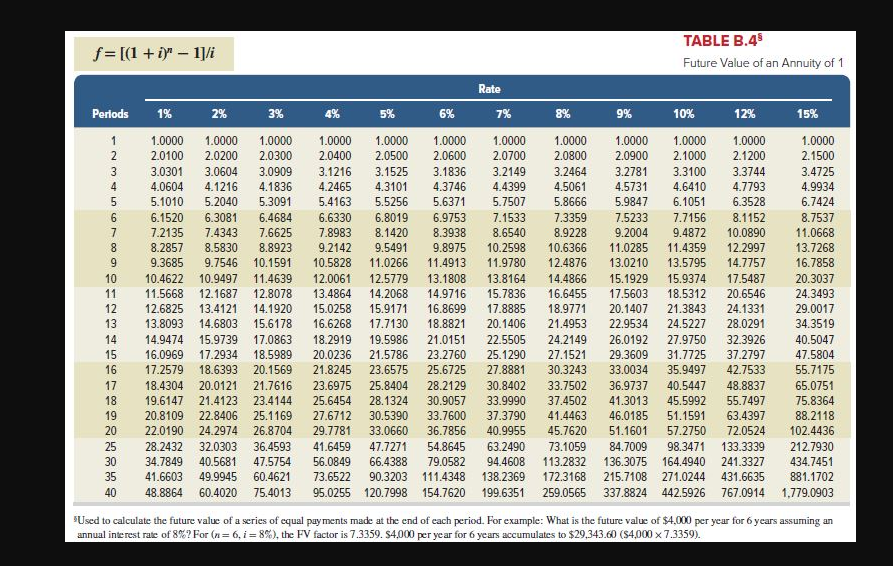

Required information [The following information applies to the questions displayed below.] A company is considering investing in a new machine that requires a cash payment of $51,939 today. The machine will generate annual cash flows of $20,885 for the next three years. Assume the company uses an 7% discount rate. Compute the net present value of this investment. (PV of $1, FV of $1, PVA of $1, and FVA of $1 ) (Use appropriate factor(s) from the tables provided. Round your present value factor to 4 decimals.) TABLE B. 1* Present Value of 1 p=1/(1+i)n TABLE B. 2+ f=(1+i)n the factors of n=20 and i=2% (20 quarterly periods and a quarterly interest rate of 2%), the factor is 1.4859 . The accumulated value is $4,457.70 ( $3,0001.4859). p=[1(1+i)n1]/i TABLE B. 3t Present Value of an Annuity of 1 Used to calculate the present value of a series of equal payments made at the end of each period. For example: What is the present value of $2,000 per year for 10 years assuming an annual interest rate of 9% For (n=10,i=9% ), the PV factor is 6.4177.$2,000 per year for 10 years is the equivalent of $12,835 today ( $2,0006.4177 ). f=[(1+i)n1]/i TABLE B. 4B Fiture Value of an Annuity of 1 annual interest rate of 8% For (n=6,i=8%), the FV factor is 7.3359.$4,000 per year for 6 years accumulates to $29,343.60($4,0007.3359)

Required information [The following information applies to the questions displayed below.] A company is considering investing in a new machine that requires a cash payment of $51,939 today. The machine will generate annual cash flows of $20,885 for the next three years. Assume the company uses an 7% discount rate. Compute the net present value of this investment. (PV of $1, FV of $1, PVA of $1, and FVA of $1 ) (Use appropriate factor(s) from the tables provided. Round your present value factor to 4 decimals.) TABLE B. 1* Present Value of 1 p=1/(1+i)n TABLE B. 2+ f=(1+i)n the factors of n=20 and i=2% (20 quarterly periods and a quarterly interest rate of 2%), the factor is 1.4859 . The accumulated value is $4,457.70 ( $3,0001.4859). p=[1(1+i)n1]/i TABLE B. 3t Present Value of an Annuity of 1 Used to calculate the present value of a series of equal payments made at the end of each period. For example: What is the present value of $2,000 per year for 10 years assuming an annual interest rate of 9% For (n=10,i=9% ), the PV factor is 6.4177.$2,000 per year for 10 years is the equivalent of $12,835 today ( $2,0006.4177 ). f=[(1+i)n1]/i TABLE B. 4B Fiture Value of an Annuity of 1 annual interest rate of 8% For (n=6,i=8%), the FV factor is 7.3359.$4,000 per year for 6 years accumulates to $29,343.60($4,0007.3359) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started