please help solve similar to this answer online using my question answer

please help solve similar to this answer online using my question answer

-------------------------------------------------------

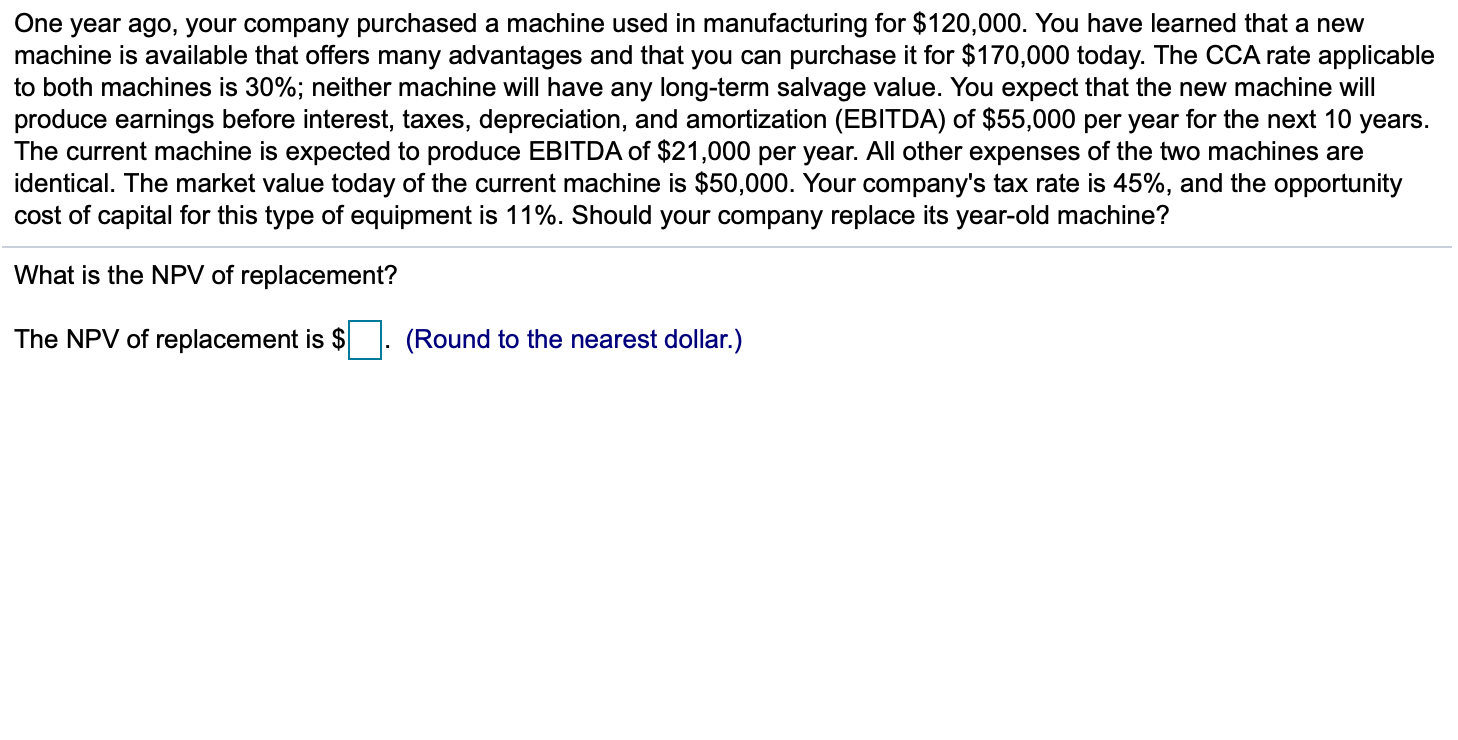

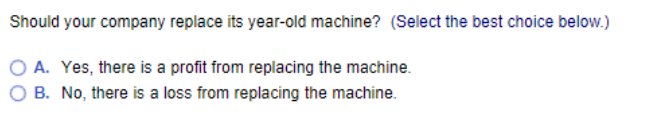

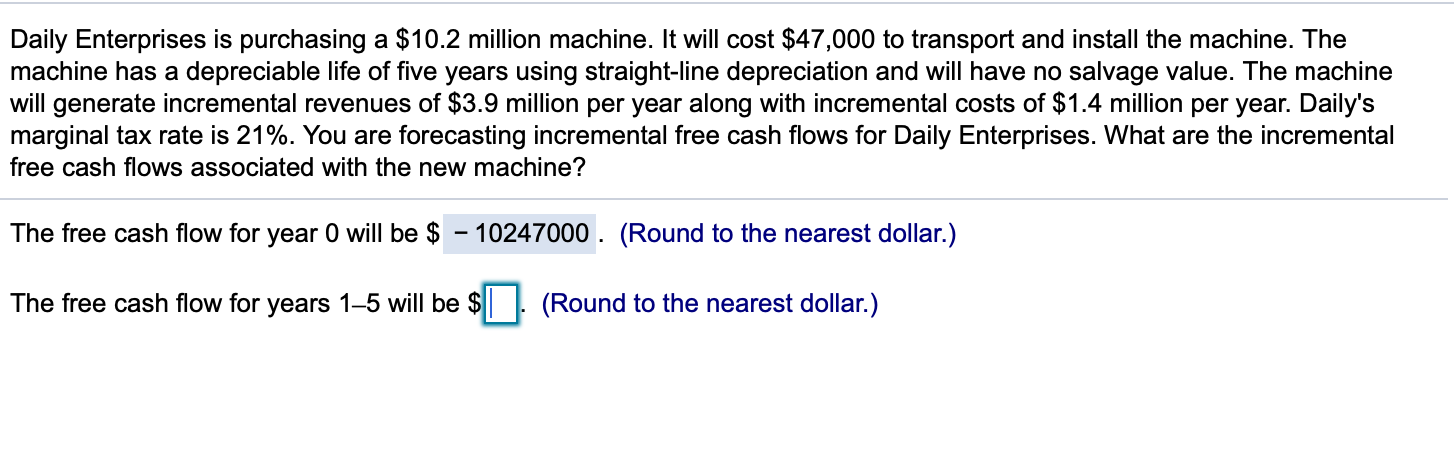

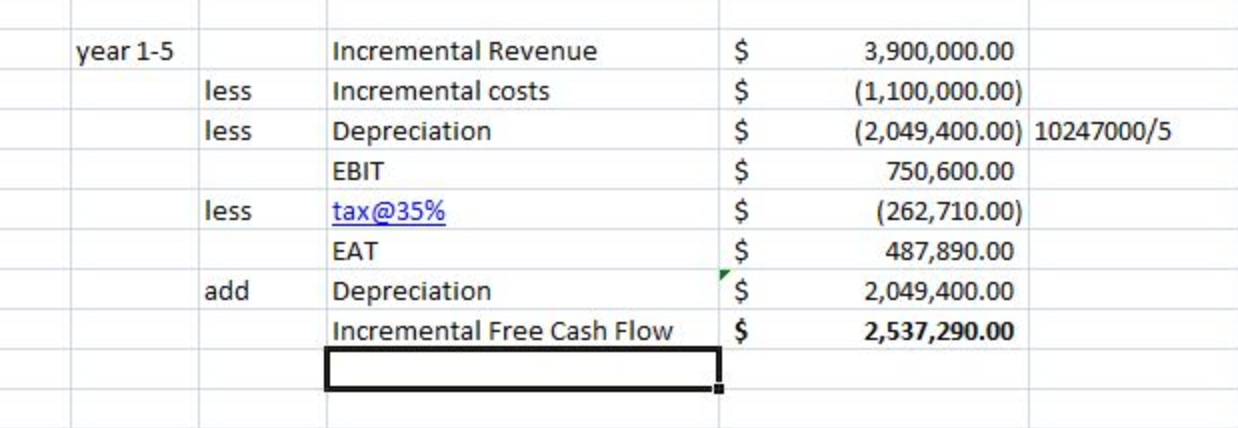

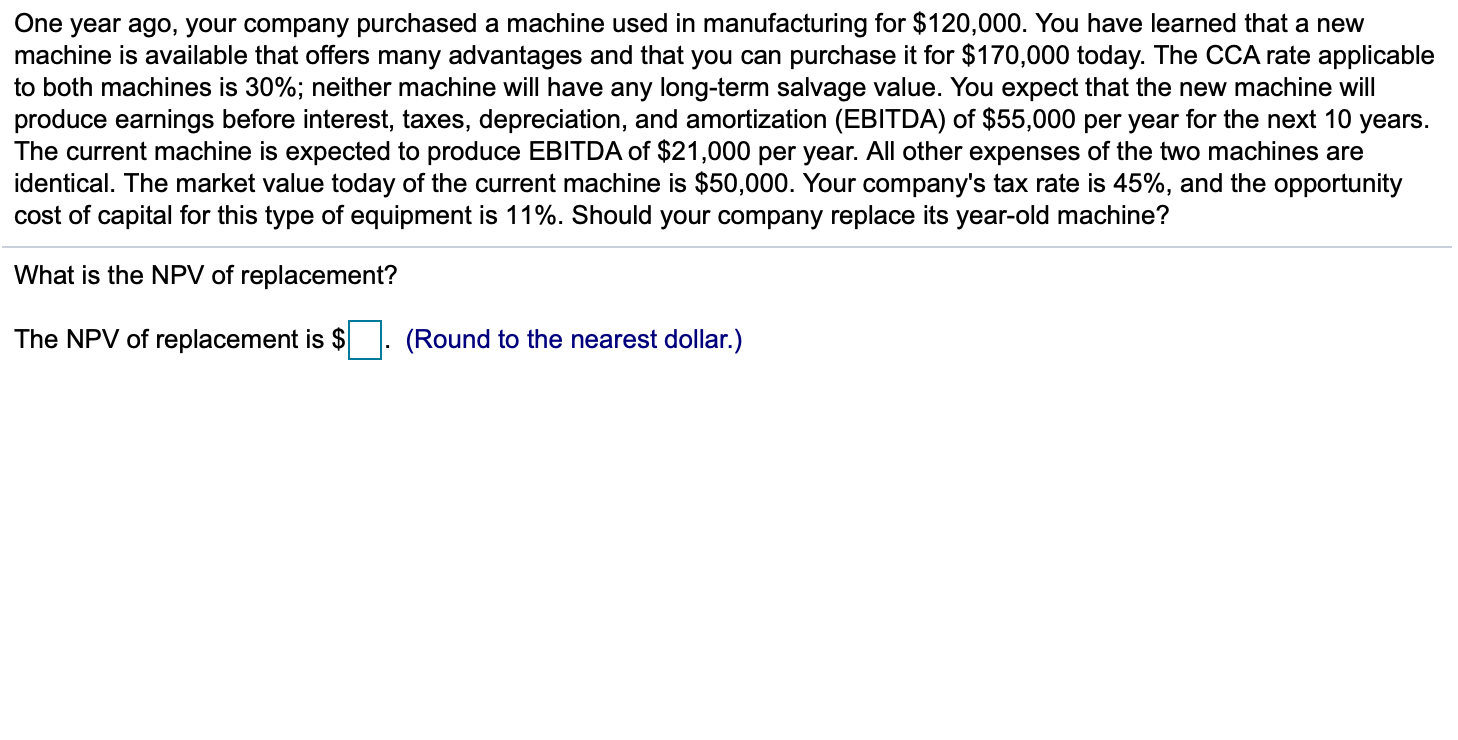

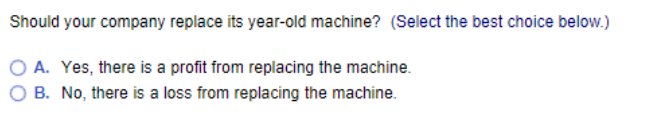

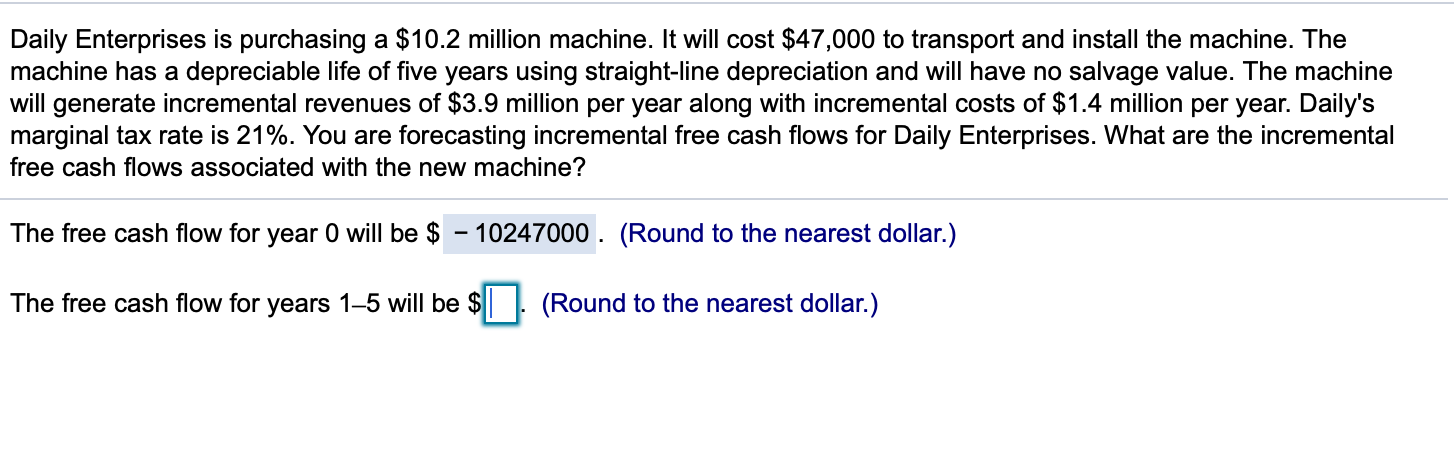

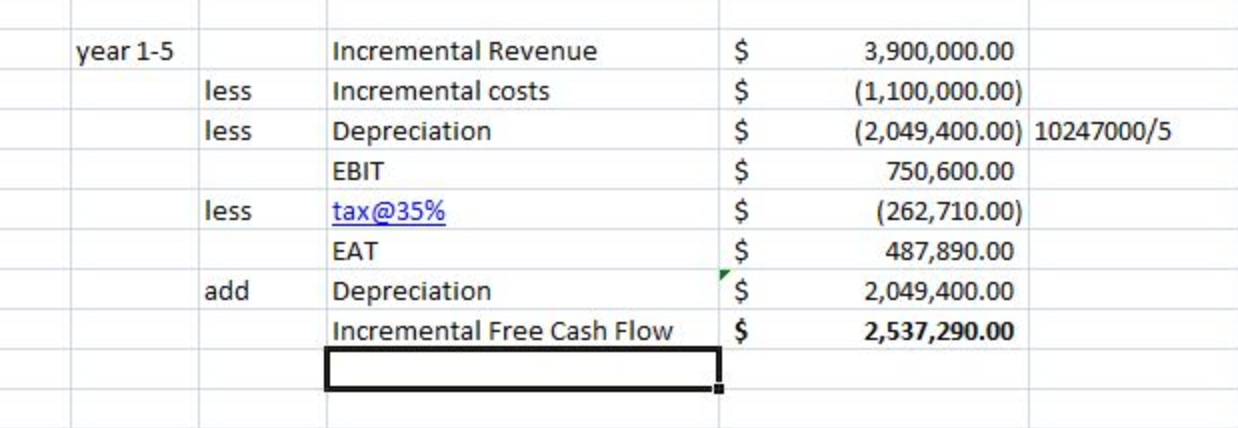

Should your company replace its year-old machine? (Select the best choice below.) O A. Yes, there is a profit from replacing the machine. O B. No, there is a loss from replacing the machine. Daily Enterprises is purchasing a $10.2 million machine. It will cost $47,000 to transport and install the machine. The machine has a depreciable life of five years using straight-line depreciation and will have no salvage