Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help solve this problem. Refer to Problem 15-18. In addition to addressing the required questions in this problem write a memo to the bank

Please help solve this problem.

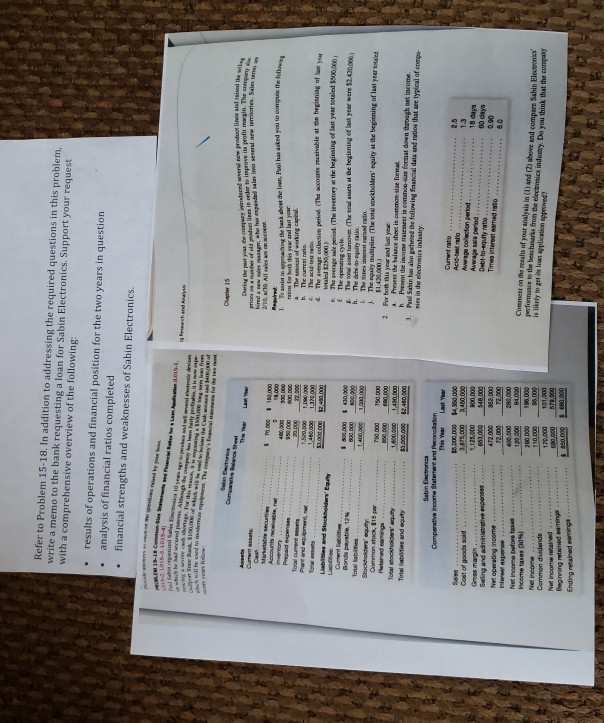

Refer to Problem 15-18. In addition to addressing the required questions in this problem write a memo to the bank requesting a loan for Sabin Electronics. Support your request with a comprehensive overview of the following results of operations and financial position for the two years in question analysis of financial ratios completed financial strengths and weaknesses of Sabin Electronics. . its proft margin. The cempany 210 to compute the followg a The anoust of werking capial Plane and $3.0000 $2.40 m 00,000 430,000 E. The toral aisel tunorer (The soal asets at he beginning of last yew were $2.420000 The nquiry muiplier 2 For both this year and lest year A Presens the balance shees in common-size foemat b Present the income stalenett is commeo-kine format down through net income 3,000 000 3480 000 3. Prul Sakin has ao paheed tbe folowing fancial dats and ratios that are tyical of mp and equty nies in the electronics industry Acid-best atio $5,000 000 $4,350 000 Saies Awerage saie period Debt to-equity ratio 18 days 60 days 0.90 Gross magn Seling and administrative 633000 $48.000 400,00028,000 Comment on the resalts of your analysis in () and (2) above and compare Sahin peformaace to the benchmarks from the electronics industry. Da you think that the compaay Net income Income taxes pos Net income ear Ending retaned eamings Refer to Problem 15-18. In addition to addressing the required questions in this problem write a memo to the bank requesting a loan for Sabin Electronics. Support your request with a comprehensive overview of the following results of operations and financial position for the two years in question analysis of financial ratios completed financial strengths and weaknesses of Sabin Electronics. . its proft margin. The cempany 210 to compute the followg a The anoust of werking capial Plane and $3.0000 $2.40 m 00,000 430,000 E. The toral aisel tunorer (The soal asets at he beginning of last yew were $2.420000 The nquiry muiplier 2 For both this year and lest year A Presens the balance shees in common-size foemat b Present the income stalenett is commeo-kine format down through net income 3,000 000 3480 000 3. Prul Sakin has ao paheed tbe folowing fancial dats and ratios that are tyical of mp and equty nies in the electronics industry Acid-best atio $5,000 000 $4,350 000 Saies Awerage saie period Debt to-equity ratio 18 days 60 days 0.90 Gross magn Seling and administrative 633000 $48.000 400,00028,000 Comment on the resalts of your analysis in () and (2) above and compare Sahin peformaace to the benchmarks from the electronics industry. Da you think that the compaay Net income Income taxes pos Net income ear Ending retaned eamingsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started