Answered step by step

Verified Expert Solution

Question

1 Approved Answer

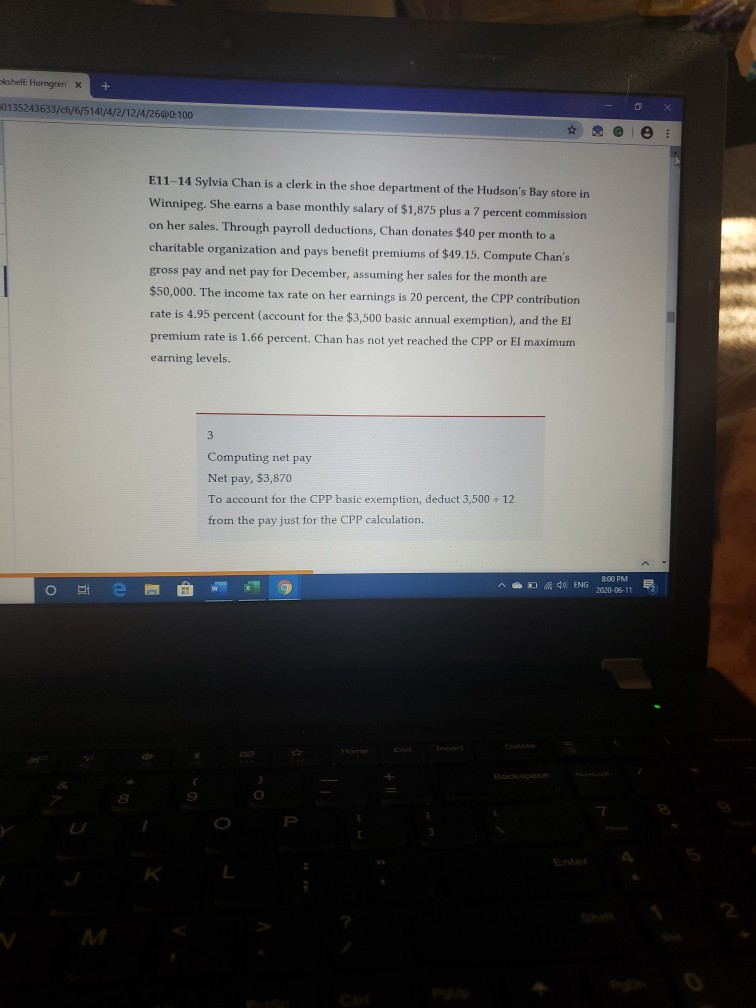

please help Sleshell Horngren X 20135243633/cf/6/514/4/2/12/4/26@0:100 E11-14 Sylvia Chan is a clerk in the shoe department of the Hudson's Bay store in Winnipeg. She earns

please help

Sleshell Horngren X 20135243633/cf/6/514/4/2/12/4/26@0:100 E11-14 Sylvia Chan is a clerk in the shoe department of the Hudson's Bay store in Winnipeg. She earns a base monthly salary of $1,875 plus a 7 percent commission on her sales. Through payroll deductions, Chan donates $40 per month to a charitable organization and pays benefit premiums of $49.15. Compute Chan's gross pay and net pay for December, assuming her sales for the month are $50,000. The income tax rate on her earnings is 20 percent, the CPP contribution rate is 4.95 percent (account for the $3,500 basic annual exemption), and the EI premium rate is 1.66 percent. Chan has not yet reached the CPP or El maximum earning levels. 3 Computing net pay Net pay, $3,870 To account for the CPP basic exemption, deduct 3,500 - 12 from the pay just for the CPP calculation. 8:00 PM A ENG 2020-06-11 O E Sleshell Horngren X 20135243633/cf/6/514/4/2/12/4/26@0:100 E11-14 Sylvia Chan is a clerk in the shoe department of the Hudson's Bay store in Winnipeg. She earns a base monthly salary of $1,875 plus a 7 percent commission on her sales. Through payroll deductions, Chan donates $40 per month to a charitable organization and pays benefit premiums of $49.15. Compute Chan's gross pay and net pay for December, assuming her sales for the month are $50,000. The income tax rate on her earnings is 20 percent, the CPP contribution rate is 4.95 percent (account for the $3,500 basic annual exemption), and the EI premium rate is 1.66 percent. Chan has not yet reached the CPP or El maximum earning levels. 3 Computing net pay Net pay, $3,870 To account for the CPP basic exemption, deduct 3,500 - 12 from the pay just for the CPP calculation. 8:00 PM A ENG 2020-06-11 O EStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started