please help

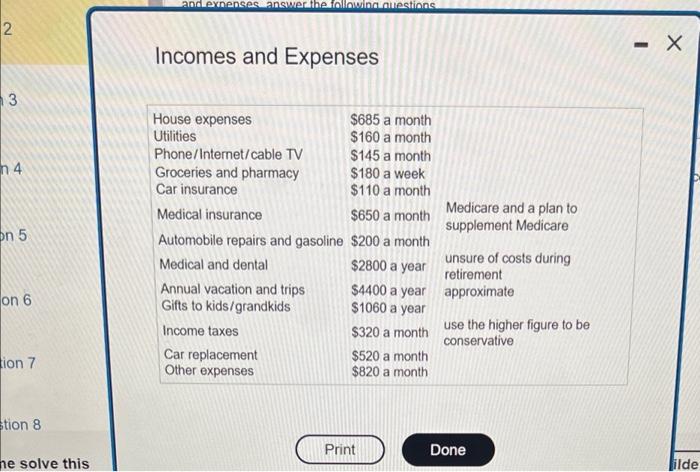

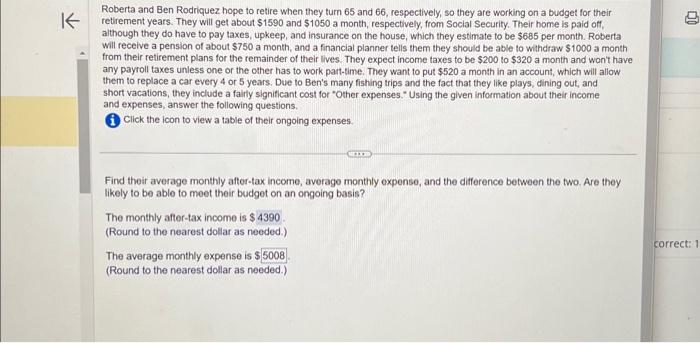

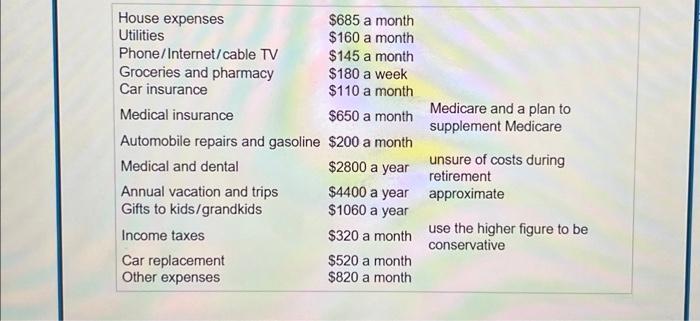

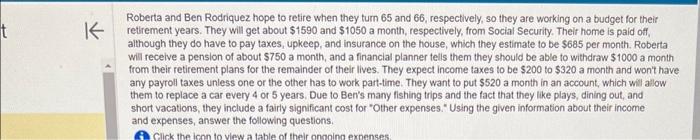

Roberta and Ben Rodriquez hope to retire when they turn 65 and 66 , respectively, so they are working on a budget for their retirement years. They will get about $1590 and $1050 a month, respectively, from Social Security. Their home is paid of, although they do have to pay taxes, upkeep, and insurance on the house, which they estimate to be $685 per month. Roberta will recelve a pension of about $750 a month, and a financial planner telis them they should be able to withdraw $1000 a month from their retirement plans for the remainder of their lives. They expect income taxes to be $200 to $320 a month and won't have any payroll taxes unless one or the other has to work part-lime. They want to put $520 a month in an account, which will allow them to replace a car every 4 or 5 years. Due to Ben's many fishing trips and the fact that they like plays, dining out, and short vacations, they include a fairly significant cost for "Other expenses. "Using the given information about their income and expenses, answer the following questions. Incomes and Expenses Roberta and Ben Rodriquez hope to retire when they turn 65 and 66 , respectively, so they are working on a budget for their retirement years. They will get about $1590 and $1050 a month, respectively, from Social Security. Their home is paid off, although they do have to pay taxes, upkeep, and insurance on the house, which they estimate to be $685 per month. Roberta will receive a pension of about $750 a month, and a financial planner telis them they should be able to withdraw $1000 a month from their retirement plans for the remainder of their lives. They expect income taxes to be $200 to $320 a month and won't have any payroll taxes unless one or the other has to work part-time. They want to put $520 a month in an account, which will allow them to replace a car every 4 or 5 years. Due to Ben's many fishing trips and the fact that they like plays, dining out, and short vacations, they include a falrly significant cost for "Other expenses," Using the given information about their income and expenses, answer the following questions. Click the icon to view a table of their ongoing expenses. Find their average monthly after-tax income, avorago monthly expenso, and the difference between the two. Are they likely to be able to meet their budget on an ongoing basis? The monthly after-tax income is $4390. (Round to the nearest dollar as needed.) The average monthly expense is $5008 (Round to the nearest dollar as needed.) HouseexpensesUtilitiesPhone/Internet/cableTVGroceriesandpharmacyCarinsuranceMedicalinsuranceAutomobilerepairsandgasolineAupplementMedicareMedicalanddentalAnnualvacationandtripsGiftstokids/grandkidsIncometaxesCarreplacementOtherexpenses$685amonth$160amonth$145amonth$180aweek$110amonth$650amonth$200amonth$2800ayear$4400ayearofcostsduring$1060ayear$320amonth$520amonth$820amonth