Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help, show workings please Pharoah Inc. has 1.05 million common shares outstanding as at January 1,2020 . On June 30,2020,4% convertible bonds were converted

please help, show workings please

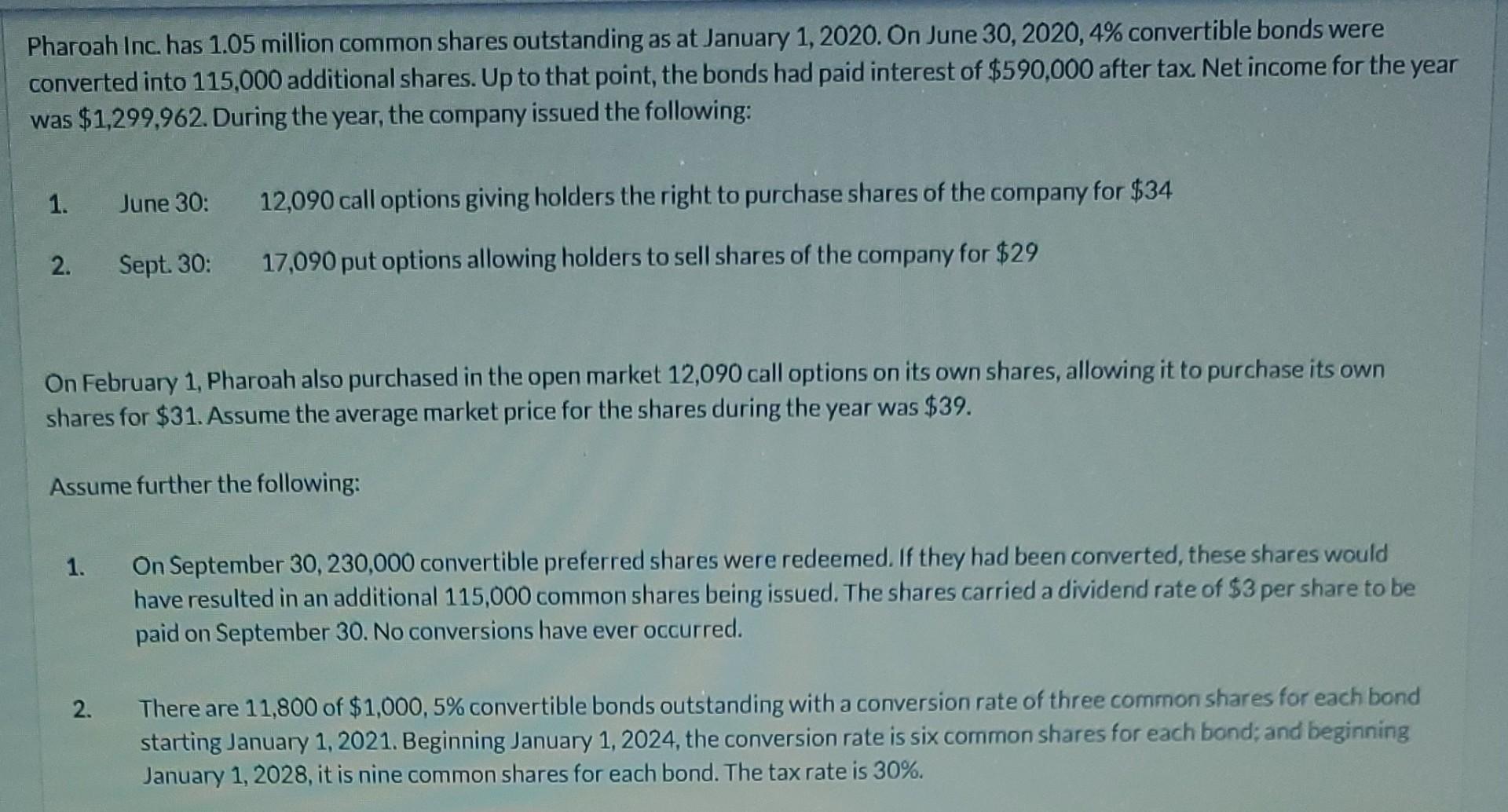

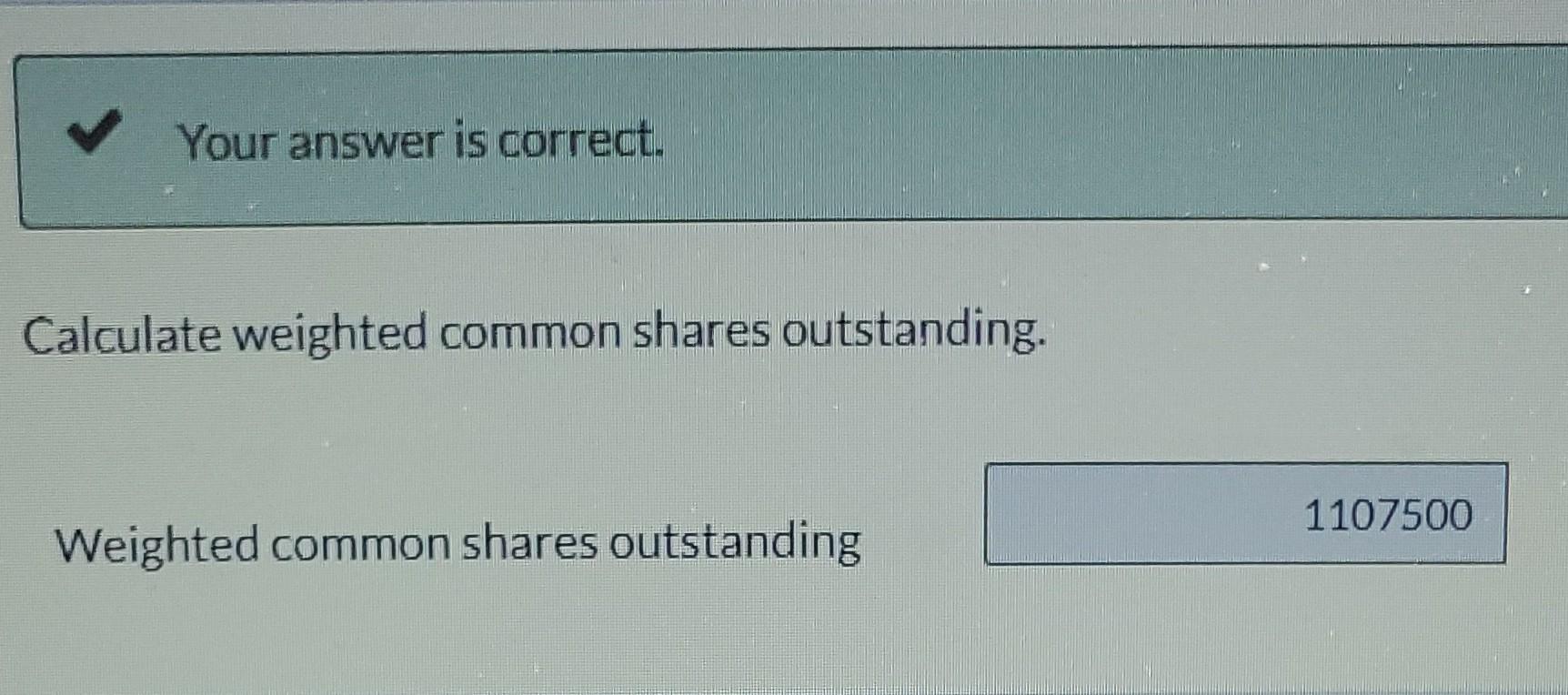

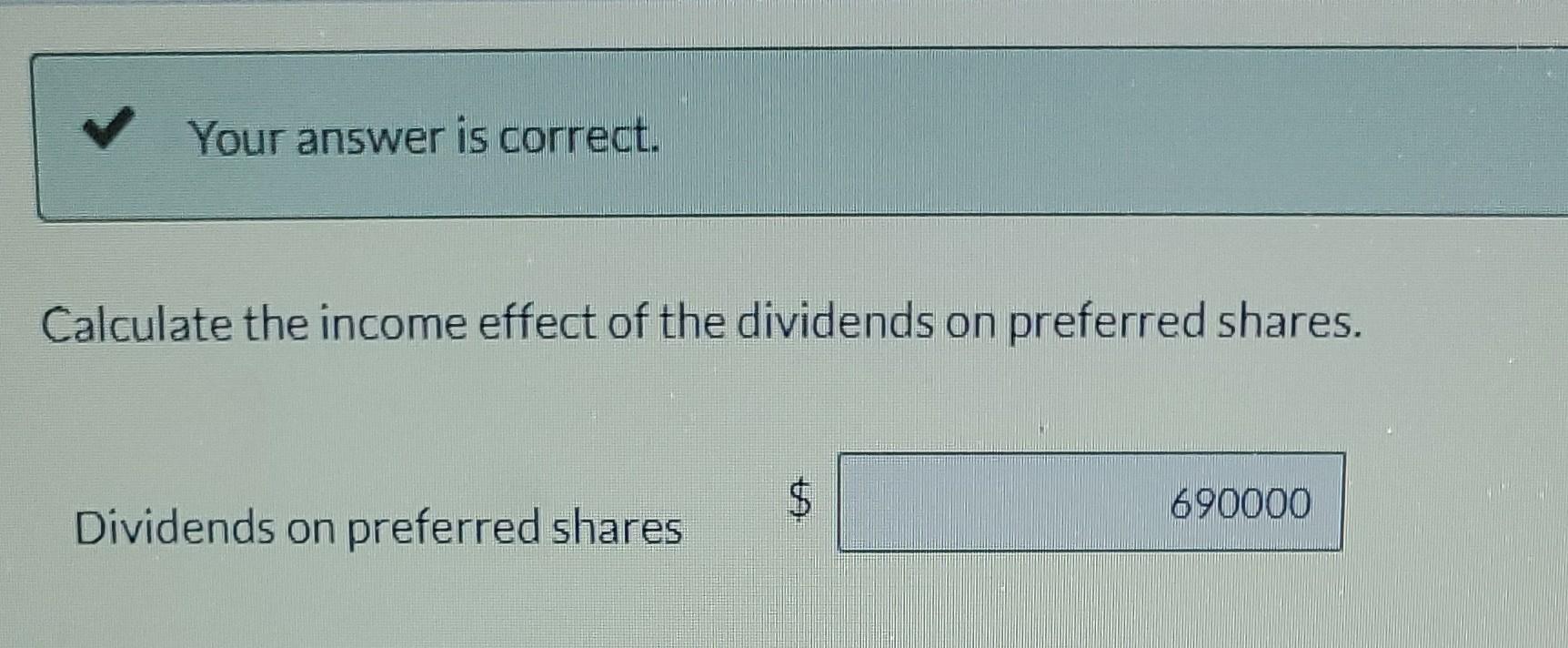

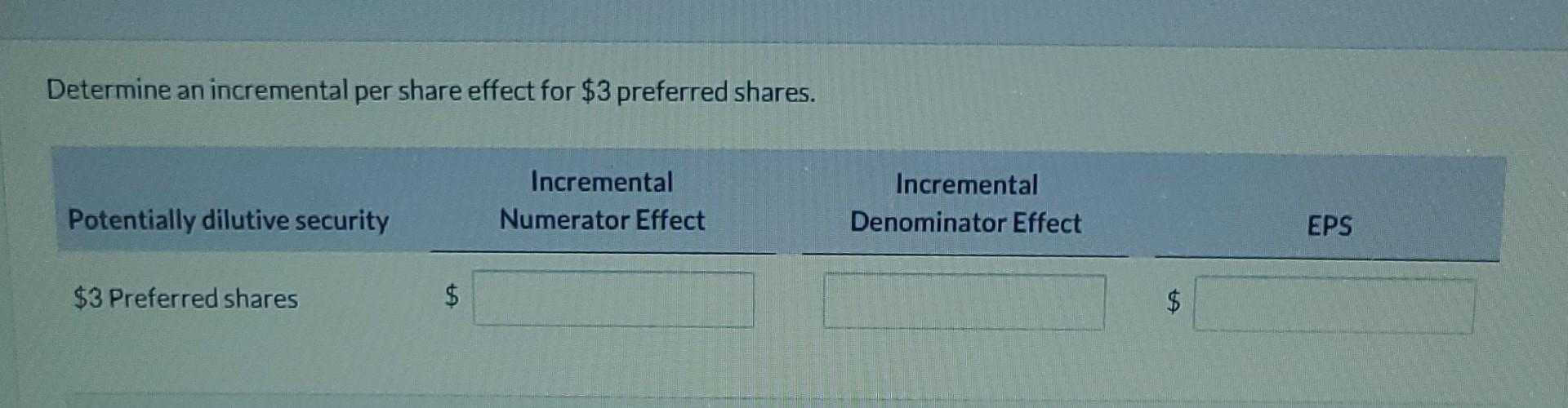

Pharoah Inc. has 1.05 million common shares outstanding as at January 1,2020 . On June 30,2020,4% convertible bonds were converted into 115,000 additional shares. Up to that point, the bonds had paid interest of $590,000 after tax. Net income for the year was $1,299,962. During the year, the company issued the following: 1. June 30: 12,090 call options giving holders the right to purchase shares of the company for $34 2. Sept 30: 17,090 put options allowing holders to sell shares of the company for $29 On February 1, Pharoah also purchased in the open market 12,090 call options on its own shares, allowing it to purchase its own shares for $31. Assume the average market price for the shares during the year was $39. Assume further the following: 1. On September 30,230,000 convertible preferred shares were redeemed. If they had been converted, these shares would have resulted in an additional 115,000 common shares being issued. The shares carried a dividend rate of $3 per share to be paid on September 30. No conversions have ever occurred. 2. There are 11,800 of $1,000,5% convertible bonds outstanding with a conversion rate of three common shares for each bond starting January 1, 2021. Beginning January 1, 2024, the conversion rate is six common shares for each bond; and beginning January 1,2028 , it is nine common shares for each bond. The tax rate is 30%. Your answer is correct. Calculate weighted common shares outstanding. Weighted common shares outstanding Your answer is correct. Calculate the income effect of the dividends on preferred shares. Dividends on preferred shares $ Your answer is correct. Calculate the basic earnings per share under IFRS. For simplicity, ignor being a hybrid security. (Round answer to 2 decimal places, e.g. 15.25.) Determine an incremental per share effect for $3 preferred sharesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started