Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help solve this problem input data, initial investmen outlay, depreciation, salvage value, operating cash flows, and terminal cash flow must be shown. home appliances.

Please help solve this problem input data, initial investmen outlay, depreciation, salvage value, operating cash flows, and terminal cash flow must be shown.

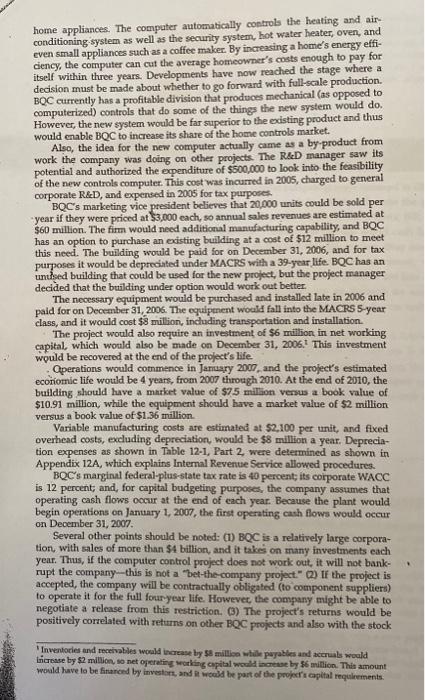

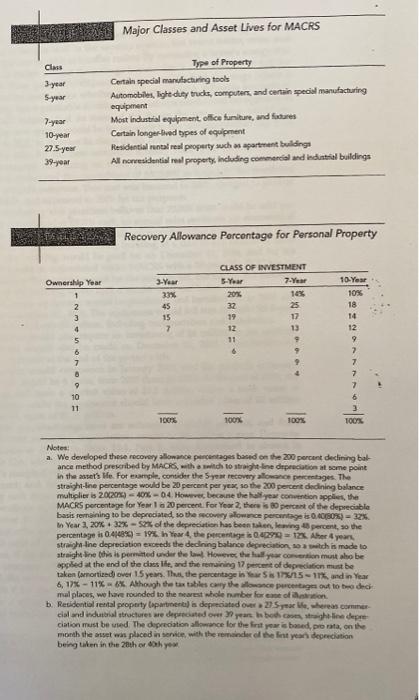

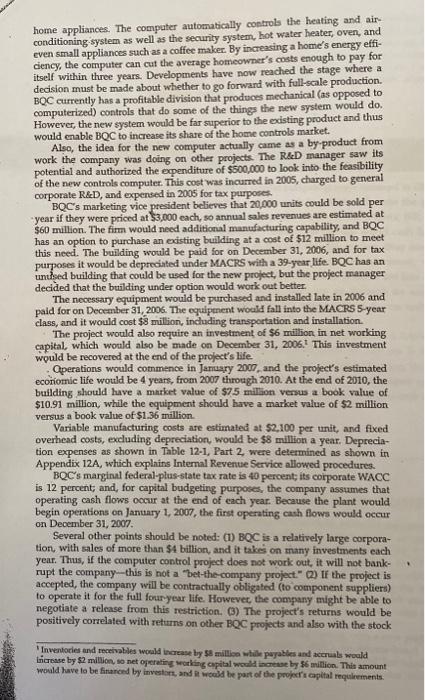

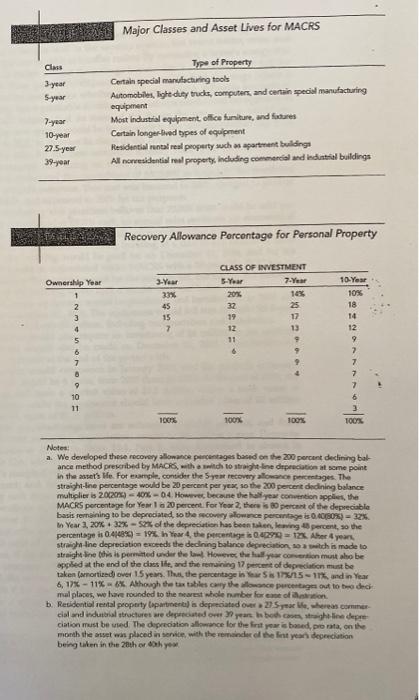

home appliances. The computer automatically controls the heating and airconditioning.system as well as the security system, hot water heater, oven, and even small appliances such as a coffee maker. By increasing a home's energy efficiency, the computer can cut the average homeowner's costs enough to pay for itself within throe years. Developments have now reached the stage where a decision must be made about whether to go forwand with full-scale production. BQC currently has a profitabie division that produoes mechanical (as opposed to computerized) controls that do some of the things the new system would do. However, the new system would be far superior to the edsting product and thus would cable BQC to increase its share of the home controls market. Also, the idea for the new computer actually came as a by-product from work the company was doing on other projects. The RedD manager saw its potential and authorized the expenditure of $500,000 to look into the feasibility of the new controls computer. This cost was incurred in 2005 , charged to general corporate R\&D, and expensed in 2005 for tax purposes. BQC s marketing vice president believes that 20,000 units could be sold per year if they were priced at $3,000 each, so annual sales revenues are estimated at $60 million. The firm would need additional manufacturing capability, and BQC has an option to purchase an existing building at a cost of $12 million to meet this need. The building would be paid for on Docember 31, 2006, and for tax purposes it would be deprecited under MACRS with a 39-your life. BQC has an untised building that could be used for the new project, but the project manager decided that the building under option would work out better. The nocessary equipment would be purchased and installed late in 2006 and paid for on December 31, 2006. The equipenent woald fall into the MACPS 5-year class, and it would cost $8 million, inchuding transportation and installation. The project would also require an investment of $6 million, in net working capital, which would also be made on December 31, 2006.1 This investment would be recovered at the end of the project's life Qperations would commence in January 2000 , and the project's estimated ecoriomic life woutd be 4 years, from 2007 through 2010. At the end of 2010, the building should have a minket value of $7.5 milion versus a book value of $10.91 million, while the equipment should have a market value of $2 million versus a book value of $1.36 