value. The machine will generate incremental revenues of $3.9 million per year along with incremental costs of $1.4 million per year. Daily's marginal tax rate is 21%. You are forecasting incremental free cash flows for Daily Enterprises. What are the incremental free cash flows associated with the new machine? The free cash flow for year 0 will be $ - 10247000. (Round to the nearest dollar.) The free cash flow for years 1-5 will be $(Round to the nearest dollar.) year 1-5 Incremental Revenue 3,900,000.00 less Incremental costs less Depreciation EBIT $ $ $ $ $ $ $ $ (1,100,000.00) (2,049,400.00) 10247000/5 750,600.00 (262,710.00) 487,890.00 2,049,400.00 less tax@35% EAT add Depreciation Incremental Free Cash Flow 2,537,290.00 One year ago, your company purchased a machine used in manufacturing for $120,000. You have learned that a new machine is available that offers many advantages and that you can purchase it for $170,000 today. The CCA rate applicable to both machines is 30%; neither machine will have any long-term salvage value. You expect that the new machine will produce earnings before interest, taxes, depreciation, and amortization (EBITDA) of $55,000 per year for the next 10 years. The current machine is expected to produce EBITDA of $21,000 per year. All other expenses of the two machines are identical. The market value today of the current machine is $50,000. Your company's tax rate is 45%, and the opportunity cost of capital for this type of equipment is 11%. Should your company replace its year-old machine? What is the NPV of replacement? The NPV of replacement is $ (Round to the nearest dollar.) Should your company replace its year-old machine? (Select the best choice below.) O A. Yes, there is a profit from replacing the machine. O B. No, there is a loss from replacing the machine. Daily Enterprises is purchasing a $10.2 million machine. It will cost $47,000 to transport