Roberta and Ben Rodriquez hope to retire when they turn 65 and 66 , respectively, so they are working on a budget for their retirement years. They will get about $1590 and $1050 a month, respectively, from Social Security. Their home is paid of, although they do have to pay taxes, upkeep, and insurance on the house, which they estimate to be $685 per month. Roberta will recelve a pension of about $750 a month, and a financial planner telis them they should be able to withdraw $1000 a month from their retirement plans for the remainder of their lives. They expect income taxes to be $200 to $320 a month and won't have any payroll taxes unless one or the other has to work part-lime. They want to put $520 a month in an account, which will allow them to replace a car every 4 or 5 years. Due to Ben's many fishing trips and the fact that they like plays, dining out, and short vacations, they include a fairly significant cost for "Other expenses. "Using the given information about their income and expenses, answer the following questions. Incomes and Expenses Roberta and Ben Rodriquez hope to retire when they turn 65 and 66 , respectively, so they are working on a budget for their retirement years. They will get about $1590 and $1050 a month, respectively, from Social Security. Their home is paid off, although they do have to pay taxes, upkeep, and insurance on the house, which they estimate to be $685 per month. Roberta will receive a pension of about $750 a month, and a financial planner telis them they should be able to withdraw $1000 a month from their retirement plans for the remainder of their lives. They expect income taxes to be $200 to $320 a month and won't have any payroll taxes unless one or the other has to work part-time. They want to put $520 a month in an account, which will allow them to replace a car every 4 or 5 years. Due to Ben's many fishing trips and the fact that they like plays, dining out, and short vacations, they include a falrly significant cost for "Other expenses," Using the given information about their income and expenses, answer the following questions. Click the icon to view a table of their ongoing expenses. Find their average monthly after-tax income, avorago monthly expenso, and the difference between the two. Are they likely to be able to meet their budget on an ongoing basis? The monthly after-tax income is $4390. (Round to the nearest dollar as needed.) The average monthly expense is $5008 (Round to the nearest dollar as needed.) HouseexpensesUtilitiesPhone/Internet/cableTVGroceriesandpharmacyCarinsuranceMedicalinsuranceAutomobilerepairsandgasolineAupplementMedicareMedicalanddentalAnnualvacationandtripsGiftstokids/grandkidsIncometaxesCarreplacementOtherexpenses$685amonth$160amonth$145amonth$180aweek$110amonth$650amonth$200amonth$2800ayear$4400ayearofcostsduring$1060ayear$320amonth$520amonth$820amonth