Answered step by step

Verified Expert Solution

Question

1 Approved Answer

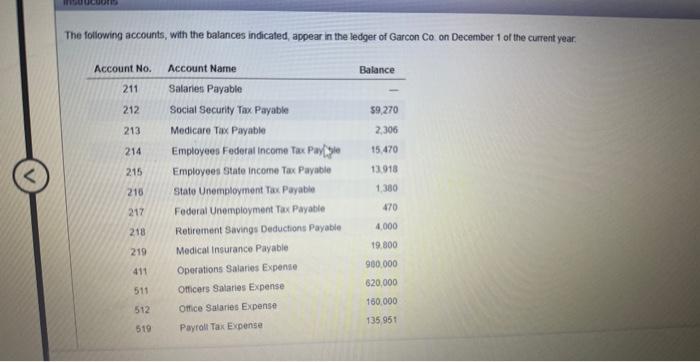

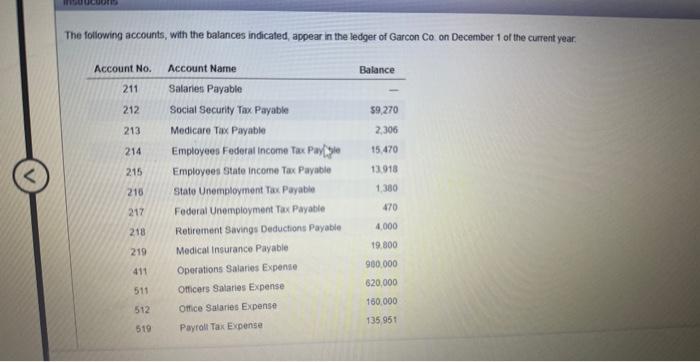

please help solve? The following accounts, with the balances indicated, appear in the ledger of Garcon Co on December 1 of the current year. The

please help solve?