and install the machine. The machine has a depreciable life of five years using straight-line depreciation and will have no salvage value. The machine will generate incremental revenues of $3.9 million per year along with incremental costs of $1.4 million per year. Daily's marginal tax rate is 21%. You are forecasting incremental free cash flows for Daily Enterprises. What are the incremental free cash flows associated with the new machine? The free cash flow for year 0 will be $ - 10247000. (Round to the nearest dollar.) The free cash flow for years 1-5 will be $(Round to the nearest dollar.) year 1-5 Incremental Revenue 3,900,000.00 less Incremental costs less Depreciation EBIT $ $ $ $ $ $ $ $ (1,100,000.00) (2,049,400.00) 10247000/5 750,600.00 (262,710.00) 487,890.00 2,049,400.00 less tax@35% EAT add Depreciation Incremental Free Cash Flow 2,537,290.00 One year ago, your company purchased a machine used in manufacturing for $120,000. You have learned that a new machine is available that offers many advantages and that you can purchase it for $170,000 today. The CCA rate applicable to both machines is 30%; neither machine will have any long-term salvage value. You expect that the new machine will produce earnings before interest, taxes, depreciation, and amortization (EBITDA) of $55,000 per year for the next 10 years. The current machine is expected to produce EBITDA of $21,000 per year. All other expenses of the two machines are identical. The market value today of the current machine is $50,000. Your company's tax rate is 45%, and the opportunity cost of capital for this type of equipment is 11%. Should your company replace its year-old machine? What is the NPV of replacement? The NPV of replacement is $ (Round to the nearest dollar.)

please help solve similar to this answer online using my question answer

please help solve similar to this answer online using my question answer