Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help solve for questions a1 and a2 exactly as the picture is shown. I appreciate your help. Thank you! You have the following information

Please help solve for questions a1 and a2 exactly as the picture is shown. I appreciate your help. Thank you!

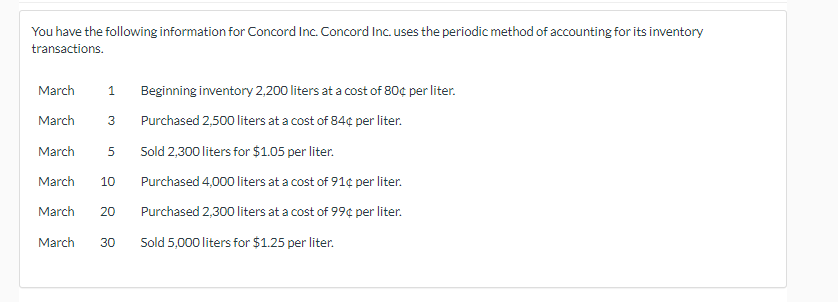

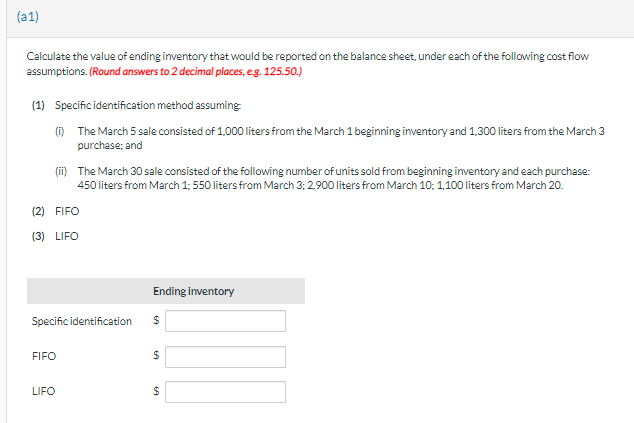

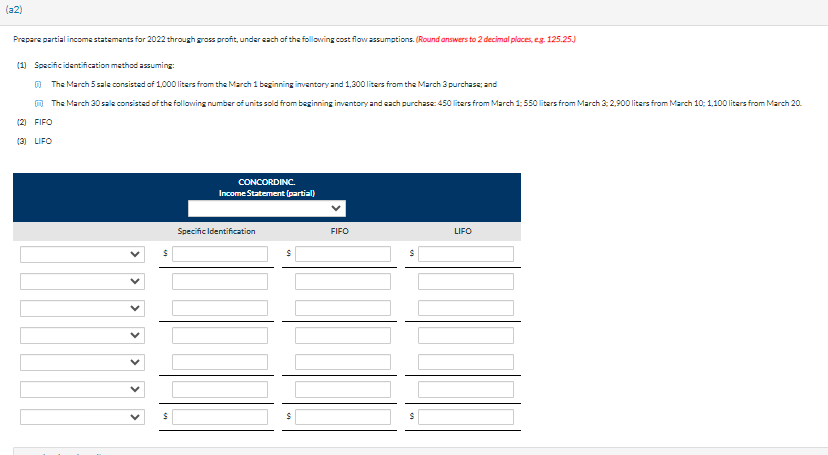

You have the following information for Concord Inc. Concord Inc. uses the periodic method of accounting for its inventory transactions. March 1 Beginning inventory 2,200 liters at a cost of 80% per liter. March 3 Purchased 2,500 liters at a cost of 844 per liter. March 5 Sold 2,300 liters for $1.05 per liter. March 10 Purchased 4,000 liters at a cost of 914 per liter. March 20 Purchased 2,300 liters at a cost of 994 per liter. March 30 Sold 5,000 liters for $1.25 per liter. Calculate the value of ending inventory that would be reported on the balance sheet, under each of the following cost flow assumptions. (Round answers to 2 decimal places, e.g. 125.50.) (1) Specific identification method assuming: (i) The March 5 sale consisted of 1,000 liters from the March 1 beginning inventory and 1,300 liters from the March 3 purchase; and (ii) The March 30 sale consisted of the following number of units sold from beginning imventory and each purchase: 450 liters from March 1; 550 liters from March 3; 2,900 liters from March 10; 1,100 liters from March 20. (2) FIFO (3) LIFO Prepare partial income statements for 2022 through ross profit, under each of the following cost flow assumptions. (Round answers to 2 decimal places, eg. 125.25 .) (1) Specificidentification method assuminz: (i) The March 5 sale consisted of 1,000 liters from the March 1 beginning inventary and 1,300 liters from the March 3 purchasz; and (2) FIFO (3) LIFOStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started