Please help solve this entire question (#1). Thank you.

Please help to solve this question (#1). Will rate thumbs up if correct. Thank you!

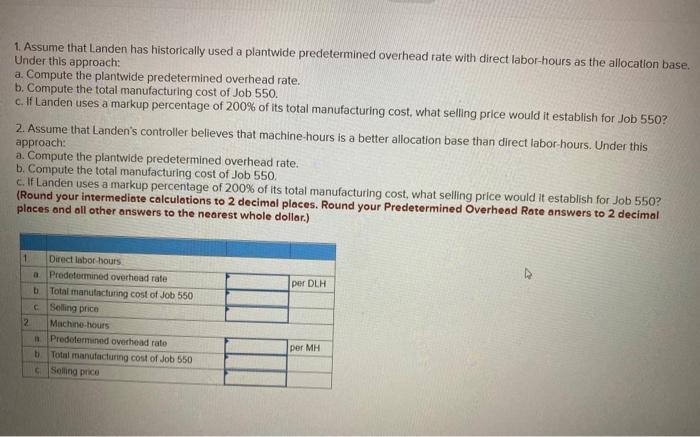

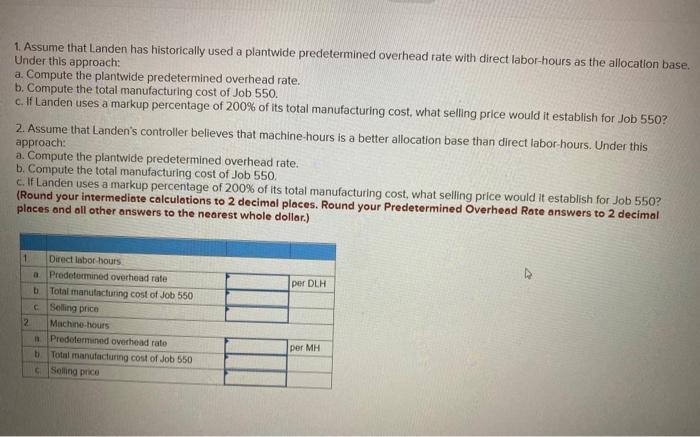

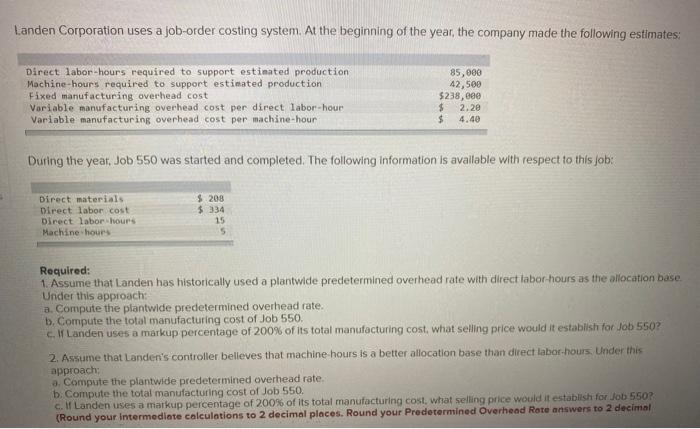

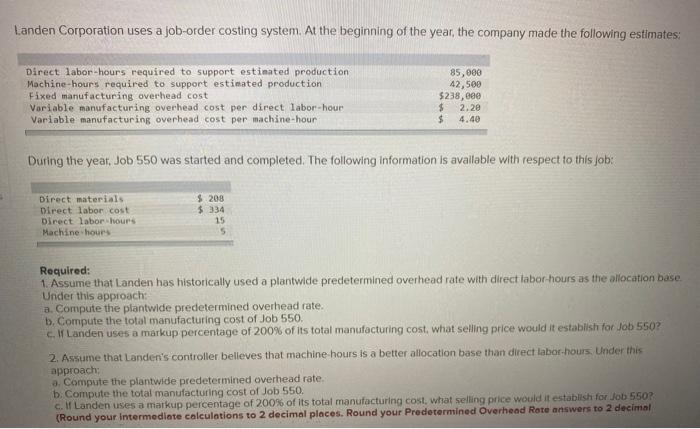

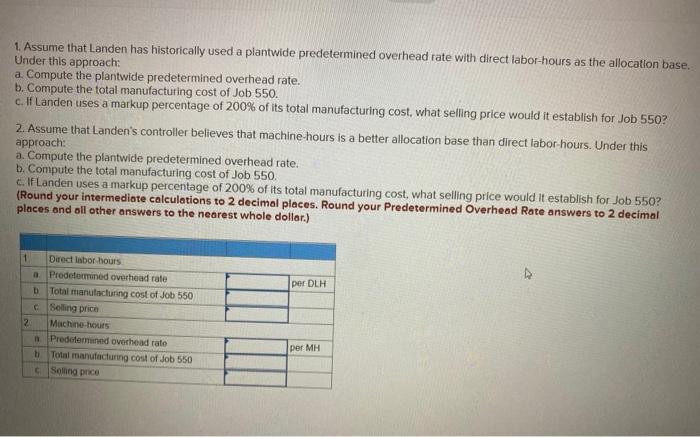

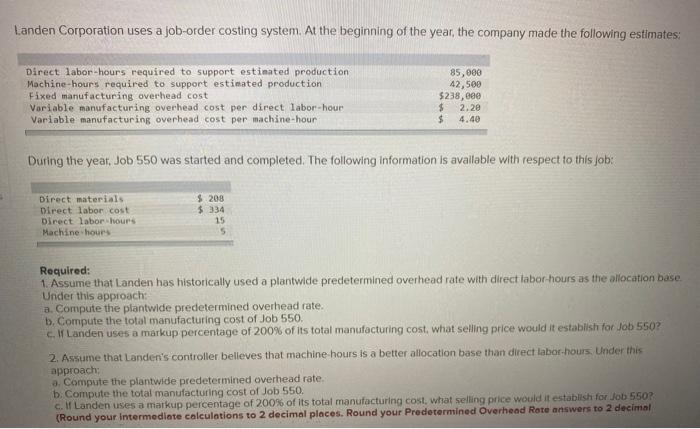

1. Assume that Landen has historically used a plantwide predetermined overhead rate with direct labor-hours as the allocation base. Under this approach: a. Compute the plantwide predetermined overhead rate. b. Compute the total manufacturing cost of Job 550. c. If Landen uses a markup percentage of 200% of its total manufacturing cost, what selling price would it establish for Job 550? 2. Assume that Landen's controller believes that machine hours is a better allocation base than direct labor-hours. Under this approach: a. Compute the plantwide predetermined overhead rate. b. Compute the total manufacturing cost of Job 550 c. If Landen uses a markup percentage of 200% of its total manufacturing cost, what selling price would it establish for Job 550? (Round your intermediate calculations to 2 decimal places. Round your predetermined Overhead Rate answers to 2 decimal places and all other answers to the nearest whole dollar.) per DLH 1 Direct labor hours a Predetermined overhead rate Total manutacturing cost of Job 550 Selling price 2 Machine-hours Predetermined overhead rato ti Total manufacturing cost of Job 550 Selling price per MH Landen Corporation uses a job-order costing system. At the beginning of the year, the company made the following estimates: Direct labor-hours required to support estimated production Machine-hours required to support estimated production Fixed manufacturing overhead cost Variable manufacturing overhead cost per direct labor-hour Variable manufacturing overhead cost per machine-hour 85,000 42,500 $238,000 $ 2.2e $ 4.40 During the year, Job 550 was started and completed. The following information is available with respect to this job: Direct materials