Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help solve the percentages aswell as fill in the block of sufficient or insufficient The security market line (SML) is an equation that shows

please help solve the percentages aswell as fill in the block of sufficient or insufficient

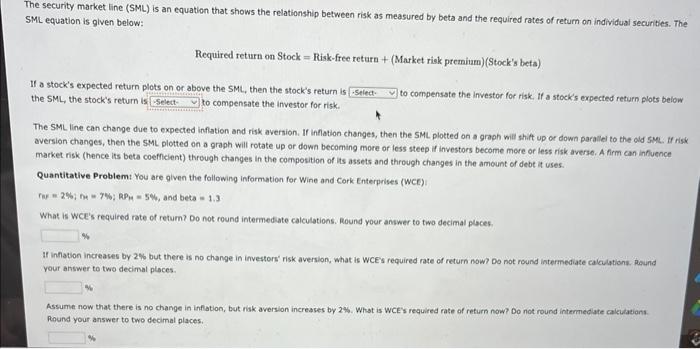

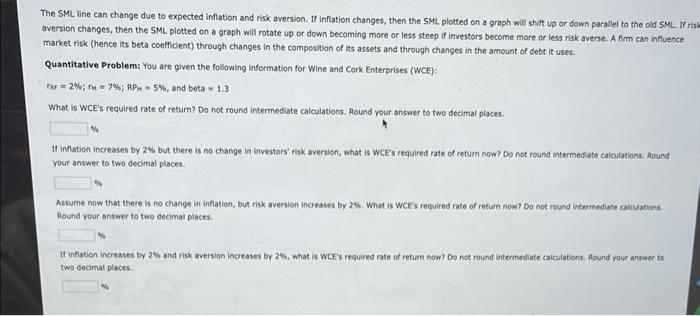

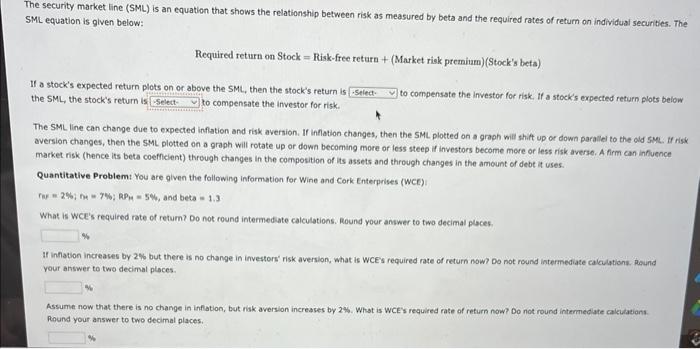

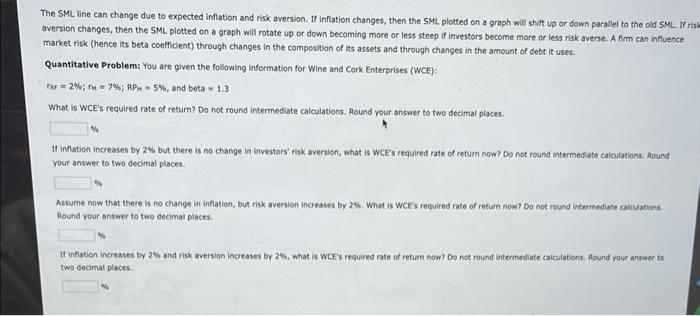

The security market line (SML) is an equation that shows the relationship between risk as measured by beta and the required rates of return on individual securities. The SML equation is glven below: Required return on Stock = Risk-free return + (Market risk premium) ( Stock's beta) If a stock's expected return plots on or above the SML, then the stock's return is to compensate the investor for risk. If a stock's expected return plots below the SML, the stock's retum is to compensate the investor for risk. The SML line can change due to expected inflation and risk aversion. If inflation changes, then the SML. plotted on a graph will shift up or down parallel to the old suL. If risk aversion changes, then the SML plotted on a graph will rotate up or down becoming more or less steep if investors become more or less risk averse. A firm can influence market risk (hence its beta coefficient) through changes in the composition of its assets and through changes in the amount of debt it uses. Quantitative Problem: You are given the following information for Wine and Cork Enterprises (WCE): fN=2%;fe=7%;P14=5%, and beta =1.3. What is WCE's required rate of retum? Do not round intermedate calculations. Round your answer to two decimal places. If infiation increases by 2% but there is no change in investors' risk aversion, what is wces required rate of return now? Do not round intermediate calculations. Round your answer to two decimal places. Assume now that there is no change in inflation, but risk aversion increases by 2%. What is wCE's required rate of return now? Do not round intermeclate cakulations. Round your answer to two decimal places. The SML line can change due to expected inflation and risk aversion. If infiation changes, then the SML plotted on a graph will shit up or down parallel to the old SML. If r aversion changes, then the SML plotted on a graph will rotate up or down becoming more or less steep if investors become more or less risk averse. A firm can influence market risk (hence its beta coefficient) through changes in the composition of its assets and through changes in the amount of debt it uses. Quantitative Problem: You are given the following information for Wine and Cork Enterprises (WCE): rm=2%;rM=7%;RPM=5%,andbeta=1,3 What is WCE's required rate of return? Do not round intermediate calculations. Round your answer to two decimal places. If inflation increases by 2% but there is no change in investors' risk aversion, what is wce's required rate of return now? Do not round intermediate calculations. Round your answer to two decimal places. Assume now that there is no change in infiation, but risk aversion increases by 2W. What is wci's required rate of retura now? Do not round intermediate calculations. Round your answer to two decimal places. If infiation increases by 24 and risk aversion increases by 2%, what is wCE's required rate of return now? Do not round intermediate calculations. lound your anseer to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started