Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help reviewing for exam 0 0 1. RETURN = LOSS/ORIGINAL COST 0 0 2. If Stock X has a higher profit than Stock Y,

please help reviewing for exam

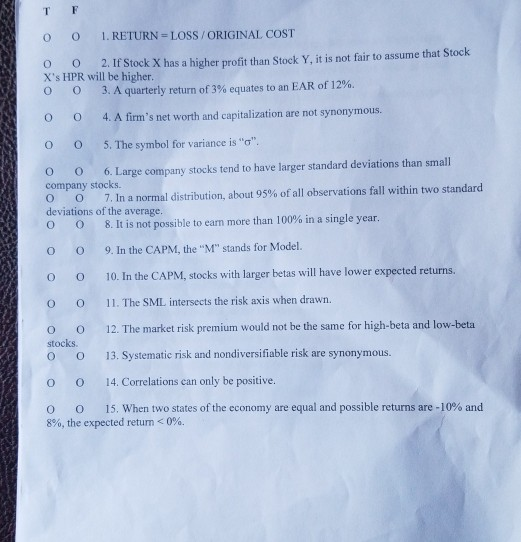

0 0 1. RETURN = LOSS/ORIGINAL COST 0 0 2. If Stock X has a higher profit than Stock Y, it is not fair to assume that Stock X's HPR will be higher. 0 0 3. A quarterly return of 3% equates to an EAR of 12% 0 0 4. A firm's net worth and capitalization are not synonymous. 0 0 5. The symbol for variance is "o". 0 0 6. Large company stocks tend to have larger standard deviations than small company stocks. 0 0 7. In a normal distribution, about 95% of all observations fall within two standard deviations of the average. 0 0 8. It is not possible to earn more than 100% in a single year. 0 0 9. In the CAPM, the "M" stands for Model 0 0 10. In the CAPM, stocks with larger betas will have lower expected returns. 0 0 11. The SML intersects the risk axis when drawn. 12. The market risk premium would not be the same for high-beta and low-beta 0 0 stocks. 0 0 13. Systematic risk and nondiversifiable risk are synonymous. 0 0 14. Correlations can only be positive. 0 0 15. When two states of the economy are equal and possible returns are -10% and 8%, the expected returnStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started