million. Variable manufacturing costs are estimated at $2,100 per unit, and fxed overhead costs, excluding depreciation, would be $8 million a year. Depreciation expenses as shown in Table 12-1, Part 2, were defermined as shown in Appendix 12A, which exphins lntemal Revente Servioe allowed procedures. BQC's marginal federal-plas-state tax rate is 40 percent its corporate WACC is 12 percent; and, for capital budgeting purposes, the company assumes that operating cash flows occur at the end of each year. Because the plant would begin operations on Jantary 1, 2007, the finst operating cash flows would occur on December 31,2007 . Several other points should be noted: (1) BQC is a relatively large corporation, with sales of more than $4 billion, and it takes on many investments each year. Thus, if the computer control project does not work out, it will not bankrupt the company-this is not a bet-the-company project." (2) If the project is accepted, the company will be contractually obligated (to component suppliers) to operate it for the full foraryear life. Howevec, the company might be able to negotiate a release from this restriction. (3) The project's returns would be positively correlated with returns on other BQC projects and also with the stock Inveriories and receivables would increase by ss mallion whill puyables and accouils would lincrose by \$2 milion, so net oferefing wouking cupital would in mease by $6 million. This amount woald have to be finaroed by investsrs, and in woobd be port of bee pooforis copital requinements. Recovery Allowance Percontage for Personal Property Notes: a. We developed these roconcy aliomanoe gurcentages becid on the 200 percont declining batance method prescribed by MACCS, weth o minth to straight lene drpenciation at seme point in the auset's We. For earngle, contider the Syear recovery allomance perceetages. The straight-the percentage would be 20 percent per yex, so the 200 percert dedining balance MACRS percentage for Yome 1 a 20 percent. For Yoor 2, thers is 20 pevcent of the depseciable basis remsining to be deprodiated, io the me0vey allowence percintage is 0.40(0055)=325. on Year 3200 + 320x - STts of the depreciation thas been nal en, lening as percent, so the straight the depreciation exceeds the dedining bolunce degreciution, 10 a metch is mode to atraight line this is permited undir ter law. Heweres the hull yoar convertion must aloo be oppled at the end of the diss life, and the remaining 17 percent of depreciafion munt be taken (smortized) ove 1.5 year. Thas, the percentsge in fear 5 is 1176n.5=11%, and in Year mal places, wo tare rounded to the nevest whole number for eme of is ankicion. b. Reeidential reital peoperty (opartocentel in depecciated outr a 2) 5 , ywar Hle, whereas ecominer. ciation must be uned The depredation allomance for the firt year ie bued, pro mata, on the month the orset wan placed in servite, wieh the remaindur of the fint year deperciution being tiken in the 2ath or tah yox

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started