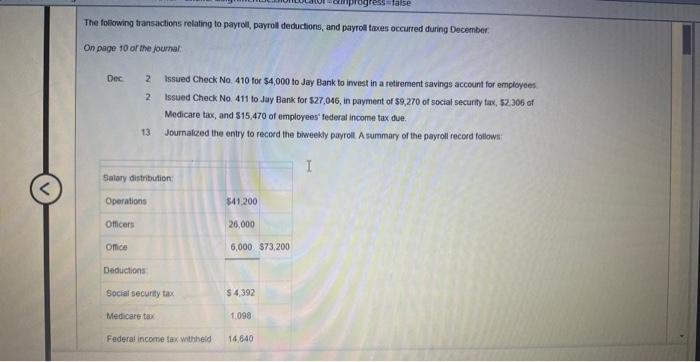

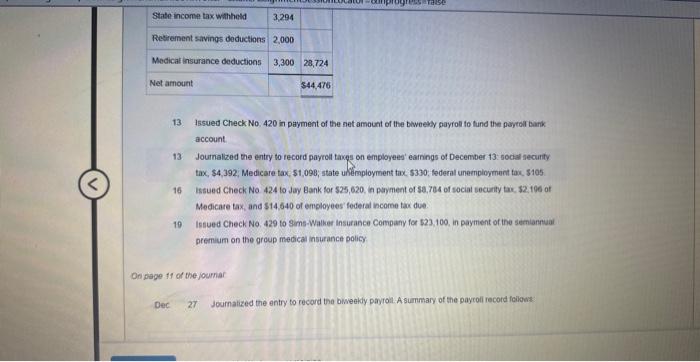

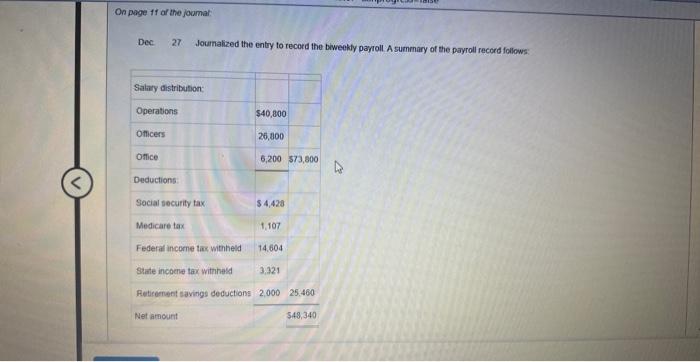

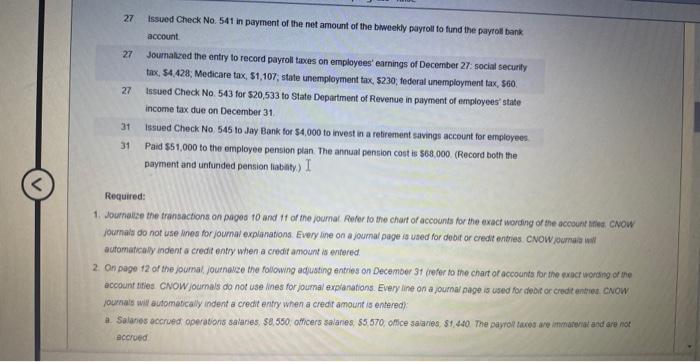

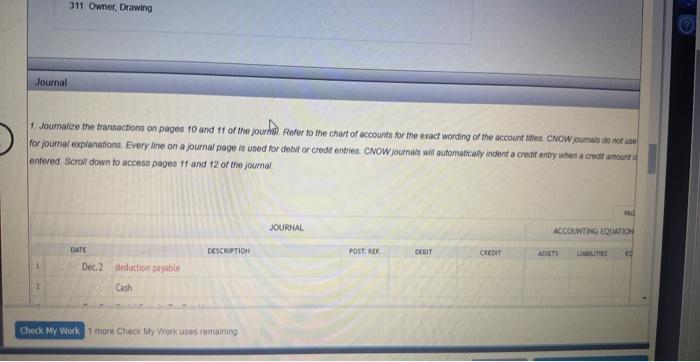

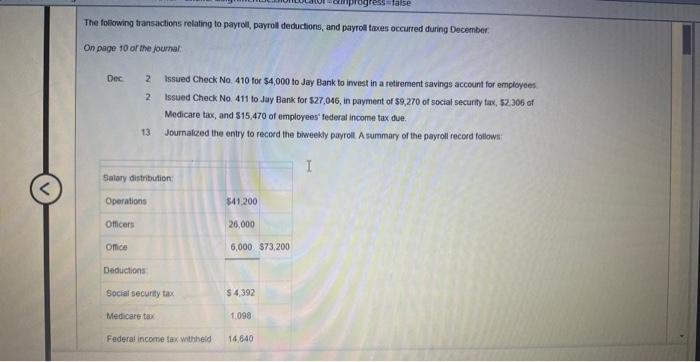

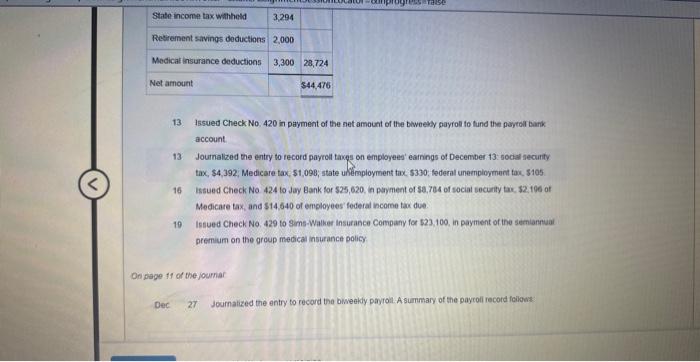

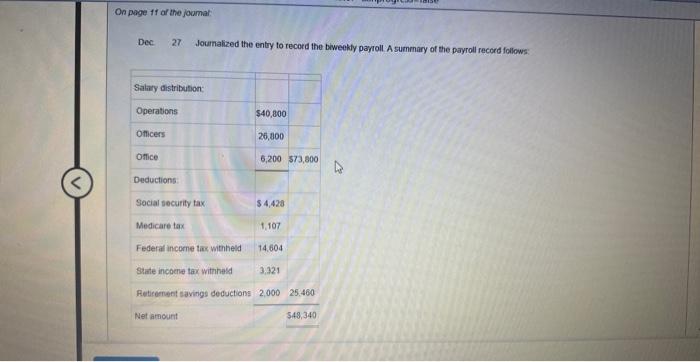

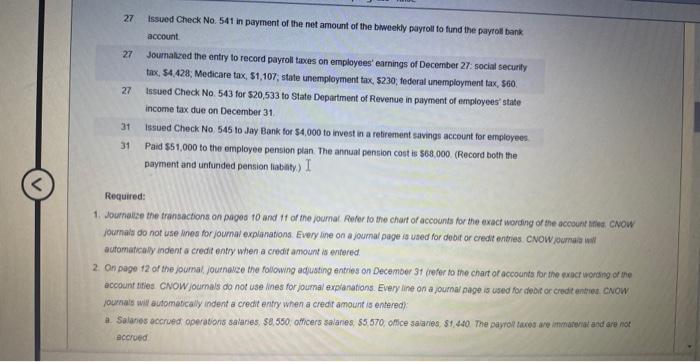

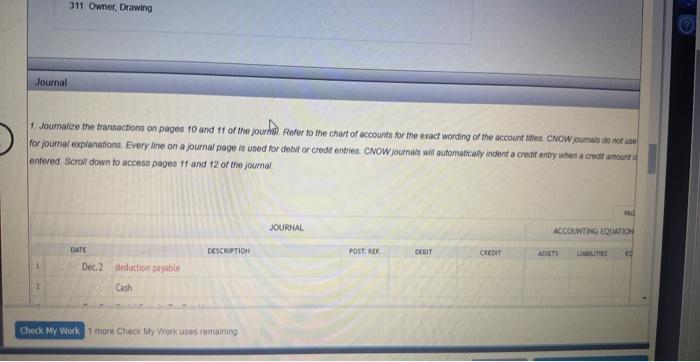

The following accounts, with the balances indicated, appear in the ledger of Garcon Co on December 1 of the current year. The folicwing transactions relating to nayroll, payrol deductions, and payroa taxes occurred during December. On page 10 of the journal: Dec 2. Issued Check No, 410 for $4,000 to Jay Bank to imvest in a retirement savings account for employees 2. Issued Check No. 411 to Jay Bank for $27,046, in payment of $9,270 of soctal secunty tax, 52,306 of Medicare tax, and $15,470 of employees' federal income tax due. 13. Journaleed the entry to recoed the biveekly paryroll A summary of the payroll record fotlows: 13. Issued Check No. 420 in payment of the net amount of the bewnesly payroll fo tund the paytol bark account. 13 Journalized the entry to record payreil taxes on employees' earnings of December 13: sockal secuity tax, \$4, 392, Medicare tax, $1,098; state uniemployment tax, $330, federal unempioyment tax, 3105 16 Issued Check No 424 to Jay Bank for 525,620 , in paryment of 52,784 of social security tax, 32,196 of Medicare tax, and $14,640 of employees federal income tax due. 10 Issued Check No. 429 to Sims-Walker insurance Company for 523,100 , in payment of the semiannual premium on the group medical insurance policy. Dec: 27 Joumalized the entry to record the beweekly payroll A summary of the payroll record follows: 27. Issued Check No. 541 in payment of the net amount of the bhweekty payroll to fund the payroll bank account. 