Direct labor cost Direct labor hours Machine hours $ 208 $ 334 15 5 Required: 1. Assume that Landen has historically used a plantwide predetermined overhead rate with direct labor-hours as the allocation base. Under this approach: a Compute the plantwide predetermined overhead rate. b. Compute the total manufacturing cost of Job 550. c. Landen uses a markup percentage of 200% of its total manufacturing cost, what selling price would it establish for Job 550? 2. Assume that Landen's controller believes that machine hours is a better allocation base than direct labor-hours Under this approach a. Compute the plantwide predetermined overhead rate. b. Compute the total manufacturing cost of Job 550 c. If Landen uses a markup percentage of 200% of its total manufacturing cost, what selling price would it establish for Job 550? (Round your intermediate calculations to 2 decimal places. Round your Predetermined Overhead Rote answers to 2 decimal 1. Assume that Landen has historically used a plantwide predetermined overhead rate with direct labor-hours as the allocation base. Under this approach: a. Compute the plantwide predetermined overhead rate. b. Compute the total manufacturing cost of Job 550. c. If Landen uses a markup percentage of 200% of its total manufacturing cost, what selling price would it establish for Job 550? 2. Assume that Landen's controller believes that machine hours is a better allocation base than direct labor-hours. Under this approach: a. Compute the plantwide predetermined overhead rate. b. Compute the total manufacturing cost of Job 550 c. If Landen uses a markup percentage of 200% of its total manufacturing cost, what selling price would it establish for Job 550? (Round your intermediate calculations to 2 decimal places. Round your predetermined Overhead Rate answers to 2 decimal places and all other answers to the nearest whole dollar.) per DLH 1 Direct labor hours a Predetermined overhead rate Total manutacturing cost of Job 550 Selling price 2 Machine-hours Predetermined overhead rato ti Total manufacturing cost of Job 550 Selling price per MH