Answered step by step

Verified Expert Solution

Question

1 Approved Answer

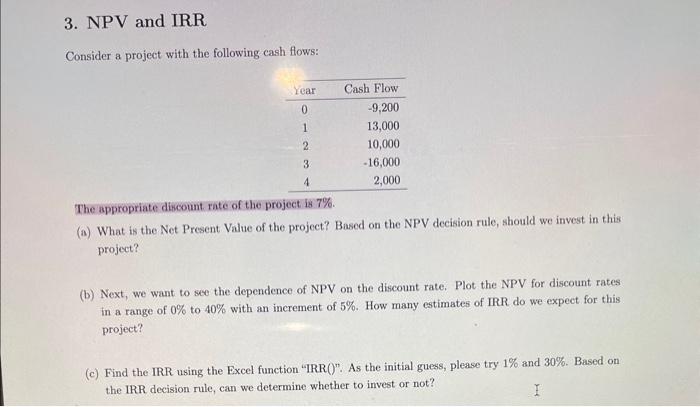

please help solve all parts! 3. NPV and IRR Consider a project with the following cash flows: The sppropriate discount rate of the project is

please help solve all parts!

3. NPV and IRR Consider a project with the following cash flows: The sppropriate discount rate of the project is 7%. (a) What is the Net Present Value of the project? Based on the NPV decision rule, should we invest in this project? (b) Next, we want to see the dependence of NPV on the discount rate. Plot the NPV for discount rates in a range of 0% to 40% with an increment of 5%. How many estimates of IRR do we expect for this project? (c) Find the IRR using the Excel function "IRR()". As the initial guess, please try 1% and 30%. Based on the IRR decision rule, can we determine whether to invest or not

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started