Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help solve all requirements Solve various time value of monay scenarios. (Cick the icon to view the soenarios) (Click the icon to viow the

Please help solve all requirements

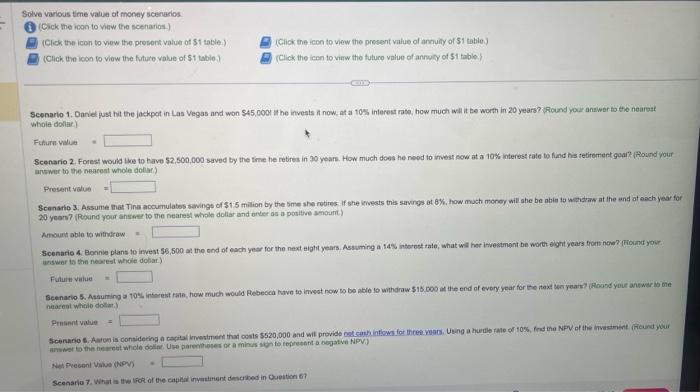

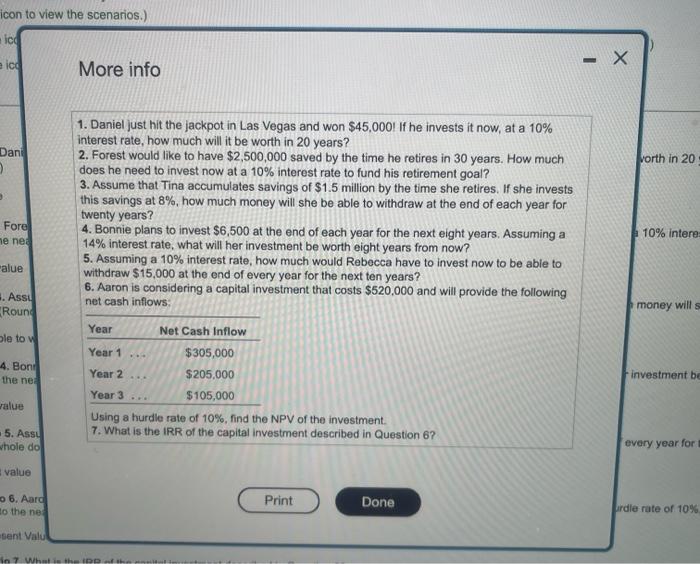

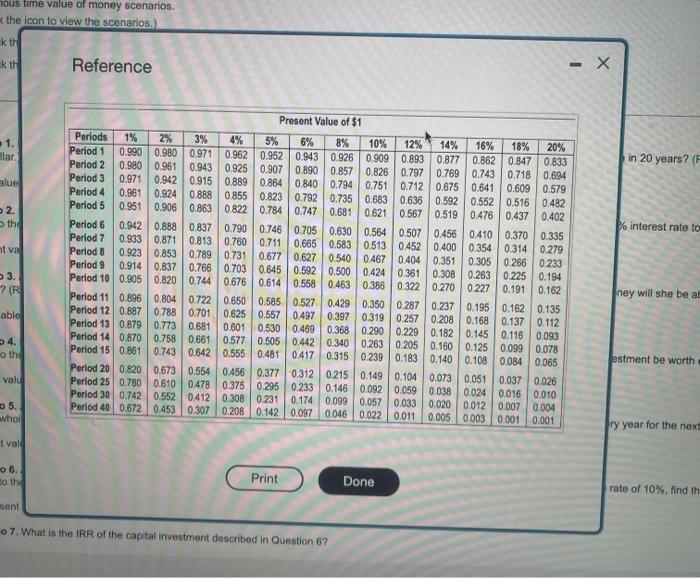

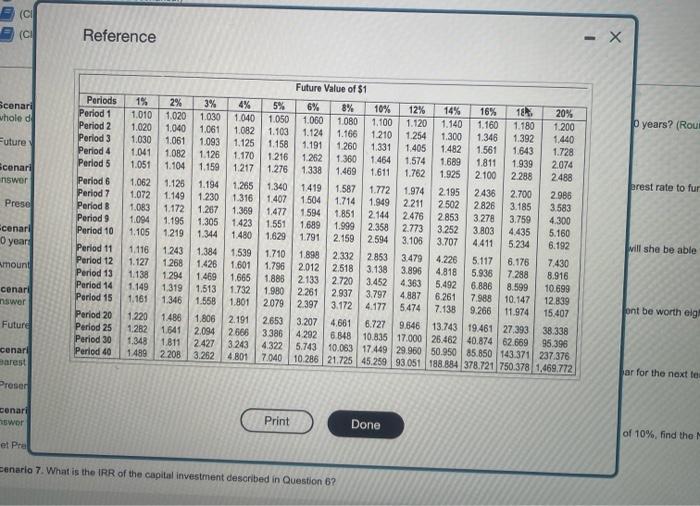

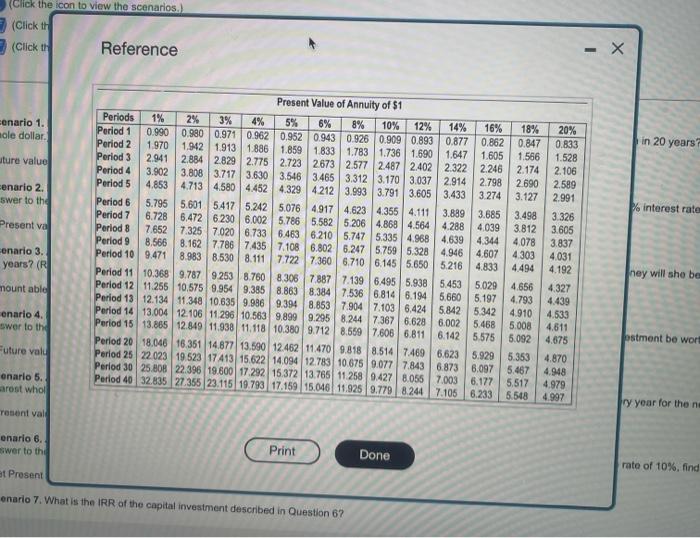

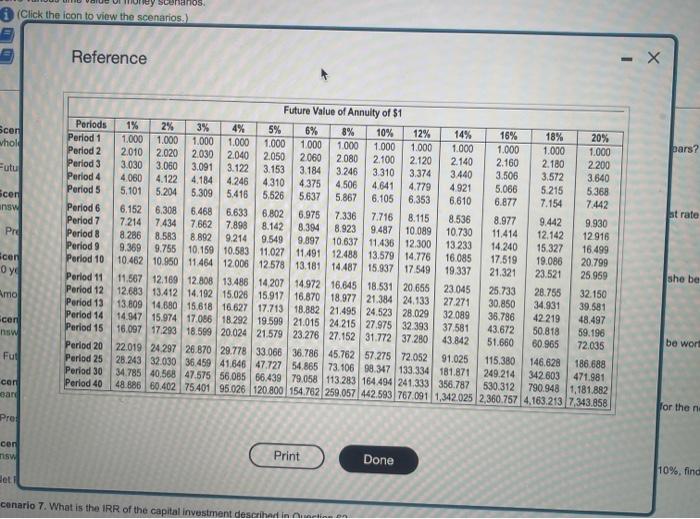

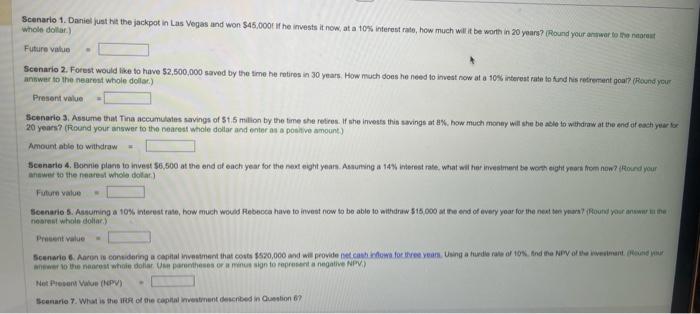

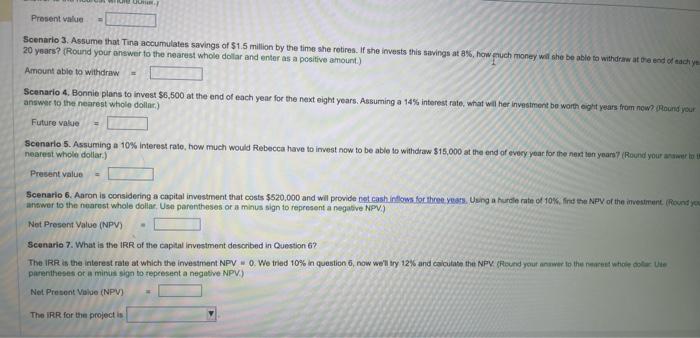

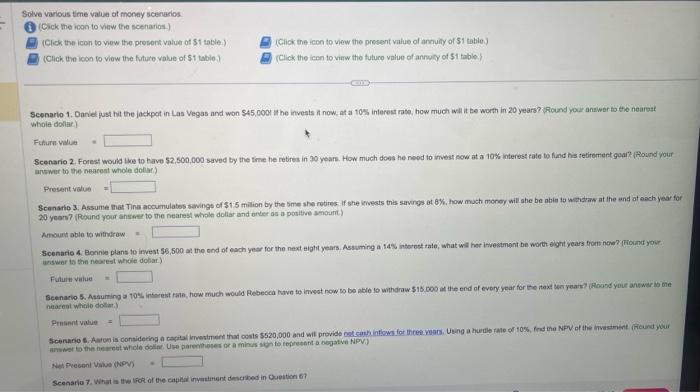

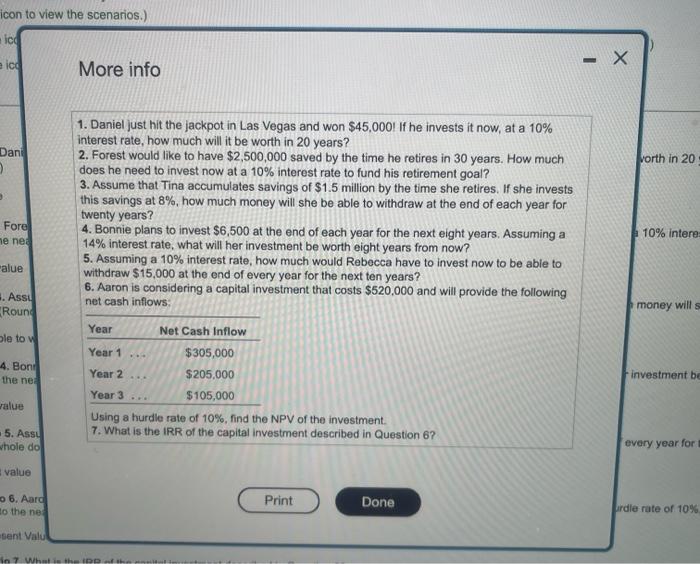

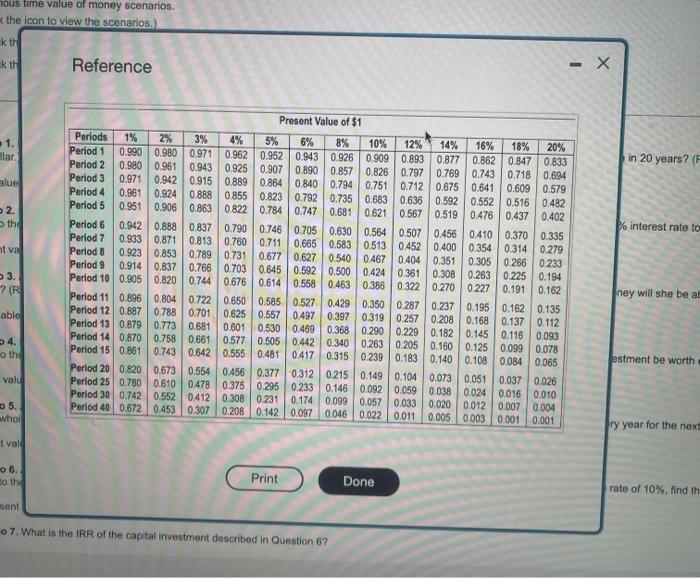

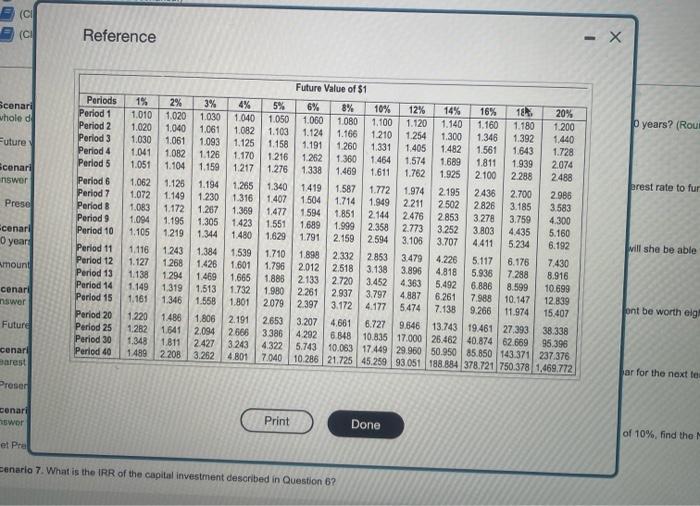

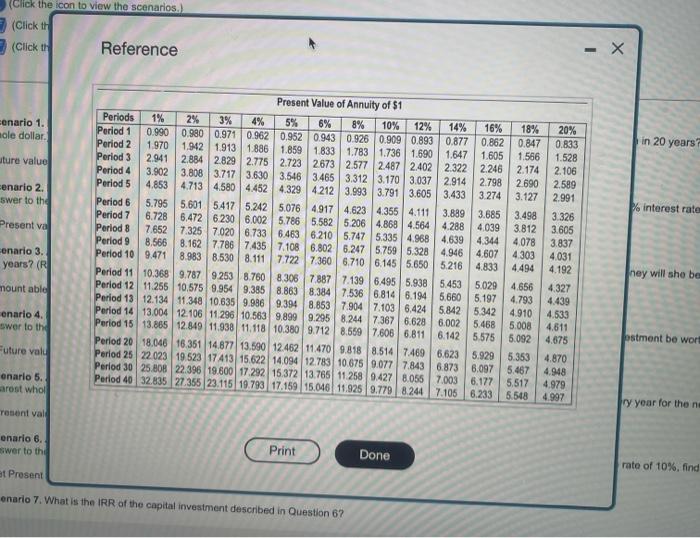

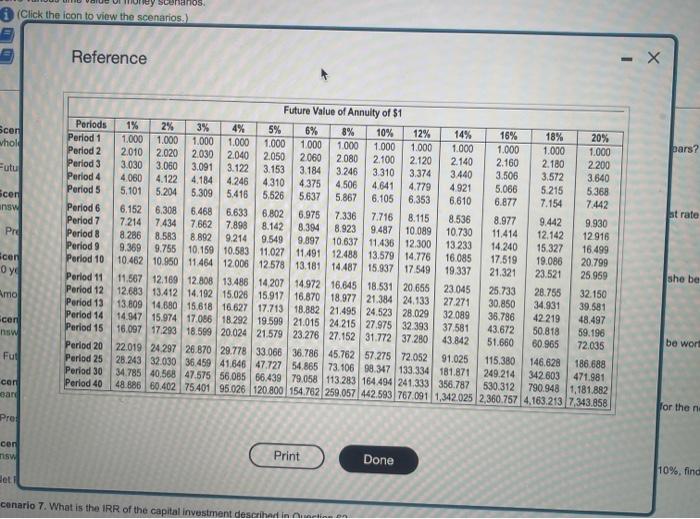

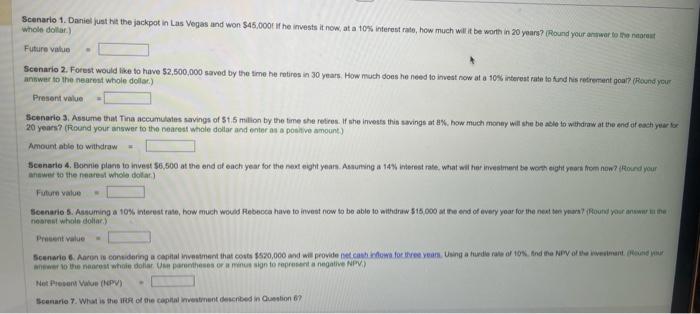

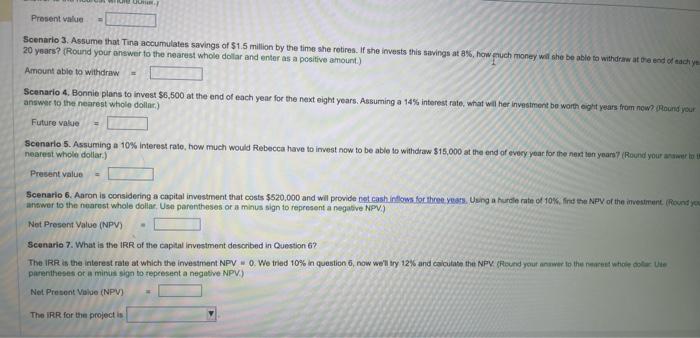

Solve various time value of monay scenarios. (Cick the icon to view the soenarios) (Click the icon to viow the present value of 51 table). (Click the icon to view the present value of anmulfy of $1 table.] (Click the icon to viow the future value of $1 table] (Click the icon to view the