Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help Sheridan Corporation produces two grades of non-alcoholic wine from grapes that it buys from California growers. It produces and sells roughly 3,000,000 liters

please help

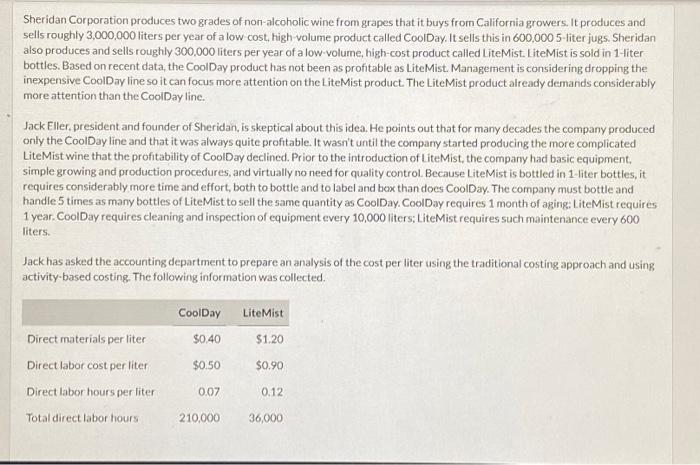

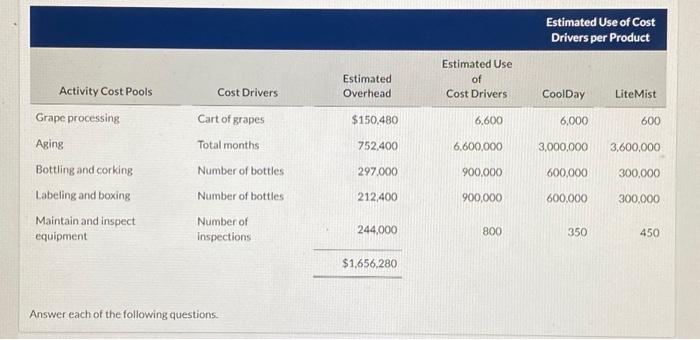

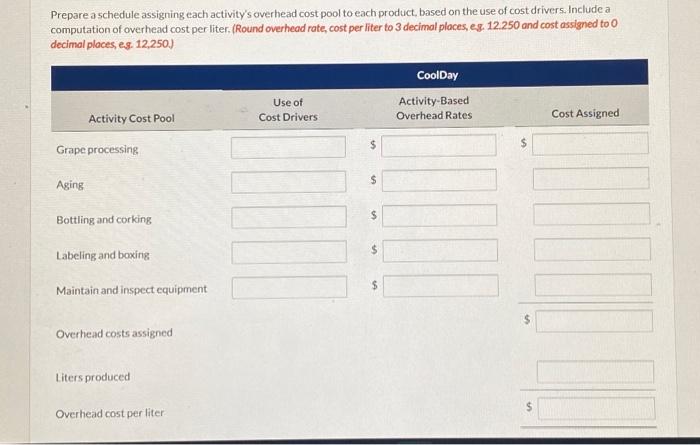

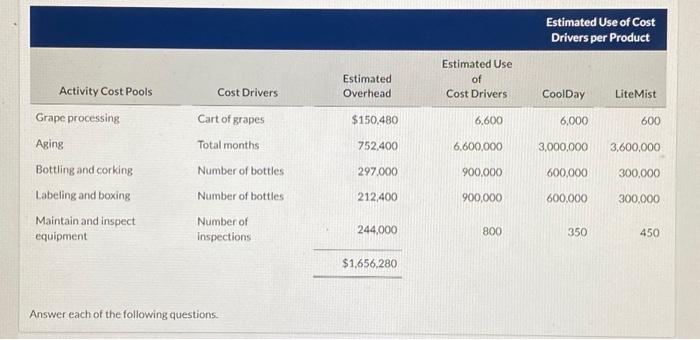

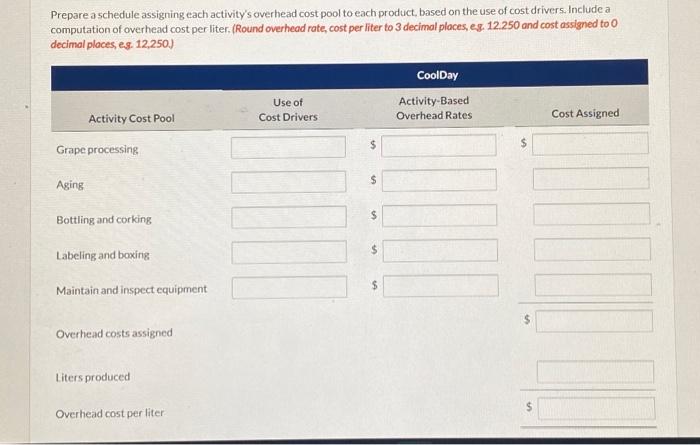

Sheridan Corporation produces two grades of non-alcoholic wine from grapes that it buys from California growers. It produces and sells roughly 3,000,000 liters per year of a low cost, high-volume product called CoolDay. It sells this in 600,0005 -liter jug5. Sheridan also produces and sells roughly 300,000 liters per year of a low-volume, high-cost product called LiteMist. LiteMist is sold in 1 -liter bottles. Based on recent data, the CoolDay product has not been as profitable as LiteMist. Management is considering dropping the inexpensive CoolDay line so it can focus more attention on the LiteMist product. The LiteMist product already demands considerably more attention than the CoolDay line. Jack Eller. president and founder of Sheridan, is skeptical about this idea. He points out that for many decades the company produced only the CoolDay line and that it was always quite profitable. It wasn't until the company started producing the more complicated LiteMist wine that the profitability of CoolDay declined. Prior to the introduction of LiteMist, the company had basic equipment. simple growing and production procedures, and virtually no need for quality control. Because LiteMist is bottled in 1 -liter bottles, it requires considerably more time and effort, both to bottle and to label and box than does CoolDay. The company must bottle and handle 5 times as many bottles of LiteMist to sell the same quantity as CoolDay. CoolDay requires 1 month of aging: LiteMist requires 1 year. CoolDay requires cleaning and inspection of equipment every 10,000 liters; LiteMist requires such maintenance every 600 liters. Jack has asked the accounting department to prepare an analysis of the cost per liter using the traditional costing approach and using activity-based costing. The following information was collected. Answer each of the following questions. Prepare a schedule assigning each activity's overhead cost pool to each product, based on the use of cost drivers. Include a computation of overhead cost per liter. (Round overhead rate, cost per liter to 3 decimal ploces, es. 12.250 and cost assigned to 0 decimal places, es. 12,250.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started