Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help solve blue boxes. All information is given. Help solve using excel. Problem 10-18 Suppose that in July 2013, Nike had sales of $25,313

Please help solve blue boxes. All information is given. Help solve using excel.

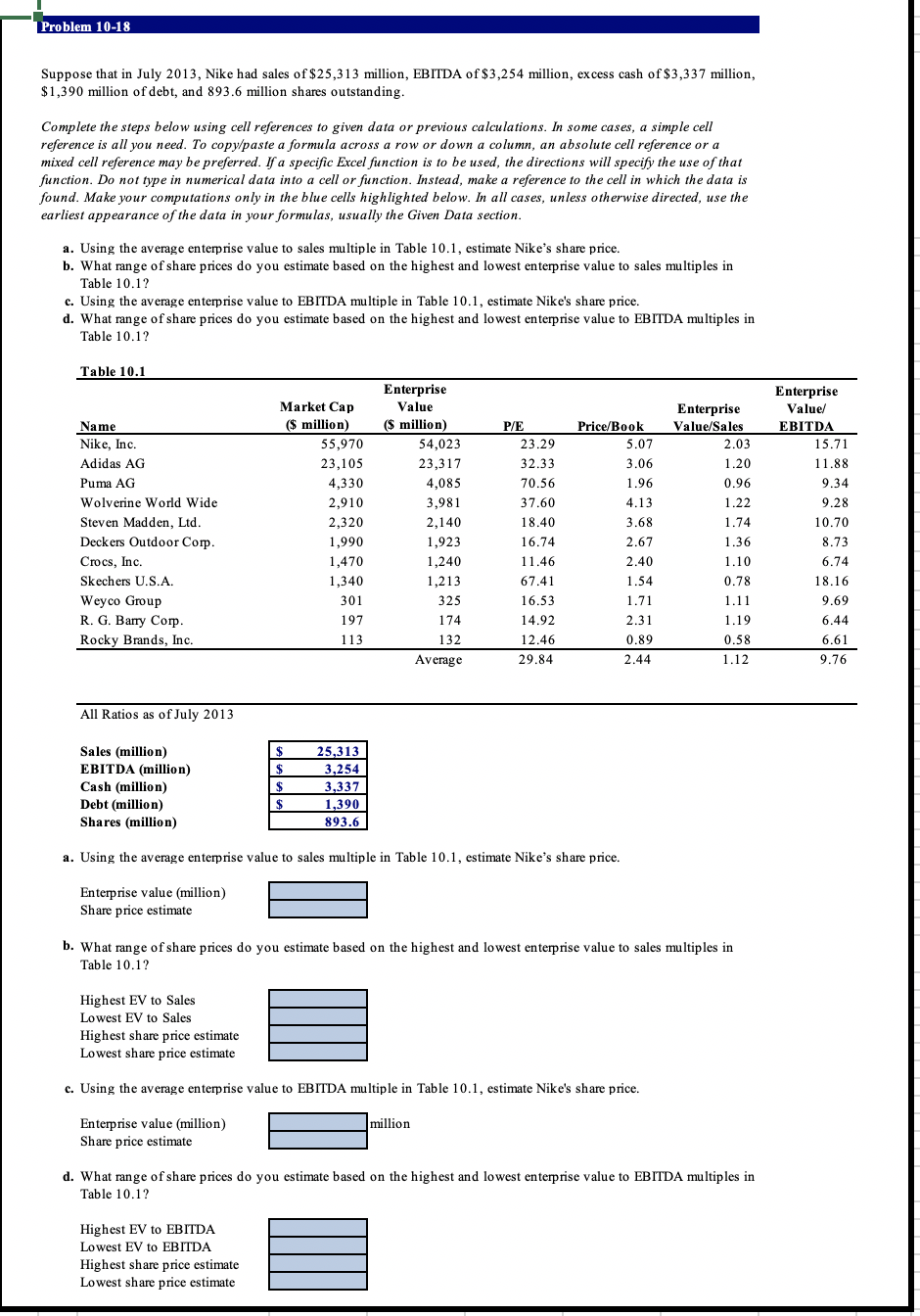

Problem 10-18 Suppose that in July 2013, Nike had sales of $25,313 million, EBITDA of $3,254 million, excess cash of $3,337 million, $1,390 million of debt, and 893.6 million shares outstanding. Complete the steps below using cell references to given data or previous calculations. In some cases, a simple cell reference is all you need. To copy/paste a formula across a row or down a column, an absolute cell reference or a mixed cell reference may be preferred. If a specific Excel function is to be used, the directions will specify the use of that function. Do not type in numerical data into a cell or function. Instead, make a reference to the cell in which the data is found. Make your computations only in the blue cells highlighted below. In all cases, unless otherwise directed, use the earliest appearance of the data in your formulas, usually the Given a. Using the average enterprise value to sales multiple in Table 10.1, estimate Nike's share price. b. What range of share prices do you estimate based on the highest and lowest enterprise value to sales multiples in Table 10.12 c. Using the average enterprise value to EBITDA multiple in Table 10.1, estimate Nike's share price. d. What range of share prices do you estimate based on the highest and lowest enterprise value to EBITDA multiples in Table 10.12 Table 10.1 Name Nike, Inc. Adidas AG Puma AG Wolverine World Wide Steven Madden, Ltd. Deckers Outdoor Corp. Crocs, Inc. Skechers U.S.A. Weyco Group R. G. Barry Corp. Rocky Brands, Inc. Market Cap ($ million) 55,970 23,105 4,330 2,910 2,320 1,990 1,470 1,340 301 197 113 Enterprise Value ($ million) 54,023 23,317 4,085 3,981 2,140 1,923 1,240 1,213 325 174 132 Average P/E 23.29 32.33 70.56 37.60 18.40 16.74 11.46 67.41 16.53 14.92 12.46 29.84 Price/Book 5.07 3.06 1.96 4.13 3.68 2.67 2.40 1.54 1.71 2.31 0.89 2.44 Enterprise Value/Sales 2.03 1.20 0.96 1.22 1.74 1.36 1.10 0.78 1.11 1.19 0.58 1.12 Enterprise Value/ EBITDA 15.71 11.88 9.34 9.28 10.70 8.73 6.74 18.16 9.69 6.44 6.61 9.76 All Ratios as of July 2013 Sales (million) EBITDA (million) Cash (million) Debt (million) Shares (million) 25,313 3,254 3,337 1,390 893.6 a. Using the average enterprise value to sales multiple in Table 10.1, estimate Nike's share price. Enterprise value (million) Share price estimate b. What range of share prices do you estimate based on the highest and lowest enterprise value to sales multiples in Table 10.1? Highest EV to Sales Lowest EV to Sales Highest share price estimate Lowest share price estimate c. Using the average enterprise value to EBITDA multiple in Table 10.1, estimate Nike's share price. million Enterprise value (million) Share price estimate d. What range of share prices do you estimate based on the highest and lowest enterprise value to EBITDA multiples in Table 10.1? Highest EV to EBITDA Lowest EV to EBITDA Highest share price estimate Lowest share price estimateStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started