future value of annwcy of $1 table.) Scenario 1. Daniet pust bit the jackpot in Las Vegas and won $45,000 it he invests i now, at a 10 , inlerest rate, how much will it be worth in 20 years? 4 Round your answer to the neareat whiche dollar Futhure vidie Scenario 2. Forest would the to have 52,500,000 saved by the time he retires in 30 yearn. How much does he nood to imves now at a 10% interest fate to find his tefirement goar? (ilound your arswer to the neacest whole dolar.) Scenario 3. Assume that Tha accumulates savinge of 31.5 milion by the ime she rotires if she imests this savngs ot 8%, how much money wil she be abie to withatas at the end of each year for 20 years? (Round your anseer to the nearest whole dollar and onter as a potitive anourt) Amount able to withiraw = scenario 4. Bonnie plans to divest 35,50 unswar is the nearest whole dolar) Fuluit value = Scenario s. Aasuming a nearect whithe dotart) Prnsent value = Scenario 7. What is the lfor of the caphid inyetimient descokod in Queviton 6? More info 1. Daniel just hit the jackpot in Las Vegas and won $45,000 I If he invests it now, at a 10% interest rate, how much will it be worth in 20 years? 2. Forest would like to have $2,500,000 saved by the time he retires in 30 years. How much does he need to invest now at a 10% interest rate to fund his retirement goal? 3. Assume that Tina accumulates savings of $1.5 million by the time she retires. If she invests this savings at 8%, how much money will she be able to withdraw at the end of each year for twenty years? 4. Bonnie plans to invest $6,500 at the end of each year for the next eight years. Assuming a 14% interest rate, what will her investment be worth eight years from now? 5. Assuming a 10% interest rate, how much would Rebecca have to invest now to be able to withdraw $15,000 at the end of every year for the next ten years? 6. Aaron is considering a capital investment that costs $520,000 and will provide the following net cash inflows: Using a hurdle rate of 10%, find the NPV of the investment. 7. What is the IRR of the capital investment described in Question 6? Reference in 20 years? % interest rate to ney will she be at sstment be worth ry year for the next rate of 10%, find th Reference (Click the icon to view the scenarios.) (Click th (Click ti- Reference Present Value of Annuity of $1 in 20 years ienario 2. swer to