please help, solve a,b,c,d,e,f thank you so much in advance

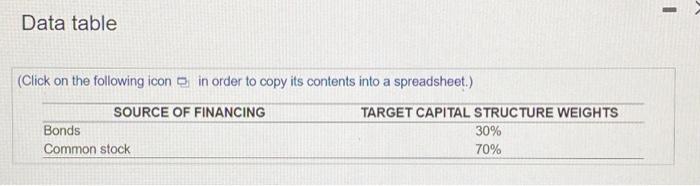

Nealon Energy Corporation engages in the accuisition, exploration, development, and production of natural gas and oil in the continental United States. The company has grown rapidly over the last 5 years as it has expanded into horizontal drilling techniques for the development of the massive deposits of both gas and oil in shale formations. The company's operabons in the Haynesville shale (located in northwost Louisiana) have been so significant that it noeds to construct a natural gas gathering and processing center near Bossier City, Louisiana, at an estimated cost of $80milion. To finance the new lacility, Nealon has $30 million in profits that it will use to finance a portion of the oxpansion and plans to sell a bond issue to raise the remaining $50 milion. The decision to use so much debt financing for the project was largely due to the argument by company CEO Douglas Nealon Sr. that debt financing is relatively cheap relative to cornmon stock (which the firm has used in the past). Company CFO Doug Nealon ir. (son of the company founder) did not object to the decision to use ali debt but pondered the issue of what cost of capital to use for the expansion project. There was no doubt that the out-of-pocket cost of financing was equal to the new interest that must be paid on the debt. However, the CFO also knew that by using debt for this project the firm would eventually have to use equity in the future if it wanted to maintain the balance of debt and equity it had in its capital structure and not become overly dependent on borrowed funds. The following baiance sheet. IH, reflects the mix of capital sources that Noalon has used in the past. Although the percentages would vary over time, the firm tended to manage its capital structure back toward these proportions. The firm currently has one issue of bonds outstanding. The bonds have a par value of $1,000 per bond, carry a coupon rate of 11 porcent, have 5 years to matunty, and are soling for $1,030. Nealon's common slock has a current market price of $31, and the fim paid a $2.60 dividend last yoar that is oxpocted lo increase at an annual rale of 4 percent for the foreseeable future a. What is the yieid to maturity for Noalon's bonds under current market conditions? b. What is the cost of new debt financing to Nealon based on current market prices after both taxes (you may use a marginal tax rate of 23 percent for your estimate) and flotation costs of $45 per bond have been considered? a. What is the yield to maturity for Nealon's bonds under current markel conditions? b. What is the cost of new debt financing to Nealon based on current market prices after both taxes (you may use a marginal tax rate of 23 percent for your estimate) and fotation costs of $45 per bond have been considered? Note: Use N=5 for the number of years until the new bond matures. c. What is the investor's requited rate of roturn for Nealon's common stock? if Nealon were to sell new shares of common stock, it would incur a cost of $3.50 per share. What is your estimate of the cost of new equity financing raised frorn the sale of common stock? d. Compute the woightod average cost of capial for Nealon's investment using the weights rofected in the actual financing max (that is, $30 million in retained earnings and 550 milion in bonds) e. Compute the weighted average cost of capital for Nealon where the firm maintains its target capital structure by reducing its debt offering to 30 percent of the s80 million in now capital, or $24 million, using $20 milion in retained earnings and raising $36 millon through a new equity olloring f. If you were the CFO for the company, would you prefer to use the calculation of the cost of capital in part d or e to evaluale the new project? Why? Data table (Click on the following icon in order to copy its contents into a spreadsheet.)