please help

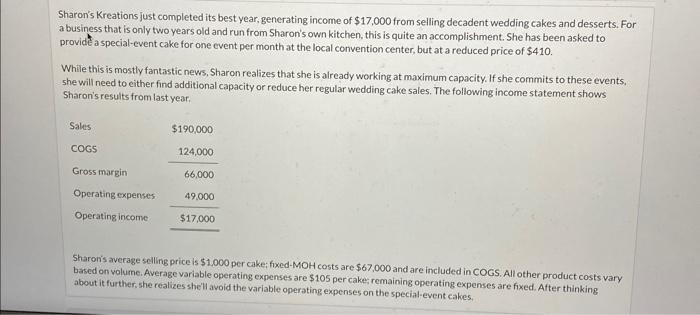

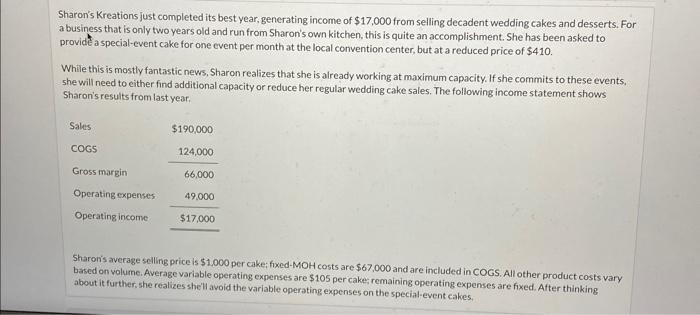

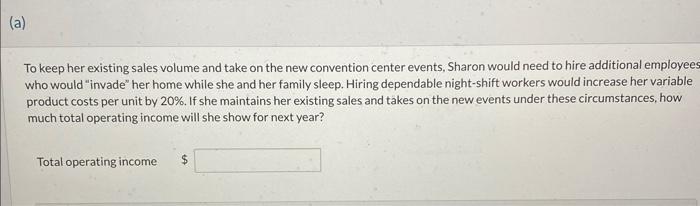

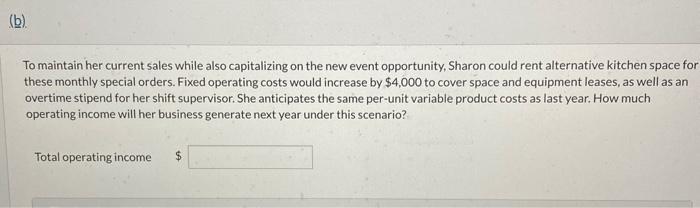

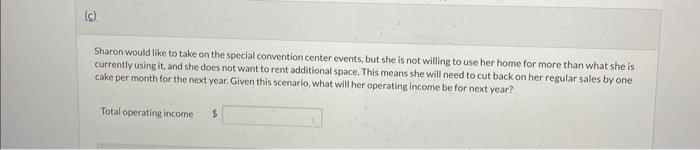

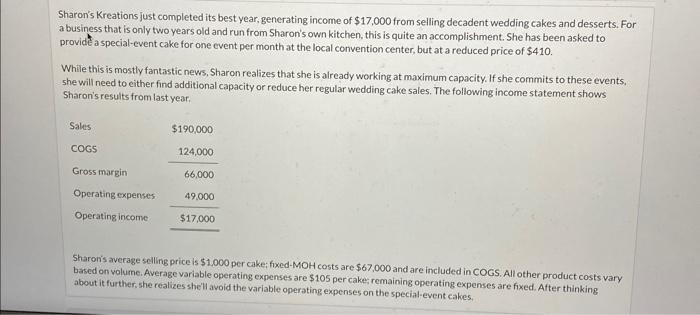

Sharon's Kreations just completed its best year, generating income of $17,000 from selling decadent wedding cakes and desserts. For a business that is only two years old and run from Sharon's own kitchen, this is quite an accomplishment. She has been asked to provide a special-event cake for one event per monthat the local convention center, but at a reduced price of $410. While this is mostly fantastic news, Sharon realizes that she is already working at maximum capacity. If she commits to these events. she will need to either find additional capacity or reduce her regular wedding cake sales. The following income statement shows Sharon's results from last year. Sharon's average selling price is $1,000 per cake: fixed-MOH costs are $67,000 and are included in COGS. All other product costs vary based on volume. Average variable operating expenses are $105 per cake; remaining operating expenses are fixed. After thinking about it further, she realizes she'll avoid the variable operating expenses on the special-event cakes. To keep her existing sales volume and take on the new convention center events, Sharon would need to hire additional employee who would "invade" her home while she and her family sleep. Hiring dependable night-shift workers would increase her variable product costs per unit by 20%. If she maintains her existing sales and takes on the new events under these circumstances, how much total operating income will she show for next year? Total operating income To maintain her current sales while also capitalizing on the new event opportunity, Sharon could rent alternative kitchen space for these monthly special orders. Fixed operating costs would increase by $4,000 to cover space and equipment leases, as well as an overtime stipend for her shift supervisor. She anticipates the same per-unit variable product costs as last year. How much operating income will her business generate next year under this scenario? Total operating income Sharon would like to take on the special convention center events, but she is not willing to use her home for more than what she is currently using it, and she does not want to rent additional space. This means she will need to cut back on her regular sales by one cake per month for the next year, Given this scenario, what will her operating income be for next year? Total operating income Sharon's Kreations just completed its best year, generating income of $17,000 from selling decadent wedding cakes and desserts. For a business that is only two years old and run from Sharon's own kitchen, this is quite an accomplishment. She has been asked to provide a special-event cake for one event per monthat the local convention center, but at a reduced price of $410. While this is mostly fantastic news, Sharon realizes that she is already working at maximum capacity. If she commits to these events. she will need to either find additional capacity or reduce her regular wedding cake sales. The following income statement shows Sharon's results from last year. Sharon's average selling price is $1,000 per cake: fixed-MOH costs are $67,000 and are included in COGS. All other product costs vary based on volume. Average variable operating expenses are $105 per cake; remaining operating expenses are fixed. After thinking about it further, she realizes she'll avoid the variable operating expenses on the special-event cakes. To keep her existing sales volume and take on the new convention center events, Sharon would need to hire additional employee who would "invade" her home while she and her family sleep. Hiring dependable night-shift workers would increase her variable product costs per unit by 20%. If she maintains her existing sales and takes on the new events under these circumstances, how much total operating income will she show for next year? Total operating income To maintain her current sales while also capitalizing on the new event opportunity, Sharon could rent alternative kitchen space for these monthly special orders. Fixed operating costs would increase by $4,000 to cover space and equipment leases, as well as an overtime stipend for her shift supervisor. She anticipates the same per-unit variable product costs as last year. How much operating income will her business generate next year under this scenario? Total operating income Sharon would like to take on the special convention center events, but she is not willing to use her home for more than what she is currently using it, and she does not want to rent additional space. This means she will need to cut back on her regular sales by one cake per month for the next year, Given this scenario, what will her operating income be for next year? Total operating income