the Present va enario 3. years? (R) nount able enario 4. swer to the "uture valu enario 5. arost whol reseant vale enario 6 . swer to thi Print Done ney will sho be Present ry year for the n enario 7. What is the IRR of the capital investment described in Question 6 ? Reference Scenario 1. Daniel just he the jackpot in Las Wegas and won $45,0000 it he imvests it now, at a 10% interest rate, how much wit it be worth in 20 years? (Round your antwar to Ean naorait whole dollar.) Future value Scenario 2. Forest would like to have 52,500,000 saved by the tme he rotires in 30 years. How much does he need to invest now at a 10 sos intereat rate ta fund his retrement goal? (Racnd ycur answer to the nearmt whole dollac.) Present value 20 years? (Round your answer to the neacest whale dollar and enter as a poeitive amount) Amount able to withuraw = ankwe to the fearest whicle dotar. Future value Seenario 5. Assuming a 10\% interest rabe, how much woubs Rebeoca have to invest now to bo able to withdinw 515 ono at the end of every yoar for the neat ten yeara? iRpund rour answar in ine nosinkt whole doliar.) Prisent value Net fleven Vwice (NoPV) Scenario 7. What is the Ifer of the capiltal mventenent described in Question 6? Scenario 3. Assume that Tina accumulates savings of $1.5 million by the time she rotires. If she imvests this savings at a\%s, how pruch money wil she be ablo to withdrine at ofe ecid of each 20 years? (Round your answer to the nearest whole dollar Bnd enter as a positive amount.) Amount able to withdraw = Scenario 4. Bonnie plans to invest $6,500 at the end of each year for the next eight years. Assuming a 14\% interest rate, what wall her investmont bo worth oight years from now s pound your answer to the nearest whole dollar.) Future value = Scenarlo 5. Assuming a 10% interest rale, how much would Rebecca have to imvest now to be able to withdraw $15,000 at the end of evecy year for the neat len years? (Round your aruinet in nearest whole dollar.) Prevent value = antwer to the noarest whole dollar. Use parentheses or a minus sign to represent a negative NPPV. Not Present Value (NPV) Scenario 7. What is the IRR of the capital investment doscribed in Question 6 ? parentheses of a minus sign to repeesent a negative NPV). Net Presont Vilie (NPV) The IRR for the project is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started