27. Joumalized the entry to record payroll towes on employees' earnings of December 27 social secuily tax,$4,428; Medicare tax, $1,107; state unemployment tax, $230; tederal unemployment tax, $60. 27 Issued Check No. 543 for $20,533 to State Department of Revenue in payment of employees' state income tax due on December 31 . 31 Issued Check No 545 to day Bank for $4,000 to invest in a rehrement savings account for employees. 31 Paid $51,000 to the employee pension plan. The annual pension cost is 568.000. (Record both the payment and unfunded pension liabinty.) I Reguired: 1. Journalie the transactions on pages 10 and 11 of the journat. Fofer to the charf of accounts for the exact wording of the account hiles cNow joumait do not use lines for joumal explanations. Every ine on a joumal page is used for doof or credt entries. cvow oumnar iain autamatically indent a credit entry when a credt amount is entered. 2. On page 12 of the journal, journalze the following aduating entries on December 31 , jefer to the chart of accounts for the exacr worsing or ane account lifies. CNOW joumals do not use ines for joumal expranations. Every ine on a journal page is used for degr or credt enties cNow jounals will automascaly indest a credit entry when a credr amount is entered): Accreed 1. Joumahize the transactions on peges 10 and 11 of the jourher. Refer to the chart of accounts for the exact wording of the account heles CNow foumatr do nat iase for journat expianafions. Every line on a journal page is used for decit or credt entries. CNOWjoumals wo automaticably indent a creot entily when a crect amourt if enfeved Scroll down to access paged 11 and 12 of the joumat 1 more Check My Work uset remaining

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started