Answered step by step

Verified Expert Solution

Question

1 Approved Answer

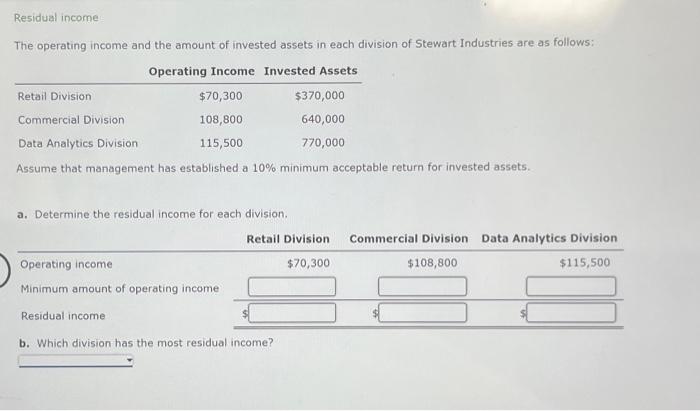

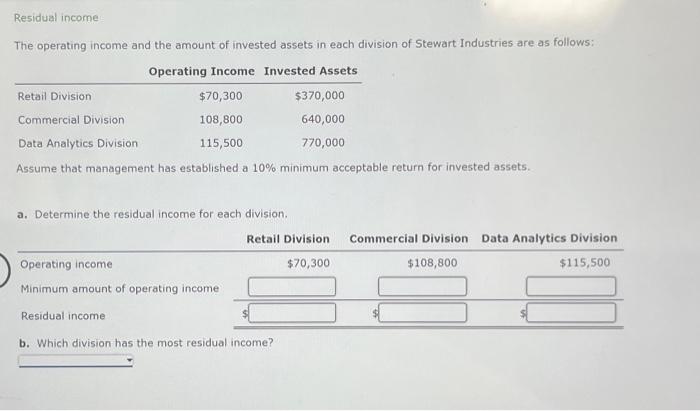

please help!! Residual income The operating income and the amount of invested assets in each division of Stewart Industries are as follows: Assume that management

please help!!

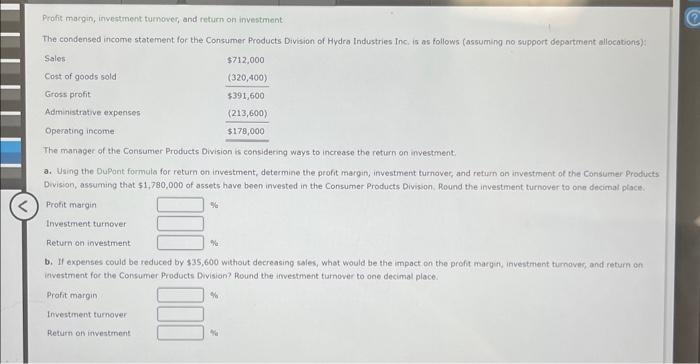

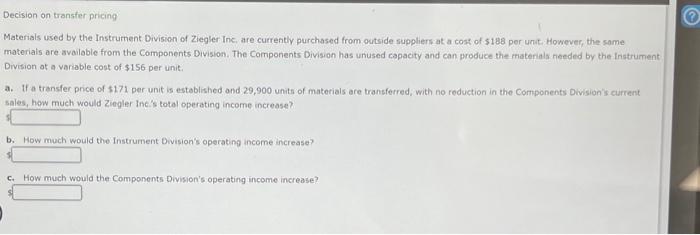

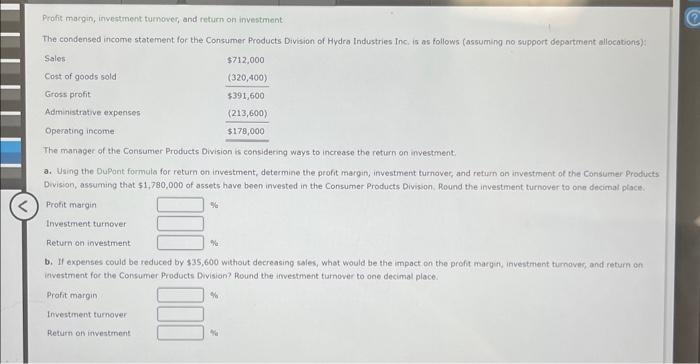

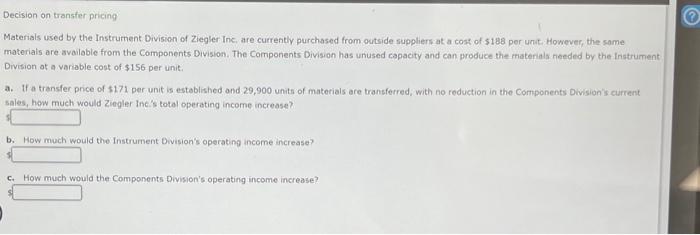

Residual income The operating income and the amount of invested assets in each division of Stewart Industries are as follows: Assume that management has established a 10% minimum acceptable return for invested assets. a. Determine the residual income for each division. b. Which division has the most residual income? Profis margin, investment turmorec; and return on investment The condensed income statement for the Consumer Products Division of Hydra Industries Inc. is as follows (assuming no support department allocations): The manager of the Consumer Products Division is considering ways to increase the return on invectment: a. Using the DuPont formula for return on investment, determine the profit margin, investment tumover, and return on investment of the Consumer Products Dwision, assuming thet 51,780,000 of assets have been invested in the Consumer Products Division, Round the investment turnover to one decimal place. b. If expenses could be reduced by $35,600 without decreasing sales, what would be the impoct on the profit margith, investment turnover, and return on ievestment for the Consumer Products Division? Round the imvestment tumower to ooe decimal place. Decision on transfer pricing Materials used by the Instrument Division of Ziegler Inc, are currently purchased from outside suppliers at a cost of $188 per unti. However, the same. materiais are availoble from the Components Division. The Components Division has unused capacity and can produce the matenals needed by the instrument Division ot a variable cost of $156 per unit. a. If a transfer price of $171 per unit is estoblished and 29,900 units of materials are transferred, with no reduction in the Components Division's ciurrent sales, how. much would Ziegler lnc:'s total operating income increase? b. How much would the Instrument Division's operating income increase? c. How much would the Components Division's operating income increase

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started